Nevada Drafting Agreement - Self-Employed Independent Contractor

Description

How to fill out Nevada Drafting Agreement - Self-Employed Independent Contractor?

If you want to total, acquire, or printing lawful record themes, use US Legal Forms, the largest selection of lawful kinds, that can be found online. Utilize the site`s simple and easy hassle-free search to find the papers you will need. Numerous themes for enterprise and personal purposes are sorted by types and suggests, or search phrases. Use US Legal Forms to find the Nevada Drafting Agreement - Self-Employed Independent Contractor within a handful of clicks.

Should you be already a US Legal Forms buyer, log in to your profile and then click the Obtain button to have the Nevada Drafting Agreement - Self-Employed Independent Contractor. Also you can access kinds you in the past downloaded from the My Forms tab of your profile.

Should you use US Legal Forms the very first time, refer to the instructions beneath:

- Step 1. Be sure you have selected the shape for that right town/country.

- Step 2. Use the Review method to check out the form`s information. Do not forget about to learn the description.

- Step 3. Should you be unhappy together with the type, use the Look for area at the top of the display screen to get other variations from the lawful type format.

- Step 4. Once you have discovered the shape you will need, click the Acquire now button. Choose the prices prepare you favor and put your credentials to register to have an profile.

- Step 5. Approach the transaction. You may use your Мisa or Ьastercard or PayPal profile to finish the transaction.

- Step 6. Select the file format from the lawful type and acquire it on the device.

- Step 7. Full, modify and printing or indication the Nevada Drafting Agreement - Self-Employed Independent Contractor.

Every lawful record format you get is the one you have permanently. You have acces to every single type you downloaded within your acccount. Go through the My Forms portion and choose a type to printing or acquire once more.

Remain competitive and acquire, and printing the Nevada Drafting Agreement - Self-Employed Independent Contractor with US Legal Forms. There are millions of specialist and condition-certain kinds you may use for your personal enterprise or personal requires.

Form popularity

FAQ

What Should Be in a Construction Contract?Identifying/Contact Information.Title and Description of the Project.Projected Timeline and Completion Date.Cost Estimate and Payment Schedule.Stop-Work Clause and Stop-Payment Clause.Act of God Clause.Change Order Agreement.Warranty.More items...

How do I create an Independent Contractor Agreement?State the location.Describe the type of service required.Provide the contractor's and client's details.Outline compensation details.State the agreement's terms.Include any additional clauses.State the signing details.

Simply put, being an independent contractor is one way to be self-employed. Being self-employed means that you earn money but don't work as an employee for someone else.

How Do I Become An Independent Contractor In Nevada? According to a 2015 state law, workers are presumed to be independent contractors instead of employees if they have insurance or an occupational license, are bonded, have a Social Security number, or have filed self-employment taxes.

2. Who must be licensed as a contractor? All businesses or individuals who construct or alter any building, highway, road, parking facility, railroad, excavation, or other structure in Nevada must be licensed by the Nevada State Contractors Board.

Under the NIIA, an independent contractor is defined as follows: Any person who renders service for a specified recompense for a specified result, under the control of the person's principal as to the result of the person's work only and not as to the means by which such result is accomplished.

BOTTOM LINE: Business owners and independent contractors need to secure a valid Nevada business license or an exemption to the state business license prior to conducting any business activity.

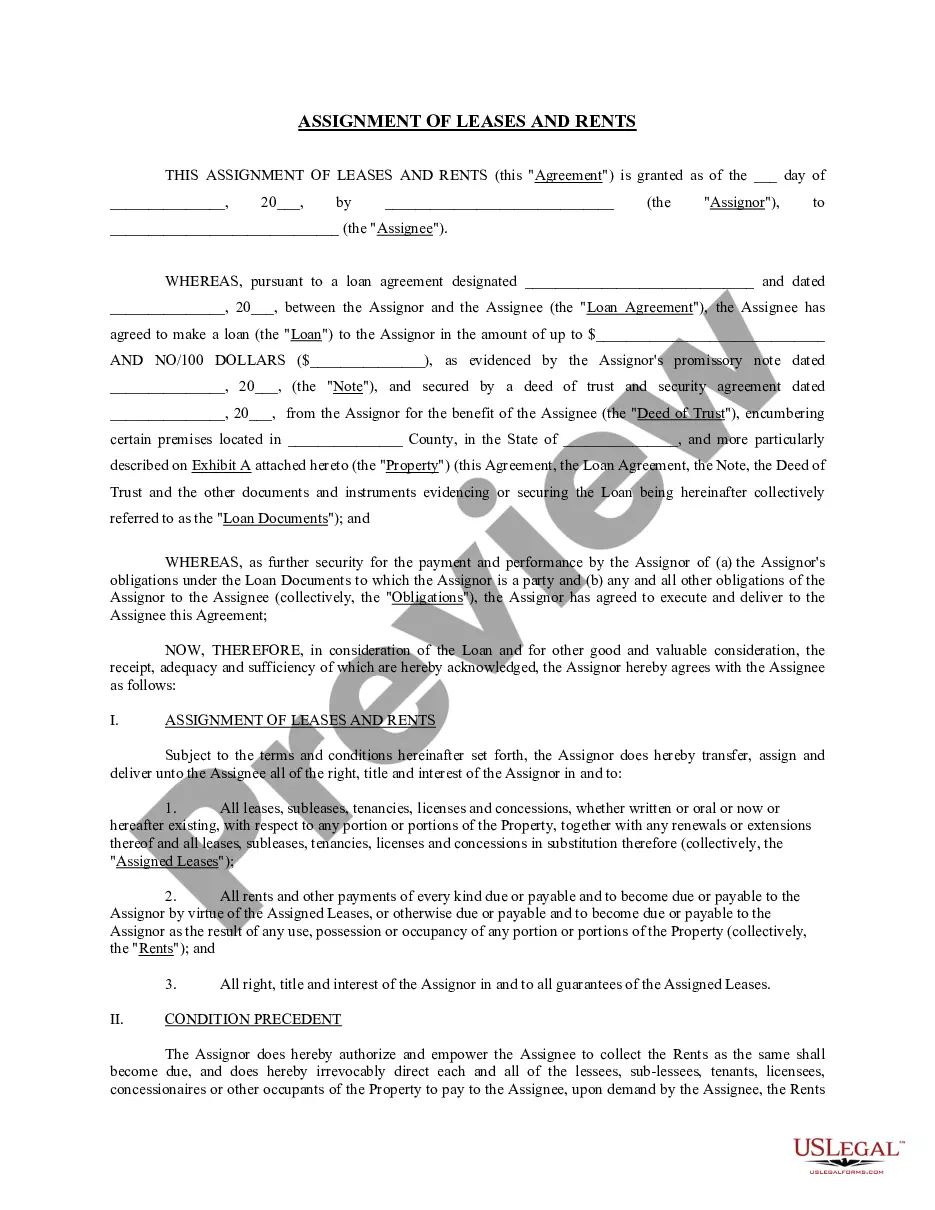

An independent contractor agreement is a legally binding document signed by a 1099 employee and the company that hires them. It outlines the scope of work and the terms under which that work will be completed, which goes a long way to making sure both parties are on the same page about the project from the start.

Nevada nonprofit entities formed pursuant to NRS Chapter 82 and corporations sole formed pursuant to NRS Chapter 84 are specifically exempted from the requirements of the State Business License and are not required to maintain a state business license nor are they required to claim an exemption.