Nevada Self-Employed Tour Guide Services Contract

Description

How to fill out Nevada Self-Employed Tour Guide Services Contract?

Are you inside a position where you need to have files for possibly company or specific functions almost every day time? There are a variety of legal document web templates available on the net, but getting types you can rely on isn`t simple. US Legal Forms delivers thousands of kind web templates, much like the Nevada Self-Employed Tour Guide Services Contract, that happen to be written to fulfill state and federal needs.

When you are previously acquainted with US Legal Forms site and have a free account, basically log in. Next, you may down load the Nevada Self-Employed Tour Guide Services Contract web template.

If you do not have an account and wish to start using US Legal Forms, adopt these measures:

- Get the kind you want and make sure it is for that proper metropolis/county.

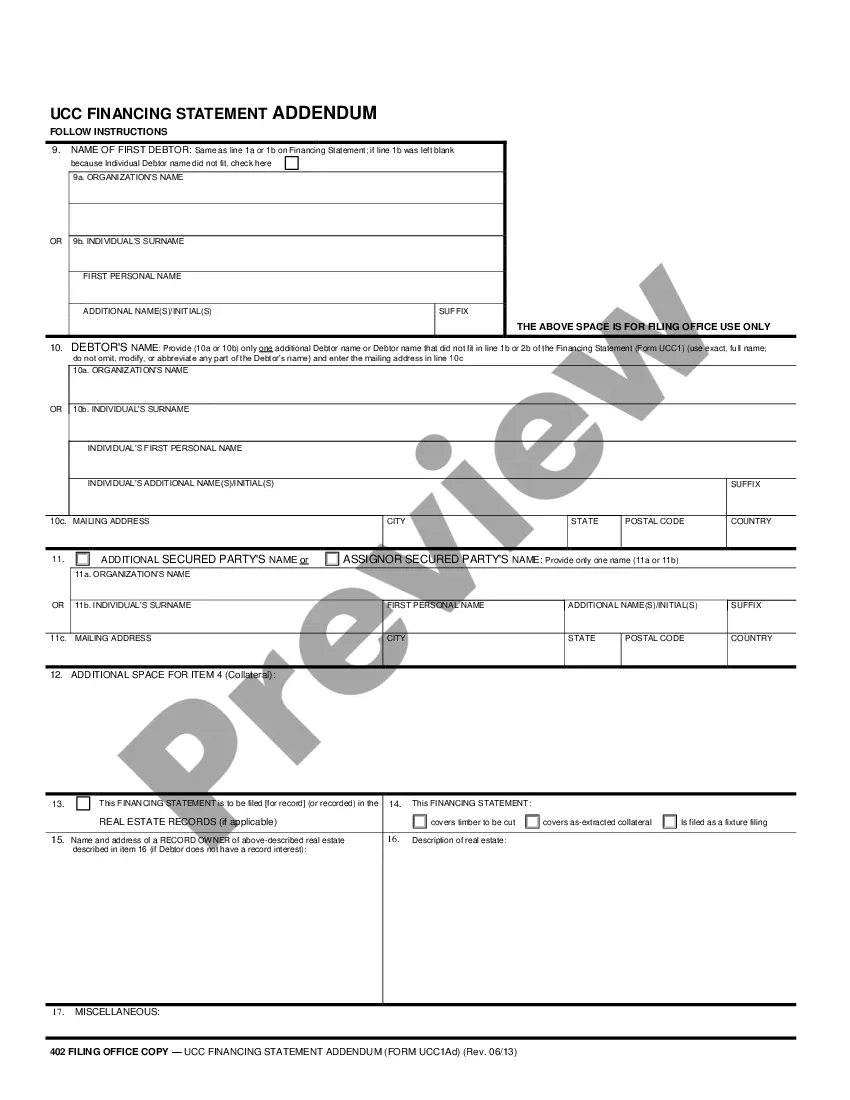

- Make use of the Preview option to check the shape.

- Browse the explanation to ensure that you have chosen the appropriate kind.

- In case the kind isn`t what you are looking for, make use of the Search industry to obtain the kind that fits your needs and needs.

- Whenever you get the proper kind, click Get now.

- Select the rates plan you desire, fill out the necessary info to make your account, and purchase the transaction making use of your PayPal or credit card.

- Decide on a convenient paper file format and down load your version.

Locate every one of the document web templates you might have purchased in the My Forms food selection. You can get a more version of Nevada Self-Employed Tour Guide Services Contract whenever, if necessary. Just click on the necessary kind to down load or produce the document web template.

Use US Legal Forms, the most comprehensive selection of legal forms, to save time and prevent blunders. The support delivers skillfully made legal document web templates which can be used for a range of functions. Produce a free account on US Legal Forms and begin creating your way of life a little easier.

Form popularity

FAQ

Becoming an independent contractor is one of the many ways to be classified as self-employed. By definition, an independent contractor provides work or services on a contractual basis, whereas, self-employment is simply the act of earning money without operating within an employee-employer relationship.

Tour Guides: A tour Operators handbook. What is the Difference? The general rule is that an individual is an independent contractor if the payer has the right to control or direct only the result of the work, not what will be done and how it will be done.

PERFORMING ARTISTS These are persons who are actually in business for themselves and hold themselves available to the general public to perform services. A person is an independent contractor only when free from control and direction in the performance of services.

How Do I Become An Independent Contractor In Nevada? According to a 2015 state law, workers are presumed to be independent contractors instead of employees if they have insurance or an occupational license, are bonded, have a Social Security number, or have filed self-employment taxes.

The general rule is that you will be: An employee if you work for someone and do not have the risks of running a business. Self-employed if you have a trade, profession or vocation, are in business on your own account and are responsible for the success or failure of that business.

The three types of self-employed individuals include:Independent contractors. Independent contractors are individuals hired to perform specific jobs for clients, meaning that they are only paid for their jobs.Sole proprietors.Partnerships.

If you are an independent contractor, then you are self-employed. The earnings of a person who is working as an independent contractor are subject to self-employment tax. To find out what your tax obligations are, visit the Self-Employed Individuals Tax Center.

Independent Contractor Responsibilities:Liaising with the client to elucidate job requirements, as needed.Gathering the materials needed to complete the assignment.Overseeing the assignment, from inception to completion.Tailoring your approach to work to suit the job specifications, as required.More items...

What Is an Independent Contractor? An independent contractor is a self-employed person or entity contracted to perform work foror provide services toanother entity as a nonemployee. As a result, independent contractors must pay their own Social Security and Medicare taxes.

Independent contractors are self-employed workers who provide services for an organisation under a contract for services. Independent contractors are not employees and are typically highly skilled, providing their clients with specialist skills or additional capacity on an as needed basis.