Nevada Agreement for Sales of Data Processing Equipment

Description

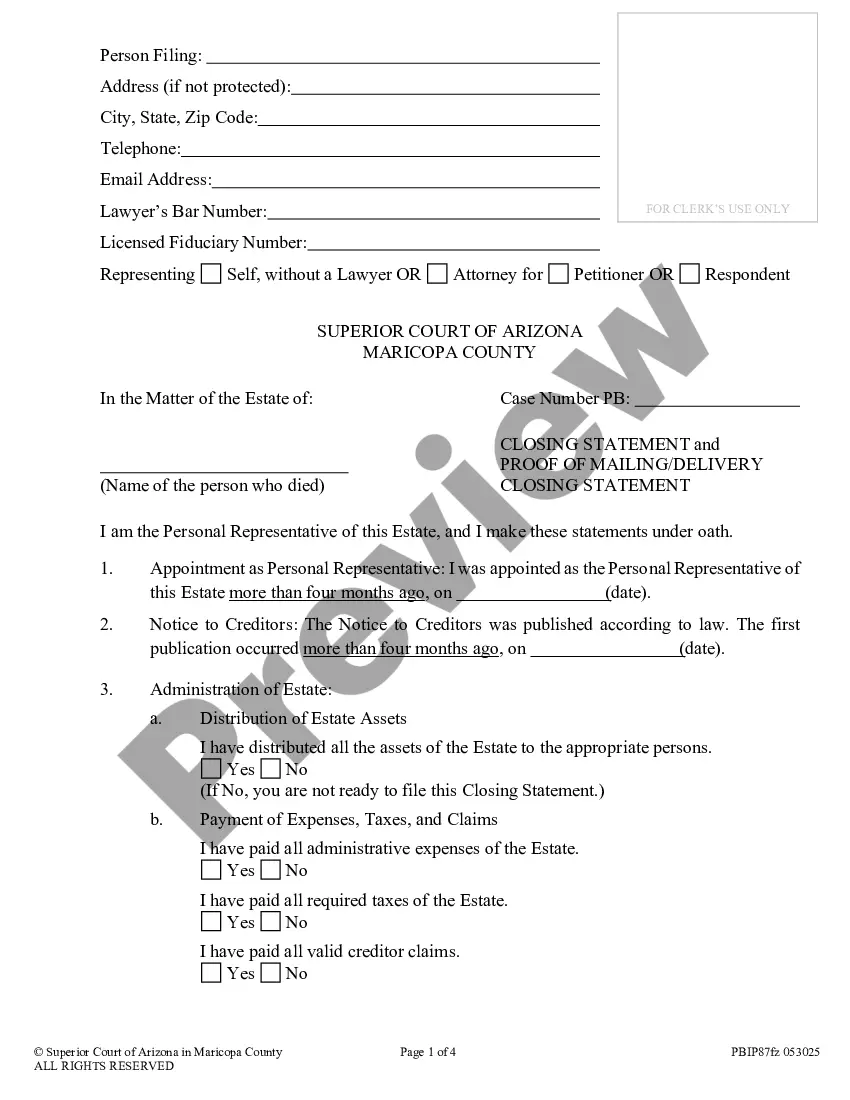

How to fill out Nevada Agreement For Sales Of Data Processing Equipment?

If you want to total, download, or print out lawful document themes, use US Legal Forms, the largest assortment of lawful varieties, that can be found on the Internet. Take advantage of the site`s basic and handy search to get the documents you need. Numerous themes for enterprise and individual uses are sorted by categories and suggests, or keywords. Use US Legal Forms to get the Nevada Agreement for Sales of Data Processing Equipment with a few mouse clicks.

When you are presently a US Legal Forms buyer, log in to the bank account and then click the Down load key to find the Nevada Agreement for Sales of Data Processing Equipment. You can even accessibility varieties you previously downloaded in the My Forms tab of your own bank account.

If you are using US Legal Forms the first time, refer to the instructions beneath:

- Step 1. Ensure you have chosen the form to the correct city/nation.

- Step 2. Utilize the Review choice to look through the form`s content. Don`t forget about to read the description.

- Step 3. When you are unhappy using the type, take advantage of the Search discipline on top of the display to discover other models in the lawful type web template.

- Step 4. When you have discovered the form you need, select the Get now key. Select the prices strategy you favor and include your accreditations to sign up for an bank account.

- Step 5. Procedure the purchase. You can utilize your Мisa or Ьastercard or PayPal bank account to finish the purchase.

- Step 6. Find the file format in the lawful type and download it in your gadget.

- Step 7. Total, revise and print out or indication the Nevada Agreement for Sales of Data Processing Equipment.

Each and every lawful document web template you purchase is yours permanently. You might have acces to each type you downloaded within your acccount. Click on the My Forms portion and select a type to print out or download again.

Be competitive and download, and print out the Nevada Agreement for Sales of Data Processing Equipment with US Legal Forms. There are thousands of expert and status-specific varieties you can use for the enterprise or individual demands.

Form popularity

FAQ

In general, clothing, groceries, medicines and medical devices and industrial equipment are sales tax exempt in many states (but don't assume they'll be exempt in all states. Every state is different when it comes to sales tax!)

Other items that are not taxable include unprepared food, farm machinery and equipment, newspapers, and interest, finance and carrying charges on credit sales.

Sales of machinery are subject to sales tax in Nevada. Sales of raw materials are exempt from the sales tax in Nevada. Sales of utilities & fuel are subject to sales tax in Nevada.

Goods that are subject to sales tax in Nevada include physical property, like furniture, home appliances, and motor vehicles. Prescription medicine, groceries, and gasoline are all tax-exempt.

The following items are deemed nontaxable by the IRS:Inheritances, gifts and bequests.Cash rebates on items you purchase from a retailer, manufacturer or dealer.Alimony payments (for divorce decrees finalized after 2018)Child support payments.Most healthcare benefits.Money that is reimbursed from qualifying adoptions.More items...?

Tangible personal property means personal property which may be seen, weighed, measured, felt or touched, or which is in any other manner perceptible to the senses. NRS 372.090 Tax Commission defined. Tax Commission means the Nevada Tax Commission.

Nevada sales tax details The Nevada (NV) state sales tax rate is currently 4.6%.

Is software, electronic magazines, clipart, program code, or other downloaded material taxable to Nevada residents? No. Products delivered electronically or by load and leave are not subject to Nevada Sales or Use Tax.

Nearly all tangible personal property transferred for value is taxable. Most goods, wares and merchandise are taxable in Nevada. Services necessary to complete the sale of tangible personal property are taxable.