Nevada Subordination of Lien (Deed of Trust/Mortgage)

Description

How to fill out Subordination Of Lien (Deed Of Trust/Mortgage)?

Are you in the place in which you need to have paperwork for either company or person uses nearly every day time? There are a variety of legitimate document templates available on the Internet, but finding ones you can depend on is not simple. US Legal Forms offers thousands of kind templates, just like the Nevada Subordination of Lien (Deed of Trust/Mortgage), that are created in order to meet federal and state demands.

Should you be previously knowledgeable about US Legal Forms web site and get your account, merely log in. After that, you are able to download the Nevada Subordination of Lien (Deed of Trust/Mortgage) template.

Unless you come with an bank account and want to start using US Legal Forms, adopt these measures:

- Discover the kind you need and make sure it is for the appropriate metropolis/area.

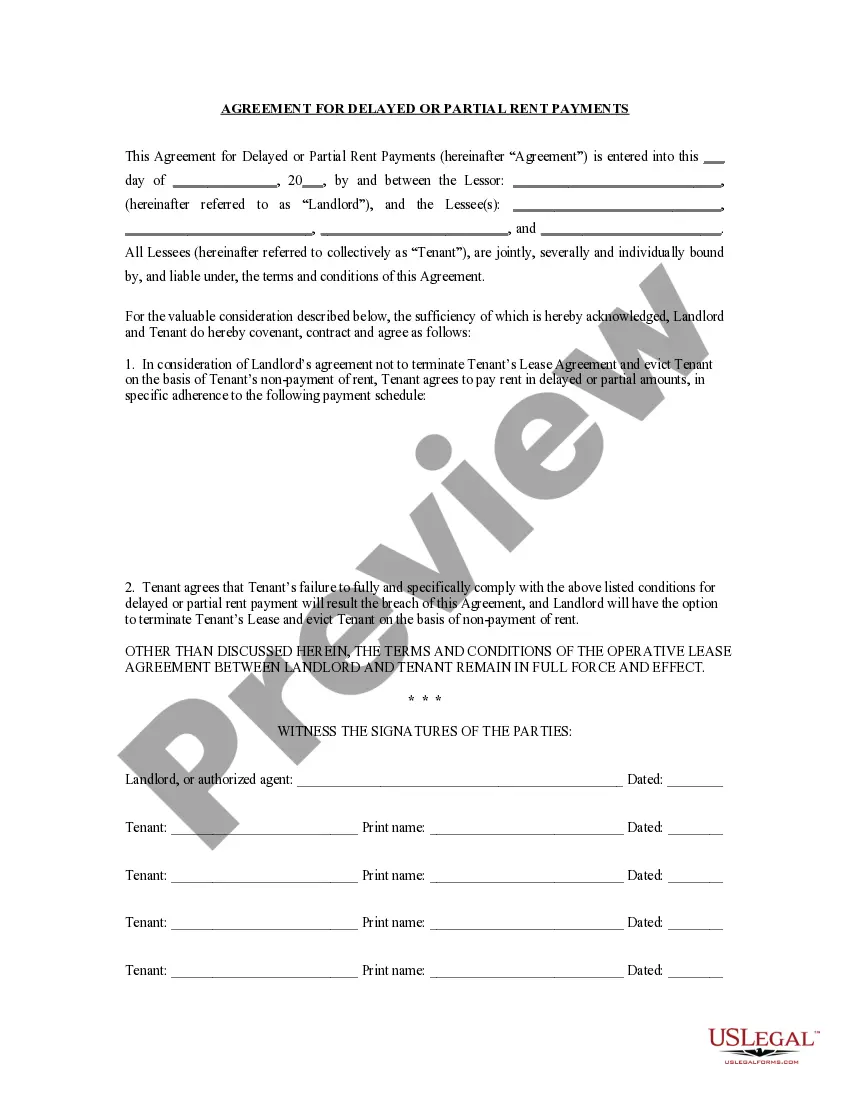

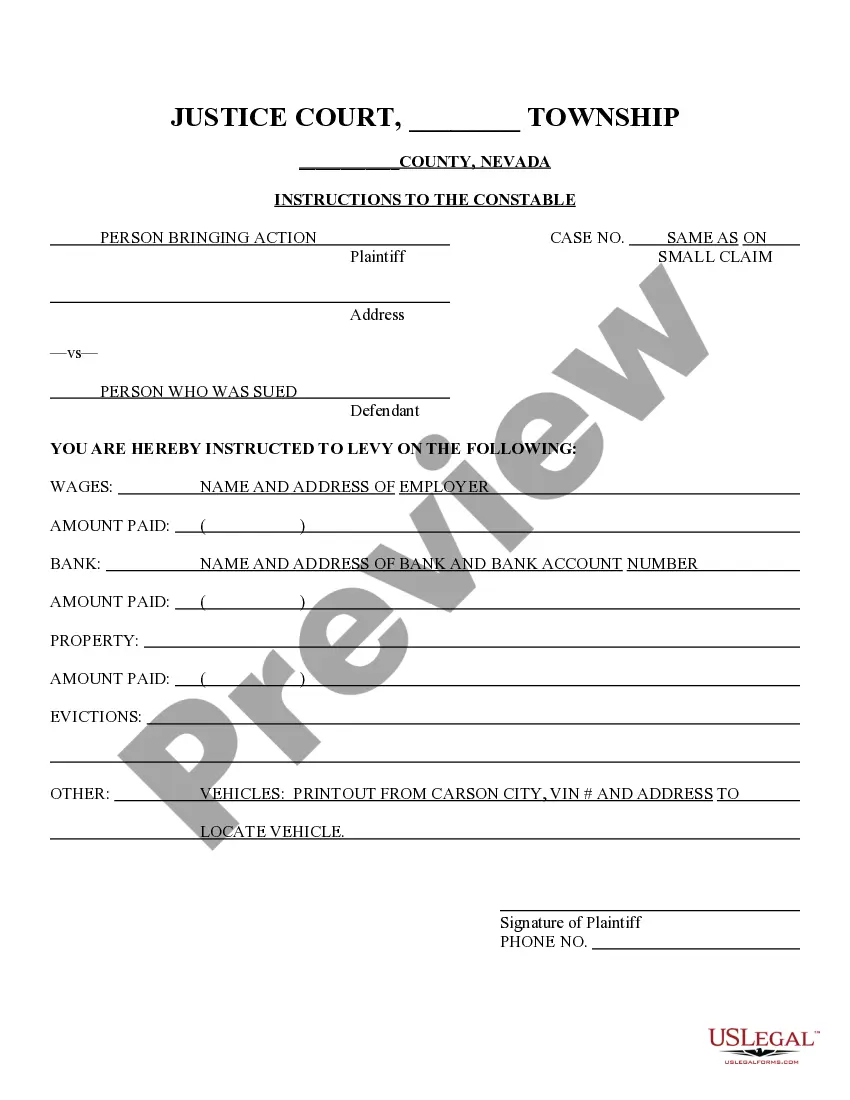

- Utilize the Preview button to review the shape.

- Read the explanation to ensure that you have chosen the correct kind.

- In the event the kind is not what you are searching for, utilize the Look for discipline to discover the kind that fits your needs and demands.

- If you discover the appropriate kind, simply click Get now.

- Choose the prices plan you desire, submit the necessary info to generate your money, and pay money for the order using your PayPal or credit card.

- Choose a practical paper structure and download your version.

Find every one of the document templates you possess purchased in the My Forms menu. You can obtain a additional version of Nevada Subordination of Lien (Deed of Trust/Mortgage) anytime, if necessary. Just click on the needed kind to download or print the document template.

Use US Legal Forms, by far the most comprehensive collection of legitimate forms, in order to save time as well as avoid mistakes. The assistance offers professionally created legitimate document templates which you can use for an array of uses. Generate your account on US Legal Forms and start creating your way of life a little easier.

Form popularity

FAQ

This Security Instrument secures to Lender (i) the. repayment of the Loan, and all renewals, extensions, and modifications of the Note, and (ii) the performance. of Borrower's covenants and agreements under this Security Instrument and the Note.

A mortgage involves only two parties: the borrower and the lender. A deed of trust has a borrower, lender and a ?trustee.? The trustee is a neutral third party that holds the title to a property until the loan is completely paid off by the borrower.

Most Deeds of Trust provide that if another Deed of Trust is foreclosed upon the property, that this becomes a violation of the terms of the Note for each Deed of Trust, so all the Deeds of Trust become due and owing. Thus, fast action should be taken by the borrower the moment one receives the first Notice of Default.

To put simply, the deed is the legal document that proves who holds title to a property, while a mortgage is an agreement between a financial lender and borrower to repay the amount borrowed to purchase a home.

Foreclosure process: Mortgages typically go through a judicial foreclosure process, through your county court system. Deeds of trust use a non-judicial foreclosure process. Length of time to foreclose: Mortgage foreclosures usually take significantly longer than non-judicial foreclosures with a deed of trust.

A deed of trust is a document used in real estate transactions. It represents an agreement between the borrower and a lender to have the property held in trust by a neutral and independent third party until the loan is paid off.

In Nevada, lenders like a deed of trust (or ?trust deed?) to give them security in case the borrower defaults. Some states use a mortgage for security, which is a two-party transaction involving both the lender and the borrower. A mortgage usually needs a lawsuit for oversight of the sale.

If your circumstances change any you are no longer able to make your payments, your Trust Deed may fail and you will still be liable for your debts or even forced into bankruptcy.