Nevada Affidavit of Heirship for Real Property

Description

How to fill out Affidavit Of Heirship For Real Property?

Choosing the best authorized papers web template can be a battle. Naturally, there are a lot of web templates available online, but how do you find the authorized kind you require? Take advantage of the US Legal Forms web site. The assistance offers 1000s of web templates, such as the Nevada Affidavit of Heirship for Real Property, that can be used for enterprise and personal demands. Every one of the types are examined by specialists and meet federal and state specifications.

Should you be presently authorized, log in in your accounts and then click the Download key to get the Nevada Affidavit of Heirship for Real Property. Make use of accounts to appear through the authorized types you might have bought previously. Check out the My Forms tab of your respective accounts and get yet another copy of the papers you require.

Should you be a fresh customer of US Legal Forms, allow me to share easy directions that you should follow:

- Initial, make certain you have chosen the correct kind for your town/region. You may check out the form making use of the Review key and study the form outline to guarantee it will be the best for you.

- If the kind is not going to meet your needs, make use of the Seach industry to obtain the appropriate kind.

- Once you are certain the form would work, select the Get now key to get the kind.

- Pick the prices strategy you want and enter in the needed information. Design your accounts and pay for the transaction making use of your PayPal accounts or charge card.

- Pick the data file structure and down load the authorized papers web template in your product.

- Full, edit and print out and indication the received Nevada Affidavit of Heirship for Real Property.

US Legal Forms will be the greatest library of authorized types where you can see a variety of papers web templates. Take advantage of the company to down load expertly-created files that follow status specifications.

Form popularity

FAQ

Potential Problems with Transfer on Death Deeds: Issues can include unintentional disinheritance, conflicts with joint tenants, and invalidation due to legal description errors.

Community Property in Nevada This means that any property acquired during a marriage by either spouse is owned by both spouses jointly. The only exception is when both spouses agree in writing that a piece of property will be owned separately or in a different form of co-ownership.

A Nevada TOD deed must be executed by the property owner and subscribed before a notary. A TOD deed need not identify anything of value provided in exchange for the transfer, as Nevada law does not require TOD deeds to be supported by consideration.

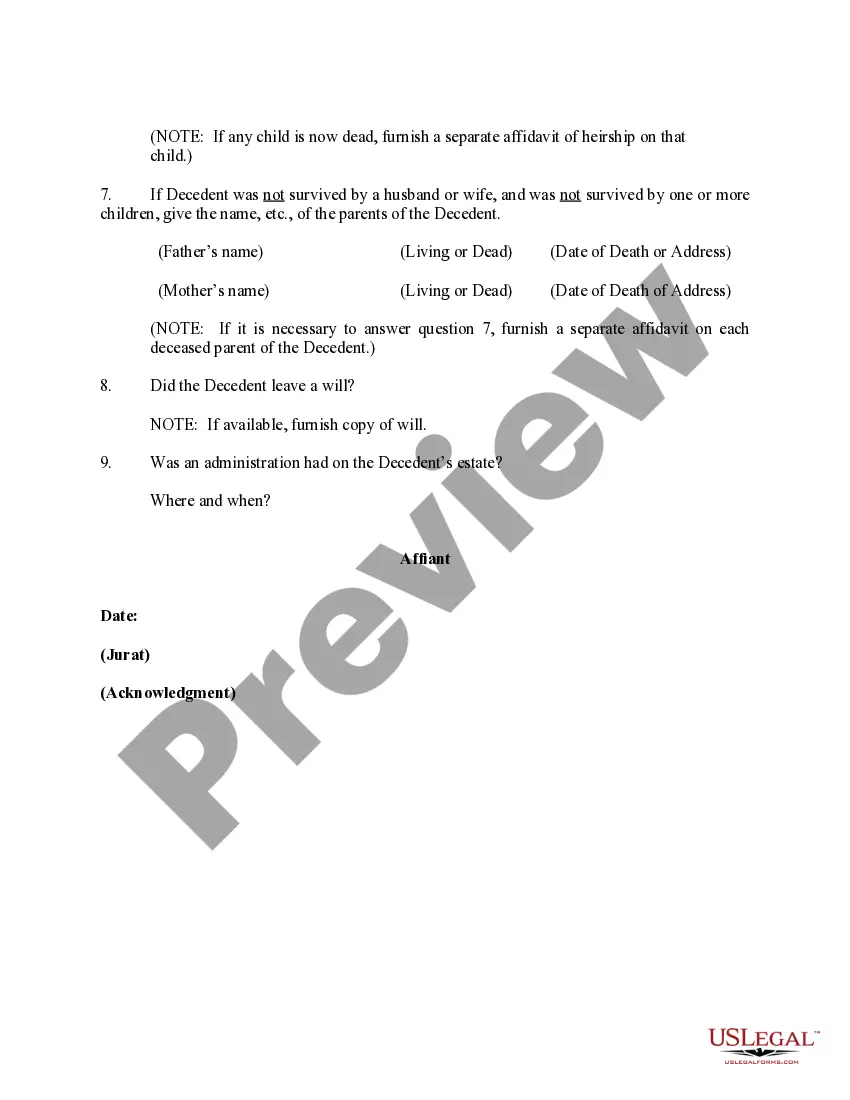

An Affidavit of Heirship is a legal document used to establish the heirs of a deceased person and their respective interests in the deceased person's estate when the deceased person dies without a will (intestate) or when there are uncertainties about the heirs and their inheritance rights.

Forty days after their death, you can file the affidavit in the local Probate Court in the county where the deceased resided. For example, if your loved one lived or died in Clark County, you would file with the county recorder in Clark County Probate Court. You will need to pay a small fee for recording the affidavit.

The beneficiary will need to record a Death of Grantor Affidavit and a certified copy of the death certificate in the county recorder's office, and will also need to give notice of the death to certain parties, including the Department of Health and Human Services and any known or readily ascertainable creditors.

Once the affidavit has been recorded, the heirs are identified in the property records as the new owners of the property. Thereafter, the heir or heirs may transfer or sell the property if they choose to do so.

To prove this to the world and effectively remove your deceased husband from the title, you simply have to record his death certificate in the public records. Because every situation is different, it would be best to consult an experienced attorney before acting.