This form is used when the events giving rise to the termination of the Trust have occurred. Pursuant to the terms of a Will, Grantor executes this Deed and Assignment for the purposes of distributing to the beneficiaries of a Testamentary Trust, all rights, title, and interests in the Properties held in the name of that Trust, and all Properties owned by the Estate of the deceased, and the Testamentary Trust created under the Will of the deceased.

Nevada Trustee's Deed and Assignment for Distribution by Testamentary Trustee to Trust Beneficiaries

Description

How to fill out Trustee's Deed And Assignment For Distribution By Testamentary Trustee To Trust Beneficiaries?

US Legal Forms - one of many most significant libraries of lawful kinds in the United States - delivers an array of lawful papers templates it is possible to acquire or printing. While using website, you can find 1000s of kinds for company and specific functions, sorted by categories, says, or search phrases.You will find the most up-to-date models of kinds like the Nevada Trustee's Deed and Assignment for Distribution by Testamentary Trustee to Trust Beneficiaries in seconds.

If you already possess a membership, log in and acquire Nevada Trustee's Deed and Assignment for Distribution by Testamentary Trustee to Trust Beneficiaries in the US Legal Forms catalogue. The Down load button can look on each form you perspective. You have access to all formerly downloaded kinds within the My Forms tab of your own accounts.

If you would like use US Legal Forms for the first time, here are simple recommendations to help you started out:

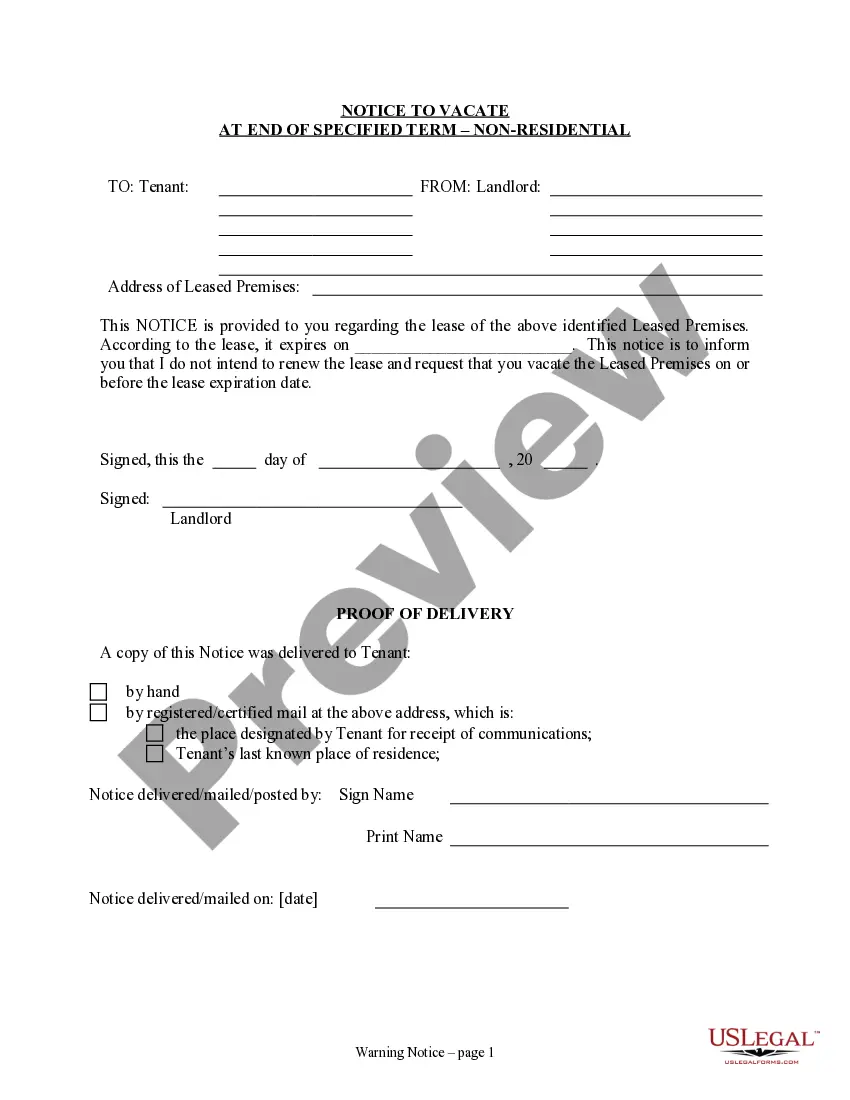

- Make sure you have selected the proper form for your area/county. Select the Preview button to analyze the form`s content material. Look at the form outline to ensure that you have chosen the right form.

- If the form does not satisfy your demands, make use of the Research area near the top of the monitor to get the one that does.

- If you are pleased with the form, verify your choice by clicking on the Purchase now button. Then, select the rates program you prefer and give your references to sign up to have an accounts.

- Method the deal. Make use of Visa or Mastercard or PayPal accounts to perform the deal.

- Choose the formatting and acquire the form on your own product.

- Make alterations. Fill up, change and printing and indication the downloaded Nevada Trustee's Deed and Assignment for Distribution by Testamentary Trustee to Trust Beneficiaries.

Each format you put into your bank account lacks an expiry date and is your own forever. So, if you wish to acquire or printing another version, just visit the My Forms segment and click on on the form you need.

Obtain access to the Nevada Trustee's Deed and Assignment for Distribution by Testamentary Trustee to Trust Beneficiaries with US Legal Forms, probably the most substantial catalogue of lawful papers templates. Use 1000s of expert and express-distinct templates that meet your organization or specific needs and demands.

Form popularity

FAQ

How to Get a Copy of a Trust Make a written demand for a copy of the Trust and its amendments, if any; Wait 60 days; and. If you do not receive a copy of the Trust within 60 days of making your written demand, file a petition with the probate court.

The Clark County, Nevada, Recorder's Office (which serves Las Vegas, Henderson, Boulder City, North Las Vegas, Mesquite among other towns) will accept your trust for filing if you want. It's your choice whether to record the trust or not.

Nevada law specifies that interested parties (e.g., trustees or beneficiaries) may ask a Nevada probate court to terminate a trust if continuing the trust is no longer feasible or economical. This may occur when: The trust's assets are worth less than $100,000.

Irrevocable trusts cannot be modified, amended, or terminated without permission from the grantor's beneficiaries or by court order. The grantor transfers all ownership of assets into the trust and legally removes all of their ownership rights to the assets and the trust.

Trustees are required to distribute to trust beneficiaries the inheritances they were left once the trust is settled. Depending on the terms of the trust, distributions can be in the form of the transfer of a specific asset, a lump sum cash payment or periodic payments made over time.

Under Nevada trust law, any individual may create a legally valid trust where they act as both the settlor and the beneficiary of the trust. The settlor may also serve as the trustee. This allows the settlor to maintain control of the assets held in the trust.

As previously mentioned, trustees generally cannot withhold money from a beneficiary for no reason or indefinitely. Similarly, trustees cannot withdraw money from a trust to benefit themselves, even if the trustee is also a beneficiary.

Section 163.556 of the Nevada Revised Statutes authorizes a trustee to decant a trust that has a Nevada situs, is governed by Nevada law, or that is administered under Nevada law.

If the borrower has land, (or uses the money to buy land), then many lenders request a deed of trust as a condition of giving the borrower the money. In Nevada, lenders like a deed of trust (or ?trust deed?) to give them security in case the borrower defaults.

Whether or not the trustee can withhold funds from you depends on the terms of the trust itself. If the trust requires withholding distributions under certain circumstances, such as the beneficiary reaching a specific age, the trustee must follow those stipulations.