Nevada Ratification of Oil, Gas, and Mineral Lease by Nonparticipating Royalty Owner to Allow For Pooling

Description

How to fill out Ratification Of Oil, Gas, And Mineral Lease By Nonparticipating Royalty Owner To Allow For Pooling?

Discovering the right authorized file template might be a have difficulties. Of course, there are tons of web templates available on the net, but how will you get the authorized develop you need? Utilize the US Legal Forms site. The assistance gives a huge number of web templates, such as the Nevada Ratification of Oil, Gas, and Mineral Lease by Nonparticipating Royalty Owner to Allow For Pooling, which you can use for organization and personal demands. All of the varieties are inspected by pros and fulfill state and federal specifications.

In case you are previously listed, log in to your account and then click the Download button to get the Nevada Ratification of Oil, Gas, and Mineral Lease by Nonparticipating Royalty Owner to Allow For Pooling. Make use of account to look from the authorized varieties you have bought earlier. Proceed to the My Forms tab of the account and acquire yet another backup of your file you need.

In case you are a brand new end user of US Legal Forms, allow me to share straightforward instructions that you should comply with:

- Initial, ensure you have selected the right develop for the metropolis/region. It is possible to look over the shape using the Preview button and look at the shape explanation to guarantee it is the best for you.

- In the event the develop does not fulfill your preferences, take advantage of the Seach area to get the proper develop.

- Once you are sure that the shape would work, click on the Purchase now button to get the develop.

- Pick the rates plan you would like and enter in the essential information and facts. Build your account and pay money for the transaction making use of your PayPal account or Visa or Mastercard.

- Choose the submit format and download the authorized file template to your gadget.

- Total, revise and print and signal the received Nevada Ratification of Oil, Gas, and Mineral Lease by Nonparticipating Royalty Owner to Allow For Pooling.

US Legal Forms is definitely the biggest catalogue of authorized varieties where you will find various file web templates. Utilize the service to download expertly-created files that comply with express specifications.

Form popularity

FAQ

Lump Sum Payment There is a chance in your lifetime that you will never receive as much royalty income as you might be able to receive by selling a portion of your mineral and royalty assets for a lump sum. A lump sum payout can help eliminate debt, purchase a new home, or cover college expenses.

Royalty interest in the oil and gas industry refers to ownership of a portion of a resource or the revenue it produces. A company or person that owns a royalty interest does not bear any operational costs needed to produce the resource, yet they still own a portion of the resource or revenue it produces.

Participating Royalty Interest (NPRI) is an interest in oil and gas production which is created from the mineral estate. Like the plain ?royalty interest? it is expensefree, bearing no operational costs of production.

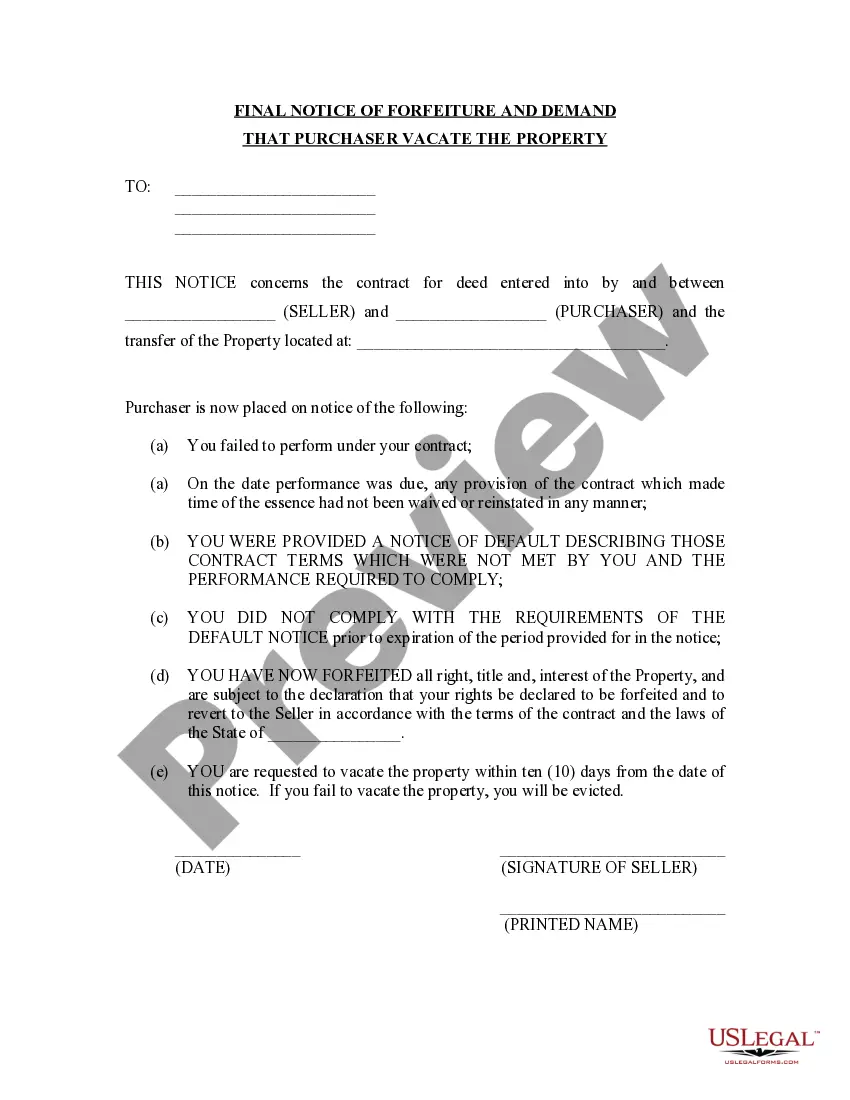

To ?ratify? a lease means that the landowner and oil & gas producer, as current lessor and lessee of the land, agree (or re-agree) to the terms of the existing lease.

Oil and gas royalties are typically calculated based on the value of the production. The royalty rate is negotiated between the owner of the mineral rights and the company extracting the oil and gas, and can range from 12.5% to 25% of the production value.

The formula to calculate NPRI without proportionate share reduction is LRR ? RI = NPRI. As an example, reducing your revenue interest from 25% LRR results in 1/16 NPRI, leaving 75% NRI for working interest owners.

In a few words, a pooling clause is written into a lease. This oil and gas clause allows the leased premises to be combined with other lands to form a single drilling unit. It's not uncommon for there to be a pool of oil or gas under numerous parcels of land.

Typically, NPRIs are created by an express grant or reservation in a deed and are entirely different from a ?leasehold? royalty. The holder of a NPRI has no power to negotiate or execute an oil and gas lease and has no power to enter upon the land to extract the hydrocarbons.