Nevada Acquisition Worksheet is a comprehensive document used in Nevada for tracking and documenting various aspects of an acquisition process. This worksheet plays a crucial role in ensuring a seamless and organized acquisition process, providing a structured framework for gathering and analyzing relevant information. It assists professionals involved in acquisitions, including business owners, attorneys, accountants, and consultants, to consolidate and review essential details. The Nevada Acquisition Worksheet includes several sections to cover different aspects of the acquisition process. It typically involves detailed information about the target company, such as financial records, assets, debts, contracts, and intellectual property. This section allows the acquiring party to understand the overall financial health, profitability, and potential risks associated with the target company. Another important section of the Nevada Acquisition Worksheet involves the valuation of the target company. This part includes multiple valuation methods, such as market comparisons, discounted cash flow analysis, and asset-based valuation. By utilizing these methods, stakeholders can determine the fair market value of the company and negotiate a suitable acquisition price. Furthermore, the worksheet may contain a section dedicated to legal documentation and compliance. It ensures that all necessary legal documents, licenses, permits, and contracts are properly reviewed and accounted for during the acquisition process. This section also enables identification and management of potential legal risks or liabilities associated with the target company. Depending on the specific needs and requirements of the acquisition, there can be different types of Nevada Acquisition Worksheets available: 1. General Nevada Acquisition Worksheet: This type encompasses the overall acquisition process, covering all the essential sections mentioned above. It serves as a comprehensive tool for acquiring a company in Nevada. 2. Startup Acquisition Worksheet: This variant focuses on acquisitions involving startup companies. It may include additional sections related to the evaluation of intellectual property, startup business model, market analysis, and potential growth opportunities. 3. Real Estate Acquisition Worksheet: This particular type of worksheet caters to acquisitions involving real estate properties in Nevada. It may have specialized sections related to property appraisals, zoning regulations, environmental assessments, and lease agreements. 4. Technology Company Acquisition Worksheet: Suitable for acquisitions targeting technology companies, this worksheet may incorporate specific sections related to software and hardware assessments, patent searches, and analysis of technological competitiveness. In conclusion, Nevada Acquisition Worksheets are instrumental in facilitating a smooth and well-organized acquisition process. Their detailed sections cover crucial aspects such as financial analysis, valuation, legal documentation, and compliance. With different types available, these worksheets can be tailored to suit specific acquisitions, whether involving startups, real estate, technology companies, or general acquisitions.

Nevada Acquisition Worksheet

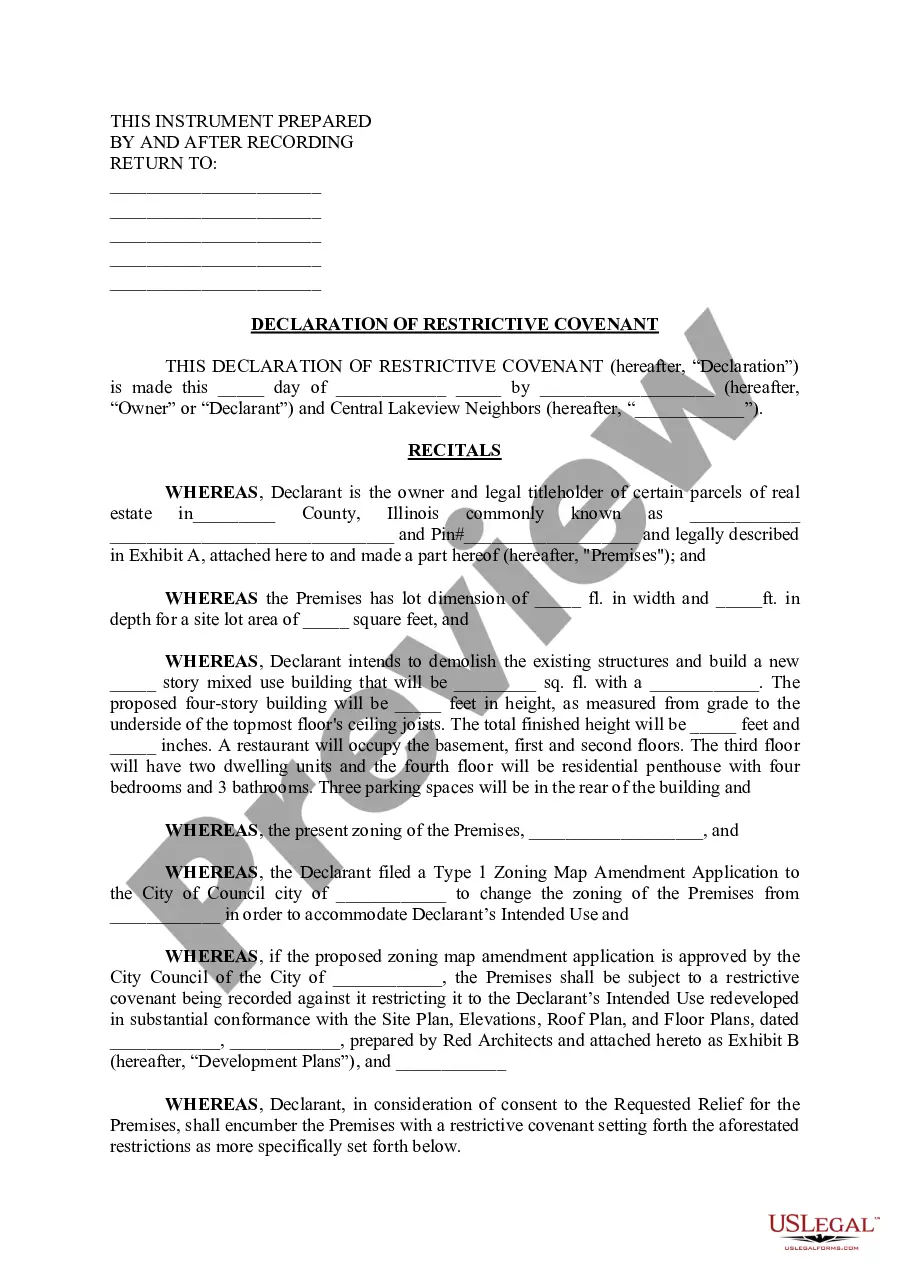

Description

How to fill out Nevada Acquisition Worksheet?

If you need to total, down load, or print out lawful document layouts, use US Legal Forms, the greatest assortment of lawful varieties, which can be found on the web. Utilize the site`s simple and easy practical research to get the documents you need. Different layouts for organization and person purposes are categorized by types and suggests, or key phrases. Use US Legal Forms to get the Nevada Acquisition Worksheet within a number of mouse clicks.

If you are presently a US Legal Forms client, log in in your profile and then click the Download button to have the Nevada Acquisition Worksheet. You can even gain access to varieties you formerly acquired from the My Forms tab of the profile.

If you use US Legal Forms the very first time, follow the instructions listed below:

- Step 1. Be sure you have selected the shape for the correct metropolis/country.

- Step 2. Take advantage of the Review choice to check out the form`s content. Never forget to read the outline.

- Step 3. If you are not happy using the type, use the Search field near the top of the display screen to get other models from the lawful type design.

- Step 4. Once you have discovered the shape you need, click the Get now button. Opt for the prices program you prefer and add your accreditations to register for an profile.

- Step 5. Method the transaction. You may use your charge card or PayPal profile to perform the transaction.

- Step 6. Select the formatting from the lawful type and down load it on your device.

- Step 7. Total, edit and print out or sign the Nevada Acquisition Worksheet.

Every single lawful document design you acquire is the one you have eternally. You might have acces to each type you acquired inside your acccount. Click on the My Forms segment and decide on a type to print out or down load once again.

Compete and down load, and print out the Nevada Acquisition Worksheet with US Legal Forms. There are millions of skilled and express-certain varieties you can utilize for your organization or person demands.