Nevada Reservation of Production Payment

Description

How to fill out Reservation Of Production Payment?

You are able to invest hrs on the web trying to find the authorized papers template that fits the state and federal demands you require. US Legal Forms gives thousands of authorized forms that are reviewed by pros. You can actually download or printing the Nevada Reservation of Production Payment from our service.

If you already possess a US Legal Forms bank account, you can log in and click the Down load switch. Next, you can comprehensive, modify, printing, or sign the Nevada Reservation of Production Payment. Every authorized papers template you purchase is the one you have forever. To have yet another duplicate for any acquired kind, proceed to the My Forms tab and click the corresponding switch.

If you use the US Legal Forms web site for the first time, stick to the straightforward directions listed below:

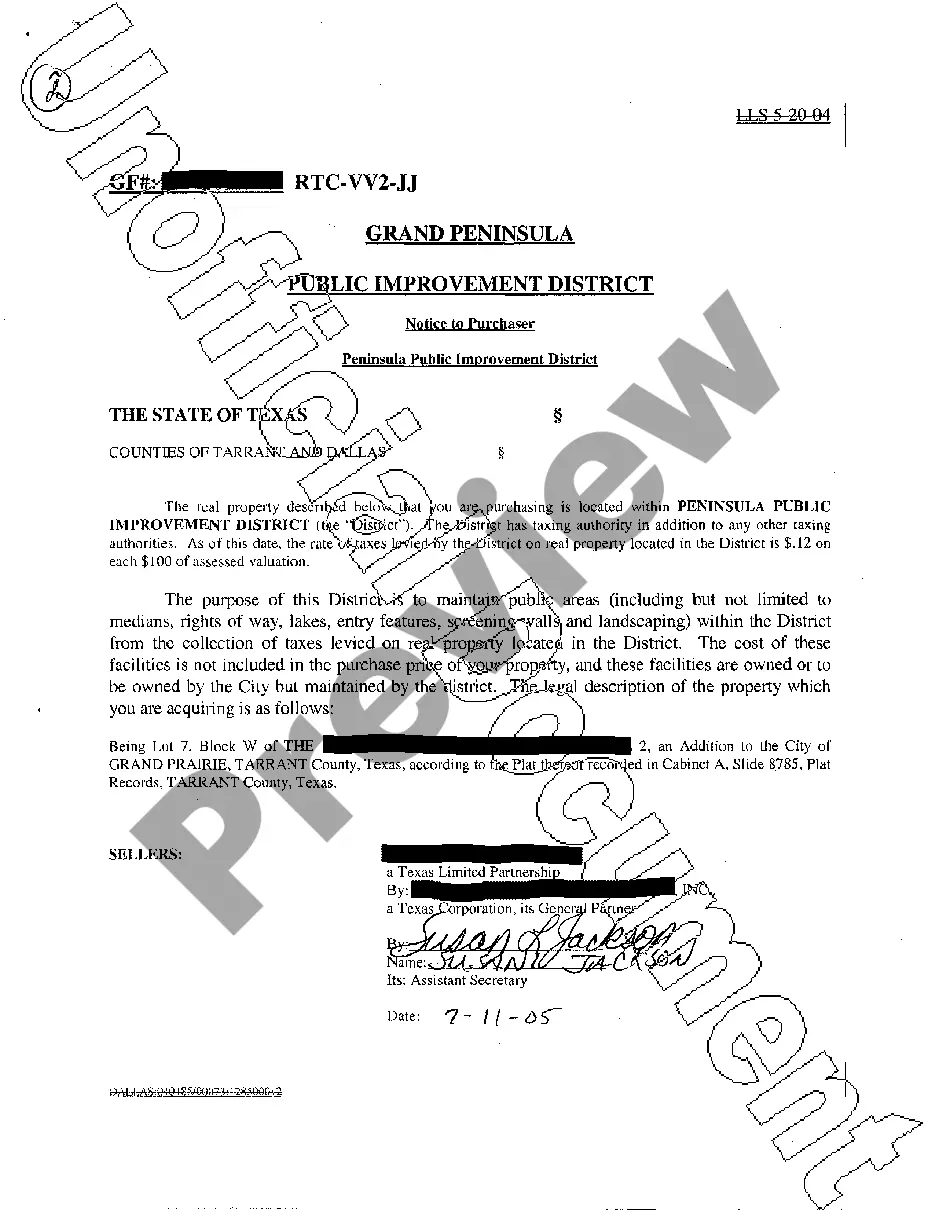

- First, ensure that you have selected the right papers template for the region/metropolis of your choice. Look at the kind description to make sure you have chosen the appropriate kind. If available, make use of the Review switch to check with the papers template as well.

- If you wish to get yet another variation in the kind, make use of the Search field to find the template that fits your needs and demands.

- When you have found the template you need, just click Buy now to proceed.

- Choose the costs plan you need, type in your qualifications, and register for an account on US Legal Forms.

- Full the transaction. You can utilize your Visa or Mastercard or PayPal bank account to cover the authorized kind.

- Choose the file format in the papers and download it for your gadget.

- Make alterations for your papers if required. You are able to comprehensive, modify and sign and printing Nevada Reservation of Production Payment.

Down load and printing thousands of papers templates while using US Legal Forms website, which offers the largest selection of authorized forms. Use expert and state-certain templates to take on your organization or personal demands.

Form popularity

FAQ

The definition of assignment in real estate is the sale, transfer, or conveyance of a whole property ownership/rights or part of it to another party. The term in the oil and gas industry is used for sale, transfer, or conveyance of working interest, lease, royalty, overriding royalty interest, or net profit interest.

Net Revenue Interest is the portion of an oil and gas leaseholder's interest in production that they are entitled to receive as part of their lease. The amount is calculated after deducting all royalty payments, production costs, and other fees.

A percentage of ownership in an oil and gas lease granting its owner the right to explore, drill and produce oil and gas from a tract of property. Working interest owners are obligated to pay a corresponding percentage of the cost of leasing, drilling, producing and operating a well or unit.

Hear this out loud PauseAn assignment of oil and gas lease is a contractual agreement between a landowner and an oil or gas company in which the company gains the right to explore for, develop, and produce oil and gas from the property.

Oil and gas interests are interests in real property and thereby have the same attributes as other real property such as a home or a ranch. Although the ownership of oil and gas interests can take many forms, courts commonly analogize the ownership of oil and gas interests to a bundle of sticks.