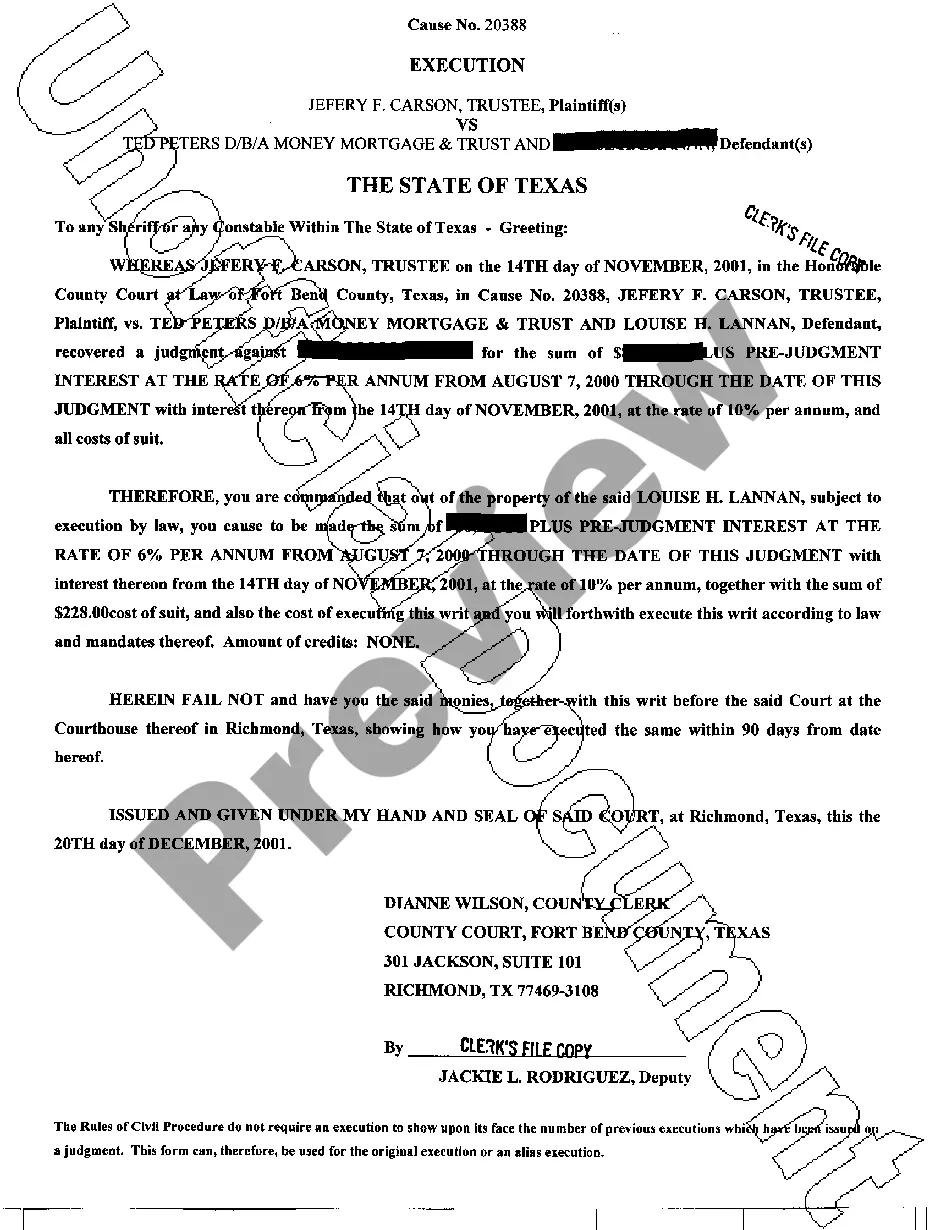

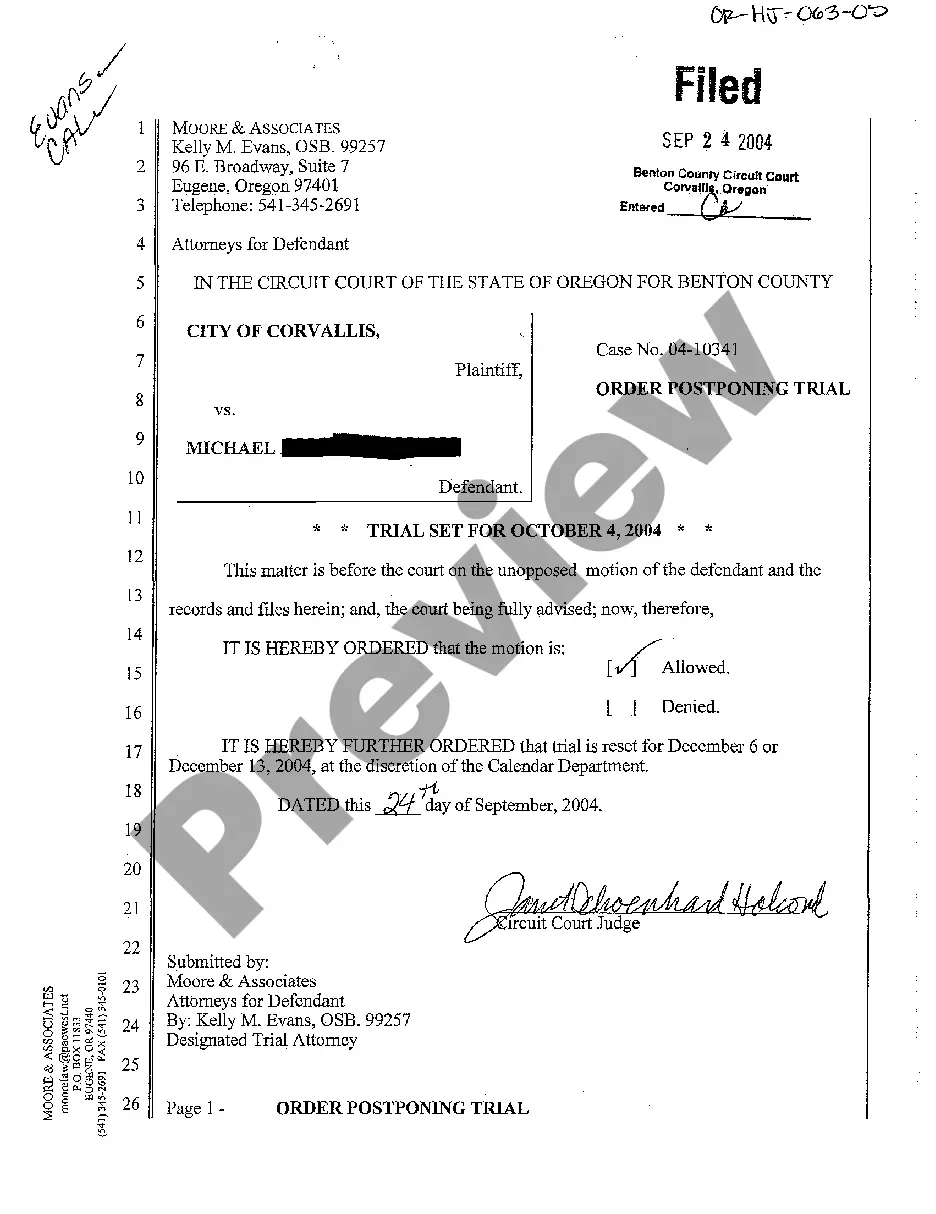

Nevada Disclaimer and Quitclaim of Interest in Mineral / Royalty Interest

Description

How to fill out Disclaimer And Quitclaim Of Interest In Mineral / Royalty Interest?

You may commit time online looking for the legal record template which fits the federal and state requirements you want. US Legal Forms supplies thousands of legal forms that are evaluated by professionals. You can easily acquire or print the Nevada Disclaimer and Quitclaim of Interest in Mineral / Royalty Interest from my assistance.

If you already possess a US Legal Forms account, you are able to log in and then click the Down load button. Following that, you are able to full, edit, print, or indication the Nevada Disclaimer and Quitclaim of Interest in Mineral / Royalty Interest. Every single legal record template you buy is your own forever. To have another copy of the acquired form, proceed to the My Forms tab and then click the corresponding button.

If you use the US Legal Forms web site the very first time, follow the straightforward guidelines listed below:

- Very first, ensure that you have chosen the best record template to the region/area of your choice. See the form outline to make sure you have picked the correct form. If available, make use of the Preview button to appear through the record template as well.

- In order to discover another model from the form, make use of the Lookup area to discover the template that meets your requirements and requirements.

- After you have located the template you want, click on Get now to proceed.

- Pick the costs prepare you want, type in your credentials, and sign up for a merchant account on US Legal Forms.

- Comprehensive the deal. You can utilize your credit card or PayPal account to fund the legal form.

- Pick the formatting from the record and acquire it to the system.

- Make adjustments to the record if possible. You may full, edit and indication and print Nevada Disclaimer and Quitclaim of Interest in Mineral / Royalty Interest.

Down load and print thousands of record web templates using the US Legal Forms site, which provides the most important collection of legal forms. Use specialist and express-certain web templates to deal with your organization or specific requirements.

Form popularity

FAQ

Nevada law requires that deeds include certain information to be recordable and validly transfer ownership of real estate. Names and addresses, a legal description and parcel number for the property, and the current owner's notarized signature all must appear within a quitclaim deed or other Nevada deed.

Mineral rights deeds are not the same as royalty deeds. Royalty deeds do not allow for surface access, or for the initiation of the extraction and sale of minerals. A royalty owner will only benefit economically if the mineral owner decides to produce and sell the minerals.

Mineral Rights Owner- If you are solely a mineral rights owner, you earn the royalties that come from extracting the minerals from the land in question. You do not have control over what occurs on the surface. As the mineral rights owner, you can sell, mine or produce the gas or oil below the surface.

A quick overview of the differences between mineral rights and royalty interests shows a mineral interest is a real property interest obtained by severing the minerals from the surface and a royalty interest grants an owner a portion of the production revenue generated.

This is an estate or ownership in fee simple in and to the minerals. A conveyance or reservation of a mineral fee gives title to the minerals. The ownership of a mineral interest includes all ownership, including the right to execute oil, gas and mineral leases and the right to receive bonuses, rentals and royalties.