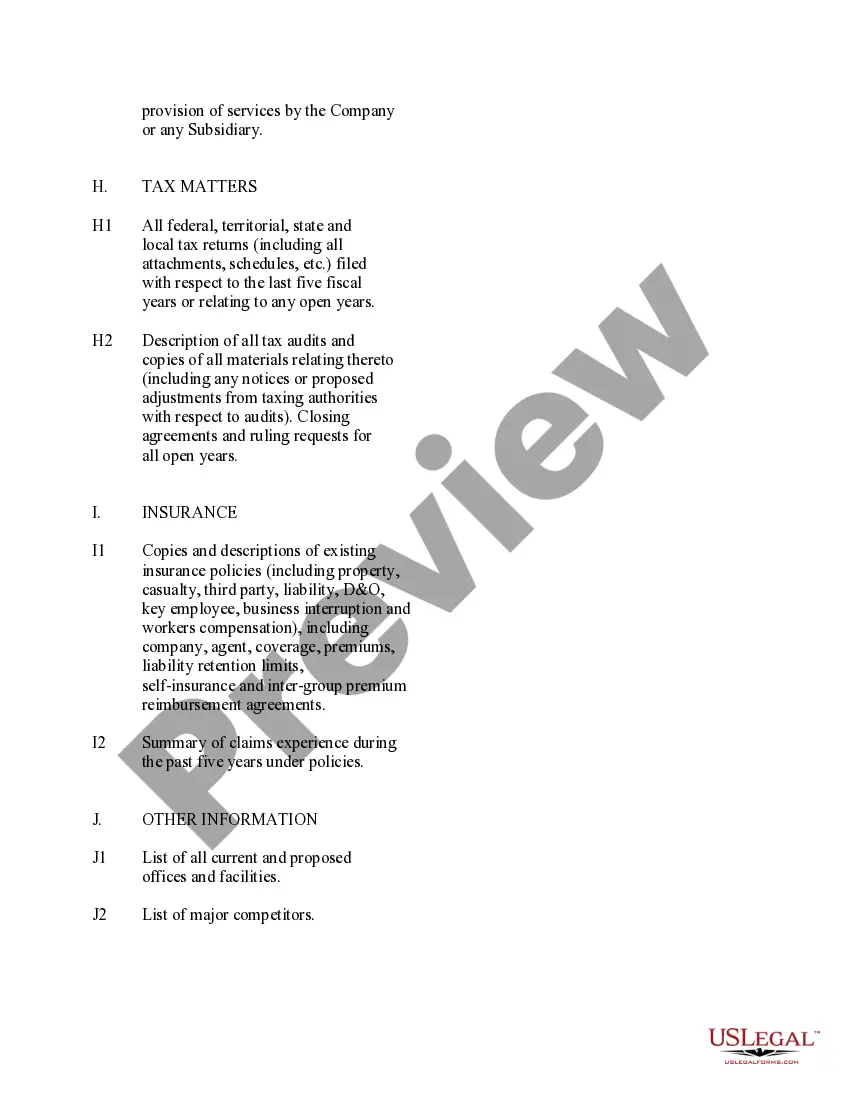

What is Nevada Due Diligence List: A Comprehensive Guide When conducting business in the state of Nevada, it is crucial to be fully informed and compliant with the legal and regulatory requirements. One essential aspect of this process is completing the Nevada Due Diligence List. This list serves as a comprehensive guide to ensure that all necessary steps are taken to operate legally and ethically in Nevada. It encompasses various areas that businesses and individuals must investigate and validate to meet state standards. The Nevada Due Diligence List primarily focuses on legal and financial matters. It includes a range of elements that must be thoroughly researched and addressed before conducting business activities or transactions. While the specific content of the list may vary based on individual circumstances, some common components often included are: 1. Business Licensing: Nevada requires specific licenses and permits for various industries. This section of the due diligence list prompts individuals or businesses to verify whether they have obtained the necessary licenses for their specific operations. 2. Business Entity: This part of the list ensures that the business entity is legally registered with the Nevada Secretary of State, whether it is a corporation, LLC, partnership, or sole proprietorship. It entails verifying the certificate of formation, articles of organization, or other relevant documents. 3. Tax Obligations: Compliance with tax requirements is a vital part of due diligence. This section includes examining state tax obligations, sales tax permits, and payroll tax registration, among others. It also involves confirming that federal tax payments, such as income tax withholding or employer identification numbers, are properly addressed. 4. Employment Compliance: Employers must adhere to various labor laws, including minimum wage regulations, workers' compensation insurance, and workplace safety standards. Here, due diligence ensures that all necessary employment measures are in place. 5. Environmental Compliance: Environmental regulations must be considered, especially for industries involved in hazardous materials, waste management, or land use. This section covers investigating permits, reports, and compliance with state environmental laws. 6. Zoning and Land Use: For businesses operating on physical premises, it is crucial to verify zoning regulations and any restrictions on land use. This involves checking zoning ordinances, planning permission requirements, and ensuring the business aligns with the specified area's restrictions. Types of Nevada Due Diligence Lists: While the core elements of the Nevada Due Diligence List generally apply across all industries, there may be specific variations for different sectors. Some examples include: 1. Real Estate Due Diligence List: Tailored to those involved in property development, purchase, or leasing. It includes additional checks on title searches, building permits, land utilization, and environmental site assessments. 2. Financial Due Diligence List: This variant focuses on financial institutions, investment firms, or those engaged in financial transactions. It emphasizes assessing compliance with state banking regulations, anti-money laundering measures, and reporting obligations. 3. Licensing and Permits Due Diligence List: This type is designed specifically for businesses that require numerous licenses and permits operating in Nevada, such as liquor licenses, gaming permits, or healthcare-related certifications. By following the Nevada Due Diligence List specific to their industry, individuals and businesses can ensure they comply with all legal, financial, and regulatory requirements within the state. This comprehensive approach minimizes potential risks and legal issues, allowing for a smooth and lawful operation in Nevada.

Nevada Due Diligence List

Description

How to fill out Nevada Due Diligence List?

Finding the right lawful papers format can be a have difficulties. Of course, there are plenty of web templates available on the net, but how do you find the lawful kind you need? Use the US Legal Forms web site. The services delivers a huge number of web templates, for example the Nevada Due Diligence List, which you can use for company and personal needs. All of the varieties are checked out by specialists and meet federal and state specifications.

Should you be presently registered, log in to your profile and click the Acquire option to get the Nevada Due Diligence List. Make use of your profile to search with the lawful varieties you may have purchased formerly. Proceed to the My Forms tab of your respective profile and have another backup of your papers you need.

Should you be a brand new customer of US Legal Forms, allow me to share simple recommendations for you to comply with:

- First, make sure you have chosen the appropriate kind to your city/county. It is possible to look through the form making use of the Preview option and browse the form explanation to make certain it is the right one for you.

- In the event the kind fails to meet your preferences, take advantage of the Seach area to find the right kind.

- When you are positive that the form is proper, go through the Get now option to get the kind.

- Select the pricing strategy you desire and enter in the required details. Design your profile and pay for the order using your PayPal profile or charge card.

- Select the file file format and down load the lawful papers format to your system.

- Full, edit and produce and sign the attained Nevada Due Diligence List.

US Legal Forms may be the greatest local library of lawful varieties in which you will find numerous papers web templates. Use the company to down load appropriately-created documents that comply with state specifications.