Nevada Clauses Relating to Dividends, Distributions

Description

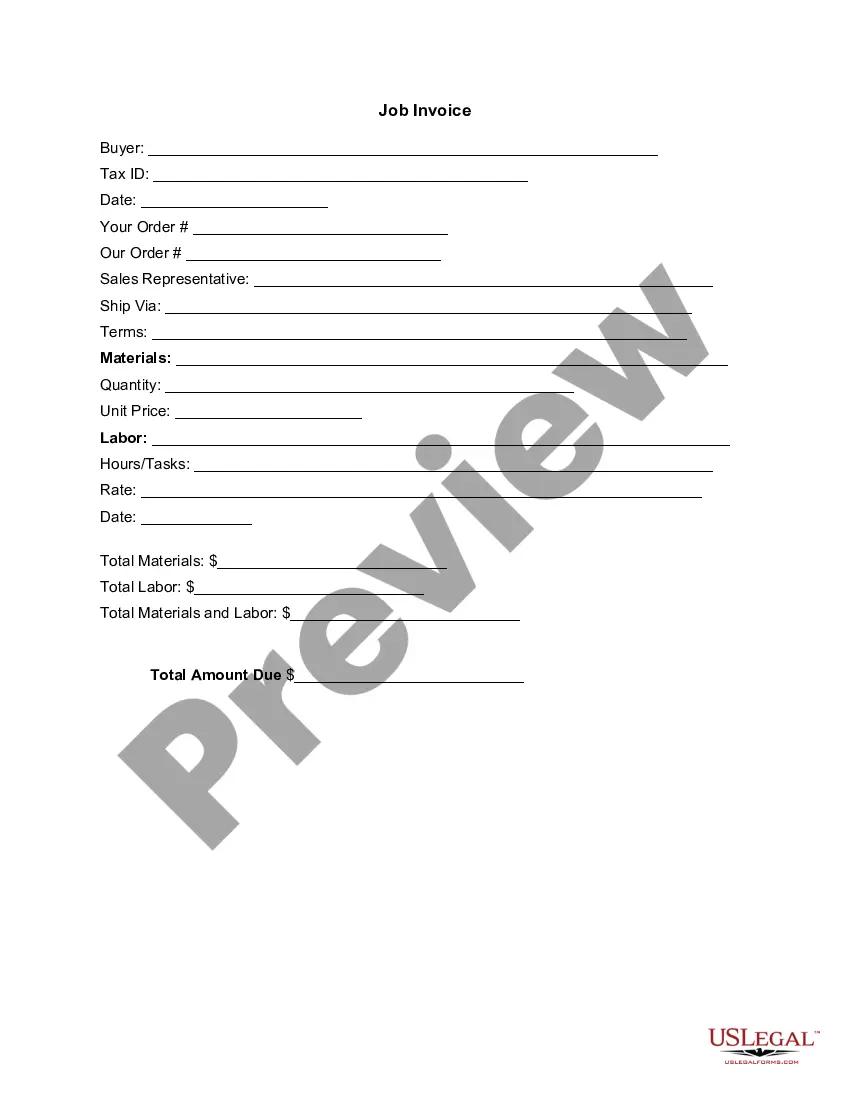

How to fill out Clauses Relating To Dividends, Distributions?

US Legal Forms - one of several greatest libraries of authorized kinds in the States - delivers a variety of authorized document web templates you can down load or produce. Using the web site, you can find 1000s of kinds for enterprise and individual uses, sorted by groups, suggests, or search phrases.You will find the most recent versions of kinds much like the Nevada Clauses Relating to Dividends, Distributions within minutes.

If you have a subscription, log in and down load Nevada Clauses Relating to Dividends, Distributions in the US Legal Forms local library. The Down load key can look on each and every kind you perspective. You have access to all previously acquired kinds within the My Forms tab of your respective profile.

If you wish to use US Legal Forms for the first time, listed below are basic guidelines to obtain began:

- Be sure you have selected the proper kind for the city/region. Go through the Preview key to review the form`s information. Read the kind description to actually have chosen the appropriate kind.

- When the kind does not suit your needs, utilize the Research discipline near the top of the display to get the one who does.

- When you are content with the form, validate your option by clicking the Purchase now key. Then, choose the pricing strategy you want and supply your credentials to sign up to have an profile.

- Method the deal. Make use of credit card or PayPal profile to perform the deal.

- Select the structure and down load the form in your product.

- Make adjustments. Fill up, modify and produce and sign the acquired Nevada Clauses Relating to Dividends, Distributions.

Each format you included with your account does not have an expiration day and is also the one you have eternally. So, if you wish to down load or produce yet another duplicate, just visit the My Forms portion and then click in the kind you require.

Gain access to the Nevada Clauses Relating to Dividends, Distributions with US Legal Forms, probably the most considerable local library of authorized document web templates. Use 1000s of professional and state-certain web templates that meet up with your organization or individual requirements and needs.

Form popularity

FAQ

A seller or salesperson who receives a written request for a refund or replacement shall not require prior authorization for a return of goods and shall give a refund or replacement within 14 days after receipt of the request.

NRS 82.271 - Meetings of board of directors or delegates: Quorum; consent to action taken without meeting; alternative means for participating at meeting.

Starting a Nevada Nonprofit Guide: Choose your NV nonprofit filing option. File the NV nonprofit articles of incorporation. File your Initial List of Officers. Get a Federal EIN from the IRS. Adopt your nonprofit's bylaws. Apply for federal and/or state tax exemptions. Apply for any required state licenses.

Chapter 78 Private Corporations. NRS 78.315 Directors' meetings: Quorum; consent for actions taken without meeting; participation by telephone or similar method. NRS 78.315 Directors' meetings: Quorum; consent for actions taken without meeting; participation by telephone or similar method.

Nevada law contains a provision governing ?acquisition of controlling interest.? This law provides generally that any person or entity that acquires 20% or more of the outstanding voting shares of a publicly-held Nevada corporation in the secondary public or private market may be denied voting rights with respect to ...

OVERVIEW OF NEVADA NONPROFIT CORPORATIONS. Nonprofit Corporation. A nonprofit corporation is a corporation formed to carry out a charitable, educational, religious, literary, or scientific purpose. A business organization that serves some public purpose and therefore enjoys special treatment under the law.

Recruit Incorporators and Initial Directors You will need at least one, but can have more than one. Directors make up the governing body of your nonprofit corporation and are stakeholders in your organization's purpose and success. You'll want to identify three, unrelated individuals to meet IRS requirements.

What it Costs to Form a Nevada Nonprofit. The Nevada's Attorney General's Office charges $50 to file non-profit Articles of Incorporation. A name reservation fee is $25. The fee for your organization's annual list of directors, officers and registered agent is $25.