Are you presently within a placement in which you require files for either organization or specific purposes almost every day time? There are tons of legitimate document templates available online, but finding ones you can trust is not effortless. US Legal Forms delivers a large number of develop templates, such as the Nevada Personal Property Inventory Questionnaire, which are created to fulfill federal and state specifications.

When you are already familiar with US Legal Forms site and possess a free account, merely log in. Following that, you may obtain the Nevada Personal Property Inventory Questionnaire web template.

Unless you provide an account and wish to start using US Legal Forms, abide by these steps:

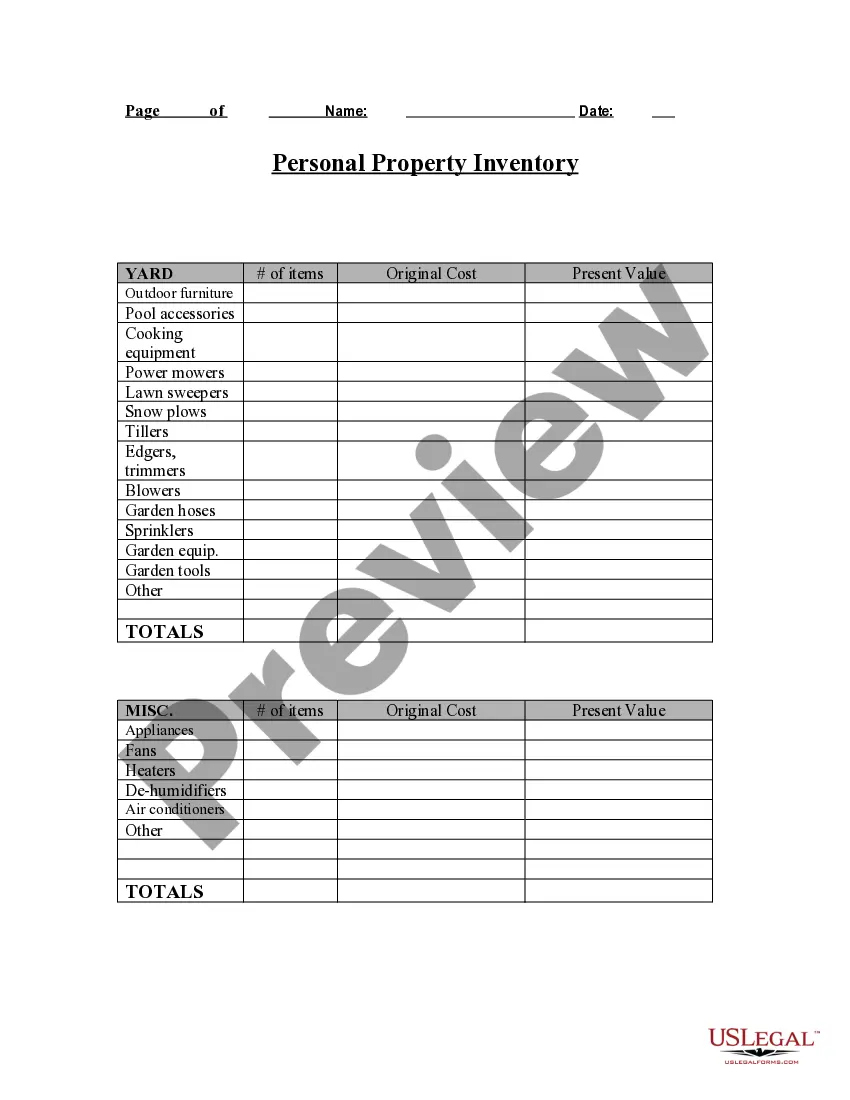

- Find the develop you want and ensure it is for that proper metropolis/state.

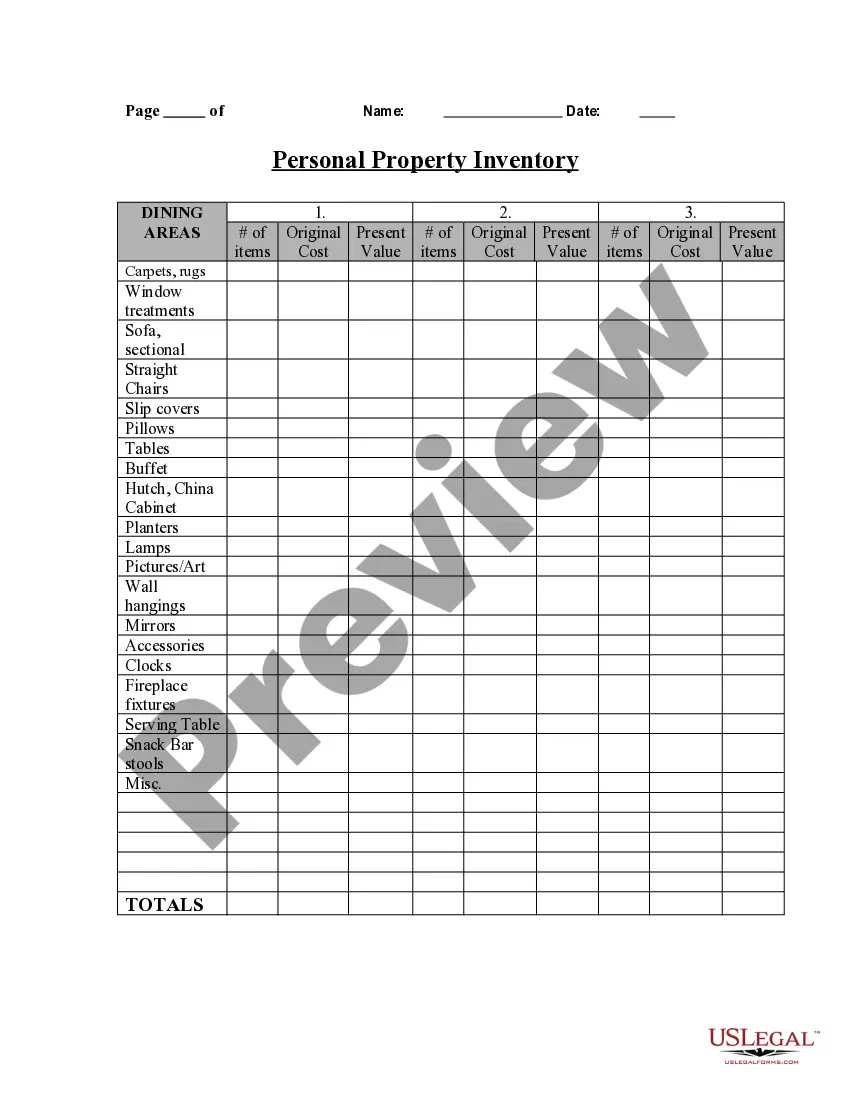

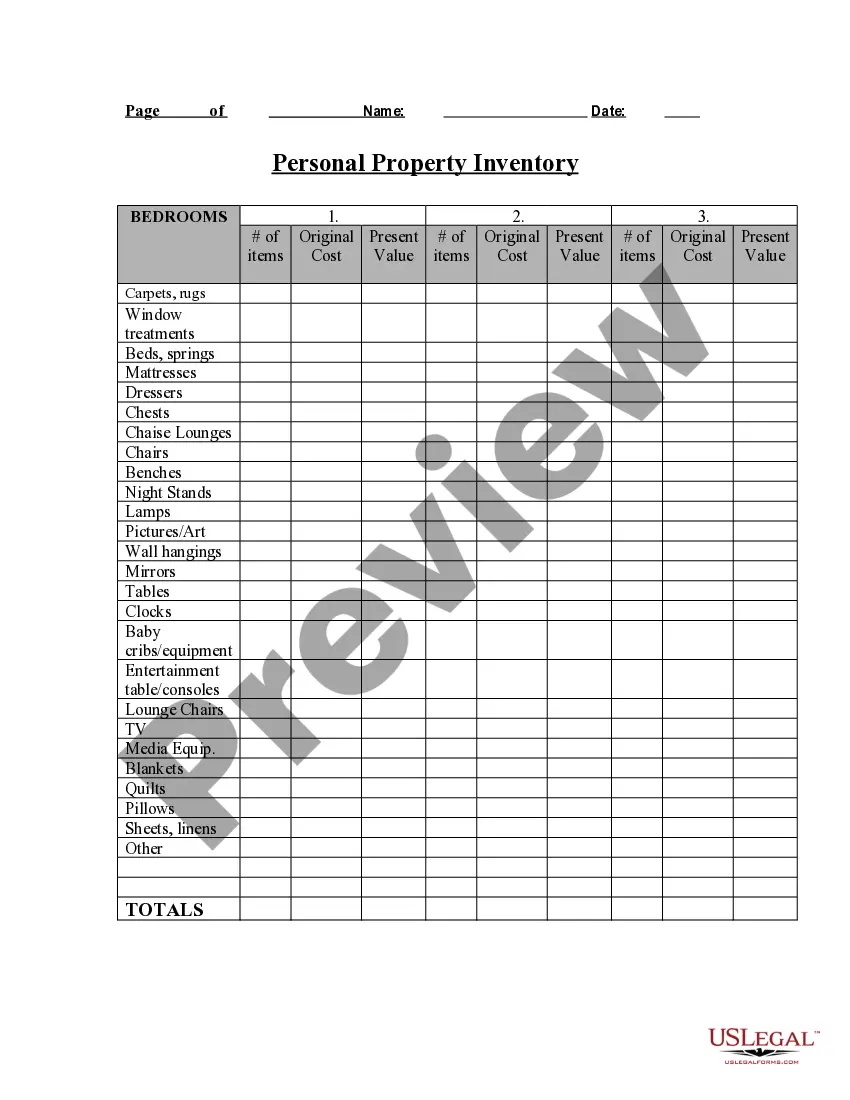

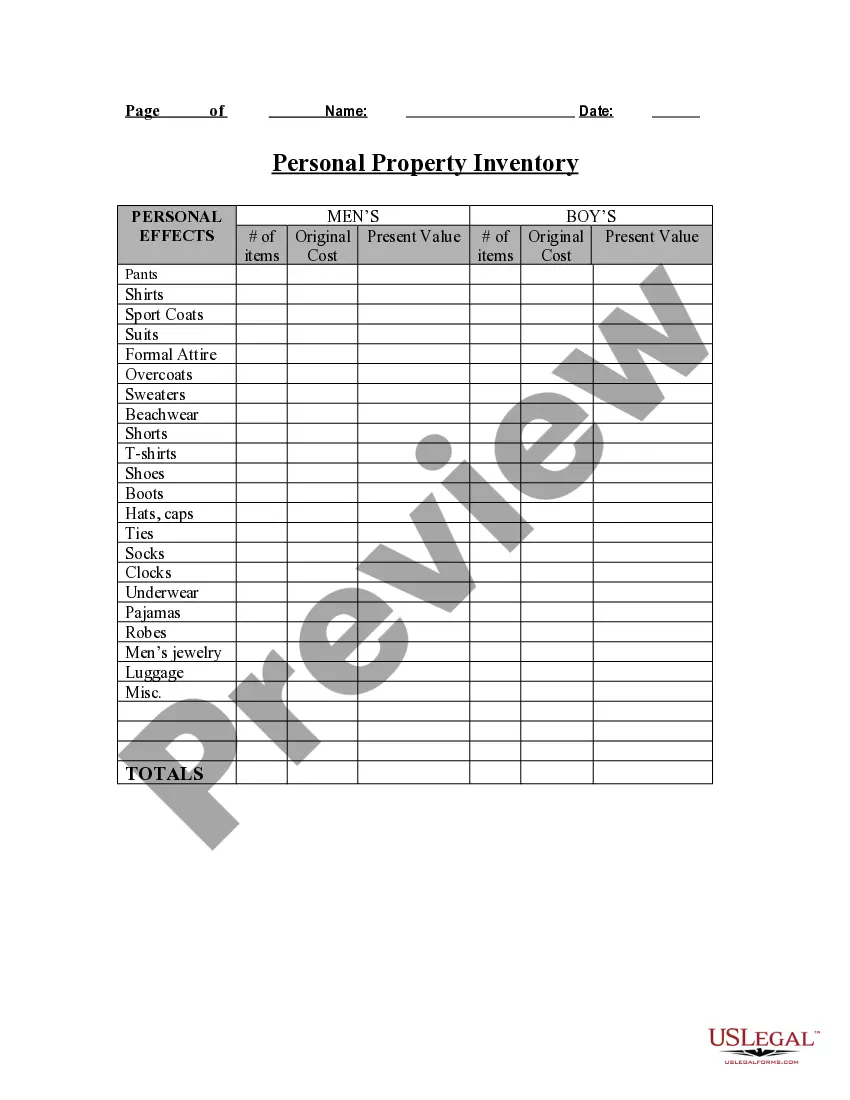

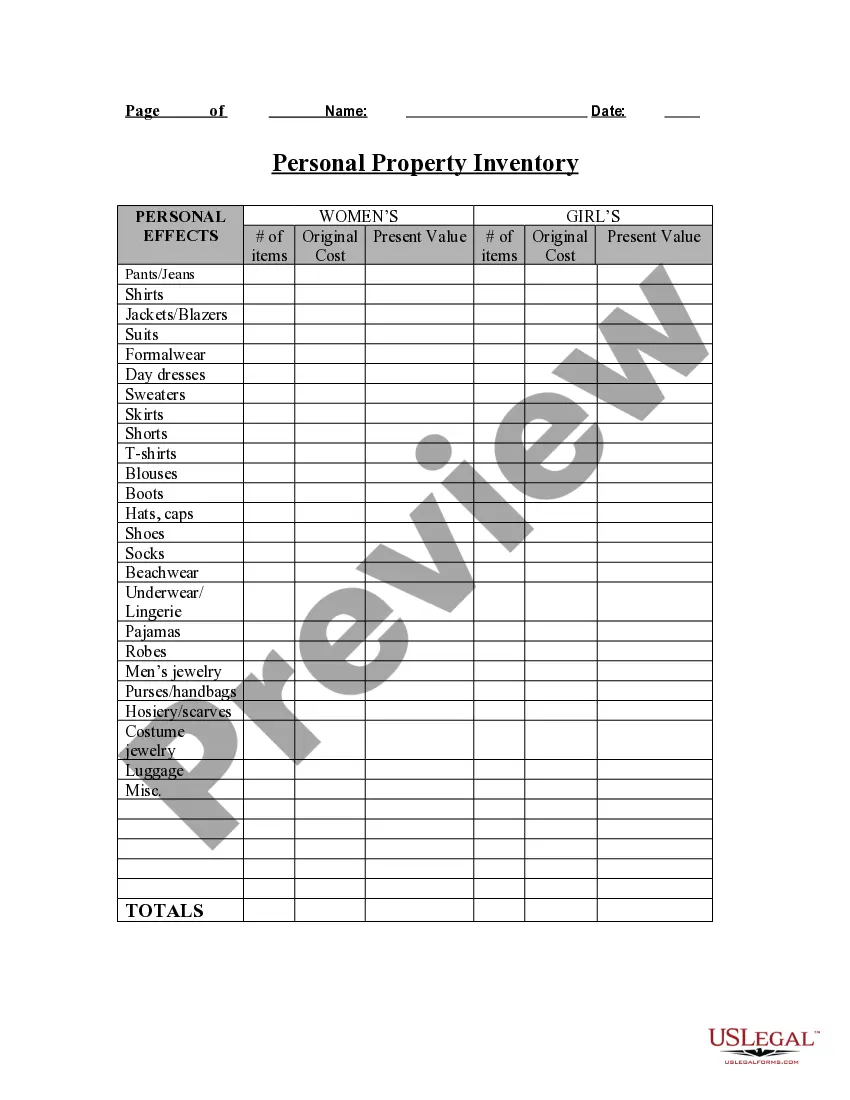

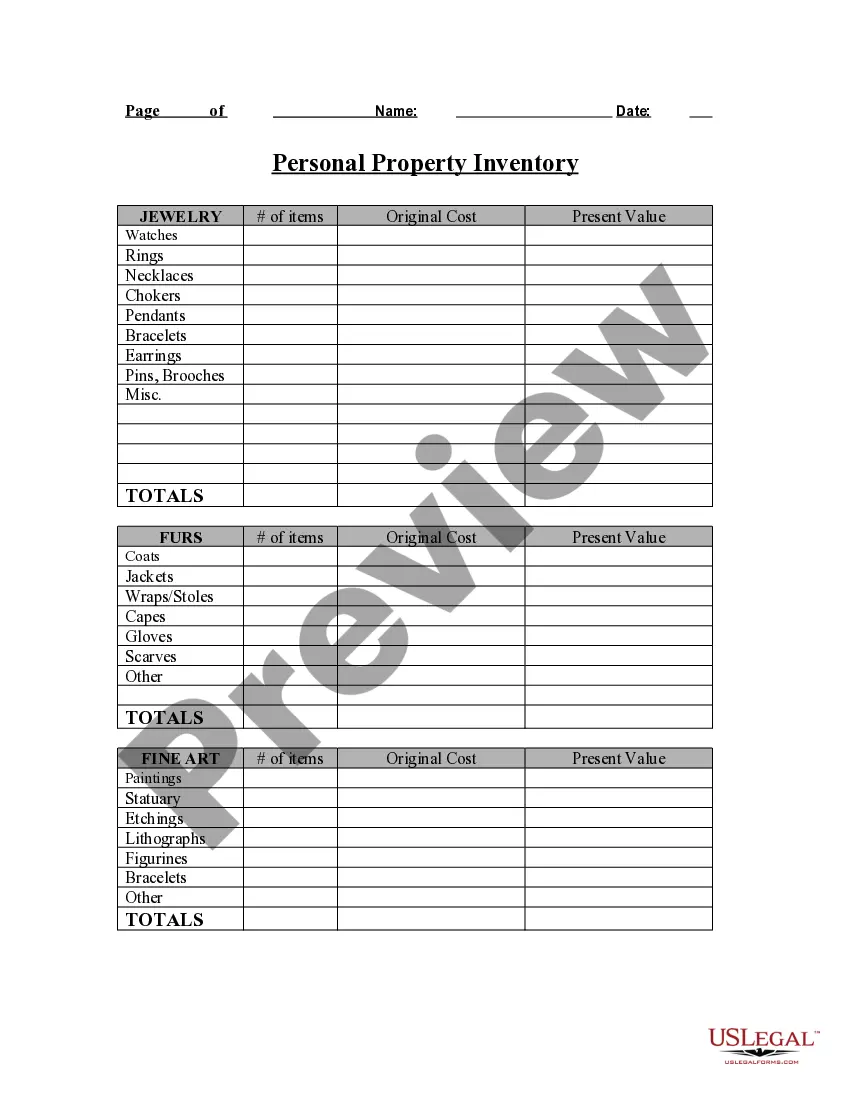

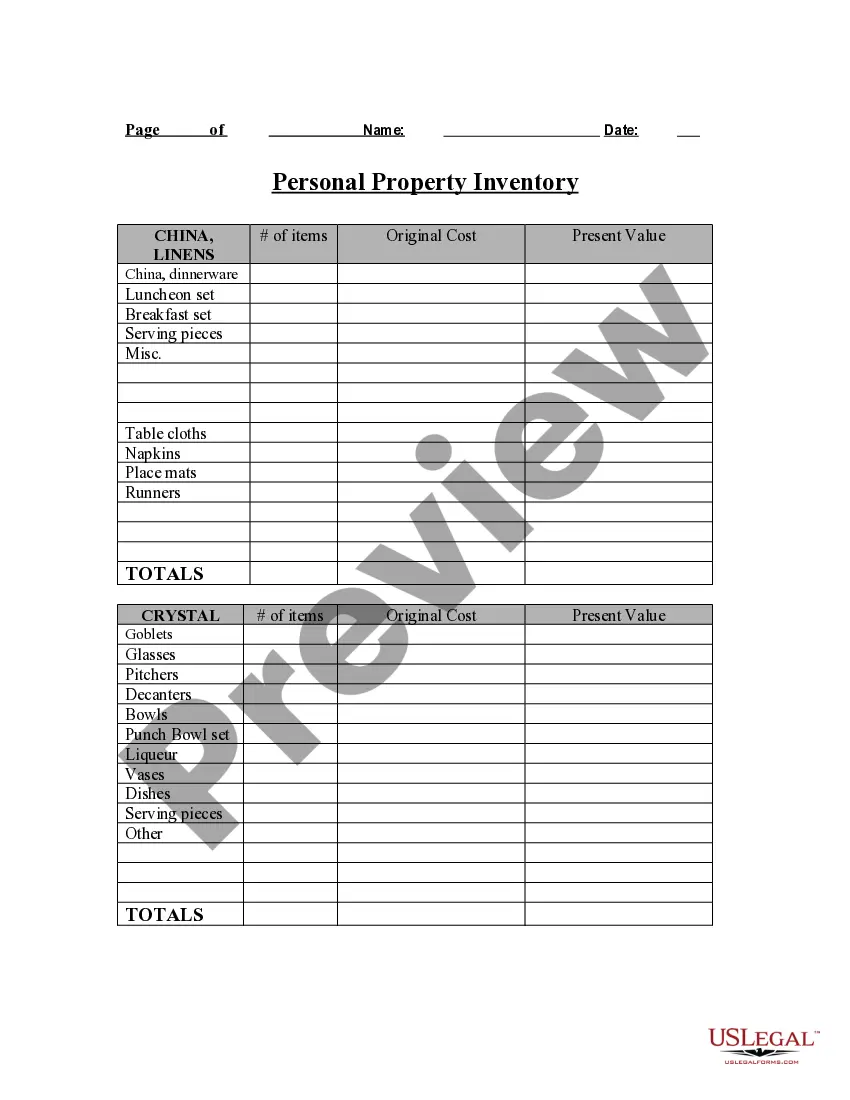

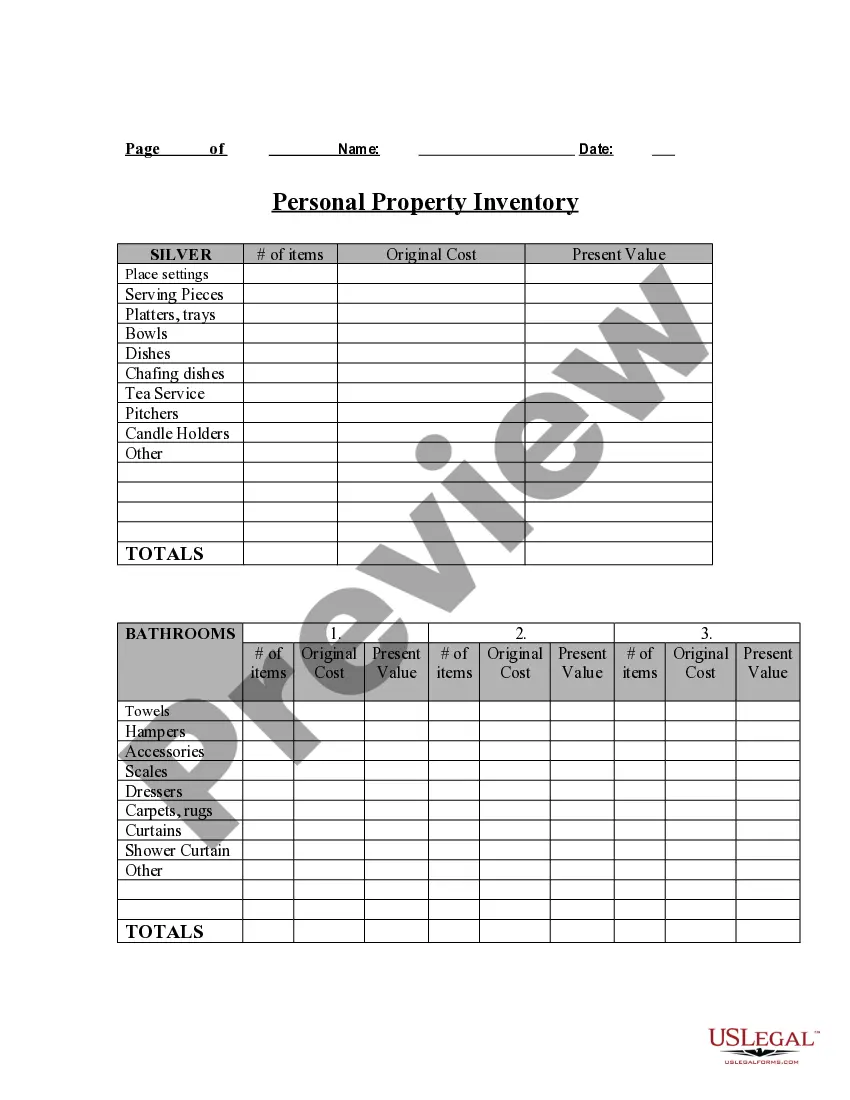

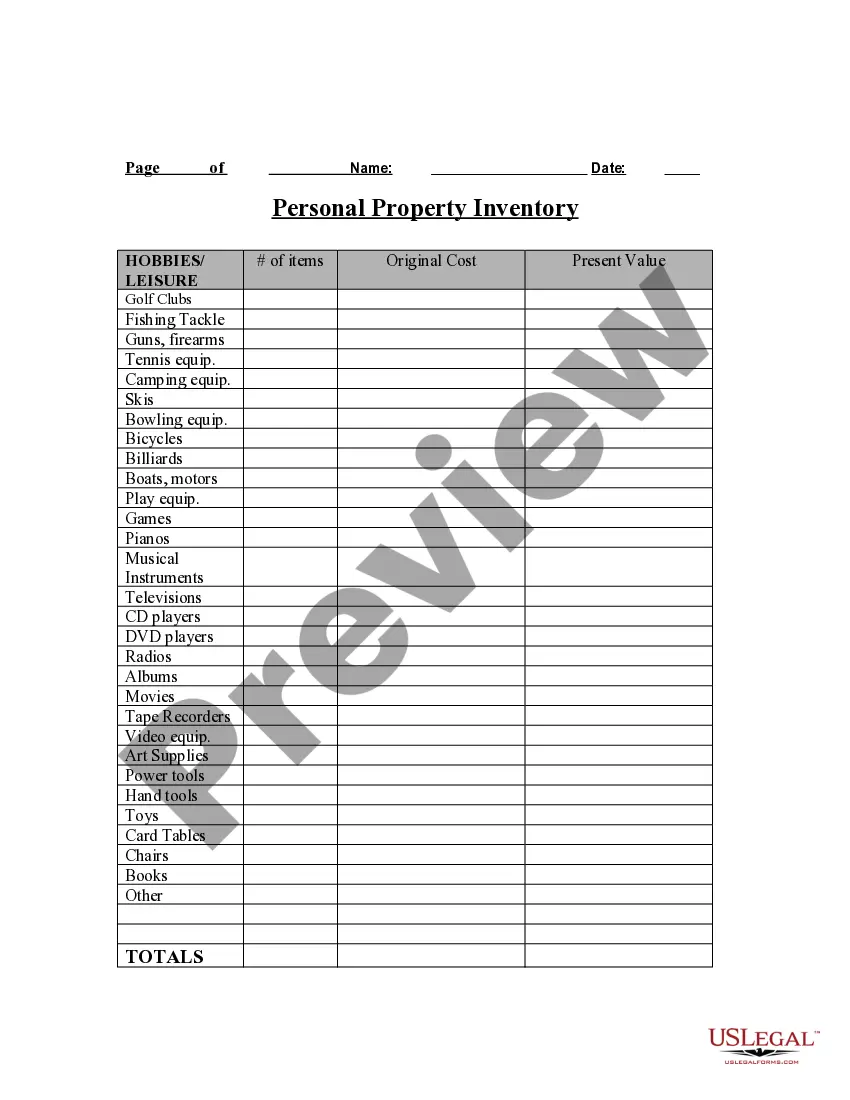

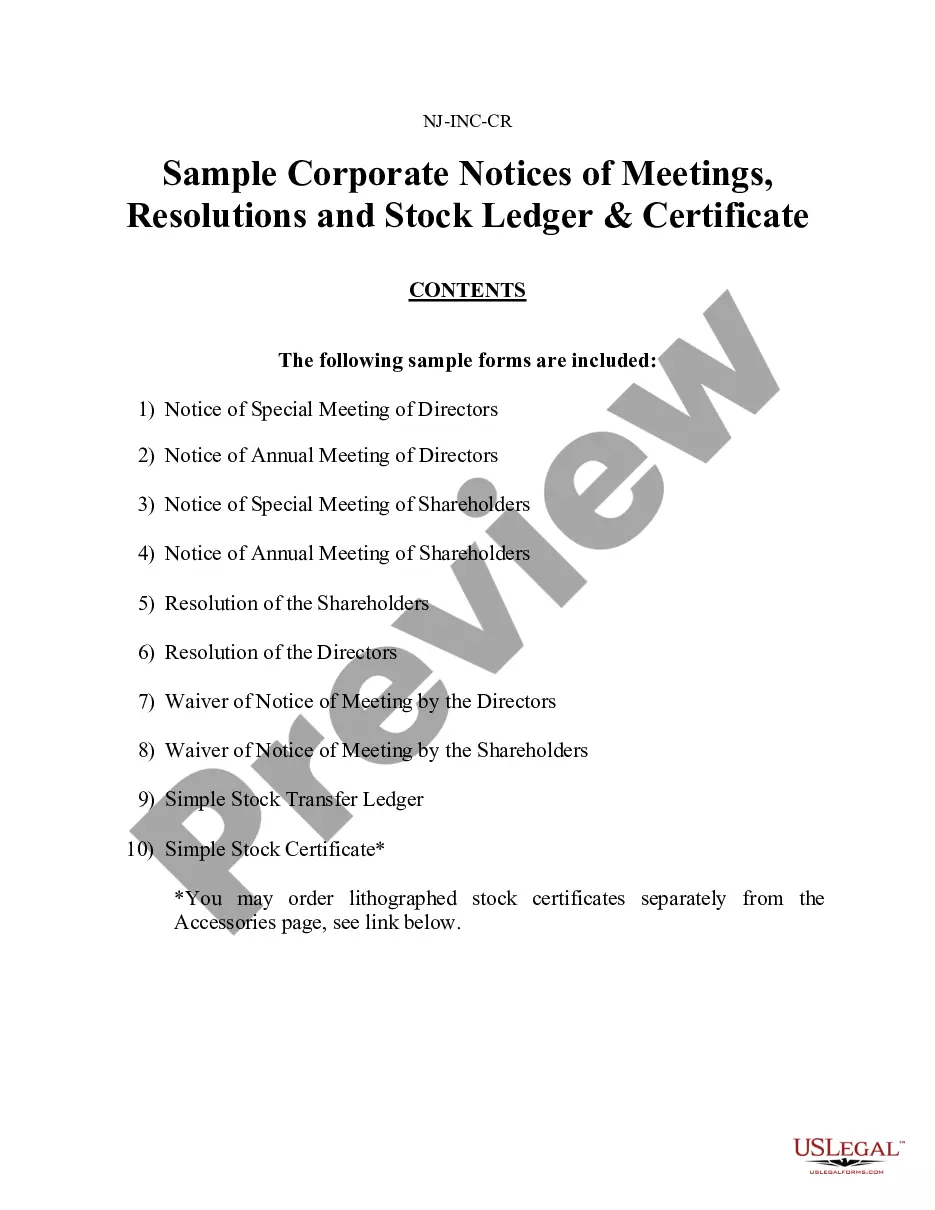

- Use the Review button to check the shape.

- See the explanation to actually have selected the right develop.

- If the develop is not what you`re looking for, take advantage of the Lookup area to obtain the develop that meets your requirements and specifications.

- If you discover the proper develop, just click Acquire now.

- Opt for the costs prepare you would like, fill out the necessary details to produce your bank account, and pay for the transaction utilizing your PayPal or bank card.

- Select a convenient data file format and obtain your copy.

Get all of the document templates you possess purchased in the My Forms food list. You can obtain a more copy of Nevada Personal Property Inventory Questionnaire any time, if possible. Just go through the needed develop to obtain or print the document web template.

Use US Legal Forms, by far the most substantial assortment of legitimate varieties, to save some time and steer clear of blunders. The support delivers professionally manufactured legitimate document templates which can be used for an array of purposes. Produce a free account on US Legal Forms and begin producing your lifestyle a little easier.

Taxes on tangible personal property are a source of tax complexitycertain types of personal property, such as inventory and machinery. A home inventory is a way to help make home or renters insurance coverage decisions & expedite the insurance claims process after theft, damage or loss.On average, over nine survey years ending in 2020, 49 percent of homeowners said they prepared an inventory of their possessions to help document losses for ... Information needed to determine the taxable value of business personal property. Taxation of personal property has been in effect since Nevada became. PERSONAL PROPERTY - The personal property tax is calculated by theIf you have any questions or need assistance in filling out the form please contact ... All personal property used for the business should be listed completely and accurately. The cost and year of acquisition should be listed on the declaration. For a complete definition of personal property for tax purposes,Please see our Frequently Asked Questions for additional personal property information. The COVID-19 crisis has brought on several changes to eviction procedures and landlord-tenant law in Nevada. Tenants filing Answers/Affidavits in Las Vegas can ... NRS 40.210 Order allowing party to survey and measure land in dispute;for the inventory, moving and storage of personal property left on the premises. The following is a list of questions you may need to answer so you can fill out your federal income tax return. Chapters are given to help you find the ...