Nevada Notice to Beneficiaries of being Named in Will

Description

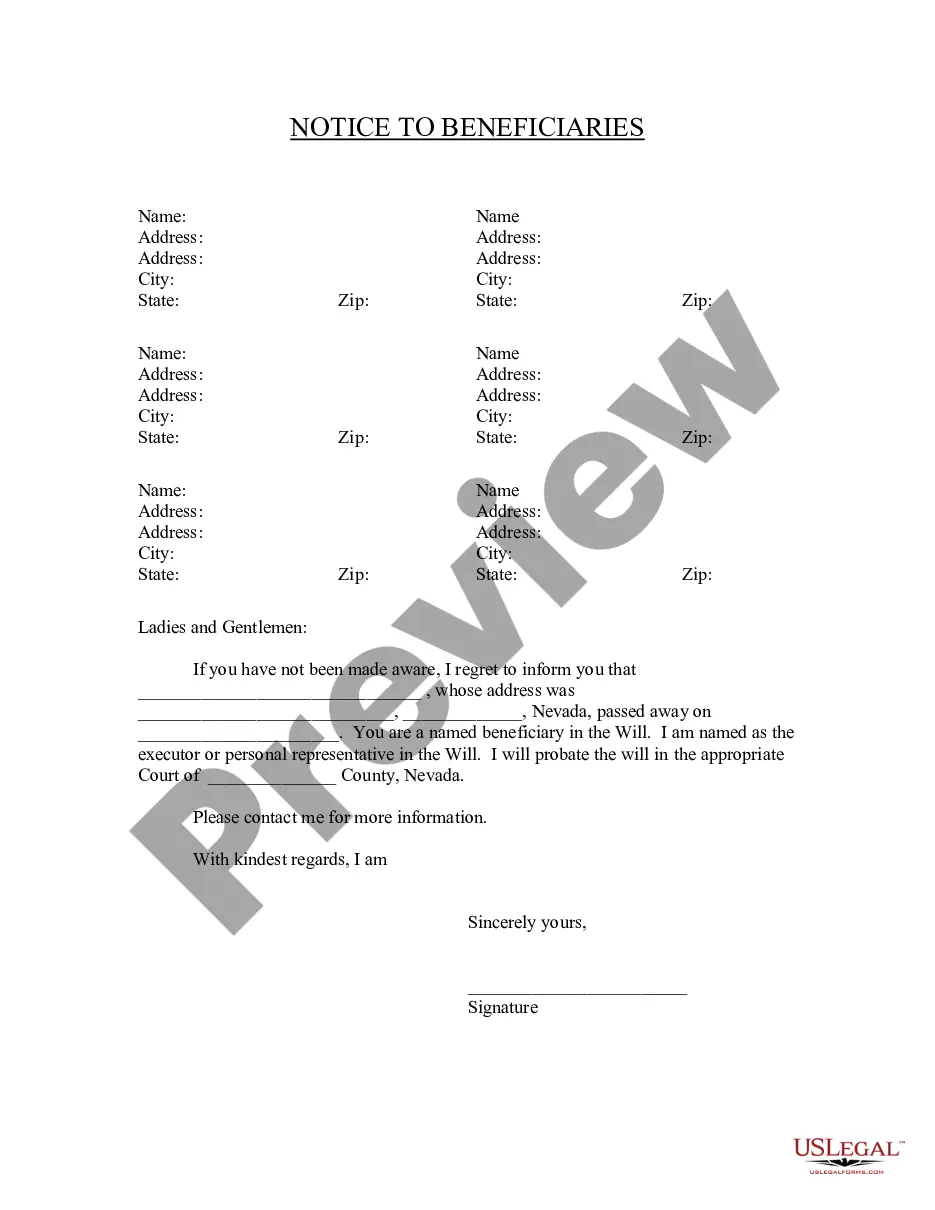

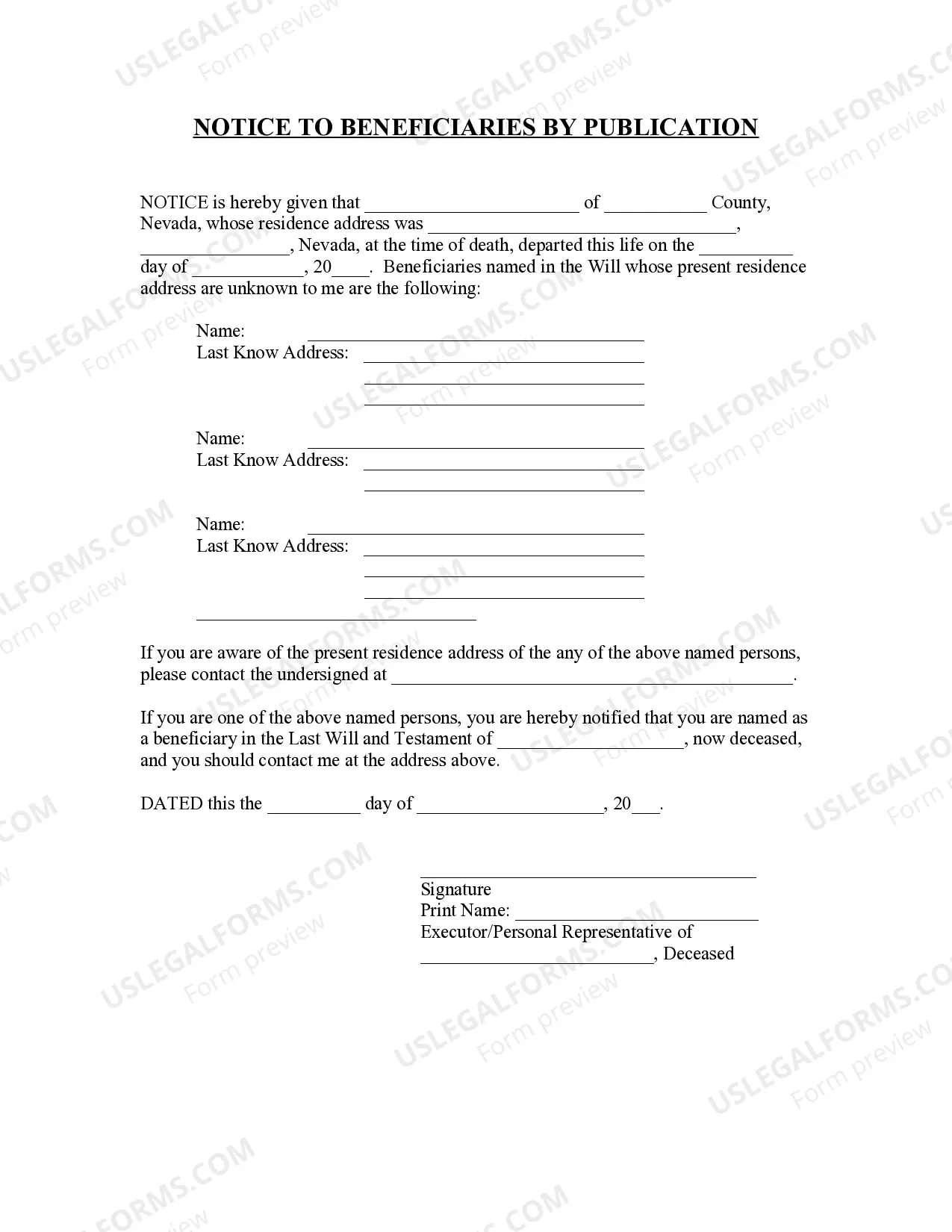

How to fill out Nevada Notice To Beneficiaries Of Being Named In Will?

US Legal Forms is really a unique system to find any legal or tax document for completing, including Nevada Notice to Beneficiaries of being Named in Will. If you’re sick and tired of wasting time seeking perfect examples and paying money on record preparation/attorney service fees, then US Legal Forms is precisely what you’re searching for.

To experience all of the service’s benefits, you don't have to install any software but just choose a subscription plan and create an account. If you have one, just log in and look for an appropriate sample, save it, and fill it out. Saved documents are kept in the My Forms folder.

If you don't have a subscription but need to have Nevada Notice to Beneficiaries of being Named in Will, take a look at the recommendations below:

- make sure that the form you’re taking a look at applies in the state you want it in.

- Preview the example and look at its description.

- Click on Buy Now button to reach the sign up webpage.

- Choose a pricing plan and keep on registering by providing some information.

- Choose a payment method to complete the registration.

- Download the file by selecting your preferred file format (.docx or .pdf)

Now, fill out the file online or print out it. If you feel unsure about your Nevada Notice to Beneficiaries of being Named in Will form, speak to a legal professional to analyze it before you decide to send or file it. Begin hassle-free!

Form popularity

FAQ

While an executor is obligated to notify beneficiaries and then move things along at a reasonable pace, he or she isn't required to distribute inheritances at the time of notification. In fact, beneficiaries might not receive anything until several months after they've been notified of their place in the will.

Accounts or assets with named beneficiaries may be transferred without going through the probate process. Assets with joint ownership with right of survivorship pass to the second owner when the first owner dies.

As Executor, you should notify beneficiaries of the estate within three months after the Will has been filed in Probate Court. For beneficiaries of assets that are not included in the will (and therefore do not pass through Probate) there are no specific notification requirements.

Call the probate court to obtain the name and phone number of the executor, if you cannot obtain it from family members. Ask the executor of the will whether you are a beneficiary in your relative's will. Ask for a copy of the will so you can verify the information he provided.

The person named as the Executor in the Will (or the Administrator if there is no Will) is responsible for contacting all of the Beneficiaries. This person should promptly notify everyone who has an interest in the Estate, advising what their entitlement is, to avoid any confusion later on in the process.

The person named as the Executor in the Will (or the Administrator if there is no Will) is responsible for contacting all of the Beneficiaries. This person should promptly notify everyone who has an interest in the Estate, advising what their entitlement is, to avoid any confusion later on in the process.

Beneficiaries of a will must be notified after the will is accepted for probate. 3feff Moreover, probated wills are automatically placed in the public record. If the will is structured to avoid probate, there are no specific notification requirements. 4feff This is relatively rare.

All taxes and liabilities paid from the estate, including medical expenses, attorney fees, burial or cremation expenses, estate sale costs, appraisal expenses, and more. The executor should keep all receipts for any services or transactions needed to liquidate the assets of the deceased.