New York Limited Liability Company LLC Operating Agreement

Description

Key Concepts & Definitions

Limited Liability Company (LLC): A business structure allowed by state statute. LLCs are popular because they offer the liability protection of a corporation with the tax benefits and flexibility of a partnership. LLC Operating Agreement: A document that outlines the operational and financial decisions of an LLC, including rules, regulations, and provisions. The purpose of the operating agreement is to govern the internal operations of the business in a way that suits the specific needs of the business owners.

Step-by-Step Guide to Creating an LLC Operating Agreement

- Determine the Needs of Your Business: Analyze what specific provisions your LLC will require to efficiently handle operations, financial management, and dispute resolution.

- Choose a Registered Agent: Appoint a registered agent who will be responsible for receiving legal documents on behalf of the LLC.

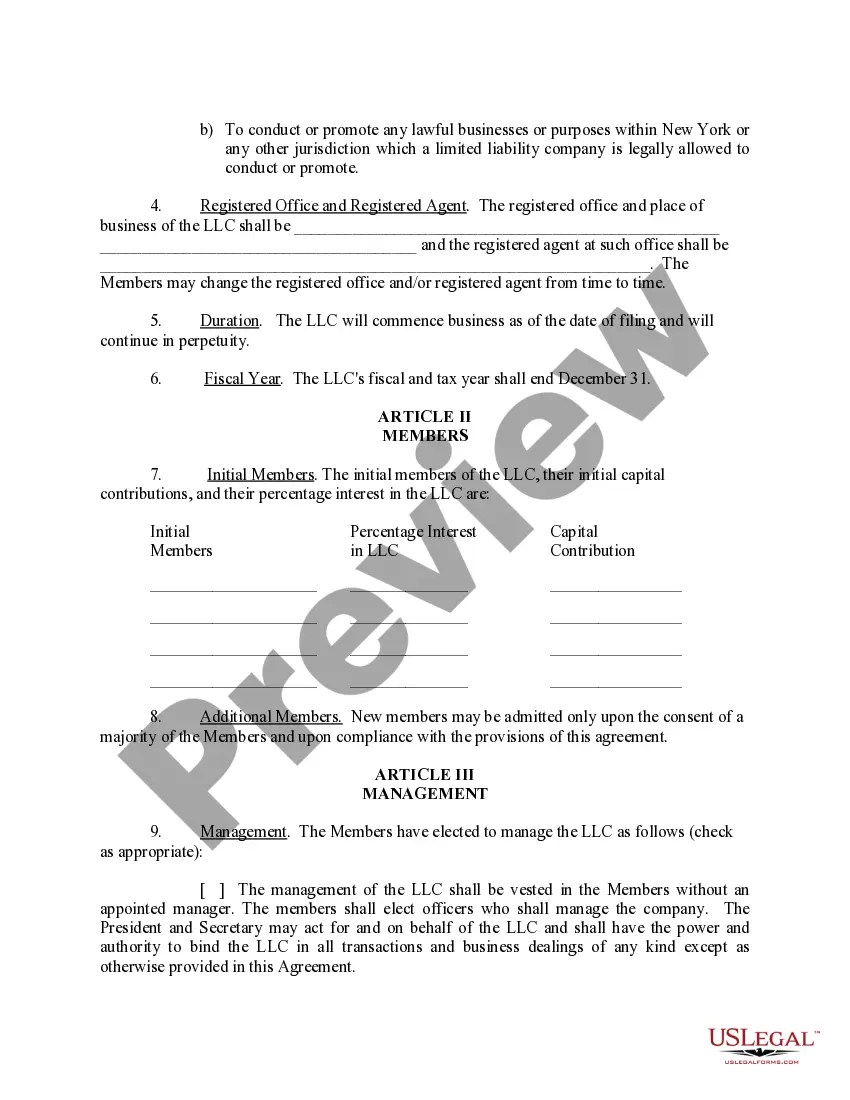

- Define Membership and Ownership Interests: Clearly state who the members are, their ownership percentages, rights, and responsibilities.

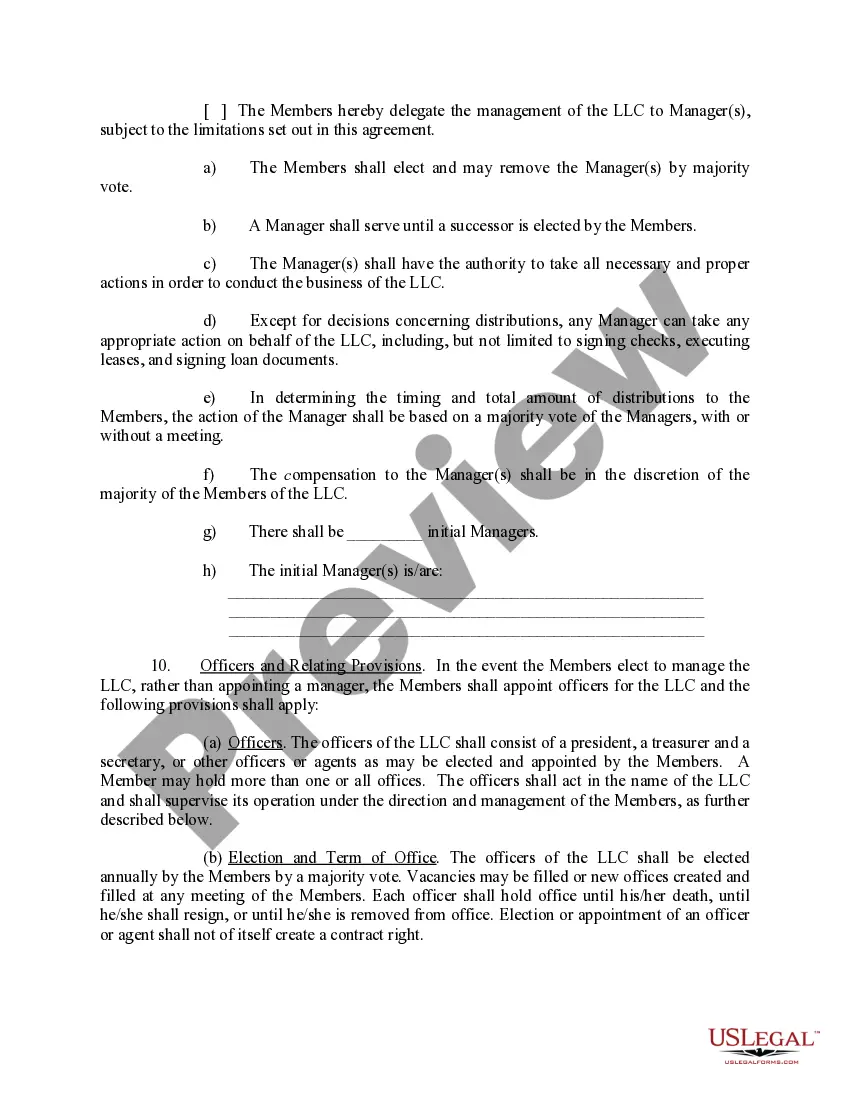

- Outline the Structure of Management: Decide whether the LLC will be managed by members or a manager, and detail the duties and powers of the management.

- Address Financial Management: Set protocols for how financial records will be kept, detailing everything from capital contributions to distributions.

- Plan for Changes and Succession: Include how changes in membership will be handled and outline any succession plans.

- Detail the Dispute Resolution Mechanisms: Specify how disputes amongst members will be governed and resolved.

- Ensure Compliance with the Company Act: Confirm that the operating agreement complies with state-specific LLC regulations and the broader Company Act.

- Review and Sign: Have all members review the agreement, make any necessary amendments, and sign off on the document.

Risk Analysis of Inadequate LLC Operating Agreements

- Legal Vulnerabilities: Without a thorough operating agreement, LLC members might face personal legal liability in case of the company's financial trouble.

- Financial Mismanagement: An incomplete financial management clause can lead to improper handling of funds, affecting the companys financial health.

- Dispute Escalation: Without predefined dispute resolution procedures, minor disagreements could escalate, causing costly legal battles and operational disruptions.

- Compliance Failures: Failure to adhere to annual compliance or acting without a duly appointed registered agent can result in fines and administrative difficulties.

Key Takeaways

Creating a comprehensive LLC Operating Agreement is crucial to ensure legal protections, operational efficacy, and management of internal disputes. It's essential to tailor the agreement to the specific needs of the business while ensuring compliance with state laws and the Company Act.

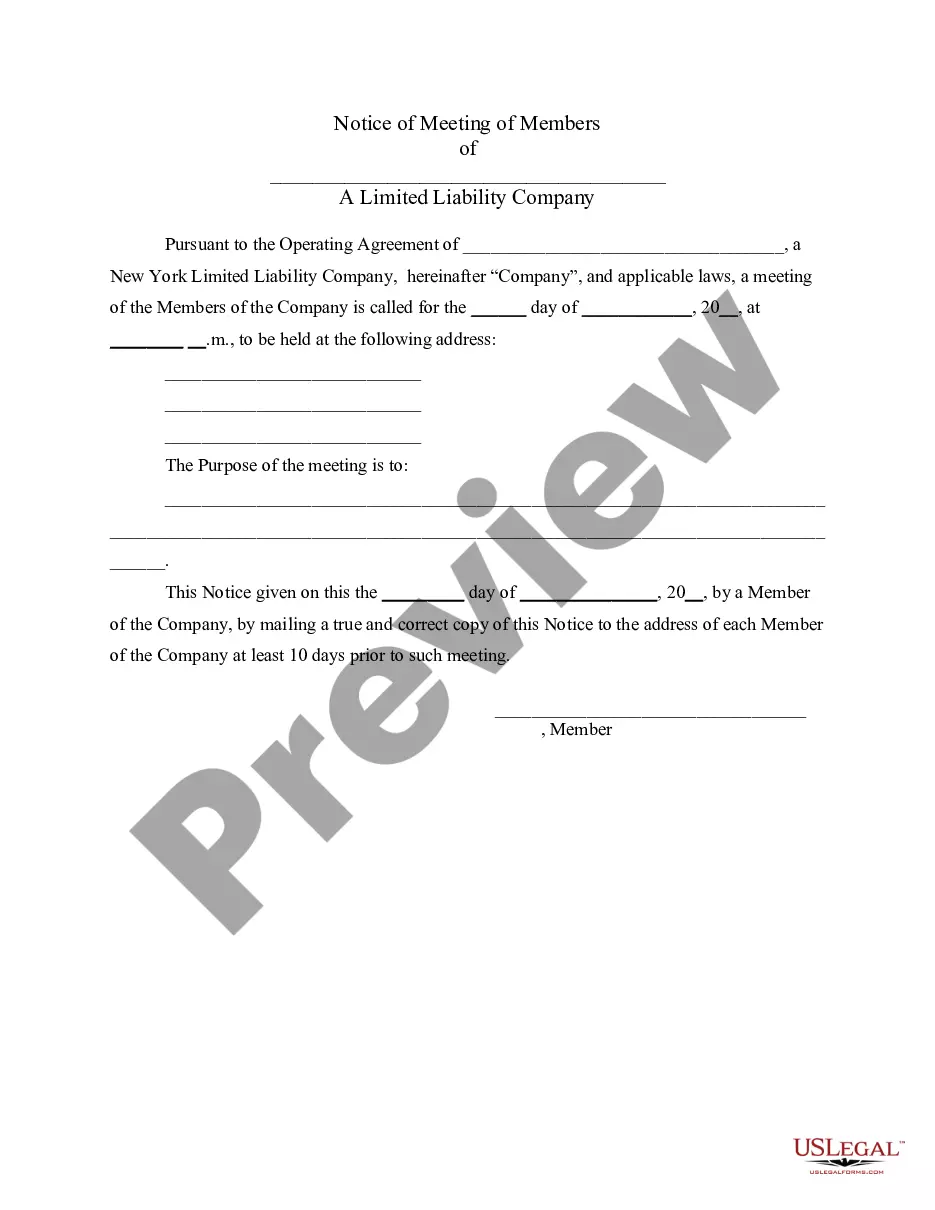

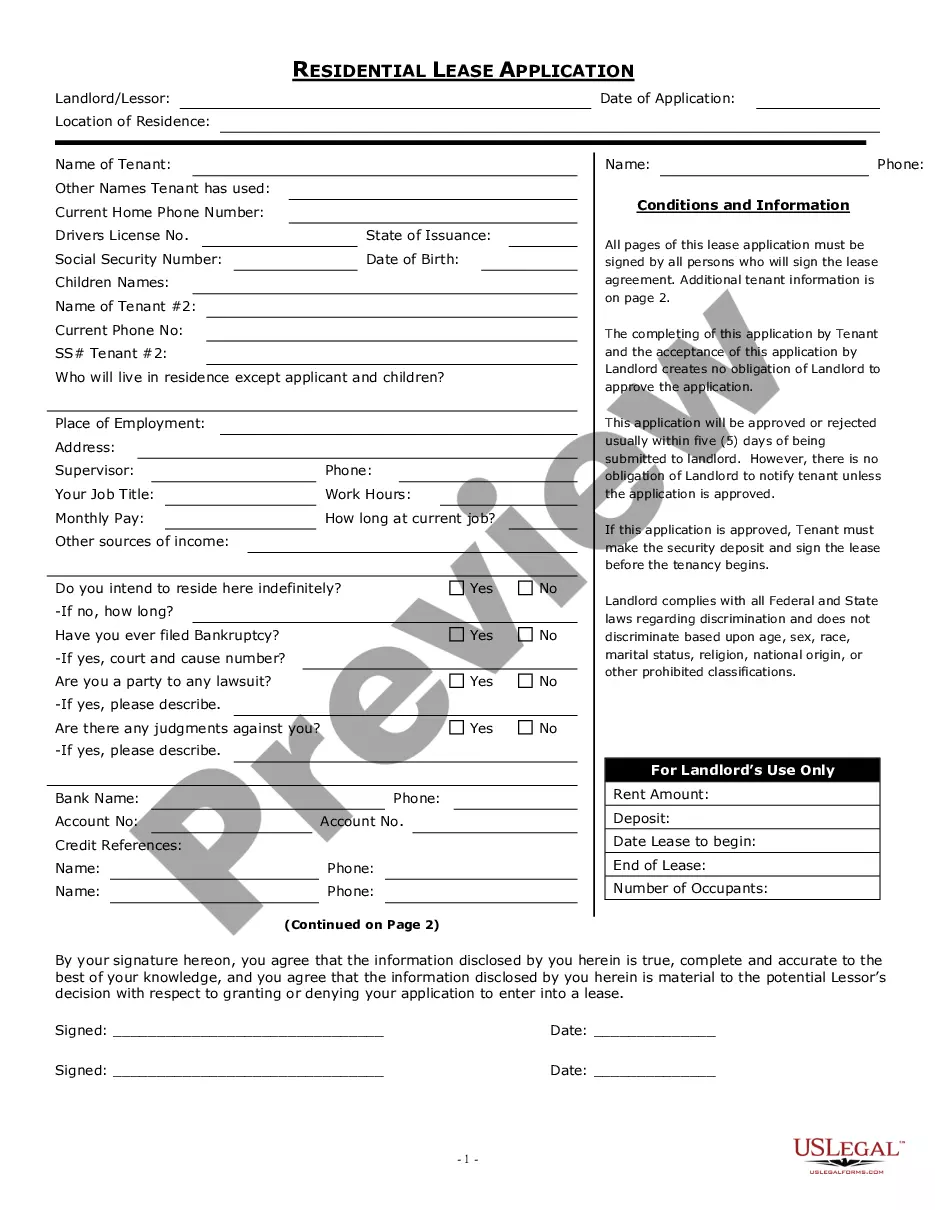

How to fill out New York Limited Liability Company LLC Operating Agreement?

US Legal Forms is actually a special platform to find any legal or tax form for submitting, such as New York Limited Liability Company LLC Operating Agreement. If you’re tired with wasting time searching for appropriate examples and spending money on file preparation/legal professional fees, then US Legal Forms is exactly what you’re trying to find.

To enjoy all of the service’s advantages, you don't need to install any software but simply choose a subscription plan and sign up your account. If you have one, just log in and find a suitable sample, download it, and fill it out. Saved documents are kept in the My Forms folder.

If you don't have a subscription but need to have New York Limited Liability Company LLC Operating Agreement, have a look at the guidelines listed below:

- check out the form you’re looking at applies in the state you need it in.

- Preview the example and read its description.

- Click on Buy Now button to access the register page.

- Pick a pricing plan and proceed signing up by providing some info.

- Pick a payment method to finish the sign up.

- Save the document by choosing your preferred format (.docx or .pdf)

Now, submit the file online or print it. If you feel uncertain concerning your New York Limited Liability Company LLC Operating Agreement form, speak to a attorney to examine it before you send or file it. Get started without hassles!

Form popularity

FAQ

An LLC operating agreement is a document that customizes the terms of a limited liability company according to the specific needs of its owners. It also outlines the financial and functional decision-making in a structured manner. It is similar to articles of incorporation that govern the operations of a corporation.

An operating agreement is a document which describes the operations of the LLC and sets forth the agreements between the members (owners) of the business. All LLC's with two or more members should have an operating agreement. This document is not required for an LLC, but it's a good idea in any case.

Unlike most states, New York's LLC law requires LLC members to adopt a written operating agreement. The Operating Agreement may be entered into before, at the time of, or within 90 days after filing the Articles of Organization.

The single member LLC doesn't need to worry about how a transfer occurs because the single member has full control of transfers. However, even with this in mind, a single member LLC does need an operating agreement!This means that an LLC must be treated as a separate entity from the business owner.

An LLC Operating Agreement is Not Compulsory, but it is Highly Recommended. An LLC operating agreement is not necessarily compulsory, although this depends on the state where your business is based. You could get into a lot of unnecessary strife if situations change in your LLC.

If there is no operating agreement, you and the co-owners will not be suitably equipped to reach any settlements concerning misunderstandings over management and finances. Worse still, your LLC will be required to follow any of your state's default operating conditions.

Most states do not require LLCs to have this document, so many LLCs choose not to draft one. While it may not be a requirement to have an operating agreement, it's actually in the best interest of an LLC to draft one.