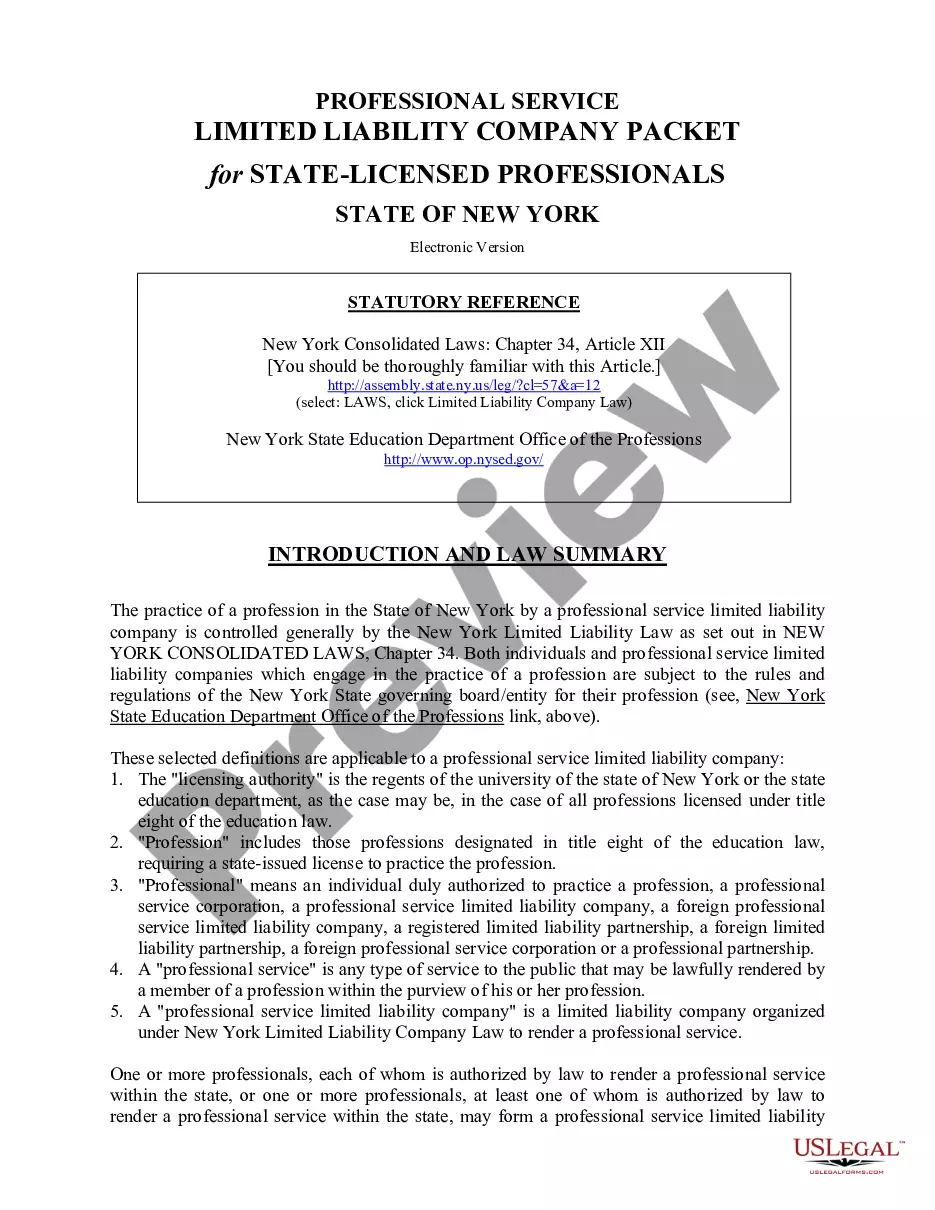

New York Professional Limited Liability Company PLLC Formation Package

Description

How to fill out New York Professional Limited Liability Company PLLC Formation Package?

US Legal Forms is actually a unique system to find any legal or tax document for submitting, such as New York Professional Limited Liability Company PLLC Formation Package. If you’re sick and tired of wasting time searching for suitable examples and paying money on file preparation/lawyer fees, then US Legal Forms is precisely what you’re looking for.

To experience all of the service’s advantages, you don't need to install any application but simply choose a subscription plan and create an account. If you already have one, just log in and get an appropriate sample, save it, and fill it out. Downloaded files are all kept in the My Forms folder.

If you don't have a subscription but need New York Professional Limited Liability Company PLLC Formation Package, take a look at the instructions below:

- Double-check that the form you’re looking at is valid in the state you need it in.

- Preview the example and look at its description.

- Simply click Buy Now to access the register page.

- Choose a pricing plan and proceed signing up by entering some information.

- Choose a payment method to complete the registration.

- Save the document by selecting the preferred file format (.docx or .pdf)

Now, fill out the document online or print it. If you are uncertain regarding your New York Professional Limited Liability Company PLLC Formation Package template, contact a legal professional to examine it before you send or file it. Begin hassle-free!

Form popularity

FAQ

A PLLC, or professional limited liability company, is a special type of LLC that may only be formed by licensed professionals for the purpose of rendering professional services. While this is not required, doing so can be beneficial for tax, liability, financing, and other reasons.

In most cases, business owners can amend the articles of organization of an LLC to change to a PLLC. For example, the state of Arizona requires that a company complete a form to amend its articles of organization and change the name of the company from LLC to PLLC.

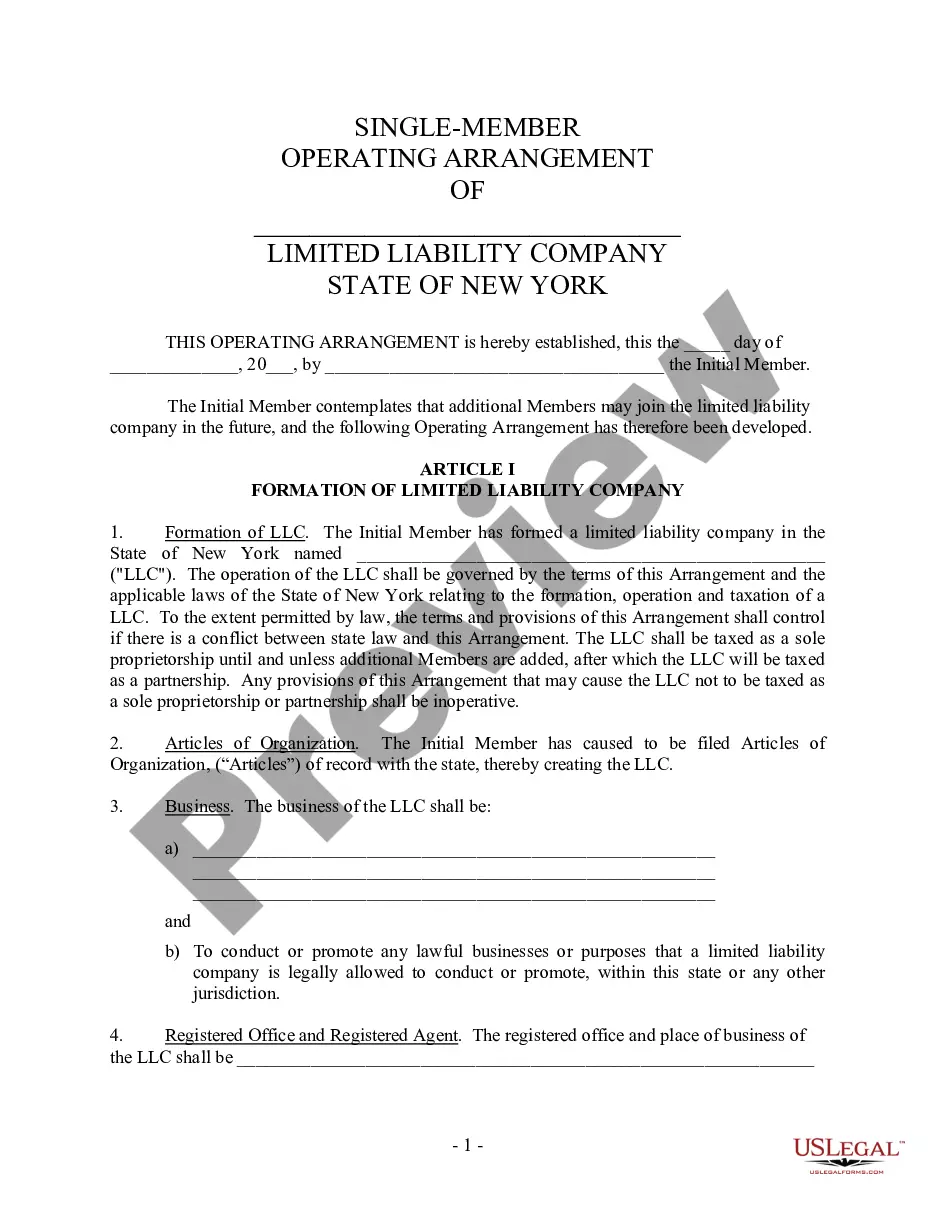

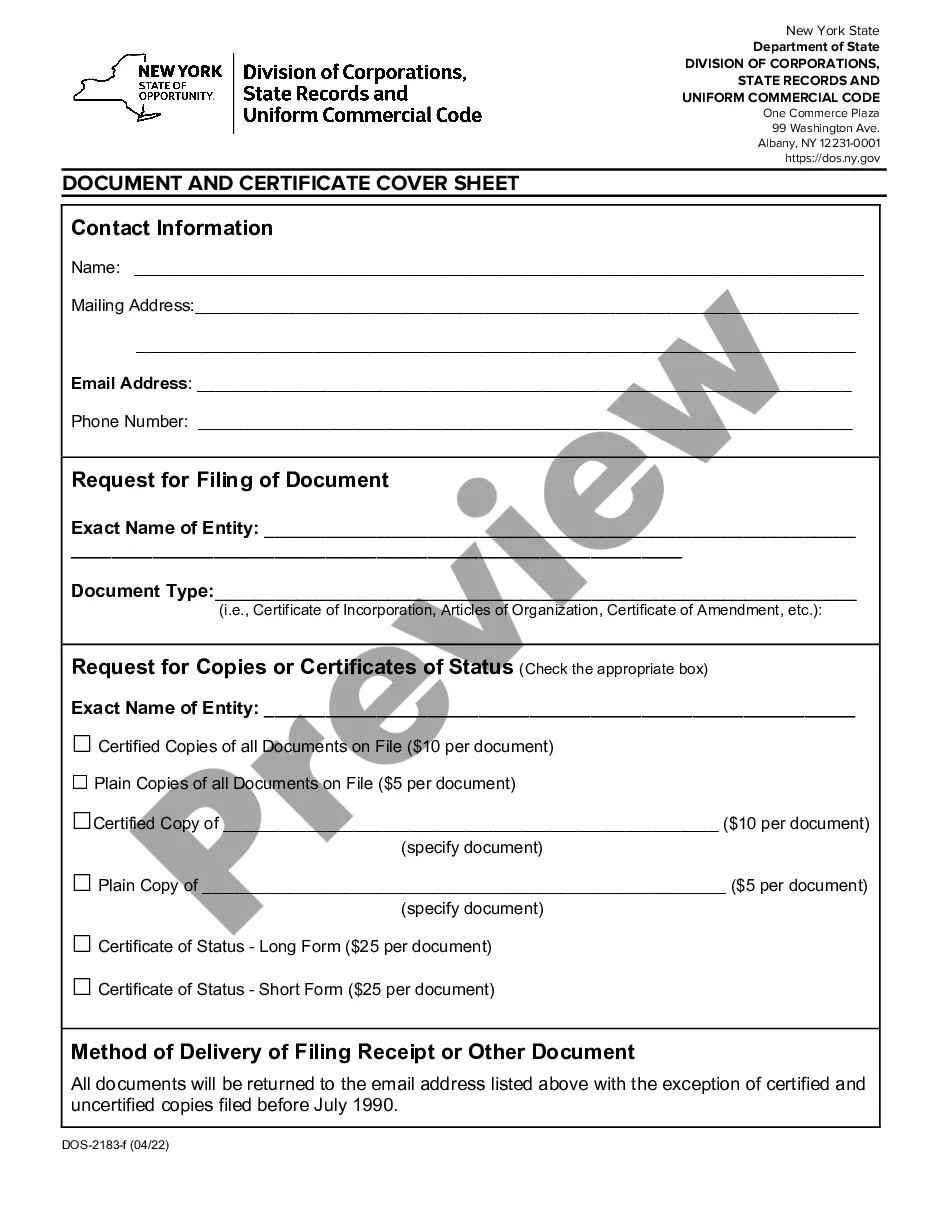

To form a PLLC, a licensed professional must sign all filing documents as well as include their professional license number and a certified copy of their license. Importantly, they must submit these documents for approval with their state licensing board before filing them with their state's secretary of state.

Members of a PLLC aren't personally liable for the malpractice of any other member. PLLC members are not personally liable for business debts and lawsuits, such as unpaid office rent. The PLLC can choose to be taxed as a pass-through entity or as a corporation.

To form a PLLC, a licensed professional must sign all filing documents as well as include their professional license number and a certified copy of their license. Importantly, they must submit these documents for approval with their state licensing board before filing them with their state's secretary of state.

Individual Reports A partnership PLLC must file a Form 1065, Return of Partnership Income, showing income, deductions and any profit or loss. This is an informational return, and no taxes are assessed. A Schedule K-1 with the form shows each partner's share, to be reported on a personal return.

The difference between a PC and a PLLC is ultimately the same as the difference between a regular corporation and a regular LLC. One major difference is how these entities are taxed.With a PLLC, you can choose to be taxed like a C corp or an S corp, but the far more common option is taxation as a pass-through entity.

Regarding the management flexibility and taxation, a PLLC has the same advantages of an LLC. The difference between the two is that the PLLC has some restrictions on who may be a member of the PLLC and the limitation of liability of the members. With an LLC, anyone can be a member, or owner, of the business.

1Step One) Choose a PLLC Name.2Step Two) Designate a Registered Agent.3Step Three) File Formation Documents with the State.4Step Four) Create an Operating Agreement.5Step Five) Handle Taxation Requirements.6Step Six) Obtain Business Licenses and Permits.