New York Warranty Deed from Individual to Husband and Wife

Description

Key Concepts & Definitions

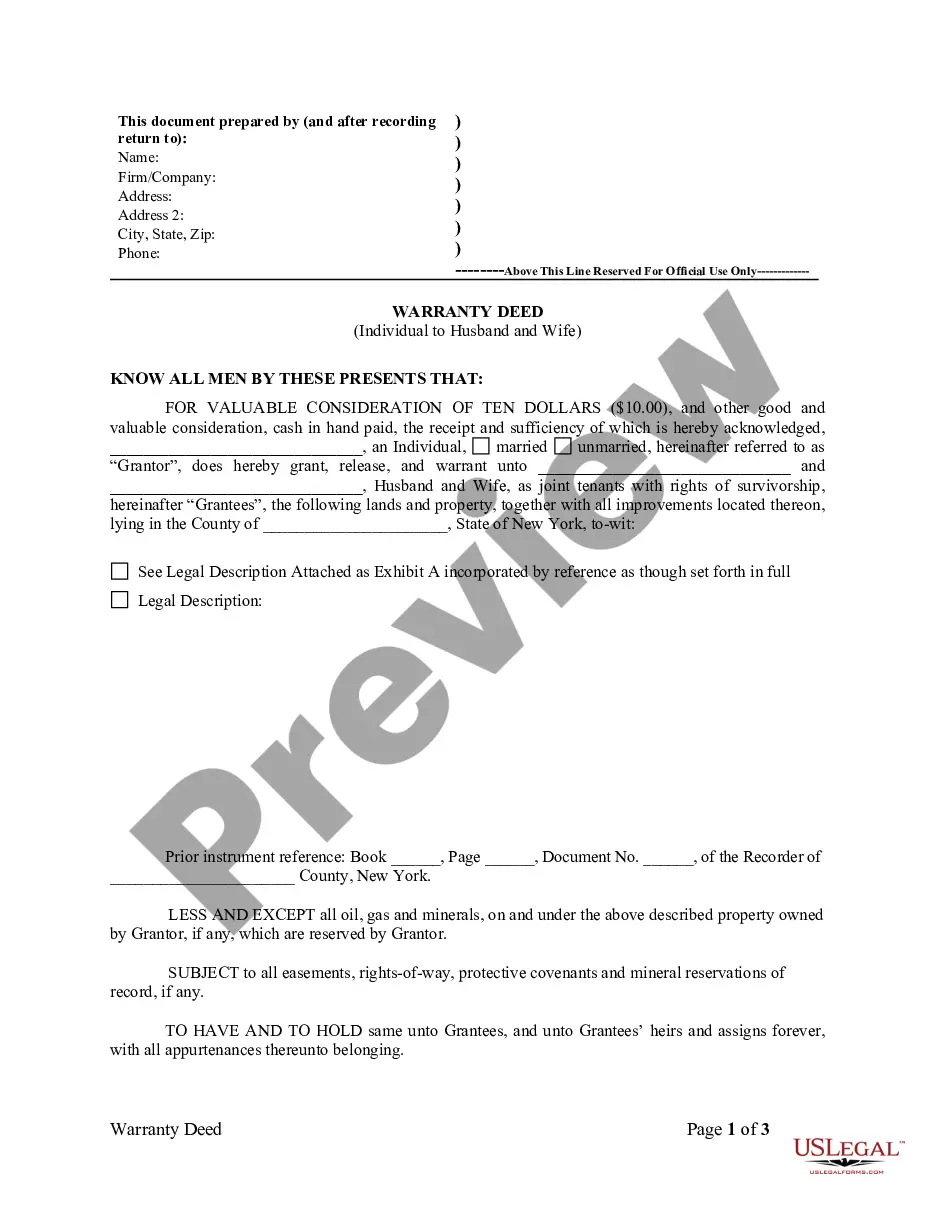

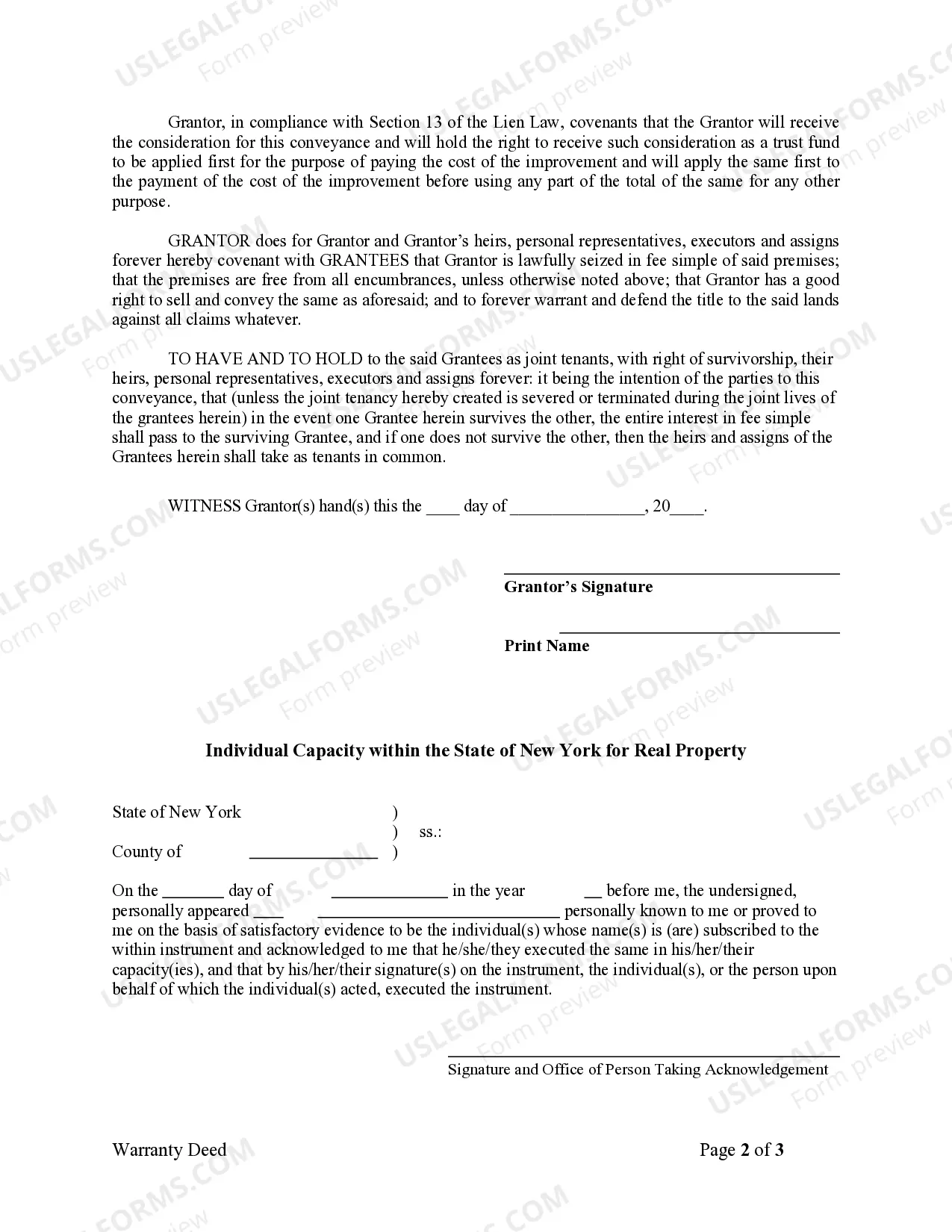

Warranty Deed: A legal document that transfers property ownership with guarantees from the seller that they hold clear title to the property and have the right to sell it. In the context of a 'warranty deed from individual to husband and wife', it typically means an individual transferring property to a married couple with warranties about the title's validity and freedom from encumbrances.

Step-by-Step Guide

- Verify the Current Property Title: Confirm that the individual holds a clear and marketable title to the property.

- Prepare the Deed: Draft the warranty deed. It must correctly identify the grantor (seller) and grantees (buyers), provide a legal description of the property, and state the warranty being provided.

- Sign the Deed: The individual must sign the deed in the presence of a notary public.

- Record the Deed: File the signed deed with the county recorders office where the property is located to make it a matter of public record.

Risk Analysis

- Title Issues: If the title isn't clear, future disputes might arise, potentially leading to legal battles.

- Incorrect Wording: Poorly drafted deeds can result in incorrect execution, affecting the warranty.

- Notarization and Recording Errors: Failing to adequately notarize or record the deed may lead to unrecognized transactions.

Key Takeaways

- Ensuring the accuracy of a warranty deed is crucial for protecting the rights of the husband and wife as new property owners.

- Consulting with a real estate attorney can help prevent common pitfalls associated with property transfers.

- Proper recording of the deed guarantees its enforceability and helps maintain a clear title history.

Common Mistakes & How to Avoid Them

- Not Using a Lawyer: Always consult with a real estate lawyer to ensure that all legal requirements are met and the deed is drafted accurately.

- Overlooking Title Search: Conduct a thorough title search to verify that there are no liens, encumbrances, or legal entanglements that could affect ownership.

- Ignoring State Laws: Real estate laws can vary by state, so it's important to adhere to specific state regulations regarding real estate transactions.

How to fill out New York Warranty Deed From Individual To Husband And Wife?

US Legal Forms is a special platform where you can find any legal or tax form for submitting, such as New York Warranty Deed from Individual to Husband and Wife. If you’re tired of wasting time searching for appropriate samples and spending money on file preparation/legal professional service fees, then US Legal Forms is precisely what you’re seeking.

To experience all the service’s benefits, you don't have to install any software but just select a subscription plan and create an account. If you already have one, just log in and look for a suitable template, save it, and fill it out. Saved files are kept in the My Forms folder.

If you don't have a subscription but need New York Warranty Deed from Individual to Husband and Wife, have a look at the instructions listed below:

- make sure that the form you’re considering is valid in the state you want it in.

- Preview the example its description.

- Click on Buy Now button to get to the sign up page.

- Pick a pricing plan and continue registering by entering some info.

- Decide on a payment method to finish the registration.

- Download the file by selecting your preferred file format (.docx or .pdf)

Now, submit the document online or print out it. If you are uncertain about your New York Warranty Deed from Individual to Husband and Wife form, contact a legal professional to examine it before you decide to send or file it. Get started without hassles!

Form popularity

FAQ

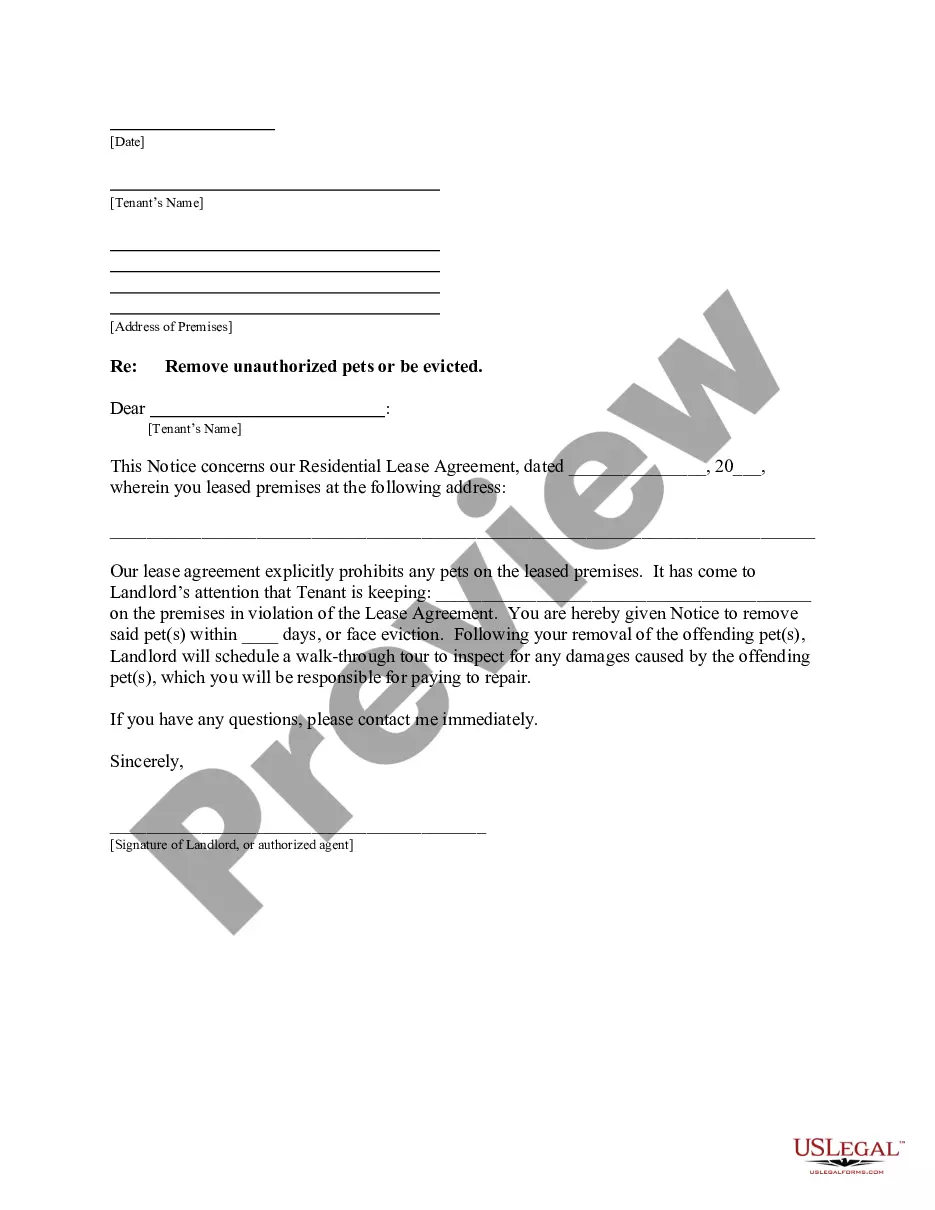

You may be able to transfer your interest in the property through a quitclaim deed, where you relinquish all ownership of the property to someone else. Your lender may also agree to add another name to the mortgage. In this case, someone else would be able to legally make payments on the mortgage.

You would simply prepare a deed to you and your fiance. You would then have to prepare and execute the other necessary forms take them to the clerks office and file them. I suggest that you consult with a local attorney. They can do this at a modest cost.

Title the deed and list the amount given for the transfer. If it is a quitclaim deed, title the deed Quitclaim Deed; for warranty deeds, title the deed Warranty Deed. Write In consideration of dollar amount to list the amount given for the transfer. List the names of the parties involved.

Identify the donee or recipient. Discuss terms and conditions with that person. Complete a change of ownership form. Change the title on the deed. Hire a real estate attorney to prepare the deed. Notarize and file the deed.

Two of the most common ways to transfer property in a divorce are through an interspousal transfer deed or quitclaim deed. When spouses own property together, but then one spouse executes an interspousal transfer or a quitclaim deed, this is known as transmutation.

In states like California and Florida, the spouses may use a quitclaim deed to transfer the property without warranting title. Other stateslike Texasrecognize a similar type of deed called a deed without warranty.

You can gift property to spouse, child or any relative and register the same. Under section 122 of the Transfer of Property Act, 1882, you can transfer immovable property through a gift deed. The deed should contain your details as well as those of the recipient.

Fill in the deed form. Print it out. Have the grantor(s) sign and get the signature(s) notarized. Complete a transfer tax form, Form TP-584. Complete and print out Form RP-5217 (or, if you are in New York City, Form RP-5217NYC).

If you've recently married and already own a home or other real estate, you may want to add your new spouse to the deed for your property so the two of you own it jointly. To add a spouse to a deed, all you have to do is literally fill out, sign and record a new deed in your county recorder's office.