New York Certified Weekly Payroll Record

Description

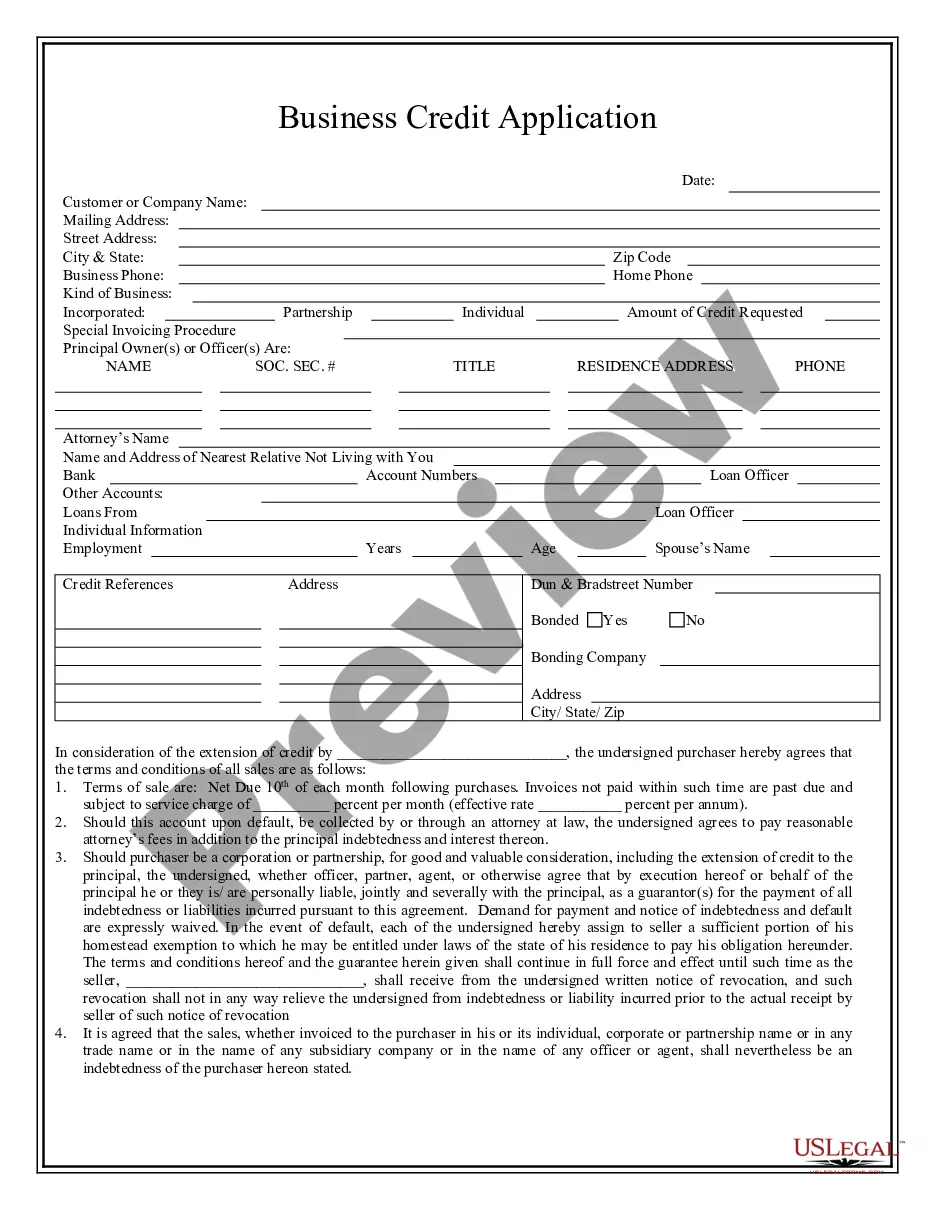

How to fill out New York Certified Weekly Payroll Record?

US Legal Forms is actually a special platform where you can find any legal or tax document for submitting, such as New York Certified Weekly Payroll Record. If you’re fed up with wasting time seeking appropriate samples and paying money on papers preparation/lawyer charges, then US Legal Forms is precisely what you’re seeking.

To experience all the service’s benefits, you don't have to install any software but simply pick a subscription plan and register an account. If you have one, just log in and look for an appropriate sample, download it, and fill it out. Saved files are all stored in the My Forms folder.

If you don't have a subscription but need New York Certified Weekly Payroll Record, take a look at the recommendations below:

- make sure that the form you’re checking out applies in the state you want it in.

- Preview the example and read its description.

- Click Buy Now to reach the sign up page.

- Pick a pricing plan and proceed registering by entering some information.

- Select a payment method to finish the sign up.

- Save the document by choosing your preferred format (.docx or .pdf)

Now, complete the file online or print it. If you feel unsure regarding your New York Certified Weekly Payroll Record form, contact a attorney to examine it before you decide to send or file it. Begin hassle-free!

Form popularity

FAQ

Go to the Reports menu. Choose Employees & Payroll. Go to More Payroll Reports in Excel, then choose New! Certified Payroll Report. Follow the on-screen instructions to create the report.

Item 4 FRINGE BENEFITS Contractors who pay all required fringe benefits: If paying all fringe benefits to approved plans, funds, or programs in amounts not less than were determined in the applicable wage decision, show the basic cash hourly rate ($16.22) and overtime rate ($24.33) paid to each worker on the face of

Certified payroll reports are special payroll reports that contractors who work on public works or government funded construction projects must file on a weekly basis. This type of payroll requires a specialized process involving the input of a date and job code with each entry.

Go to the Reports menu. Choose Employees & Payroll. Go to More Payroll Reports in Excel, then choose New! Certified Payroll Report. Follow the on-screen instructions to create the report.

ADP clients can implement the Certified Payroll Reporting solution powered by Time Bank2122 to quickly, accurately, and reliably generate these reports. The automated solution is a simple three-step process that you run at the end of each pay cycle.This automated solution is sold, serviced, and supported by ADP.

Type the word "Final" when the last payroll is submitted for the project. The last day of the payroll period. The name and location of project. The prime contractor should include the project number as listed in the loan Indicate the days and dates of the pay period.

To calculate an employee's fringe benefit rate, add up the cost of an employee's fringe benefits for the year (including payroll taxes paid) and divide it by the employee's annual wages or salary. Then, multiply the total by 100 to get the fringe benefit rate percentage.

The calculation is a simple one: just add up the cost of the fringe benefits for the year and divide it by the employee's annual salary. Then, multiply by 100 to get the percentage.