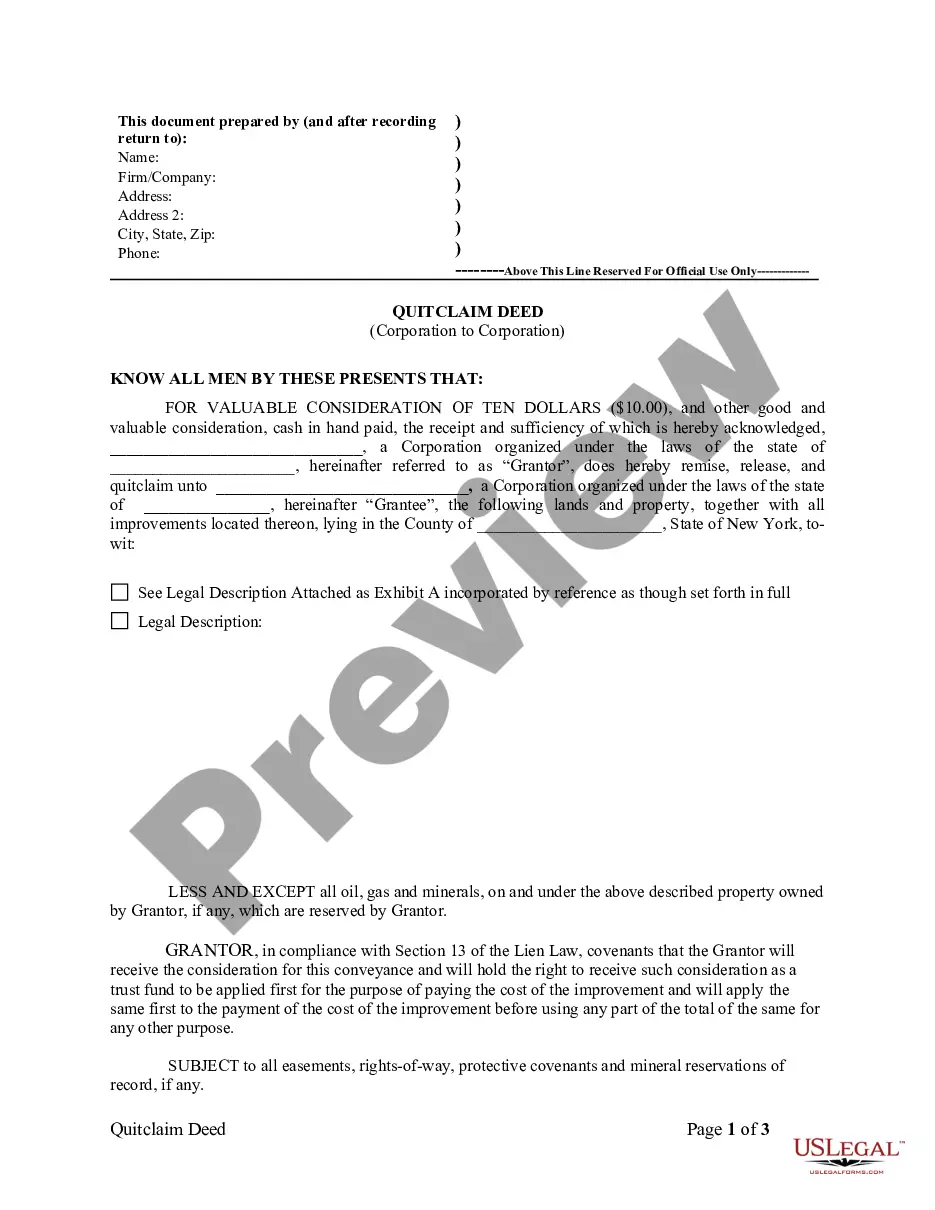

New York Quitclaim Deed from Corporation to Corporation

Description

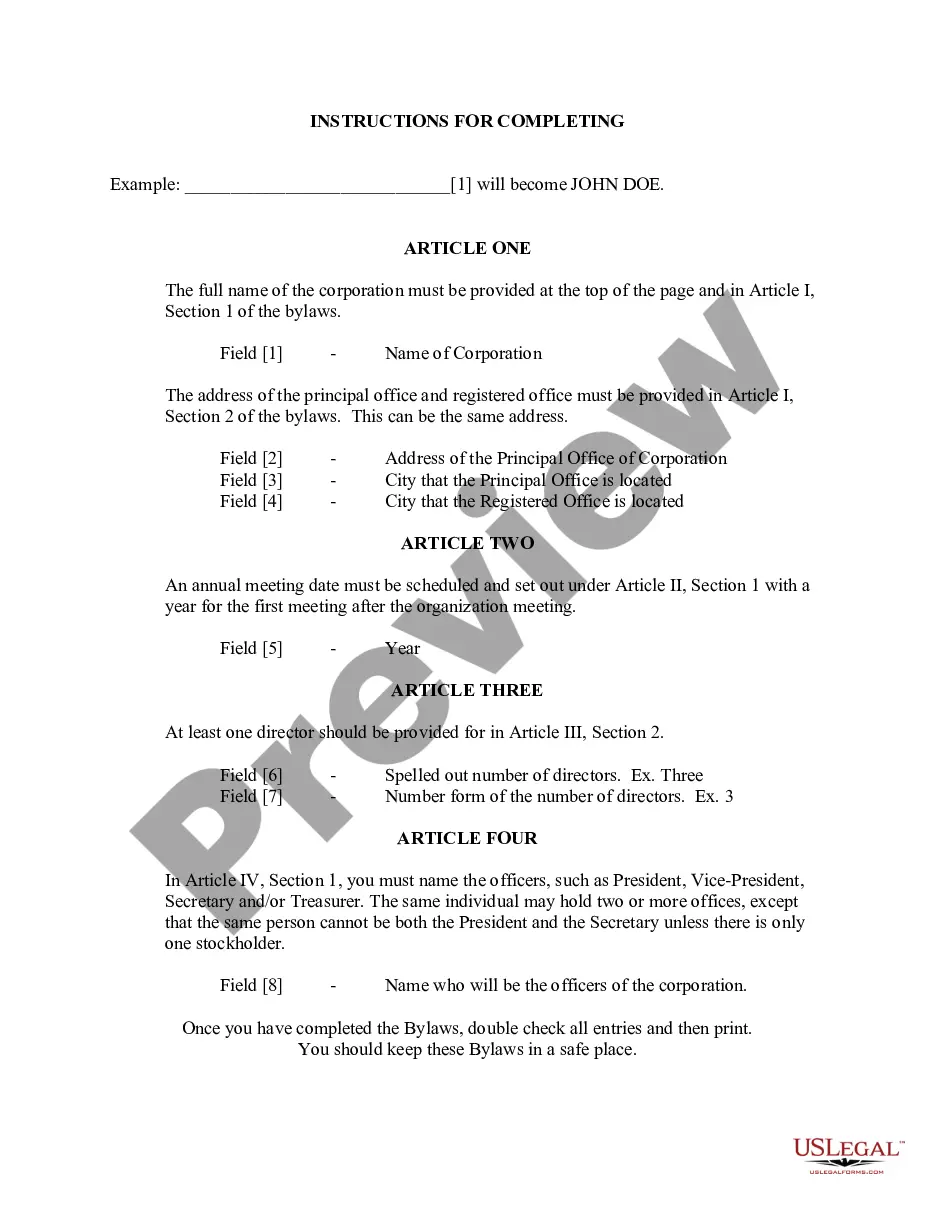

How to fill out New York Quitclaim Deed From Corporation To Corporation?

US Legal Forms is really a unique system where you can find any legal or tax template for completing, such as New York Quitclaim Deed from Corporation to Corporation. If you’re sick and tired of wasting time seeking perfect samples and spending money on document preparation/legal professional service fees, then US Legal Forms is precisely what you’re looking for.

To experience all of the service’s advantages, you don't have to download any application but just select a subscription plan and create an account. If you already have one, just log in and find the right sample, save it, and fill it out. Downloaded documents are all stored in the My Forms folder.

If you don't have a subscription but need New York Quitclaim Deed from Corporation to Corporation, check out the instructions listed below:

- make sure that the form you’re considering applies in the state you want it in.

- Preview the sample its description.

- Click Buy Now to reach the sign up page.

- Select a pricing plan and carry on signing up by providing some information.

- Choose a payment method to finish the sign up.

- Save the file by selecting your preferred format (.docx or .pdf)

Now, submit the file online or print out it. If you feel uncertain about your New York Quitclaim Deed from Corporation to Corporation sample, contact a legal professional to review it before you send out or file it. Start without hassles!

Form popularity

FAQ

A quitclaim deed is dangerous if you don't know anything about the person giving you the property. You should be sure that a person actually has rights to a property before signing it over with a quitclaim deed.

A quitclaim deed is quick and easy because it transfers all of one person's interest in the property to another.The deed transfers all claims the seller has to the property, if any. If the seller has no interest in the real estate, no interest is transferred.

A quitclaim deed transfers real estate interests from one party to another. It is a special type of deed in which the grantee takes ownership of the interests the grantor has at the time of the deed's execution whether or not the grantor is the actual property owner. A quitclaim deed offers zero protection to buyers.

Quitclaim deeds are most often used to transfer property between family members. Examples include when an owner gets married and wants to add a spouse's name to the title or deed, or when the owners get divorced and one spouse's name is removed from the title or deed.

Quitclaim Does Not Release Debts Signing a quitclaim deed and giving up all rights to the property doesn't release you from any financial obligations you may have. It only removes you from the title, not from the mortgage, and you are still responsible for making payments.

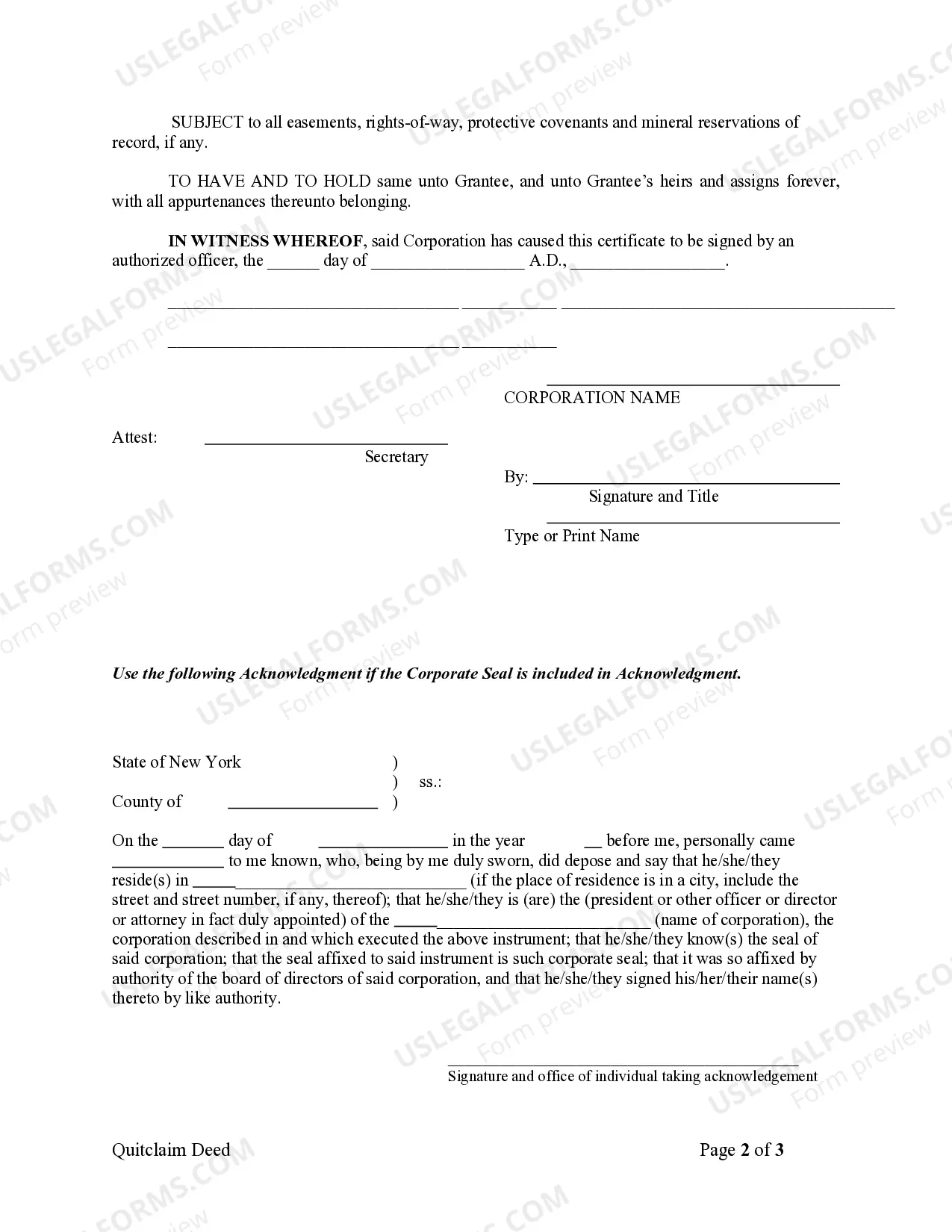

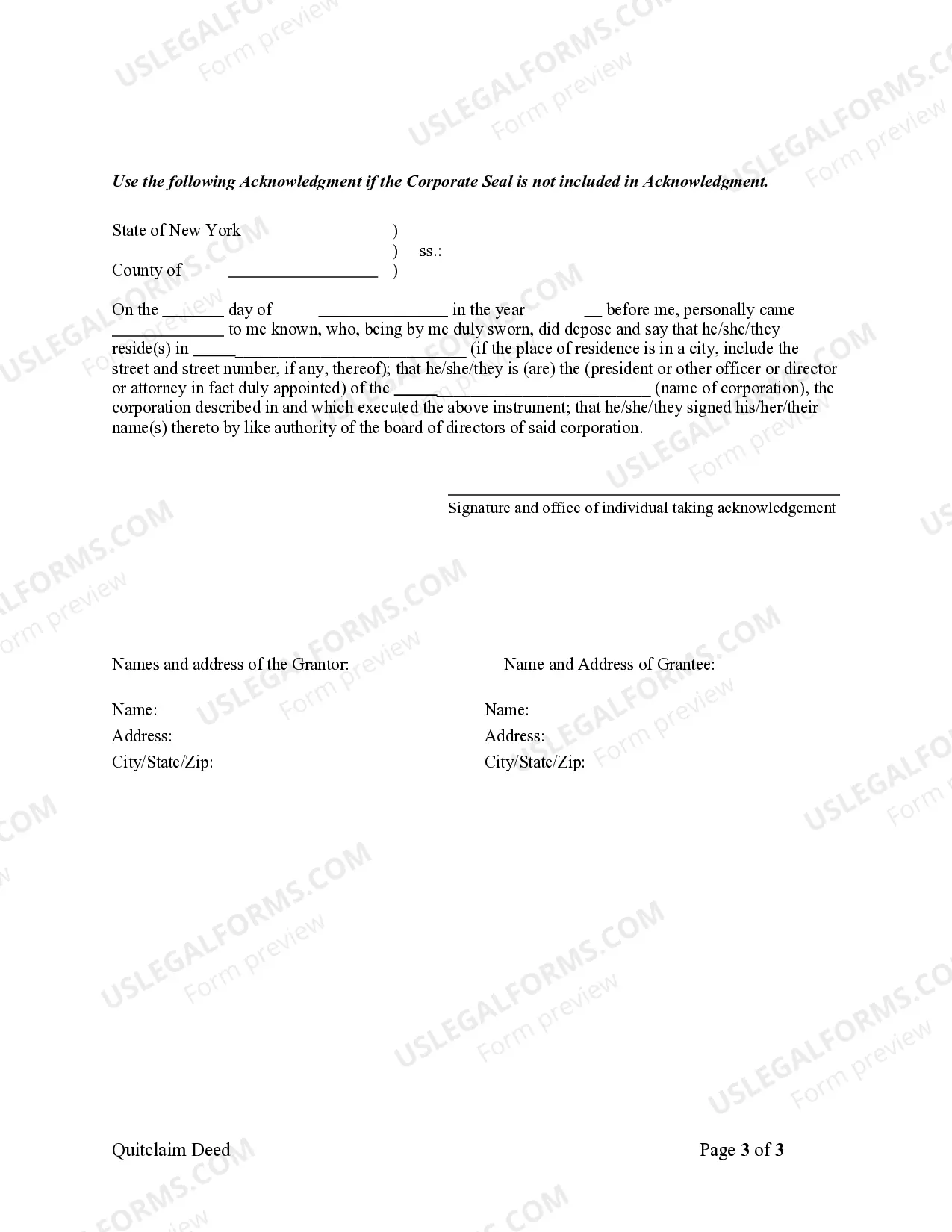

Fill in the deed form. Print it out. Have the grantor(s) sign and get the signature(s) notarized. Complete a transfer tax form, Form TP-584. Complete and print out Form RP-5217 (or, if you are in New York City, Form RP-5217NYC).

Fees to File a Quitclaim Deed in New York As of 2018, the basic fee for filing a quitclaim deed of residential or farm property is $125, while the fee for all other property is $250. These fees are for the RP-5217 form.