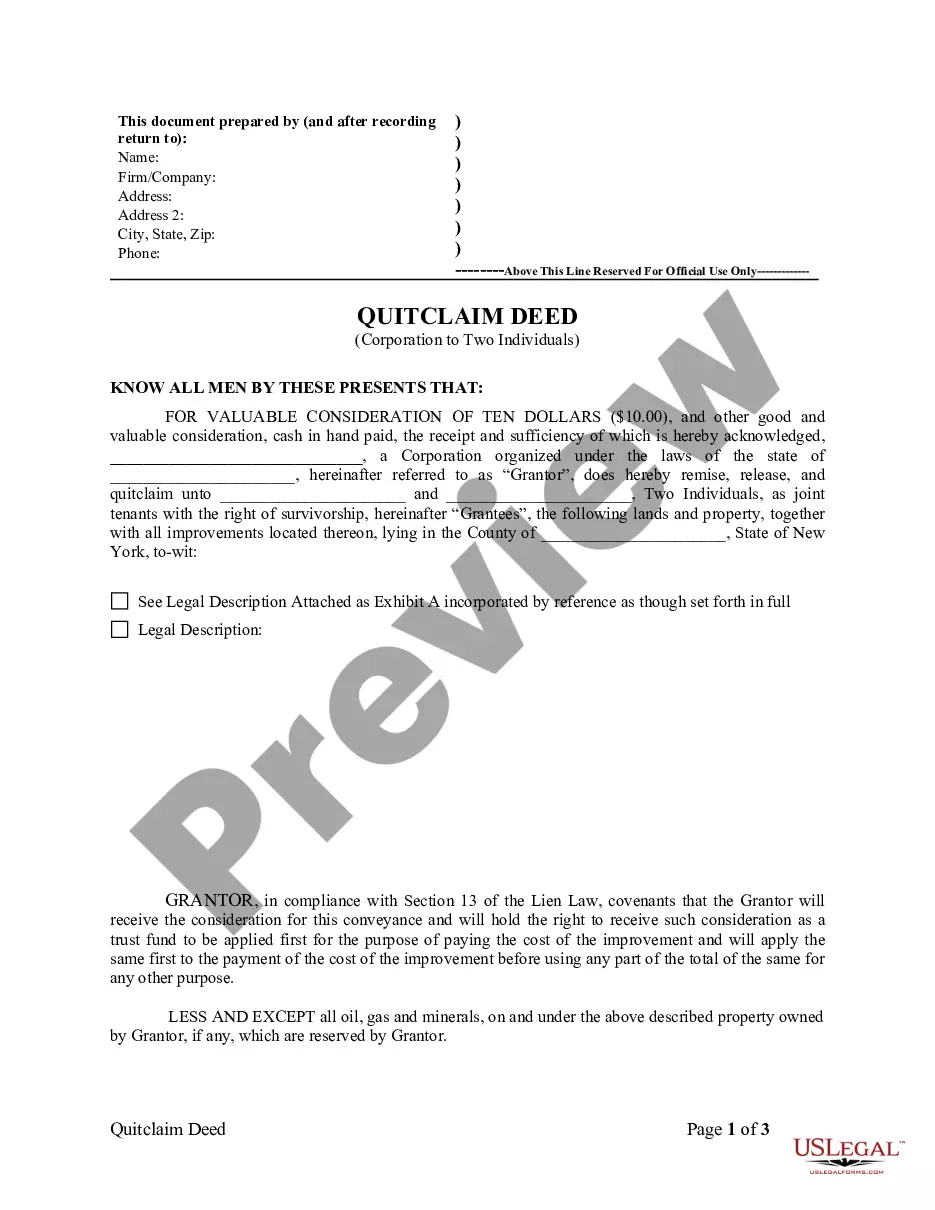

New York Quitclaim Deed from Corporation to Two Individuals

Description

How to fill out New York Quitclaim Deed From Corporation To Two Individuals?

US Legal Forms is actually a special platform where you can find any legal or tax template for completing, including New York Quitclaim Deed from Corporation to Two Individuals. If you’re fed up with wasting time seeking suitable samples and paying money on document preparation/lawyer charges, then US Legal Forms is precisely what you’re seeking.

To reap all the service’s advantages, you don't need to download any application but just pick a subscription plan and create an account. If you already have one, just log in and look for a suitable template, save it, and fill it out. Downloaded documents are kept in the My Forms folder.

If you don't have a subscription but need New York Quitclaim Deed from Corporation to Two Individuals, take a look at the guidelines listed below:

- check out the form you’re checking out applies in the state you need it in.

- Preview the sample its description.

- Simply click Buy Now to access the register webpage.

- Choose a pricing plan and keep on registering by entering some info.

- Choose a payment method to complete the registration.

- Save the file by choosing the preferred file format (.docx or .pdf)

Now, submit the file online or print it. If you feel uncertain regarding your New York Quitclaim Deed from Corporation to Two Individuals template, contact a lawyer to examine it before you send out or file it. Start without hassles!

Form popularity

FAQ

Fees to File a Quitclaim Deed in New York As of 2018, the basic fee for filing a quitclaim deed of residential or farm property is $125, while the fee for all other property is $250. These fees are for the RP-5217 form.

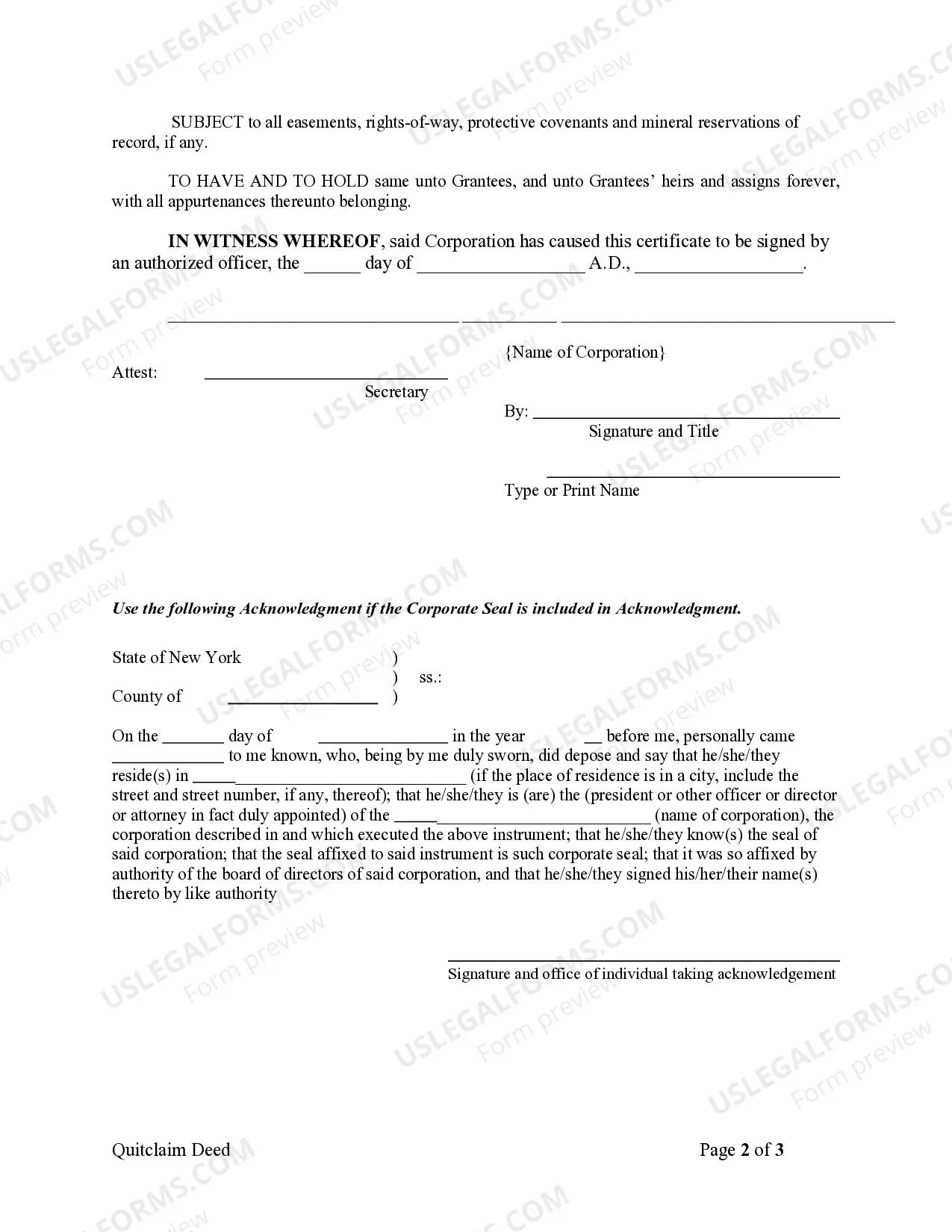

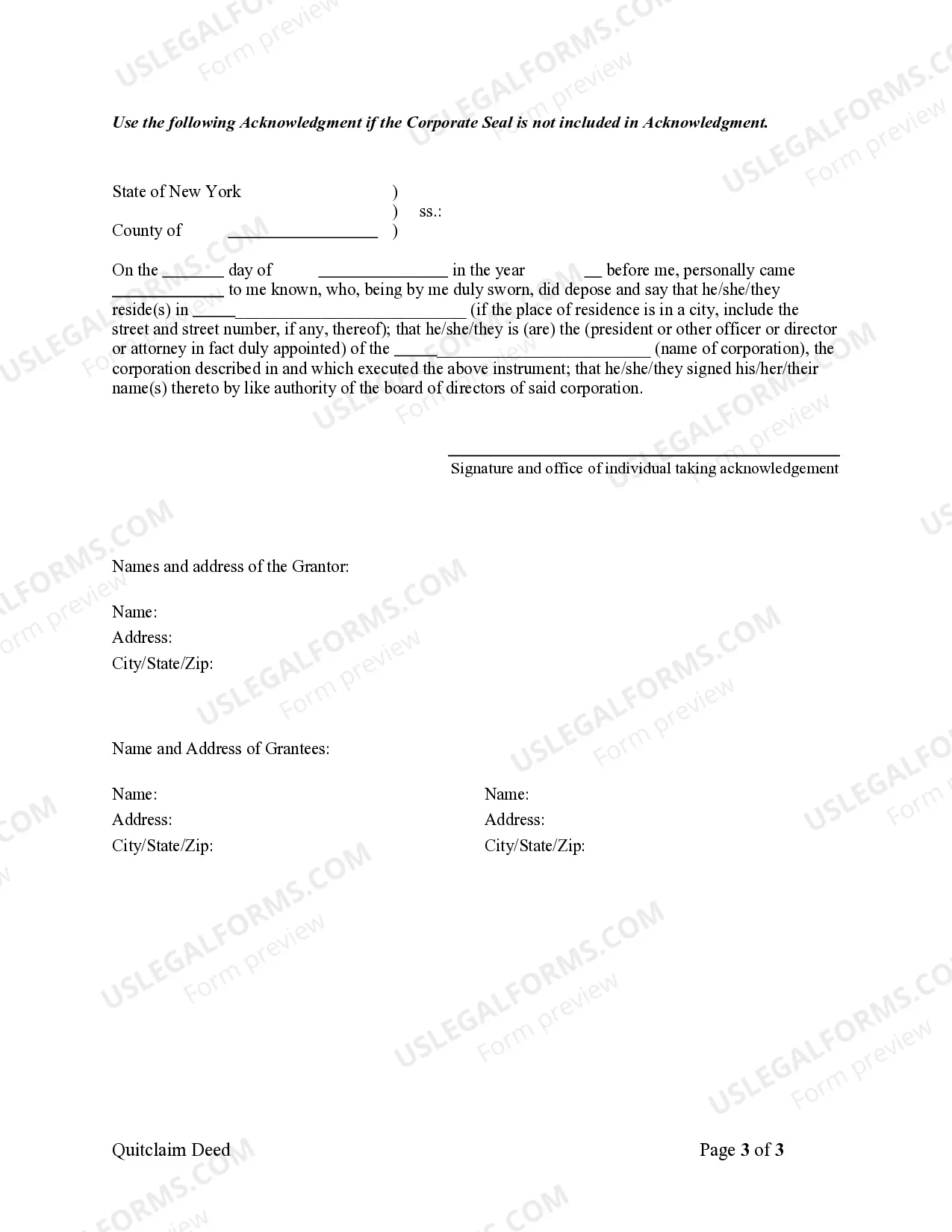

Fill in the deed form. Print it out. Have the grantor(s) sign and get the signature(s) notarized. Complete a transfer tax form, Form TP-584. Complete and print out Form RP-5217 (or, if you are in New York City, Form RP-5217NYC).

If the quitclaim deed requires the signature of all co-owners, the deed is invalid unless all co-owners have signed it and the deed is then delivered to the grantee.If one individual owns real estate and desires to add a co-owner such as a spouse, a quitclaim deed might be used.

The drawback, quite simply, is that quitclaim deeds offer the grantee/recipient no protection or guarantees whatsoever about the property or their ownership of it. Maybe the grantor did not own the property at all, or maybe they only had partial ownership.

But you might be wondering if an owner can transfer a deed to another person without a real estate lawyer. The answer is yes. Parties to a transaction are always free to prepare their own deeds.A quitclaim deed, for example, is far simpler than a warranty deed.

Fill out the quit claim deed form, which can be obtained online, or write your own using the form as a guide. The person giving up the interest in the property is the grantor, and the person receiving the interest is the grantee.

It's usually a very straightforward transaction, but it's possible for a quitclaim deed to be challenged. If a quitclaim deed is challenged in court, the issue becomes whether the property was legally transferred and if the grantor had the legal right to transfer the property.

Fill in the deed form. Print it out. Have the grantor(s) sign and get the signature(s) notarized. Complete a transfer tax form, Form TP-584. Complete and print out Form RP-5217 (or, if you are in New York City, Form RP-5217NYC).