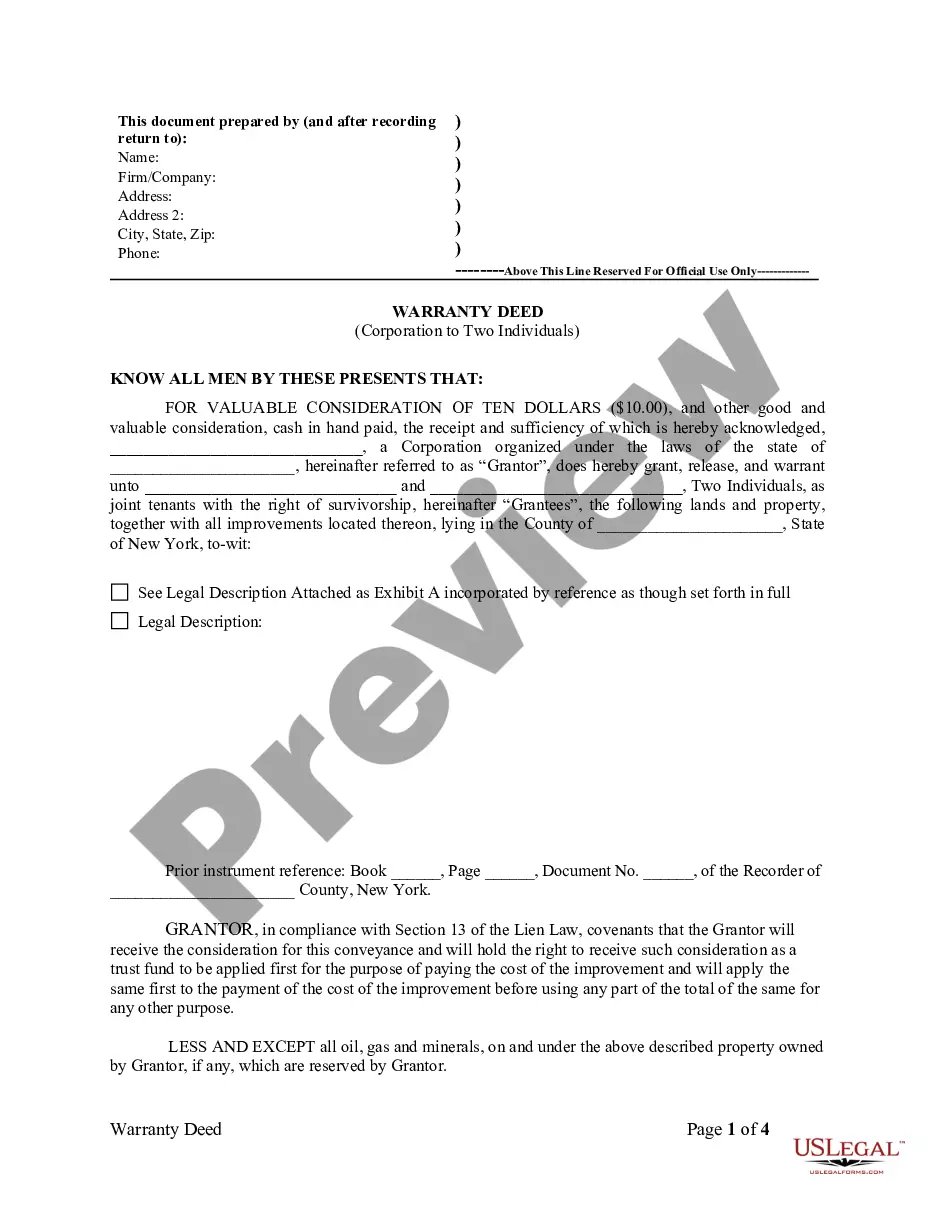

New York Warranty Deed from Corporation to Two Individuals

Description

How to fill out New York Warranty Deed From Corporation To Two Individuals?

US Legal Forms is a unique platform where you can find any legal or tax document for filling out, including New York Warranty Deed from Corporation to Two Individuals. If you’re sick and tired of wasting time looking for ideal samples and paying money on papers preparation/lawyer charges, then US Legal Forms is exactly what you’re looking for.

To enjoy all of the service’s benefits, you don't have to download any software but simply select a subscription plan and create your account. If you already have one, just log in and find an appropriate sample, download it, and fill it out. Saved documents are stored in the My Forms folder.

If you don't have a subscription but need to have New York Warranty Deed from Corporation to Two Individuals, have a look at the guidelines listed below:

- make sure that the form you’re taking a look at is valid in the state you want it in.

- Preview the sample and read its description.

- Click on Buy Now button to get to the sign up webpage.

- Select a pricing plan and keep on registering by entering some information.

- Decide on a payment method to finish the registration.

- Save the file by selecting the preferred file format (.docx or .pdf)

Now, fill out the file online or print out it. If you feel unsure regarding your New York Warranty Deed from Corporation to Two Individuals sample, contact a legal professional to examine it before you decide to send out or file it. Get started without hassles!

Form popularity

FAQ

Typically, the lender will provide you with a copy of the deed of trust after the closing. The original warranty deeds are often mailed to the grantee after they are recorded. These are your original copies and should be kept in a safe place, such as a fireproof lockbox or a safe deposit box at a financial institution.

Retrieve your original deed. Get the appropriate deed form. Draft the deed. Sign the deed before a notary. Record the deed with the county recorder. Obtain the new original deed.

Fill in the deed form. Print it out. Have the grantor(s) sign and get the signature(s) notarized. Complete a transfer tax form, Form TP-584. Complete and print out Form RP-5217 (or, if you are in New York City, Form RP-5217NYC).

After your Warranty Deed has been recorded at the County Clerk's Office, it can be sent to the grantee. However, any person or corporation can be designated as the recipient of the recorded Warranty Deed.

The original deed is returned to the owner of the property from the office of the recorder after proper entry. The office of the Recorder of Deeds maintains a set of indexes about each deed recorded, for an easy search. Almost all states have a grantor-grantee index including a reference to all documents recorded.

The fees to file a New York quitclaim deed vary from county to county, but some of the fees are similar. As of 2018, the basic fee for filing a quitclaim deed of residential or farm property is $125, while the fee for all other property is $250. These fees are for the RP-5217 form.

Adding someone to your house deed requires the filing of a legal form known as a quitclaim deed. When executed and notarized, the quitclaim deed legally overrides the current deed to your home. By filing the quitclaim deed, you can add someone to the title of your home, in effect transferring a share of ownership.