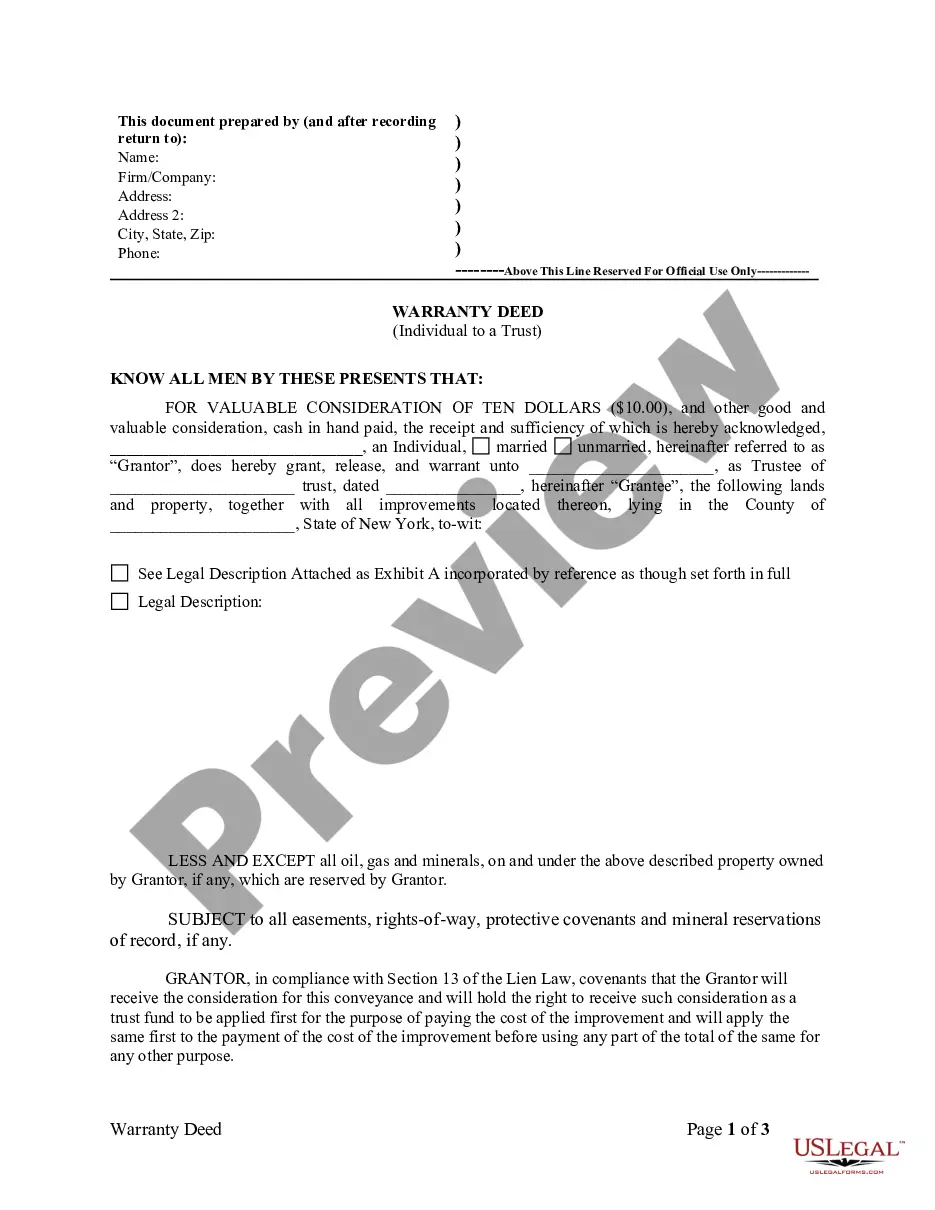

New York Warranty Deed from Individual to a Trust

Description House Deed Example

How to fill out Who Is The Trustee In A Deed Of Trust?

US Legal Forms is really a special platform where you can find any legal or tax template for completing, including New York Warranty Deed from Individual to a Trust. If you’re tired with wasting time looking for perfect examples and spending money on papers preparation/lawyer fees, then US Legal Forms is precisely what you’re searching for.

To enjoy all of the service’s advantages, you don't need to download any application but just choose a subscription plan and create an account. If you have one, just log in and get an appropriate sample, save it, and fill it out. Downloaded files are kept in the My Forms folder.

If you don't have a subscription but need to have New York Warranty Deed from Individual to a Trust, have a look at the guidelines below:

- check out the form you’re checking out applies in the state you want it in.

- Preview the form and look at its description.

- Simply click Buy Now to reach the sign up page.

- Select a pricing plan and proceed signing up by providing some information.

- Select a payment method to complete the registration.

- Download the document by choosing the preferred file format (.docx or .pdf)

Now, submit the file online or print it. If you feel uncertain about your New York Warranty Deed from Individual to a Trust template, speak to a attorney to analyze it before you send out or file it. Get started without hassles!

Deed To A House Form popularity

New York Trust Other Form Names

Deed To The House FAQ

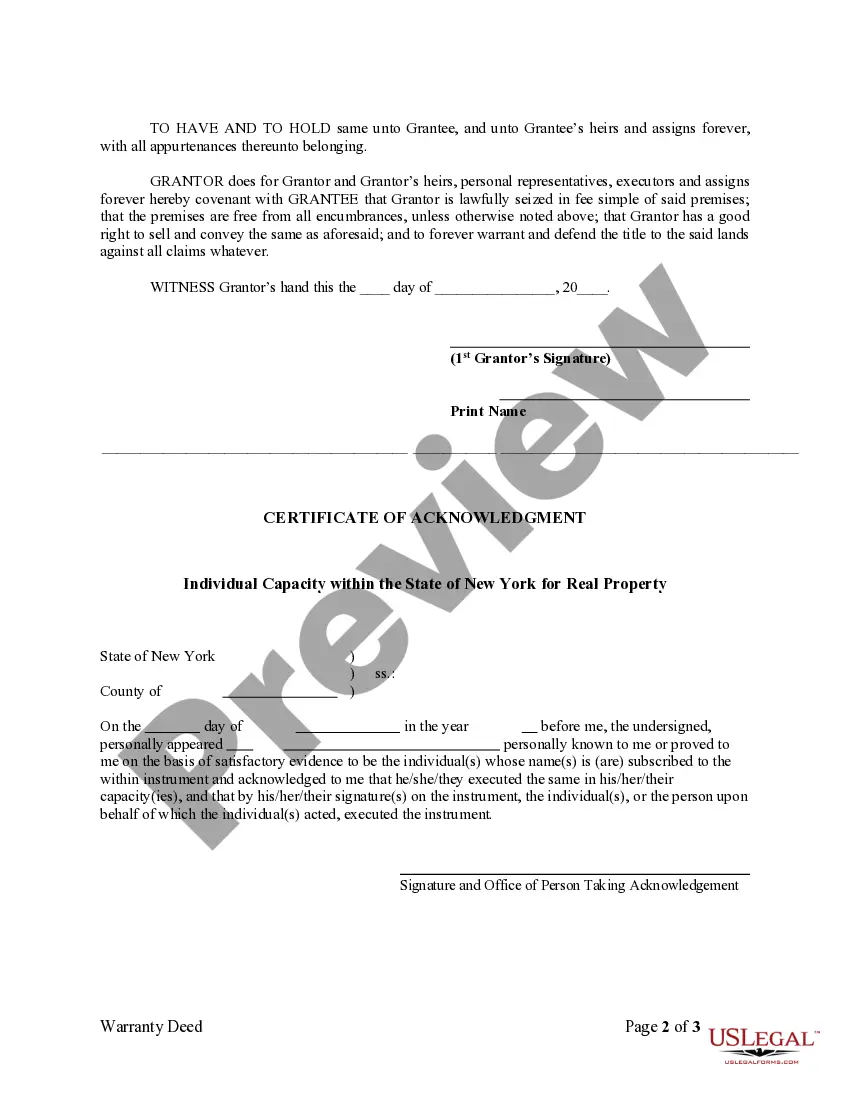

Locate your current deed. Use the proper deed. Check with your title insurance company and lender. Prepare a new deed. Sign in the presence of a notary. Record the deed in the county clerk's office. Locate the deed that's in trust. Use the proper deed.

A trustee deed offers no such warranties about the title.

No. And unless the deed identifies the trust as an owner, then father is the owner of an interest. It is a common mistake to set up a trust and then fail to deed property into the trust. However, you cannot force him to make the changes you are...

Trustee's deeds convey real estate out of a trust.This type of conveyance is named for the person using the form the trustee who stands in for the beneficiary of the trust and holds title to the property.

Determine the Current Title and Vesting to Your Property. Prepare a Deed. Be Aware of Your Lender and Title Insurance. Prepare a Preliminary Change of Ownership Report. Execute Your Deed. Record Your Deed. Wait for the Deed to be Returned. Keep the Property in the Trust.

A warranty deed protects property owners from future claims that someone else actually owns a portion (or all) of their property, while trustee deeds protect lenders when borrowers default on their mortgage loans.

The mortgage company usually prepares this deed as part of the loan package and delivers it to the title company for you to sign at closing. The title company is commonly the trustee to the deed and holds legal title to the property until the loan gets fully repaid.

Typically, the lender will provide you with a copy of the deed of trust after the closing. The original warranty deeds are often mailed to the grantee after they are recorded. These are your original copies and should be kept in a safe place, such as a fireproof lockbox or a safe deposit box at a financial institution.

The act of transferring a property that is owned by an individual into a trust, will see the trust liable to pay stamp duty on acquisition of the asset. Additionally, the individual who is transferring ownership to the trust, will be liable to pay capital gains tax on the disposal of the asset.