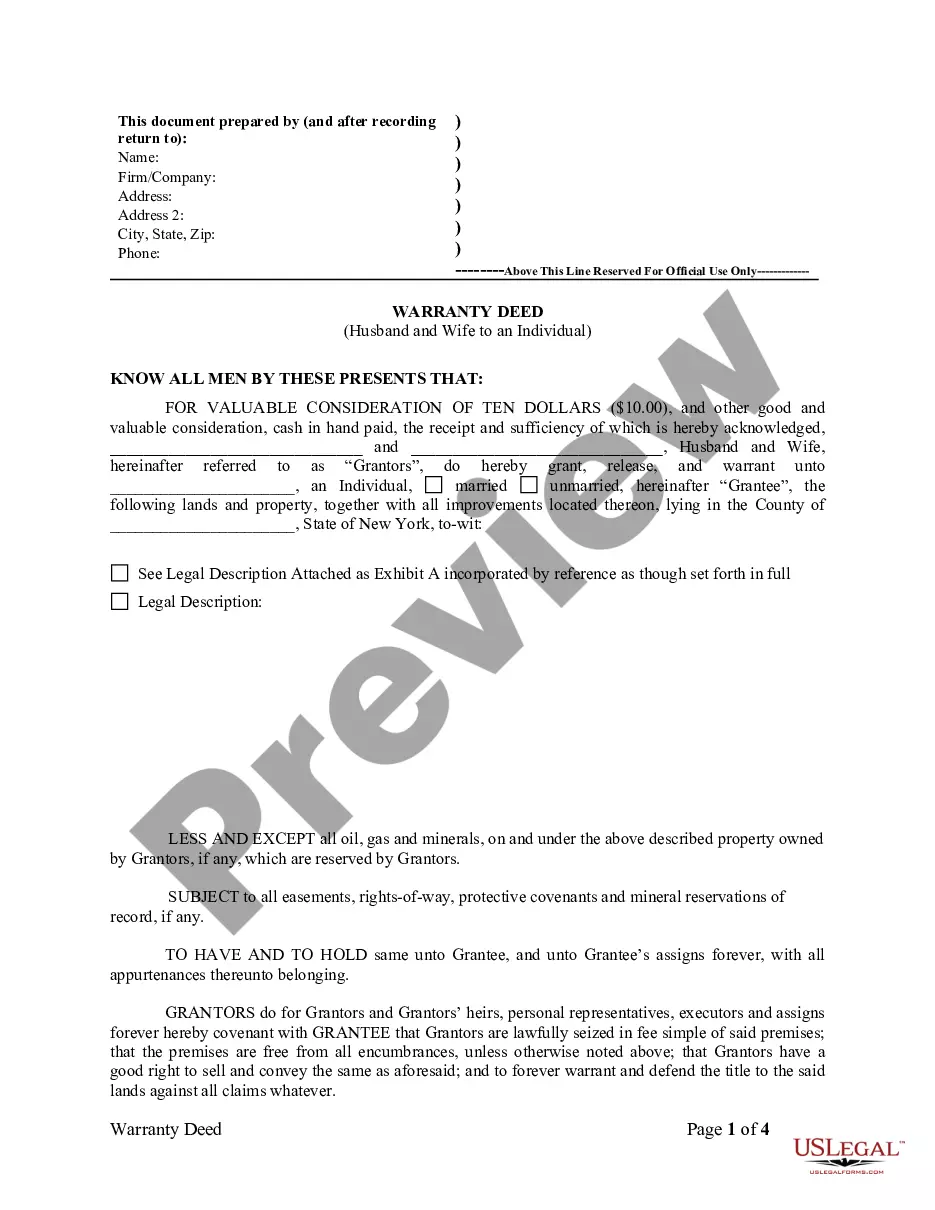

New York Warranty Deed from Husband and Wife to an Individual

Description

How to fill out New York Warranty Deed From Husband And Wife To An Individual?

US Legal Forms is really a unique platform to find any legal or tax document for filling out, including New York Warranty Deed from Husband and Wife to an Individual. If you’re tired with wasting time seeking appropriate examples and spending money on papers preparation/legal professional service fees, then US Legal Forms is exactly what you’re looking for.

To reap all the service’s benefits, you don't need to download any software but simply pick a subscription plan and create your account. If you have one, just log in and get a suitable sample, download it, and fill it out. Saved files are all saved in the My Forms folder.

If you don't have a subscription but need New York Warranty Deed from Husband and Wife to an Individual, check out the guidelines below:

- check out the form you’re looking at is valid in the state you need it in.

- Preview the sample and read its description.

- Simply click Buy Now to reach the sign up webpage.

- Pick a pricing plan and keep on registering by providing some info.

- Choose a payment method to finish the registration.

- Download the file by selecting the preferred file format (.docx or .pdf)

Now, submit the document online or print out it. If you are uncertain concerning your New York Warranty Deed from Husband and Wife to an Individual form, contact a attorney to review it before you send out or file it. Start hassle-free!

Form popularity

FAQ

If you live in a common-law state, you can keep your spouse's name off the title the document that says who owns the property.You can put your spouse on the title without putting them on the mortgage; this would mean that they share ownership of the home but aren't legally responsible for making mortgage payments.

A warranty deed guarantees that: The grantor is the rightful owner of the property and has the legal right to transfer the title.The title would withstand third-party claims to ownership of the property. The grantor will do anything to ensure the grantee's title to the property.

A In order to make your partner a joint owner you will need to add his name at the Land Registry, for which there is a fee of £280 (assuming you transfer half the house to him). You won't, however, have to pay capital gains tax, as gifts between civil partners (and spouses) are tax free.

Adding someone to your house deed requires the filing of a legal form known as a quitclaim deed. When executed and notarized, the quitclaim deed legally overrides the current deed to your home. By filing the quitclaim deed, you can add someone to the title of your home, in effect transferring a share of ownership.

To change the deed in New York City, as we discussed, we will need a deed signed and notorized by the grantor. Additionally, the deed must also be filed and recorded with the Office of the City Register along with transfer documents which identify if any taxes are due.

Special warranties allow the transfer of property title between seller and buyer. The purchase of title insurance can mitigate the risk of prior claims to the special warranty deed.

If you've recently married and already own a home or other real estate, you may want to add your new spouse to the deed for your property so the two of you own it jointly. To add a spouse to a deed, all you have to do is literally fill out, sign and record a new deed in your county recorder's office.

The fees to file a New York quitclaim deed vary from county to county, but some of the fees are similar. As of 2018, the basic fee for filing a quitclaim deed of residential or farm property is $125, while the fee for all other property is $250. These fees are for the RP-5217 form.

In California, all property bought during the marriage with income that was earned during the marriage is deemed "community property." The law implies that both spouses own this property equally, regardless of which name is on the title deed.