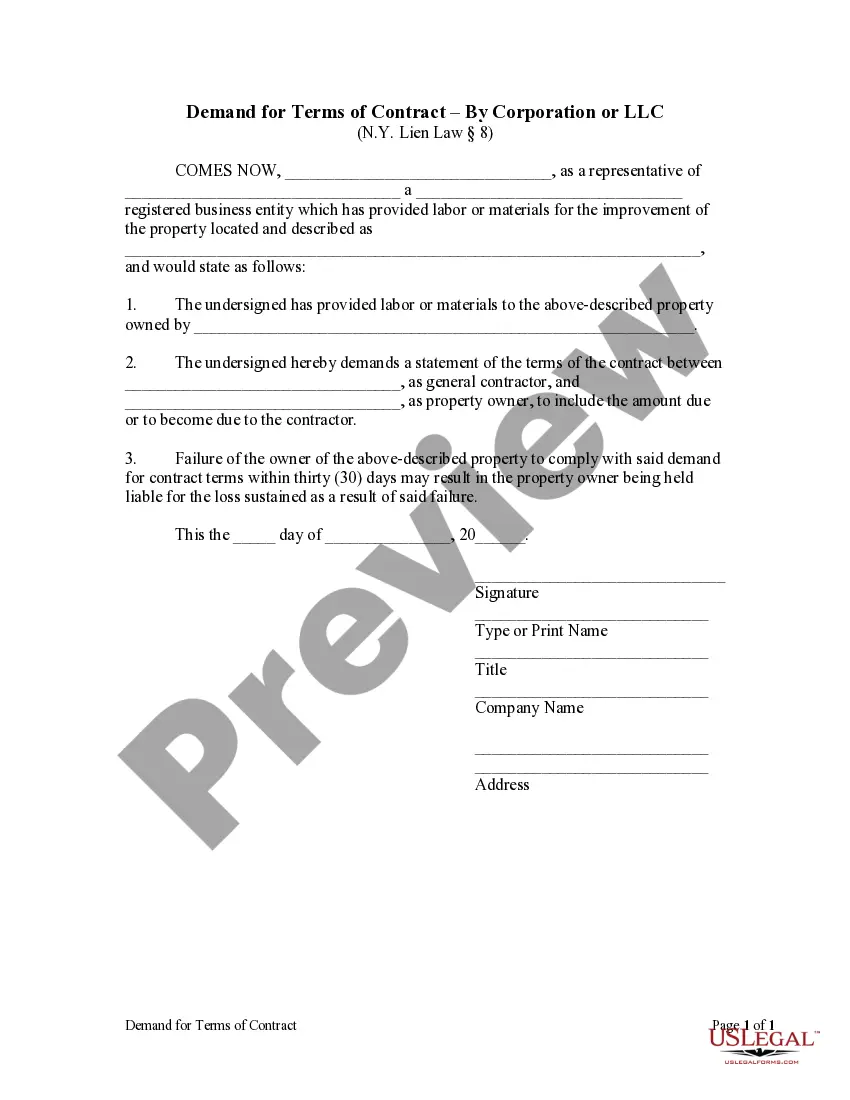

New York statutes provide that a subcontractor, laborer, or materialman providing labor or materials to a contractor or subcontractor may issue a written demand to the property owner for the terms of the contract between the contractor and the property owner. The owner is required to provide the terms of said contract within thirty (30) days or be held liable for any damages that result.

New York Demand for Terms of Contract by Corporation

Description Limited Liability Company File

How to fill out Terms Limited Liability Company?

US Legal Forms is actually a special platform where you can find any legal or tax form for filling out, such as New York Demand for Terms of Contract by Corporation or LLC. If you’re fed up with wasting time looking for ideal examples and spending money on papers preparation/legal professional charges, then US Legal Forms is precisely what you’re searching for.

To enjoy all the service’s advantages, you don't need to download any software but just choose a subscription plan and create an account. If you already have one, just log in and look for a suitable template, download it, and fill it out. Downloaded files are all kept in the My Forms folder.

If you don't have a subscription but need to have New York Demand for Terms of Contract by Corporation or LLC, take a look at the recommendations listed below:

- Double-check that the form you’re checking out applies in the state you need it in.

- Preview the sample its description.

- Click Buy Now to access the register webpage.

- Select a pricing plan and keep on registering by providing some information.

- Decide on a payment method to finish the registration.

- Download the document by choosing the preferred format (.docx or .pdf)

Now, submit the file online or print out it. If you are uncertain regarding your New York Demand for Terms of Contract by Corporation or LLC template, contact a attorney to examine it before you decide to send or file it. Start without hassles!

Limited Liability Company Application Form popularity

Limited Liability Company Agreement Other Form Names

Terms Contract Template FAQ

The first efforts to form LLCs were thwarted by IRS rulings that the business form was too much like a corporation to escape corporate tax complications.Thus it is extremely important that the LLC promoters avoid the corporate characteristics of continuity of life and free transferability of interests.

Both types of entities have the significant legal advantage of helping to protect assets from creditors and providing an extra layer of protection against legal liability. In general, the creation and management of an LLC are much easier and more flexible than that of a corporation.

In an LLC, individuals with an ownership share are called members. In a corporation, they are called shareholders. One of the advantages an LLC has over a corporation is that in many states, a creditor cannot collect a member's dividends, whereas in a corporation dividends can be collected from shareholders.

LLC owners must pay self-employment taxes for all income. S-corp owners may pay less on this tax, provided they pay themselves a "reasonable salary." LLCs can have an unlimited number of members, while S-corps are limited to 100 shareholders.

LLCs are owned by members who generally are not legally liable for company debts. LLCs have the legal authority to enter contracts relating to their business operations, but the laws of the individual states outline the parties that may legally bind an LLC to contractual agreements.

One of the main reasons to form a corporation or LLC for a small business is to avoid personal liability for the business' debts. As we mentioned earlier, corporations and LLCs have their own legal existence. It's the corporation or LLC that owns the business, its assets, debts, and liabilities.

Probably the most obvious advantage to forming an LLC is protecting your personal assets by limiting the liability to the resources of the business itself. In most cases, the LLC will protect your personal assets from claims against the business, including lawsuits.There is also the tax benefit to an LLC.

An LLC can achieve pass-through taxation status without any of those restrictions. LLCs also offer more income tax choices in how you are taxed. By default, LLCs enjoy pass-through taxation under IRS rules. However, by making an IRS election, you could have your LLC taxed as a C corporation or an S Corporation.

One of the main reasons to form a corporation or LLC for a small business is to avoid personal liability for the business' debts. As we mentioned earlier, corporations and LLCs have their own legal existence. It's the corporation or LLC that owns the business, its assets, debts, and liabilities.