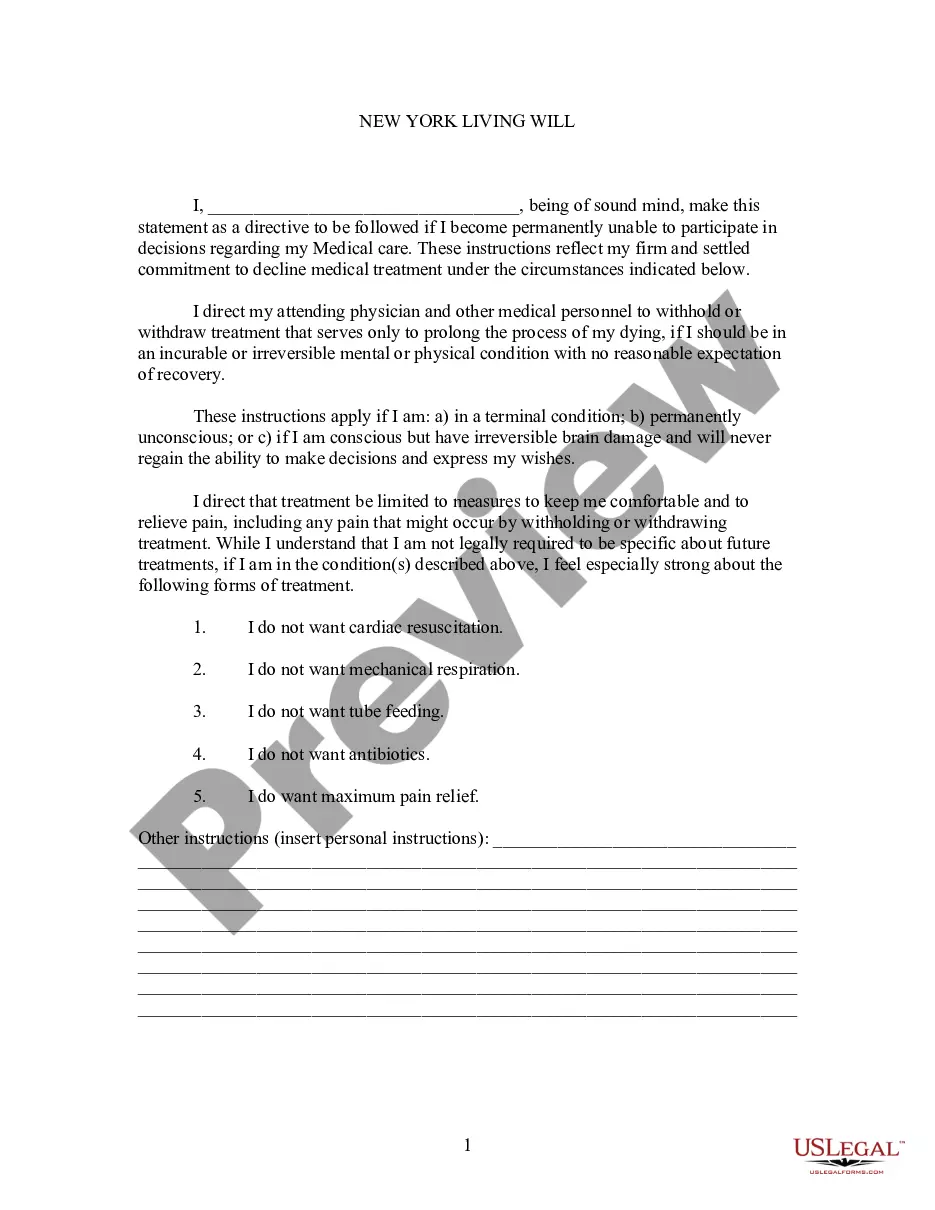

New York Living Will and Health Care Proxy

Description Living Will Health Care

How to fill out Living Will Form Sample?

US Legal Forms is actually a unique system where you can find any legal or tax document for completing, including New York Living Will and Health Care Proxy. If you’re fed up with wasting time looking for perfect examples and spending money on file preparation/attorney service fees, then US Legal Forms is precisely what you’re searching for.

To reap all of the service’s advantages, you don't need to install any application but simply pick a subscription plan and sign up your account. If you already have one, just log in and get a suitable template, download it, and fill it out. Saved files are stored in the My Forms folder.

If you don't have a subscription but need New York Living Will and Health Care Proxy, check out the guidelines listed below:

- make sure that the form you’re looking at applies in the state you need it in.

- Preview the sample and look at its description.

- Simply click Buy Now to reach the register page.

- Pick a pricing plan and carry on signing up by providing some info.

- Decide on a payment method to finish the registration.

- Download the document by choosing the preferred file format (.docx or .pdf)

Now, submit the file online or print out it. If you feel uncertain concerning your New York Living Will and Health Care Proxy template, contact a attorney to review it before you send out or file it. Begin hassle-free!

Care Proxy Form Form popularity

Care Proxy Form Template Other Form Names

Health Proxy Form Ny FAQ

The New York Department of Taxation and Finance removed the penalty so you may file a NY state tax return by mail (see page 35: https://www.tax.ny.gov/pdf/current_forms/it/it201i.pdf).You may Continue past the screen(s) regarding "Filing your New York return on paper is not recommended."

You must file Form IT-201, Resident Income Tax Return, if you were a New York State resident for the entire year.

Form NYS-1, Return of Tax Withheld, must be filed and the total tax withheld paid after each payroll that caused the total accumulated withholding tax to equal or exceed $700. If you withhold less than $700 during a calendar quarter, remit the taxes withheld with your quarterly return, Form NYS-45.

The state as a whole has a progressive income tax that ranges from 4.00% to 8.82%, depending on an employee's income level. There is also a supplemental withholding rate of 9.62% for bonuses and commissions.

Generally, you must file a New York State income tax return if you're a New York State resident and are required to file a federal return. You may also have to file a New York State return if you're a nonresident of New York and you have income from New York State sources.

The IT-201 is a New York State income tax return form. If you are filing state taxes for New York this year, then yes you will need this form and you want to make sure that you fill it out entirely. Turbo Tax would have a copy of your 2015 IT-201 only if you filed state taxes for the state of New York last year.

Form IT-201, Resident Income Tax Return.

Form NYS-1 is used to remit to New York State the personal income taxes that you have withheld from your employees' wages or from certain other payments (for example, pensions).

NYS-45, Quarterly Combined Withholding, Wage Reporting, and Unemployment Insurance Return. All employers required to withhold tax from wages must file Form NYS-45, Quarterly Combined Withholding, Wage Reporting, and Unemployment Insurance Return, each calendar quarter.