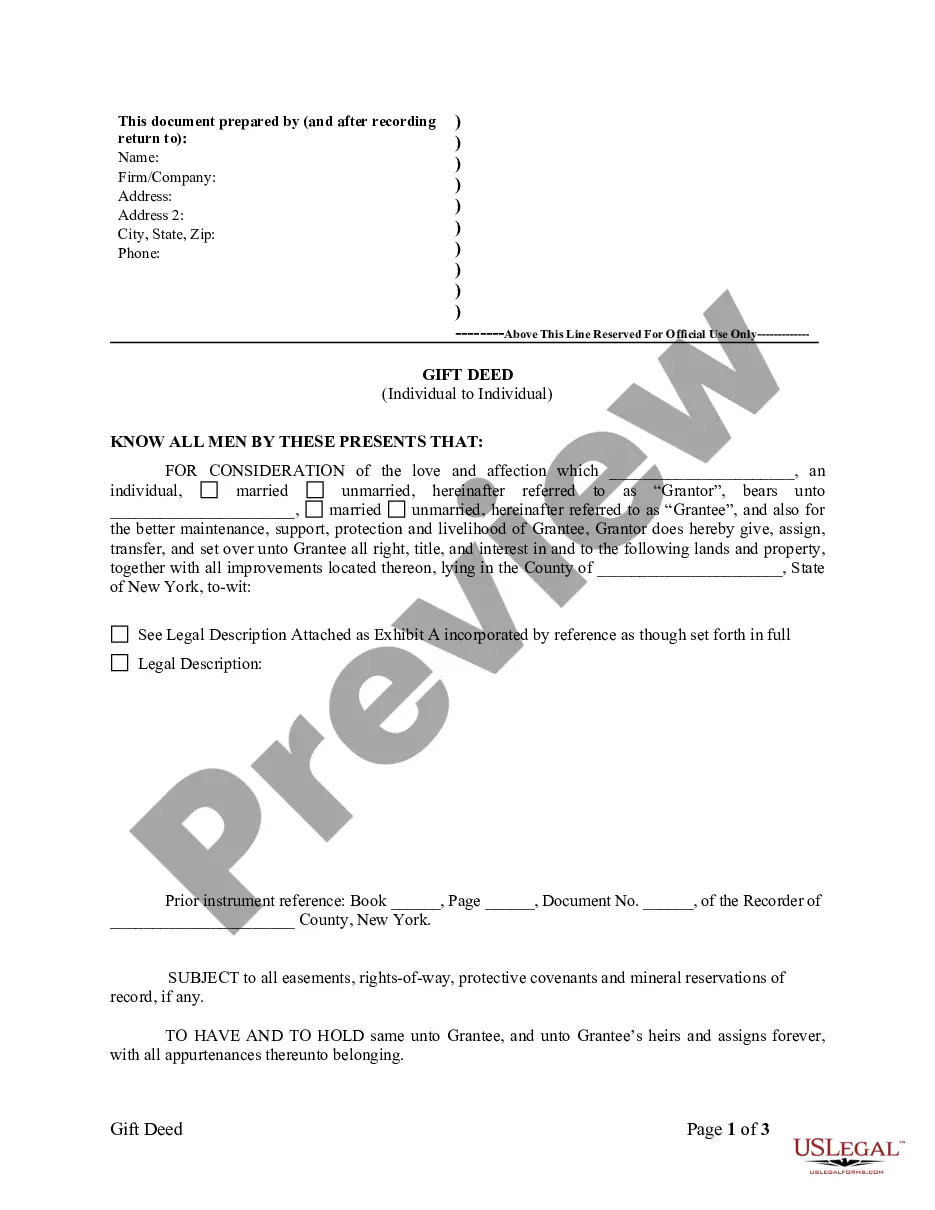

New York Gift Deed for Individual to Individual

Description

How to fill out New York Gift Deed For Individual To Individual?

US Legal Forms is a unique platform where you can find any legal or tax form for submitting, including New York Gift Deed for Individual to Individual. If you’re tired of wasting time looking for perfect examples and paying money on file preparation/lawyer fees, then US Legal Forms is exactly what you’re searching for.

To reap all the service’s advantages, you don't need to download any software but simply select a subscription plan and sign up an account. If you have one, just log in and find a suitable template, download it, and fill it out. Downloaded files are all saved in the My Forms folder.

If you don't have a subscription but need New York Gift Deed for Individual to Individual, check out the guidelines listed below:

- check out the form you’re taking a look at applies in the state you want it in.

- Preview the sample and read its description.

- Simply click Buy Now to access the register webpage.

- Select a pricing plan and proceed registering by entering some info.

- Decide on a payment method to complete the sign up.

- Save the document by selecting the preferred file format (.docx or .pdf)

Now, complete the file online or print it. If you are unsure concerning your New York Gift Deed for Individual to Individual template, speak to a legal professional to check it before you decide to send or file it. Get started hassle-free!

Form popularity

FAQ

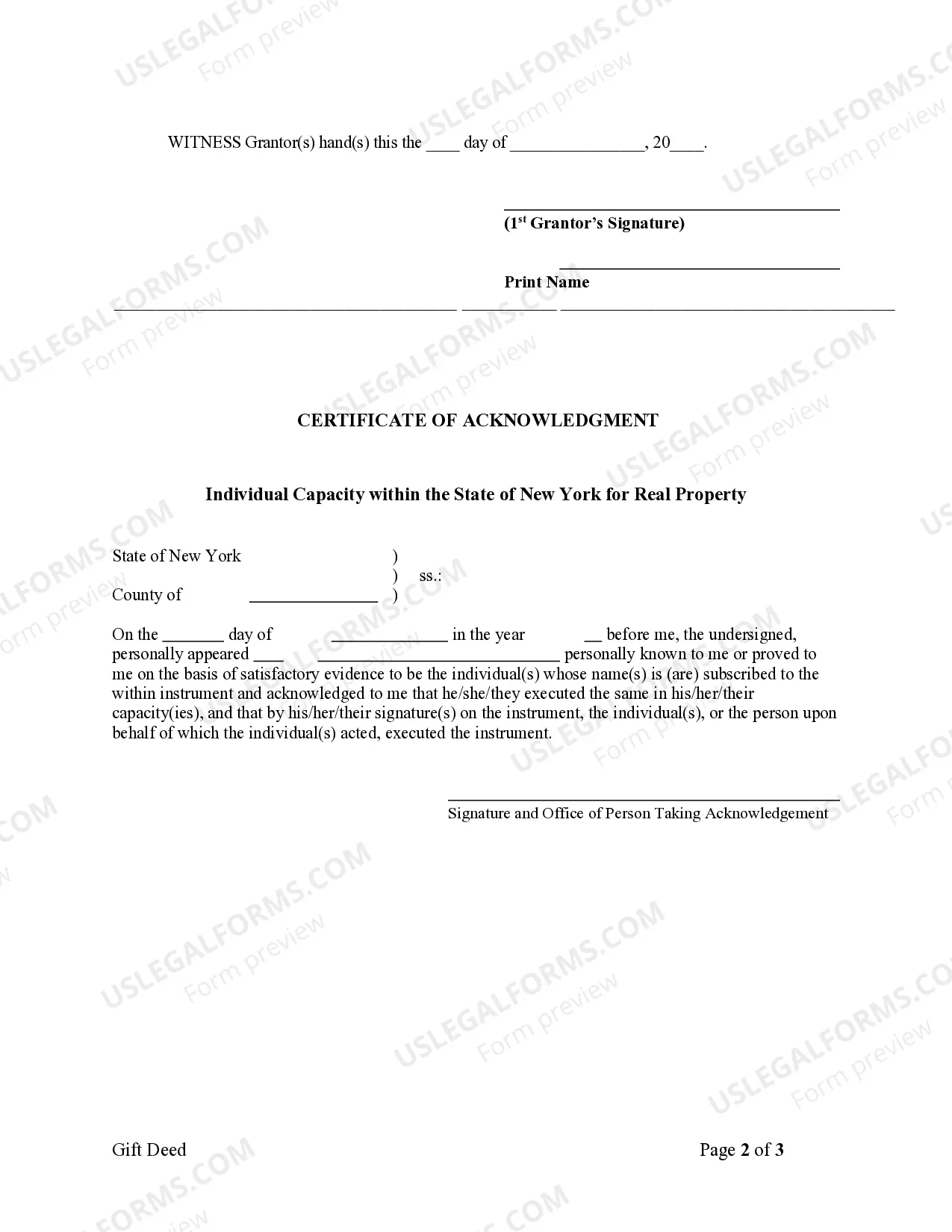

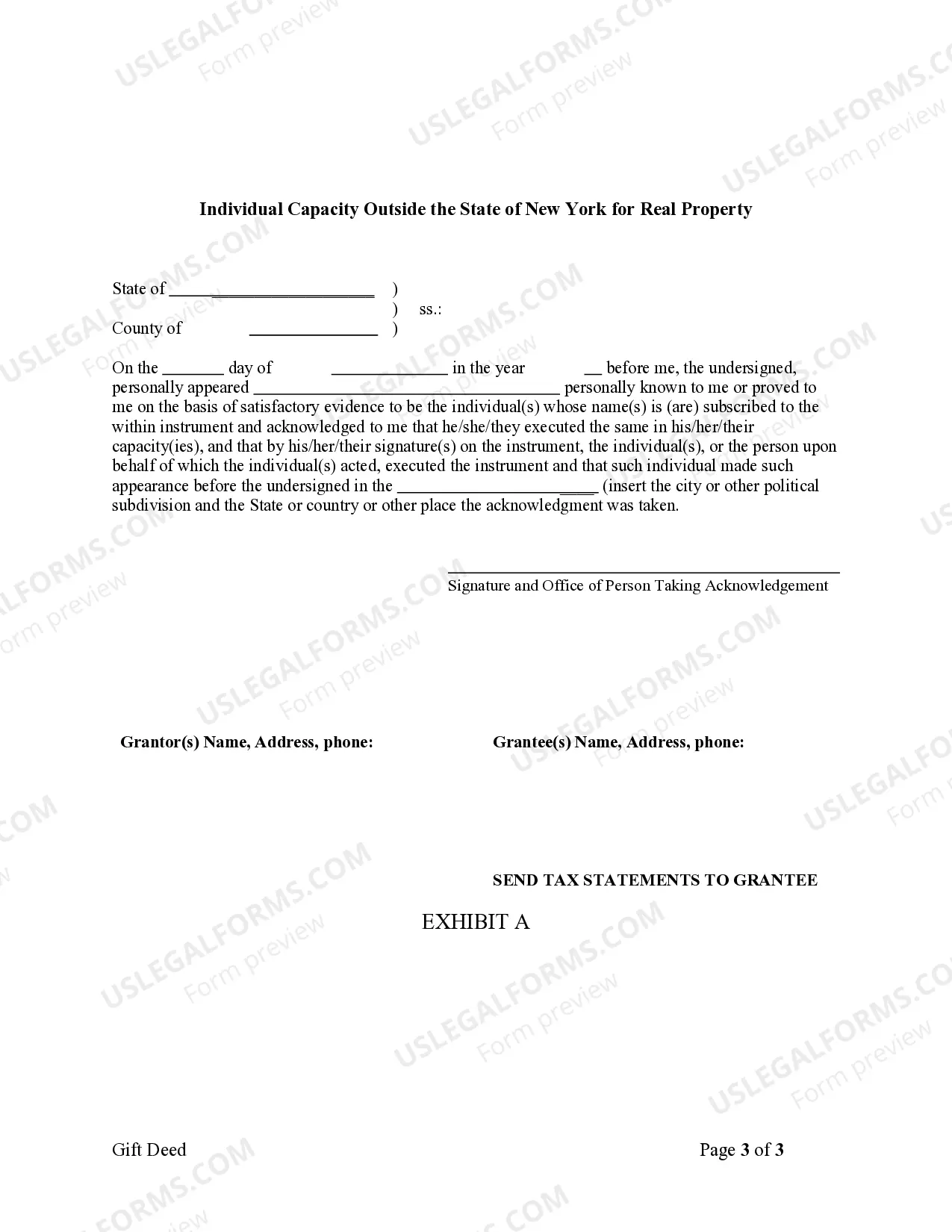

Sign the Deed (both the Donor and the Donee) in the presence of 2 witnesses and take the signed document to the nearest Sub-registrar Office. Calculate the Registration charges with the help of lawyers or consult LegalDesk.com to get an accurate measure.

To change the deed in New York City, as we discussed, we will need a deed signed and notorized by the grantor. Additionally, the deed must also be filed and recorded with the Office of the City Register along with transfer documents which identify if any taxes are due.

The gift cannot ever be revoked nor can you later ask for financial compensation.Usually a Gift Deed is used to transfer property between family members. As a result, the transaction may be subject to coercion or fraud. As such a Gift Deed may be subject to challenge in court.

The fees to file a New York quitclaim deed vary from county to county, but some of the fees are similar. As of 2018, the basic fee for filing a quitclaim deed of residential or farm property is $125, while the fee for all other property is $250. These fees are for the RP-5217 form.

A Deed of Gift is a formal legal document used to give a gift of property or money to another person. It transfers the money or ownership of property (or share in a property) to another person without payment is demanded in return.Giving a gift to someone can have some Inheritance Tax implications.

A gift deed, or deed of gift, is a legal document voluntarily transferring title to real property from one party (the grantor or donor) to another (the grantee or donee), typically between family members or close friends. Gift deeds are also used to donate to a non-profit organization or charity.

The gift deed can be questioned by filing a suit for declaration in the court of law. However, it will be challenged only if the person is able to establish that the execution of the deed was not as per the wish of the donor and was executed under fraud, coercion,misrepresentation etc.

Gift made by way of movable property is required to be made in stamp paper and stamped by the notary or court. Registration of gift deed is not required in case of transfer of moveable property.Gift of immovable property which is not registered is not a valid as per law and cannot pass any title to the donee.