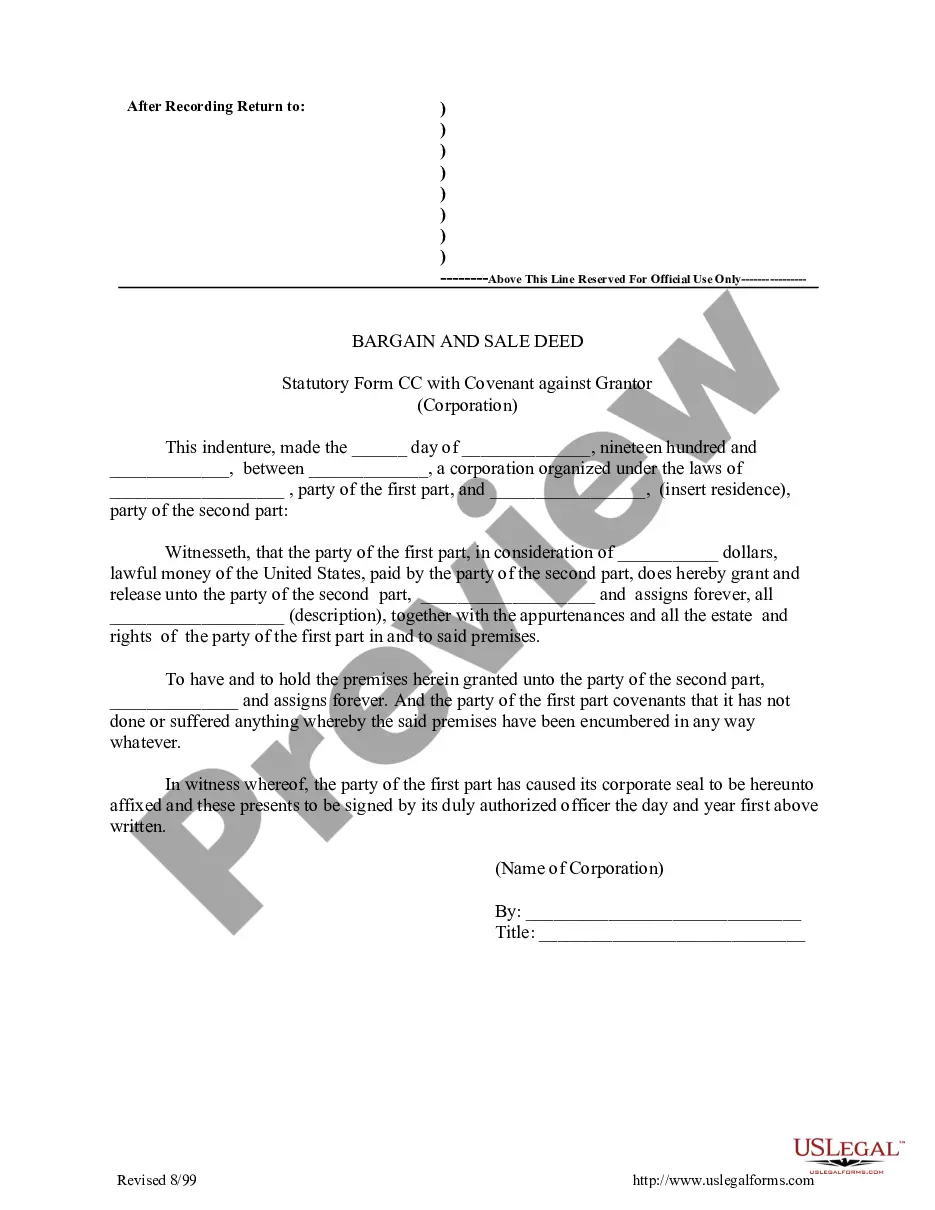

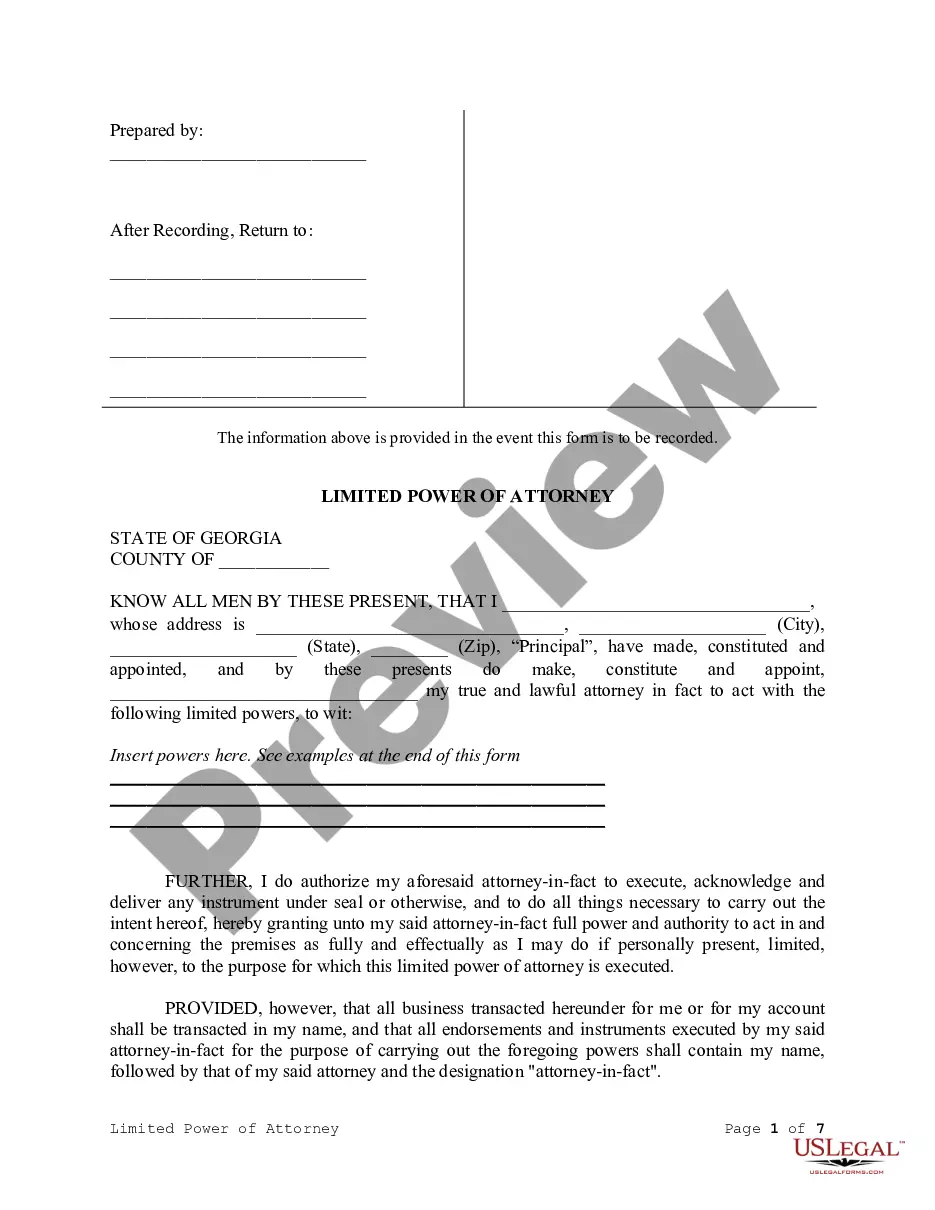

New York Bargain and Sale Deed Statutory Form CC. With Covenant against Grantor by Corporation

Description New York Deed

How to fill out New York Deed Form?

US Legal Forms is actually a unique platform where you can find any legal or tax form for filling out, such as New York Bargain and Sale Deed Statutory Form CC. With Covenant against Grantor by Corporation. If you’re sick and tired of wasting time seeking appropriate samples and paying money on document preparation/attorney charges, then US Legal Forms is precisely what you’re trying to find.

To reap all the service’s benefits, you don't have to install any software but just select a subscription plan and sign up your account. If you already have one, just log in and find the right template, save it, and fill it out. Downloaded documents are kept in the My Forms folder.

If you don't have a subscription but need New York Bargain and Sale Deed Statutory Form CC. With Covenant against Grantor by Corporation, check out the guidelines listed below:

- make sure that the form you’re checking out applies in the state you want it in.

- Preview the form and read its description.

- Simply click Buy Now to get to the sign up page.

- Select a pricing plan and continue registering by entering some info.

- Pick a payment method to complete the sign up.

- Download the document by selecting the preferred format (.docx or .pdf)

Now, submit the file online or print it. If you are uncertain about your New York Bargain and Sale Deed Statutory Form CC. With Covenant against Grantor by Corporation sample, contact a attorney to analyze it before you decide to send out or file it. Begin without hassles!

Bargain Form Form popularity

Bargain Deed Form Other Form Names

Deed Form With FAQ

New York will continue to apply state income tax to 2020 unemployment benefits in full despite the federal government exempting the first $10,200. Gov.There has been no change to the taxable status of the unemployment benefits," Robert Mujica, Cuomo's budget director, said at the news conference Wednesday.

The IT-201 is a New York State income tax return form. If you are filing state taxes for New York this year, then yes you will need this form and you want to make sure that you fill it out entirely. Turbo Tax would have a copy of your 2015 IT-201 only if you filed state taxes for the state of New York last year.

The IT-201 is the main income tax form for New York State residents. It is analogous to the US Form 1040, but it is four pages long, instead of two pages. The first page of IT-201 is mostly a recap of information that flows directly from the federal tax forms.

IT-203 (Fill-in) IT-203-I (Instructions) Nonresident and Part-Year Resident Income Tax Return; Description of Form IT-203. This is the only return for taxpayers who are nonresidents or part-year residents of New York State, whether they are itemizing their deductions or claiming the standard deduction.

You must file Form IT-201, Resident Income Tax Return, if you were a New York State resident for the entire year.

Form NYS-1, Return of Tax Withheld, must be filed and the total tax withheld paid after each payroll that caused the total accumulated withholding tax to equal or exceed $700. If you withhold less than $700 during a calendar quarter, remit the taxes withheld with your quarterly return, Form NYS-45.

Will my federal income tax refund still be sent to New York State for this debt? I currently have a payment agreement with New York State.If your liability will not be paid in full before the Internal Revenue Service (IRS) issues your refund, your refund will be offset to your New York State debt.

The IT-201 is the main income tax form for New York State residents. It is analogous to the US Form 1040, but it is four pages long, instead of two pages. The first page of IT-201 is mostly a recap of information that flows directly from the federal tax forms.

Form IT-558 is a new form for tax year 2020, which adjusts your federal adjusted gross income.For distributions taken from retirement plans, NY is requiring that the entire amount be added back to federal AGI, and then taxpayers will subtract out any taxable amount already included in federal AGI.

The state as a whole has a progressive income tax that ranges from 4.00% to 8.82%, depending on an employee's income level. There is also a supplemental withholding rate of 9.62% for bonuses and commissions.