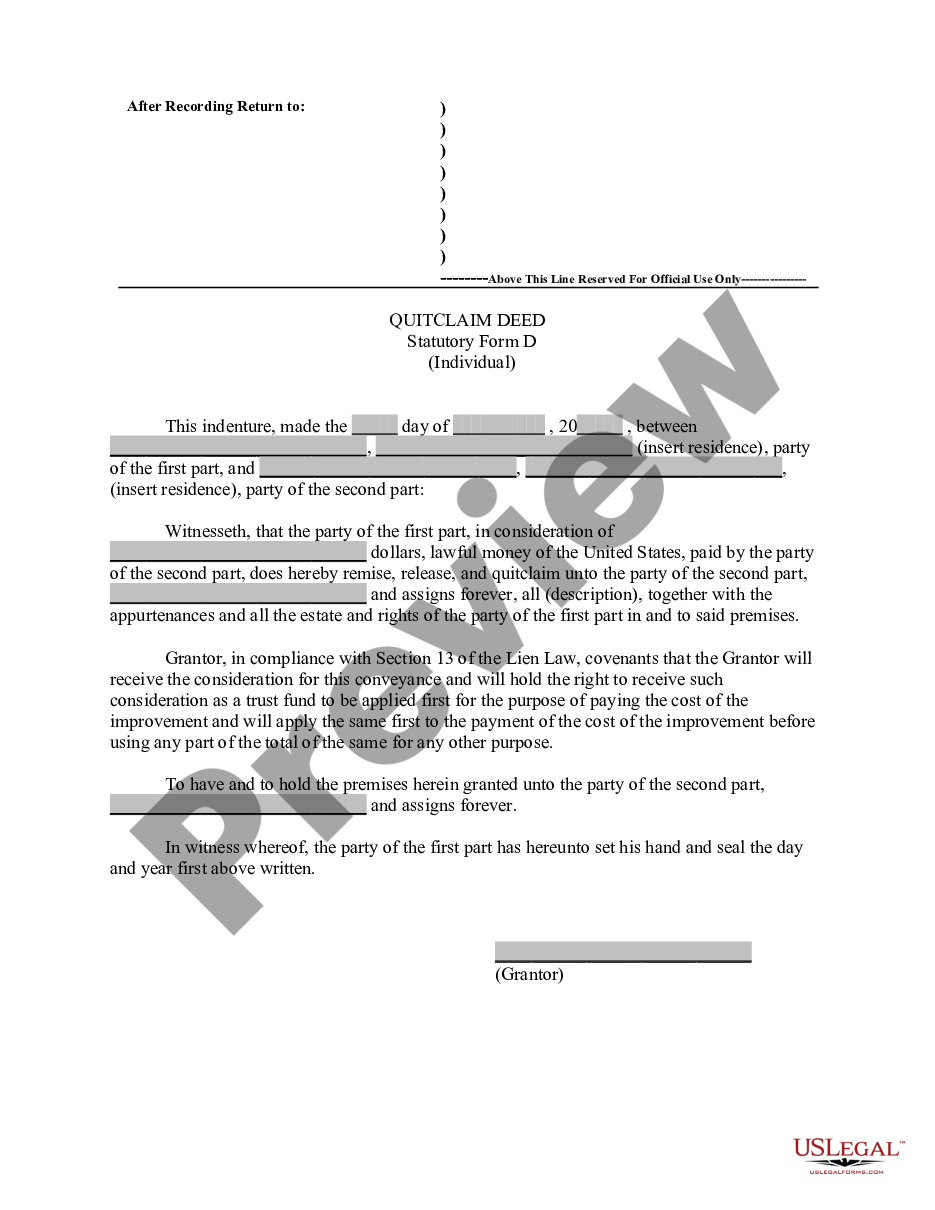

Quitclaim Deed by Individual

Definitions and Terms Relevant to Deeds

Note: The information below is a general statement of the

law of deeds and is applicable in most states. However, state laws

may vary the general statement slightly or to a large degree. The discussion

below is intended as general and not as applicable to a particular state.

The actual forms will reflect the requirements of your state.

Types of Deeds:

Warranty Deed - If a deed is intended to be a general warranty

deed, it should contain a phase specified by state law such as the phrase

"conveys and warrants". These words, called operative words of conveyance,

carry with them several warranties which the grantor is making to the grantee.

Examples of the warranties are:

First, the grantor warrants that the grantor is the lawful

owner of the property at the time the deed is made and delivered and that

the grantor has the right to convey the property.

Second, the grantor warrants that the property is free from all

encumbrances or liens.

Third, the grantor warrants that he or she will defend title to

the estate so that the grantee and the grantee's heirs and assigns may

enjoy quiet and peaceable possession of the premises with the power to

convey the property.

Quitclaim Deed - A quit claim deed conveys to the grantee and

the grantee's heirs and assigns in fee all of the legal or equitable rights

the grantor has in the property that existed at the time of the conveyance.

An example of operative words of conveyance are "convey and quit claim."

There are no warranties of title.

Special Warranty Deed - In contrast to a general warranty

deed, a special warranty deed limits the liability of the grantor by warranting

only what the deed explicitly states. A special warranty deed has practically

the same effect as a quitclaim deed. Special warranty deeds are generally

used by corporations or other entities that want to avoid assuming the

liability of a general warranty deed. Like the general warranty deed, the

special warranty deed should contain the appropriate language such as

"conveys and specially warrants." Usually, the grantor warrants that he

or she did nothing to impair title during the period the grantor held the

title. While a special warranty deed may contain covenants of title, these

covenants will usually cover only those claims arising by, through, or

under the grantor.

Fiduciary Deed - This is a deed to be executed by a fiduciary

such as a trustee, guardian, conservator, or similar person in their

appointed capacity.

Terms Common to Deeds:

Grantor - The person who owns the property and executes

the deed conveying the property to another person. This can be one

or more persons, a corporation, limited liability company (LLC), partnership

or other entity.

Grantee - The person who receives title to the property.

The grantee can be one or more persons, a corporation, LLC, partnership

or other entity.

Consideration - The value given to the grantor by the grantee

in exchange for the conveyance. Some states include the exact consideration

in the deed and others do not but instead include a statement of consideration

as being 10.00 and other good and valuable consideration.

Operative Words of Conveyance - These are state specific

and generally are statutory. They show intent to transfer present

title. As previously mentioned, examples are "conveys and warrants", or

"convey and quitclaim" or convey and specially warrant".

Legal Description - The legal definition of the property

being conveyed. This is contained in the deed where the grantor obtained

title to the property and should be used in the deed where the grantor

conveys the property exactly as written in the grantors deed unless not

all of the property is being conveyed.

Life Estate - A life estate is where a person owns all the

benefits of ownership in the property during their life, or the life of

another, with the property going to a remainder person after the death

of the life tenant.

Tenants in Common - This is how two or more people (co-tenants)

may take title to property who intend their share in the property to be

separate from the other on death. On the death of the tenant

in common the deceased persons ownership in the property is left to his

or her heirs or as specified by Will. Compare to Joint Tenants.

If tenant in common ownership is desired the deed usually provides, "to

Grantees, A and B, as tenants in common and not as joint tenants".

Joint Tenants with Rights of Survivorship - This is how two

or more persons may take title to property when the parties want the entire

ownership to go to the survivor instead of the heirs of the survivor.

On death of a joint tenant with rights of survivorship, the entire interest

of the deceased co-tenant goes to the surviving co-tenants. Compare to

Tenants in Common. It is common for husband and wife to take title

as joint tenants with rights of survivorship. If joint tenant with

rights of survivorship ownership is desired, the deed usually provides,

"to Grantees, A and B, as joint tenants with rights of survivorship and

not as tenants in common".

Community Property - In community property states, special

laws govern how property is owned between husband and wife.

Reservation Clause - This is a provision of a deed where

the grantor may reserve some right in the property such as mineral rights.

Exception Clause - This is a clause in a deed were exceptions

to title conveyed may be listed. Example, "Less and Except a prior reservation

of all oil, gas and mineral rights in the property conveyed."

Subject to Clause - This is a clause in a deed where property

useage rights may be states. Example: "Subject to all rights of way, easements

and protective covenants of record".

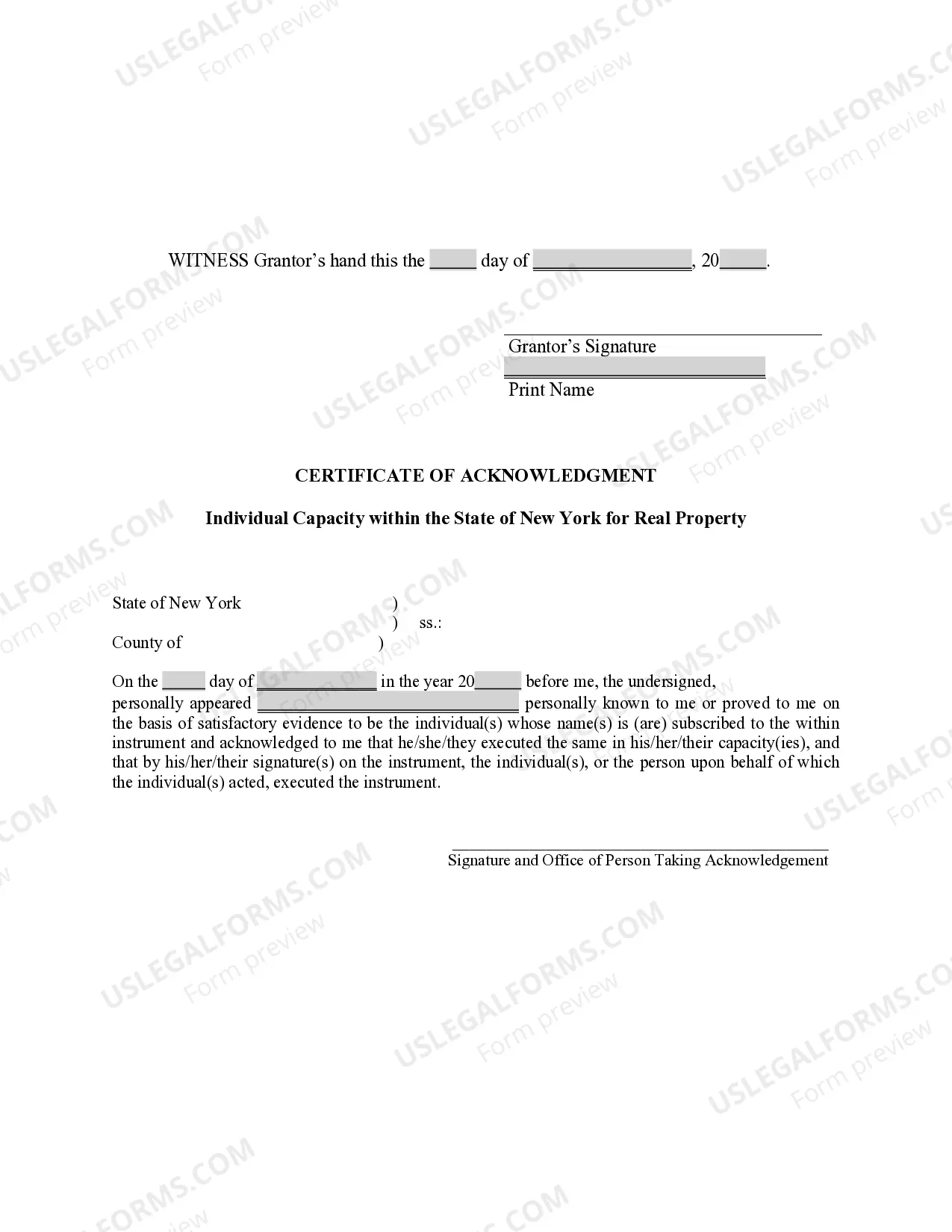

Execution and Acknowledgments

Execution - A deed must be in writing and signed by the

grantor(s). Generally, deeds conveying a homestead estate must also be

signed by the grantor's spouse.

Acknowledgments - In addition to the signature of the

grantor(s), deeds must be acknowledged to be recorded and acceptable as

evidence of ownership without other proof. Each state has special acknowledgment

forms.

Procedural Requirements

Name, Address, phone - The names of the grantor and

the grantee should appear on the deed. The address and phone numbers

are also usually included.

Recording or Filing Place - Generally, deeds should be recorded

in the county in which the real estate is located. Although generally a

deed does not have to be recorded to be a valid conveyance, there are practical

reasons for recording a deed. Deeds usually do not take effect as to creditors

and subsequent purchasers without notice until the instrument is recorded.

Thus, unrecorded deeds may be void as to all subsequent creditors and subsequent

purchasers without notice until they are filed for record. Recording a

deed places subsequent purchasers on constructive notice in that subsequent

purchasers are deemed to have actual knowledge of any recorded instrument.

Some states are "race-notice" states, which means that the first grantee

without notice to record a deed to property will be protected against the

interests of other grantees with unrecorded deeds to the same property.

Acceptance and Delivery - Another element of a valid deed

is that the deed must be delivered and accepted to be an effective conveyance.

Most states assume delivery if the grantee is in possession of the deed.

The deed also must be accepted by the grantee. This acceptance does not

need to be shown in any formal way, but rather may be by any act, conduct

or words showing an intention to accept such as recording the deed.

How to Order

To order the deed you have located, close this window and

click on the order icon.