Transfer Under The New York Uniform Transfers to Minors Act

Description

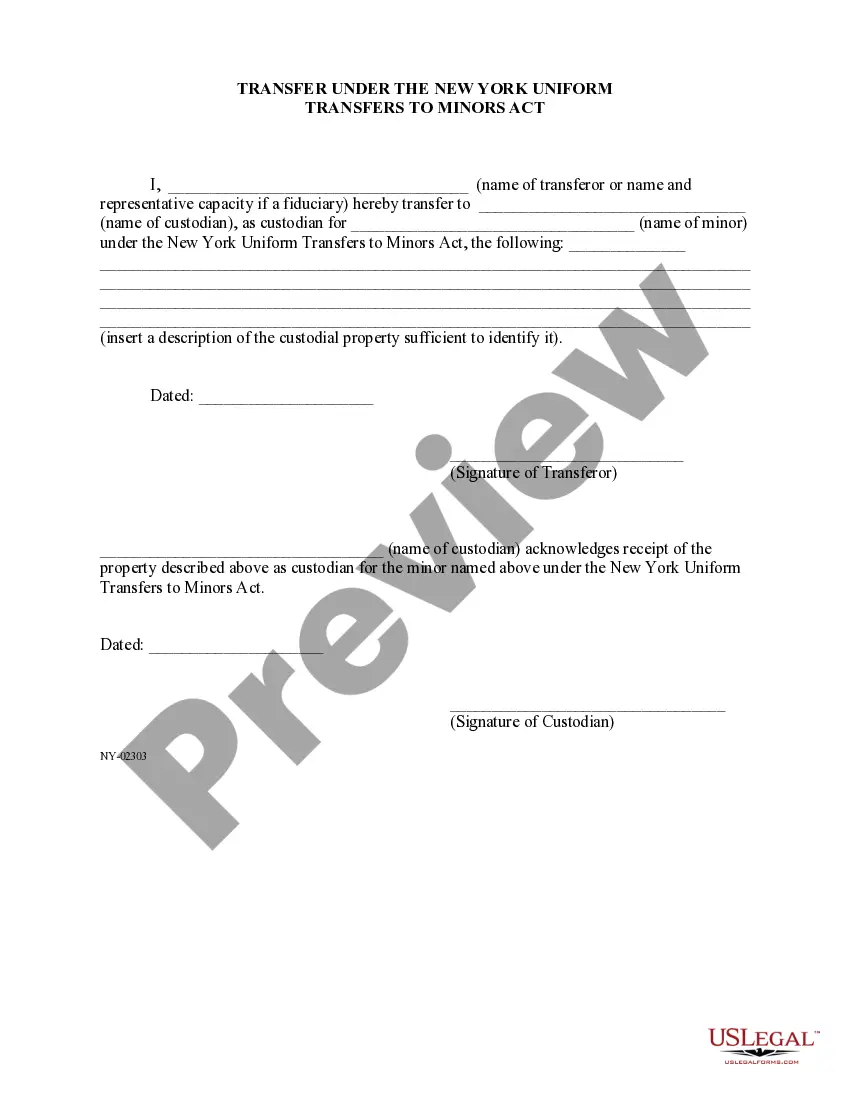

How to fill out Transfer Under The New York Uniform Transfers To Minors Act?

US Legal Forms is a unique system where you can find any legal or tax document for completing, such as Transfer Under The New York Uniform Transfers to Minors Act. If you’re tired of wasting time searching for appropriate samples and paying money on record preparation/attorney service fees, then US Legal Forms is exactly what you’re looking for.

To enjoy all of the service’s benefits, you don't have to install any software but simply choose a subscription plan and create your account. If you have one, just log in and find an appropriate sample, save it, and fill it out. Saved files are kept in the My Forms folder.

If you don't have a subscription but need Transfer Under The New York Uniform Transfers to Minors Act, check out the recommendations below:

- check out the form you’re considering is valid in the state you want it in.

- Preview the form and look at its description.

- Simply click Buy Now to access the sign up page.

- Select a pricing plan and carry on registering by providing some info.

- Select a payment method to complete the sign up.

- Save the document by selecting the preferred file format (.docx or .pdf)

Now, fill out the file online or print out it. If you feel uncertain regarding your Transfer Under The New York Uniform Transfers to Minors Act form, contact a lawyer to examine it before you send or file it. Get started without hassles!

Form popularity

FAQ

UGMA was replaced by the Uniform Transfers to Minors Act (UTMA) in New York on January 1, 1997. A UTMA account can be used to hold and protect assets for minors until they reach the age of majority as stipulated by the state or the donor.

The Uniform Transfers To Minors Act (UTMA) is a uniform act drafted and recommended by the National Conference of Commissioners on Uniform State Laws in 1986, and subsequently enacted by most U.S. States, which provides a mechanism under which gifts can be made to a minor without requiring the presence of an appointed

The Uniform Gifts to Minors Act (UGMA) provides a way to transfer financial assets to a minor without the time-consuming and expensive establishment of a formal trust. A UGMA account is managed by an adult custodian until the minor beneficiary comes of age, at which point he assumes control of the account.

Generally, the UTMA account transfers to the beneficiary when he or she becomes a legal adult, which is usually 18 or 21. However, the age of adulthood may be defined differently for custodial accounts, like UTMAs or 529 plans, depending on your state.

Virtually all states have adopted some form of UTMA that allows you to make gifts to a minor to be held in the name of a custodian during the age of minority. On reaching the age of majority, usually 21 years, the minor is entitled to all assets held in the account.

When children reach the age of majority, the account can be transferred into their name only with custodian consent. Otherwise, they can remove the custodian from the account at the age of termination.

The Uniform Transfers to Minors Act (UTMA) allows a minor to receive gifts without the aid of a guardian or trustee.The donor can name a custodian who has the fiduciary duty to manage and invest the property on behalf of the minor until the minor becomes of legal age.

Virtually all states have adopted some form of UTMA that allows you to make gifts to a minor to be held in the name of a custodian during the age of minority. On reaching the age of majority, usually 21 years, the minor is entitled to all assets held in the account.