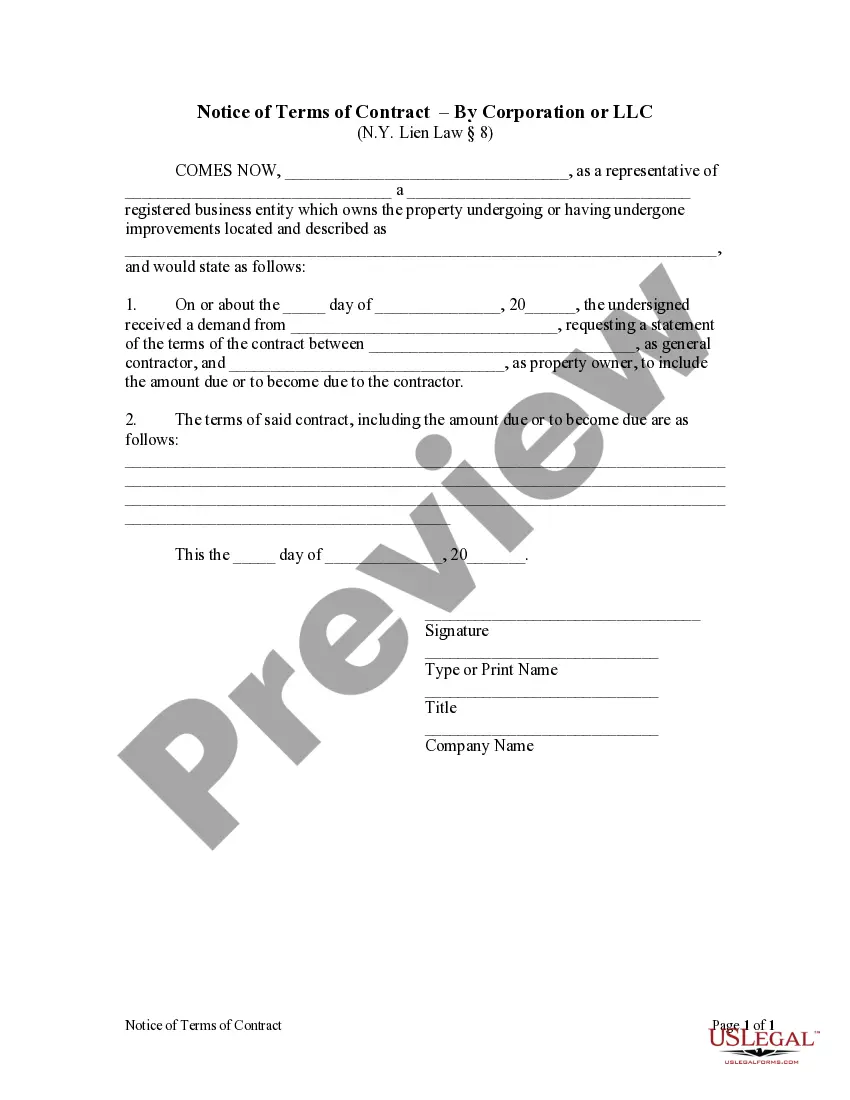

New York statutes provide that a subcontractor, laborer, or materialman providing labor or materials to a contractor or subcontractor may issue a written demand to the property owner for the terms of the contract between the contractor and the property owner. The owner is required to provide the terms of said contract within thirty (30) days or be held liable for any damages that result. This form can be used by a property owner to respond to said demand.

New York Notice of Terms of Contract by Corporation

Description Owner Corporation Paper

How to fill out Ny Owner Llc?

US Legal Forms is really a special system to find any legal or tax template for filling out, such as New York Notice of Terms of Contract by Corporation or LLC. If you’re tired with wasting time looking for suitable samples and spending money on file preparation/attorney charges, then US Legal Forms is precisely what you’re searching for.

To enjoy all the service’s benefits, you don't have to download any application but simply select a subscription plan and create an account. If you already have one, just log in and find an appropriate template, save it, and fill it out. Downloaded documents are kept in the My Forms folder.

If you don't have a subscription but need to have New York Notice of Terms of Contract by Corporation or LLC, take a look at the instructions below:

- Double-check that the form you’re considering applies in the state you need it in.

- Preview the example and look at its description.

- Click Buy Now to reach the sign up webpage.

- Select a pricing plan and proceed registering by entering some info.

- Decide on a payment method to finish the sign up.

- Save the document by selecting your preferred file format (.docx or .pdf)

Now, fill out the document online or print out it. If you are uncertain regarding your New York Notice of Terms of Contract by Corporation or LLC sample, speak to a lawyer to check it before you send or file it. Get started hassle-free!

Owner Form Corporation Form popularity

Owner Corporation Application Other Form Names

Owner Corporation New York FAQ

All states recognize businesses formed as corporations, limited liability companies (LLCs) or partnerships, or variations of these forms. Forming an LLC. An LLC is formed by one or more business people, as owners. The owners, called "members," file Articles of Organization with a state.

Unlike most states, New York's LLC law requires LLC members to adopt a written operating agreement. The Operating Agreement may be entered into before, at the time of, or within 90 days after filing the Articles of Organization.

A limited liability company (LLC) is not required to have bylaws. Bylaws, which are only relevant to businesses structured as corporations, include rules and regulations that govern a corporation's internal management.Alternatively, LLCs create operating agreements to provide a framework for their businesses.

An operating agreement is a key document used by LLCs because it outlines the business' financial and functional decisions including rules, regulations and provisions. The purpose of the document is to govern the internal operations of the business in a way that suits the specific needs of the business owners.

An LLC Operating Agreement is Not Compulsory, but it is Highly Recommended. An LLC operating agreement is not necessarily compulsory, although this depends on the state where your business is based. You could get into a lot of unnecessary strife if situations change in your LLC.

A domestic LLC with at least two members is classified as a partnership for federal income tax purposes unless it files Form 8832 and elects to be treated as a corporation.

The main difference between an LLC and a corporation is that an llc is owned by one or more individuals, and a corporation is owned by its shareholders. No matter which entity you choose, both entities offer big benefits to your business. Incorporating a business allows you to establish credibility and professionalism.

Forming an LLC or a corporation will allow you to take advantage of limited personal liability for business obligations. LLCs are favored by small, owner-managed businesses that want flexibility without a lot of corporate formality. Corporations are a good choice for a business that plans to seek outside investment.

An operating agreement is mandatory as per laws in only 5 states: California, Delaware, Maine, Missouri, and New York. LLCs operating without an operating agreement are governed by the state's default rules contained in the relevant statute and developed through state court decisions.