New York Quitclaim Deed - Two Individual to Four Individuals

Overview of this form

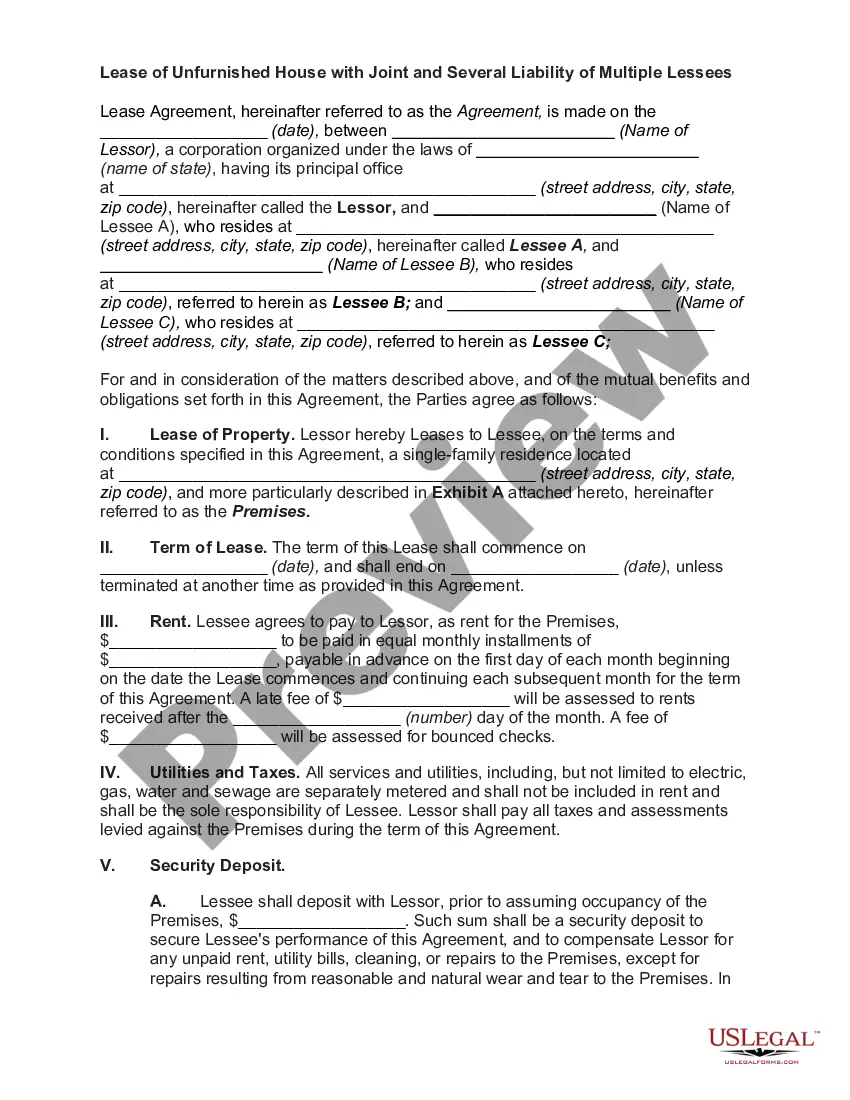

The Quitclaim Deed for Two Individuals to Four Individuals is a legal document that allows two grantors to transfer their interest in real property to four grantees. This form differs from other types of property deeds, such as warranty deeds, because it does not guarantee that the grantors have clear title to the property. The grantees can hold the property as tenants in common or joint tenants with the right of survivorship, depending on their preference.

Main sections of this form

- Grantor information: Details about the two individuals transferring property.

- Grantee information: Details about the four individuals receiving the property.

- Property description: Clear legal description of the property being conveyed.

- Ownership designation: Specifies how the grantees will hold the property (e.g., tenants in common, joint tenants with right of survivorship).

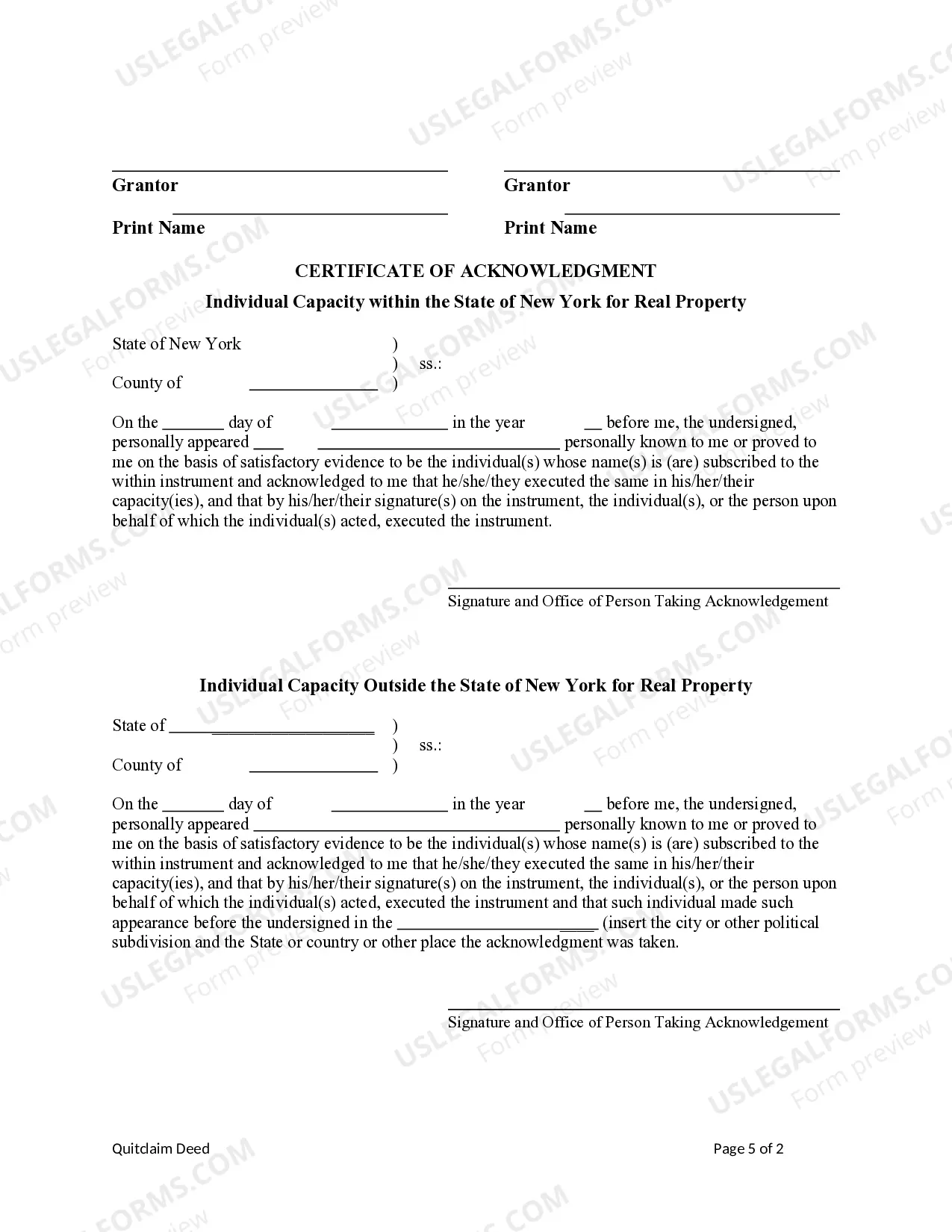

- Signature section: Requires signatures from the grantors and acknowledges the formal transfer of ownership.

When to use this form

This Quitclaim Deed should be used when two individuals wish to transfer their interests in a property to four individuals. It is commonly used in situations such as family property transfers, informal agreements between friends, or whenever the grantors want to relinquish their rights without warranting title. It is beneficial when the exact ownership rights are not in dispute, making it a faster and simpler option for real estate transactions.

Intended users of this form

- Two individuals who currently own a property and wish to transfer it to four other individuals.

- Family members involved in the transfer of property.

- Individuals participating in joint property investments or arrangements.

- Any parties wanting a straightforward method of relinquishing property rights without complex legal requirements.

Steps to complete this form

- Identify the grantors: Write the names and addresses of the two individuals transferring the property.

- Identify the grantees: Write the names and addresses of the four individuals receiving the property.

- Specify the property: Include a detailed legal description of the property to be transferred.

- Choose ownership type: Indicate how the grantees will hold the property (e.g., tenants in common or joint tenants with right of survivorship).

- Sign the form: Ensure all grantors sign the document and have it properly acknowledged.

Does this form need to be notarized?

Notarization is required for this form to take effect. Our online notarization service, powered by Notarize, lets you verify and sign documents remotely through an encrypted video session, available 24/7.

Get your form ready online

Our built-in tools help you complete, sign, share, and store your documents in one place.

Make edits, fill in missing information, and update formatting in US Legal Forms—just like you would in MS Word.

Download a copy, print it, send it by email, or mail it via USPS—whatever works best for your next step.

Sign and collect signatures with our SignNow integration. Send to multiple recipients, set reminders, and more. Go Premium to unlock E-Sign.

If this form requires notarization, complete it online through a secure video call—no need to meet a notary in person or wait for an appointment.

We protect your documents and personal data by following strict security and privacy standards.

Make edits, fill in missing information, and update formatting in US Legal Forms—just like you would in MS Word.

Download a copy, print it, send it by email, or mail it via USPS—whatever works best for your next step.

Sign and collect signatures with our SignNow integration. Send to multiple recipients, set reminders, and more. Go Premium to unlock E-Sign.

If this form requires notarization, complete it online through a secure video call—no need to meet a notary in person or wait for an appointment.

We protect your documents and personal data by following strict security and privacy standards.

Typical mistakes to avoid

- Failing to provide a complete legal description of the property.

- Not specifying how the grantees will hold the property.

- Missing signatures from all grantors.

- Not having the deed acknowledged, if required by state law.

Benefits of using this form online

- Convenience of downloading and completing forms from home.

- Editability allows users to fill out the form easily before printing.

- Access to templates that comply with state laws ensuring reliability in legal transactions.

Looking for another form?

Form popularity

FAQ

To use a Quitclaim Deed to add someone to a property deed or title, you would need to create a Quitclaim Deed and list all of the current owners in the grantor section. In the grantee section, you would list all of the current owners as well as the person you would like to add.

Fees to File a Quitclaim Deed in New York As of 2018, the basic fee for filing a quitclaim deed of residential or farm property is $125, while the fee for all other property is $250. These fees are for the RP-5217 form.

Fill in the deed form. Print it out. Have the grantor(s) sign and get the signature(s) notarized. Complete a transfer tax form, Form TP-584. Complete and print out Form RP-5217 (or, if you are in New York City, Form RP-5217NYC).

Fill in the deed form. Print it out. Have the grantor(s) sign and get the signature(s) notarized. Complete a transfer tax form, Form TP-584. Complete and print out Form RP-5217 (or, if you are in New York City, Form RP-5217NYC).

You would simply prepare a deed to you and your fiance. You would then have to prepare and execute the other necessary forms take them to the clerks office and file them. I suggest that you consult with a local attorney. They can do this at a modest cost.

The Quit Claim Deed form uses the terms of Grantor (Seller or Owner of said property) and Grantee (Buyer of said property) for the two parties involved. First, the parties must fill in the date. Then, write in the name of the county and state in which the property is located.

But you might be wondering if an owner can transfer a deed to another person without a real estate lawyer. The answer is yes. Parties to a transaction are always free to prepare their own deeds.A quitclaim deed, for example, is far simpler than a warranty deed.