New York Quitclaim Deed - Trust to a Trust

What is this form?

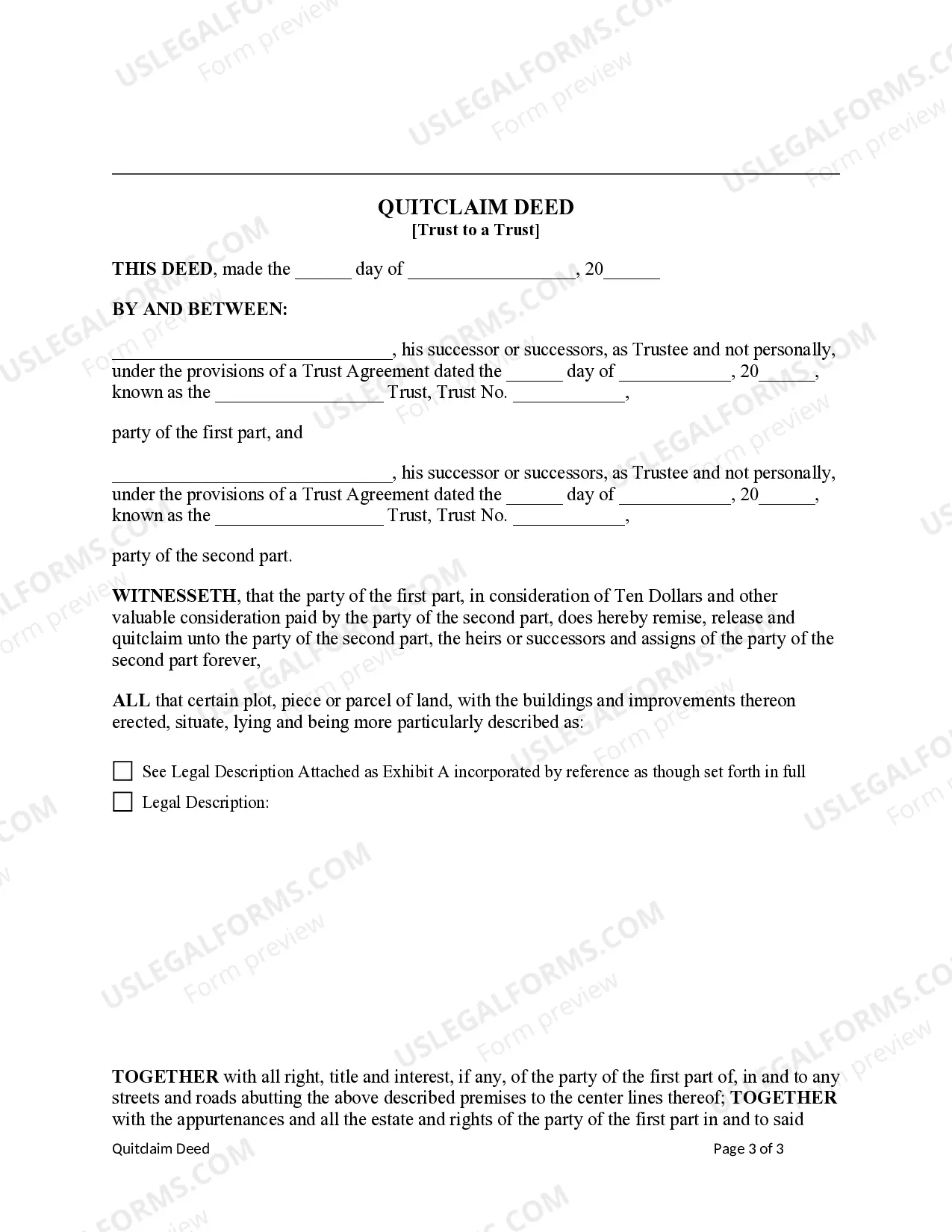

A Quitclaim Deed from Trust to Trust is a legal document used to transfer the ownership of property held in a trust from one trust to another. This form ensures that the grantor (the original trust) conveys their interest in the property to the grantee (the receiving trust) without making any warranties about the property's title. Unlike other deeds, such as warranty deeds, the quitclaim deed carries no guarantees of clear title, making it a simpler option for transferring trust property.

Key components of this form

- The identity of the grantor and grantee, both acting as trustees.

- A description of the property being transferred.

- A consideration amount, typically a nominal value such as ten dollars.

- The date of the transfer and the relevant trust agreements.

- A section for acknowledgements and signatures from the involved parties.

When to use this form

This form is ideal for situations where one trust is transferring property to another trust under the same or different trustees. Such scenarios may involve asset management strategies, estate planning, or repositioning assets for tax purposes. It's also common when consolidating properties under a single trust entity or changing the beneficiaries of a trust.

Who can use this document

- Trustees of a trust looking to transfer property to another trust.

- Individuals involved in estate planning who wish to manage their properties through trusts.

- Financial advisors or estate attorneys assisting clients with property transfers between trusts.

Completing this form step by step

- Identify the parties involved: the grantor and grantee trusts.

- Specify the property being transferred by referring to its legal description.

- Fill in the date of the transaction and indicate the consideration amount.

- Ensure that all trustees sign the document in their capacity as trustees.

- Finally, have the necessary acknowledgments or notarizations according to state law, if required.

Does this document require notarization?

To make this form legally binding, it must be notarized. Our online notarization service, powered by Notarize, lets you verify and sign documents remotely through an encrypted video session.

Get your form ready online

Our built-in tools help you complete, sign, share, and store your documents in one place.

Make edits, fill in missing information, and update formatting in US Legal Forms—just like you would in MS Word.

Download a copy, print it, send it by email, or mail it via USPS—whatever works best for your next step.

Sign and collect signatures with our SignNow integration. Send to multiple recipients, set reminders, and more. Go Premium to unlock E-Sign.

If this form requires notarization, complete it online through a secure video call—no need to meet a notary in person or wait for an appointment.

We protect your documents and personal data by following strict security and privacy standards.

Make edits, fill in missing information, and update formatting in US Legal Forms—just like you would in MS Word.

Download a copy, print it, send it by email, or mail it via USPS—whatever works best for your next step.

Sign and collect signatures with our SignNow integration. Send to multiple recipients, set reminders, and more. Go Premium to unlock E-Sign.

If this form requires notarization, complete it online through a secure video call—no need to meet a notary in person or wait for an appointment.

We protect your documents and personal data by following strict security and privacy standards.

Avoid these common issues

- Failing to provide a complete legal description of the property.

- Not having all trustees sign the deed.

- Neglecting to include the consideration amount.

- Using the form without considering state-specific requirements.

Why use this form online

- Convenient access: Download the form immediately and fill it out from home.

- Editability: Easily enter information using your computer and print the completed form.

- Reliability: The form is drafted by licensed attorneys, ensuring compliance with legal standards.

Looking for another form?

Form popularity

FAQ

Fill in the deed form. Print it out. Have the grantor(s) sign and get the signature(s) notarized. Complete a transfer tax form, Form TP-584. Complete and print out Form RP-5217 (or, if you are in New York City, Form RP-5217NYC).

Yes, a quit claim deed supercedes the trust. The only thing that can be done is to file a suit in court challenging the deed as the product of fraud and undue influence. A court action like that will cost thousands of dollars, but might be worth it if the house was owned free and clear.

In the context of a California mortgage transaction, a trust deed also transfer ownership. Only this time, the title is being placed in the hands of a third-party trustee, who holds the property on behalf of the lender and the homeowner-borrower until the mortgage is paid.

Locate your current deed. Use the proper deed. Check with your title insurance company and lender. Prepare a new deed. Sign in the presence of a notary. Record the deed in the county clerk's office. Locate the deed that's in trust. Use the proper deed.

California Property TaxesTransferring real property to yourself as trustee of your own revocable living trust -- or back to yourself -- does not trigger a reassessment for property tax purposes. (Cal. Rev. & Tax Code § 62(d).)

When you're ready to transfer trust real estate to the beneficiary who is named in the trust document to receive it, you'll need to prepare, sign, and record a deed. That's the document that transfers title to the property from you, the trustee, to the new owner.

A quitclaim deed can be used to transfer property from a trust, but a Special Warranty Deed seems to be a more common way to do this.

Fill in the deed form. Print it out. Have the grantor(s) sign and get the signature(s) notarized. Complete a transfer tax form, Form TP-584. Complete and print out Form RP-5217 (or, if you are in New York City, Form RP-5217NYC).

Determine the Current Title and Vesting to Your Property. Prepare a Deed. Be Aware of Your Lender and Title Insurance. Prepare a Preliminary Change of Ownership Report. Execute Your Deed. Record Your Deed. Wait for the Deed to be Returned. Keep the Property in the Trust.