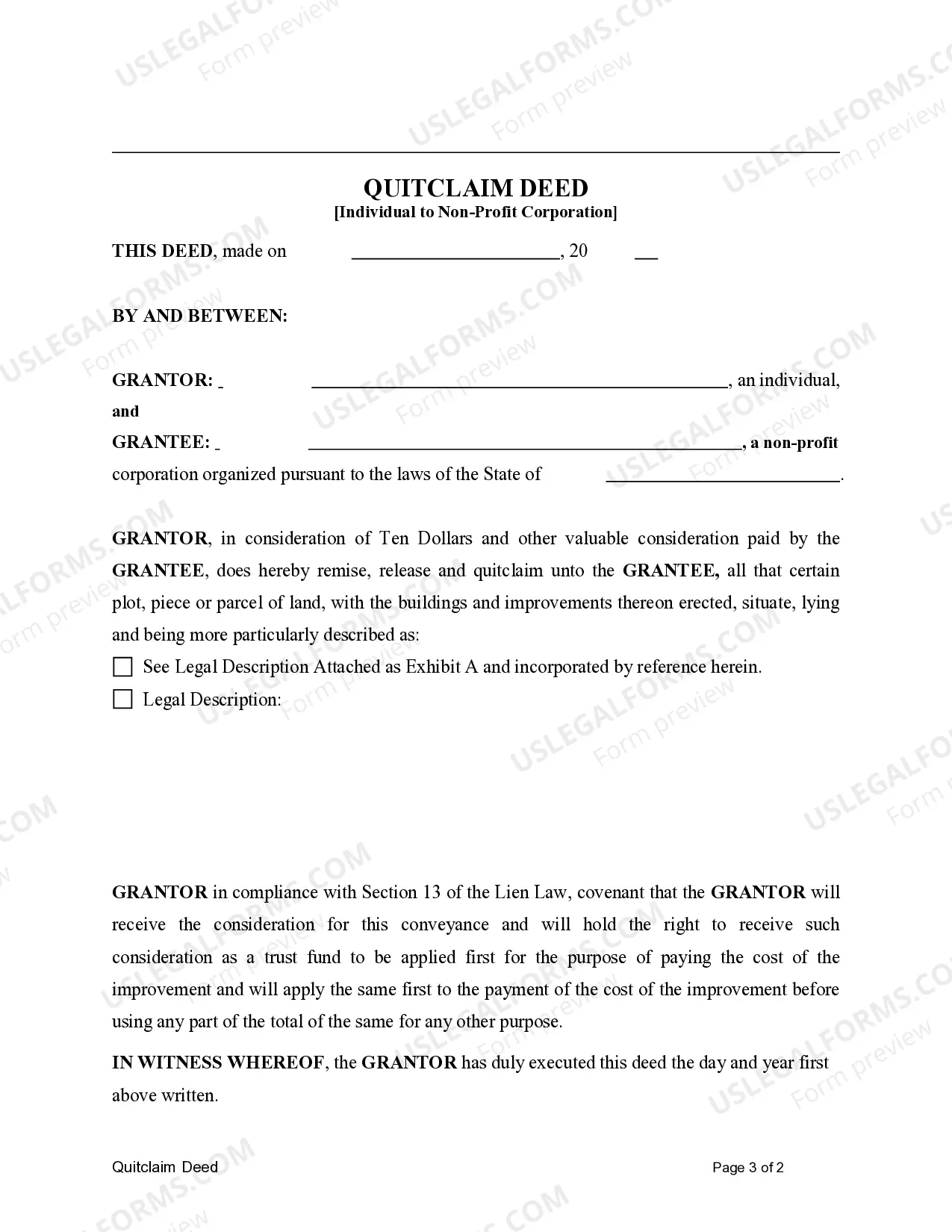

This form is a Quitclaim Deed where the Grantor is an individual, and the Grantee is a non-profit corporation. Grantor conveys and quitclaims the described property to Grantee. This deed complies with all state statutory laws.

New York Quitclaim Deed from an Individual to a Non-Profit Corporation

Description What Is A Quitclaim Deed

How to fill out New York Quitclaim Deed From An Individual To A Non-Profit Corporation?

US Legal Forms is a special platform where you can find any legal or tax template for submitting, such as New York Quitclaim Deed from an Individual to a Non-Profit Corporation. If you’re tired with wasting time looking for suitable examples and paying money on document preparation/lawyer fees, then US Legal Forms is precisely what you’re looking for.

To enjoy all the service’s advantages, you don't need to install any application but simply pick a subscription plan and create an account. If you already have one, just log in and look for a suitable sample, save it, and fill it out. Saved documents are all kept in the My Forms folder.

If you don't have a subscription but need to have New York Quitclaim Deed from an Individual to a Non-Profit Corporation, check out the guidelines listed below:

- check out the form you’re looking at applies in the state you need it in.

- Preview the form its description.

- Click Buy Now to get to the register page.

- Choose a pricing plan and proceed registering by providing some info.

- Select a payment method to finish the registration.

- Save the file by choosing your preferred format (.docx or .pdf)

Now, submit the document online or print out it. If you are unsure about your New York Quitclaim Deed from an Individual to a Non-Profit Corporation sample, speak to a legal professional to examine it before you decide to send out or file it. Begin without hassles!

Form popularity

FAQ

Enter the Corporation or Business Entity Name being searched for. Select a Name Type. Select a Search Type. Enter the numbers from the image into the CAPTCHA field. Tab to Search the Database and press the enter key or click Search the Database.

Search for a business entity (Corporation, LLC, Limited Partnership) in New York by using the Secretary of State's Website. The only way to preform a lookup is by Name, when doing so, you will want to use as many matching keywords as you can as the database will pull all matching records.

Navigate to the Secretary of State website for the state in which the corporation is registered. Start your search. Look for a Businesses or Corporations tab. Each state website is constructed differently, and the specific tab name may vary, but should always be business or corporation related.

The fee for filing the Certificate of Incorporation is $125. The fee may be paid by cash, check, money order, MasterCard, Visa or American Express.