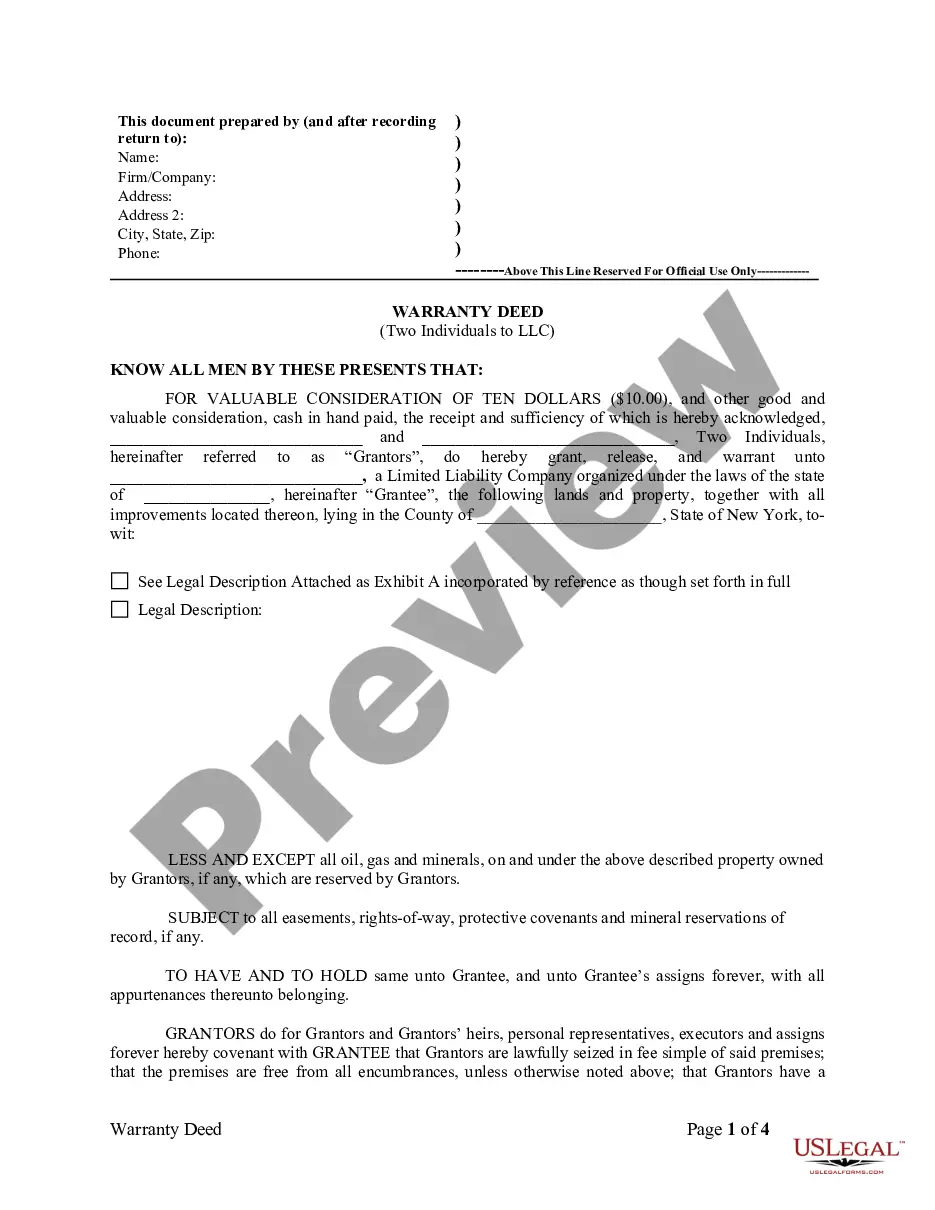

New York Warranty Deed from two Individuals to LLC

Description Limited Liability Company Form

How to fill out New York Warranty Deed From Two Individuals To LLC?

US Legal Forms is really a unique platform to find any legal or tax document for submitting, including New York Warranty Deed from two Individuals to LLC. If you’re tired of wasting time looking for perfect examples and paying money on document preparation/legal professional fees, then US Legal Forms is precisely what you’re trying to find.

To reap all the service’s benefits, you don't have to install any software but just choose a subscription plan and sign up an account. If you already have one, just log in and look for an appropriate template, download it, and fill it out. Saved documents are all stored in the My Forms folder.

If you don't have a subscription but need New York Warranty Deed from two Individuals to LLC, take a look at the guidelines below:

- Double-check that the form you’re considering is valid in the state you need it in.

- Preview the example and read its description.

- Click Buy Now to get to the sign up page.

- Choose a pricing plan and keep on signing up by providing some information.

- Choose a payment method to complete the sign up.

- Save the document by choosing your preferred format (.docx or .pdf)

Now, fill out the file online or print out it. If you feel uncertain concerning your New York Warranty Deed from two Individuals to LLC template, speak to a legal professional to analyze it before you decide to send out or file it. Get started hassle-free!

Warranty Deed Llc Form popularity

Warranty Deed Two Other Form Names

FAQ

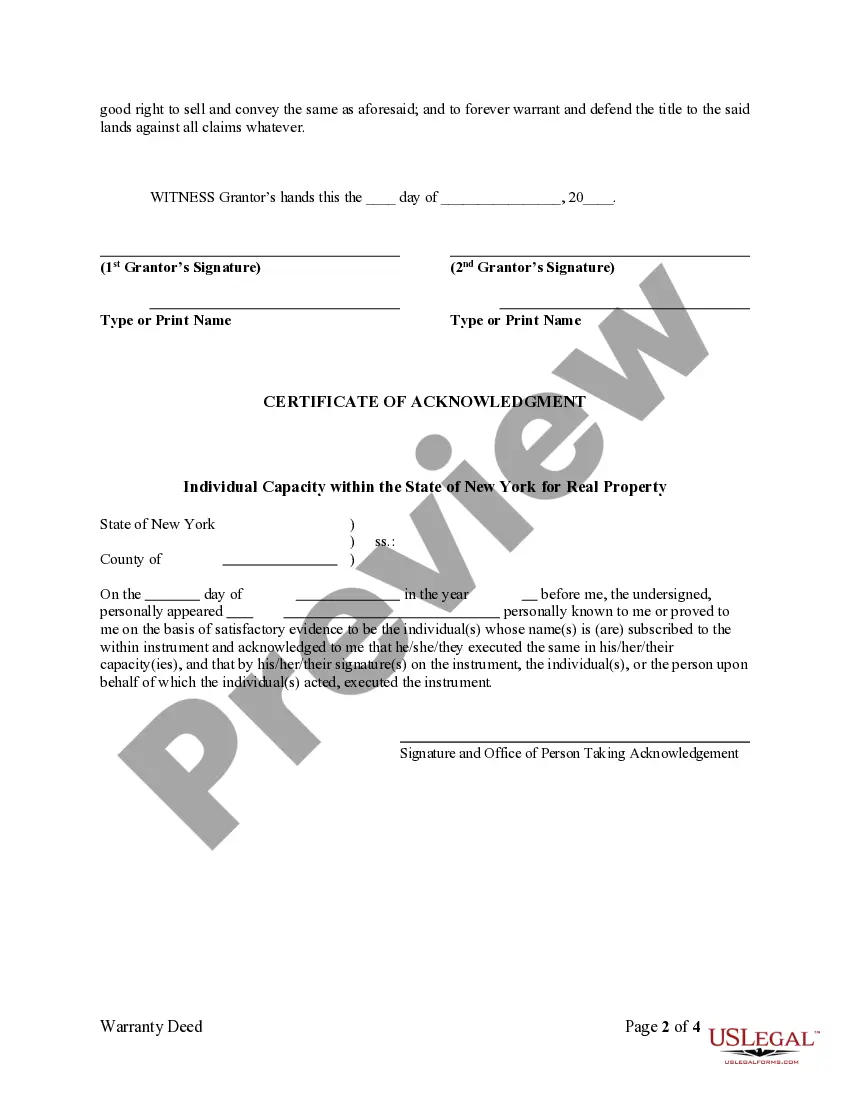

Retrieve your original deed. Get the appropriate deed form. Draft the deed. Sign the deed before a notary. Record the deed with the county recorder. Obtain the new original deed.

Fill in the deed form. Print it out. Have the grantor(s) sign and get the signature(s) notarized. Complete a transfer tax form, Form TP-584. Complete and print out Form RP-5217 (or, if you are in New York City, Form RP-5217NYC).

Before adding your spouse to the deed, speak with your attorney. The easiest way to grant your spouse title to your home is via a quitclaim deed (Californians generally use an interspousal grant deed). With a quitclaim deed, you can name your spouse as the property's joint owner.

To change the deed in New York City, as we discussed, we will need a deed signed and notorized by the grantor. Additionally, the deed must also be filed and recorded with the Office of the City Register along with transfer documents which identify if any taxes are due.

It is possible to be named on the title deed of a home without being on the mortgage. However, doing so assumes risks of ownership because the title is not free and clear of liens and possible other encumbrances.If a mortgage exists, it's best to work with the lender to make sure everyone on the title is protected.

Under New York law, a person who wishes to update her name on a deed must execute a new deed and record it with the county clerk where the property is located. Obtain or purchase a New York warranty deed form.

Yes you can. This is called a transfer of equity but you will need the permission of your lender. If you are not married or in a civil partnership you may wish to consider creating a deed of trust and a living together agreement which we can explain to you.

You would simply prepare a deed to you and your fiance. You would then have to prepare and execute the other necessary forms take them to the clerks office and file them. I suggest that you consult with a local attorney. They can do this at a modest cost.

The fees to file a New York quitclaim deed vary from county to county, but some of the fees are similar. As of 2018, the basic fee for filing a quitclaim deed of residential or farm property is $125, while the fee for all other property is $250. These fees are for the RP-5217 form.