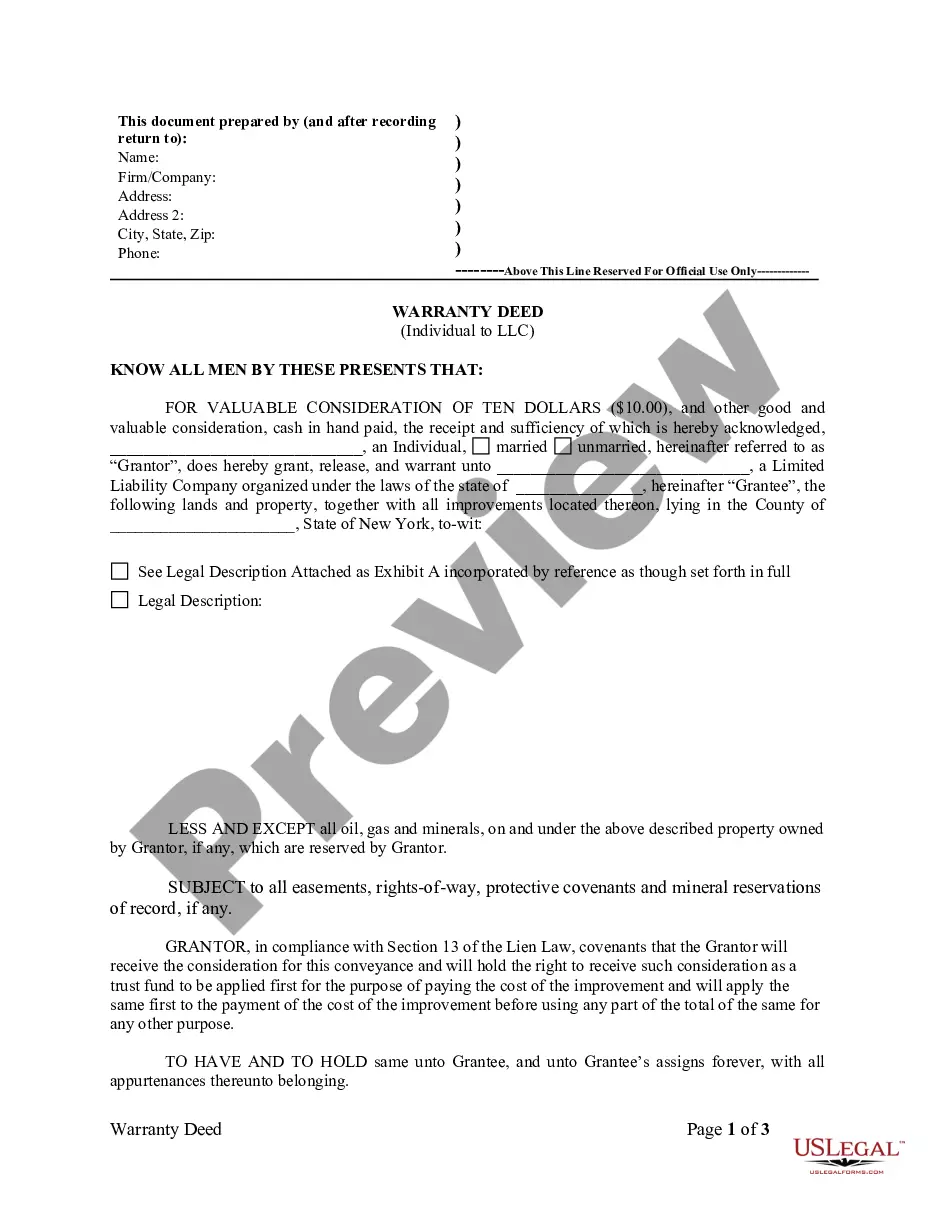

New York Warranty Deed from Individual to LLC

Description Ny Limited Liability Company

How to fill out Warranty Claim Letter?

US Legal Forms is actually a special platform where you can find any legal or tax document for completing, including New York Warranty Deed from Individual to LLC. If you’re sick and tired of wasting time looking for perfect examples and spending money on file preparation/legal professional charges, then US Legal Forms is precisely what you’re seeking.

To enjoy all of the service’s benefits, you don't need to download any software but just select a subscription plan and create an account. If you have one, just log in and get an appropriate sample, download it, and fill it out. Downloaded documents are all kept in the My Forms folder.

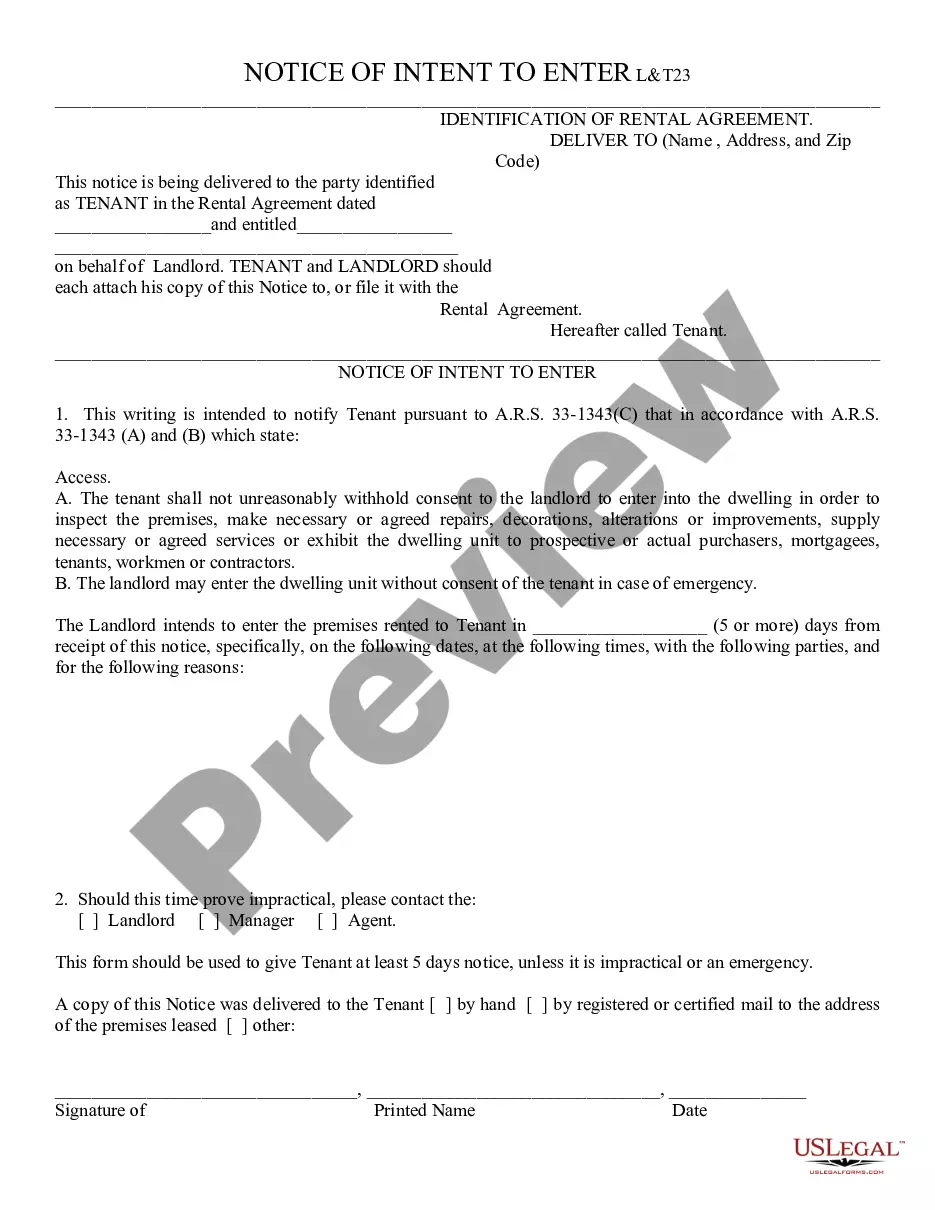

If you don't have a subscription but need New York Warranty Deed from Individual to LLC, check out the instructions listed below:

- make sure that the form you’re looking at applies in the state you want it in.

- Preview the sample its description.

- Simply click Buy Now to get to the sign up webpage.

- Choose a pricing plan and proceed signing up by entering some information.

- Select a payment method to complete the sign up.

- Save the document by choosing your preferred file format (.docx or .pdf)

Now, fill out the file online or print it. If you are uncertain concerning your New York Warranty Deed from Individual to LLC sample, contact a legal professional to check it before you decide to send or file it. Begin without hassles!

Limited Warranty Deed Form popularity

Deed Limited Liability Company Other Form Names

Warranty Deed Example Filled Out FAQ

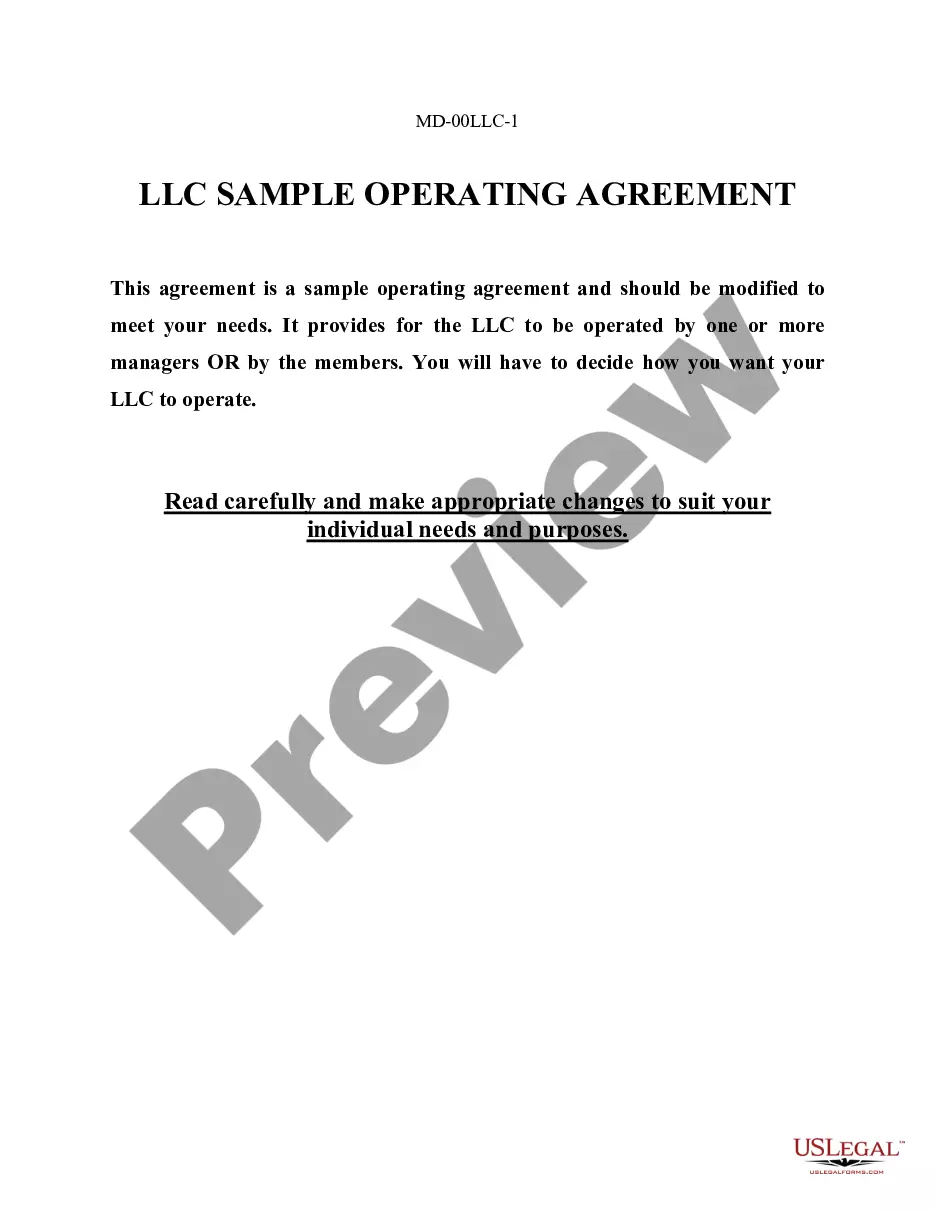

Creating an LLC for your rental property is a smart choice as a property owner. It reduces your liability risk, effectively separates your assets, and has the tax benefit of pass-through taxation.You can add unique bank accounts for each rental property.

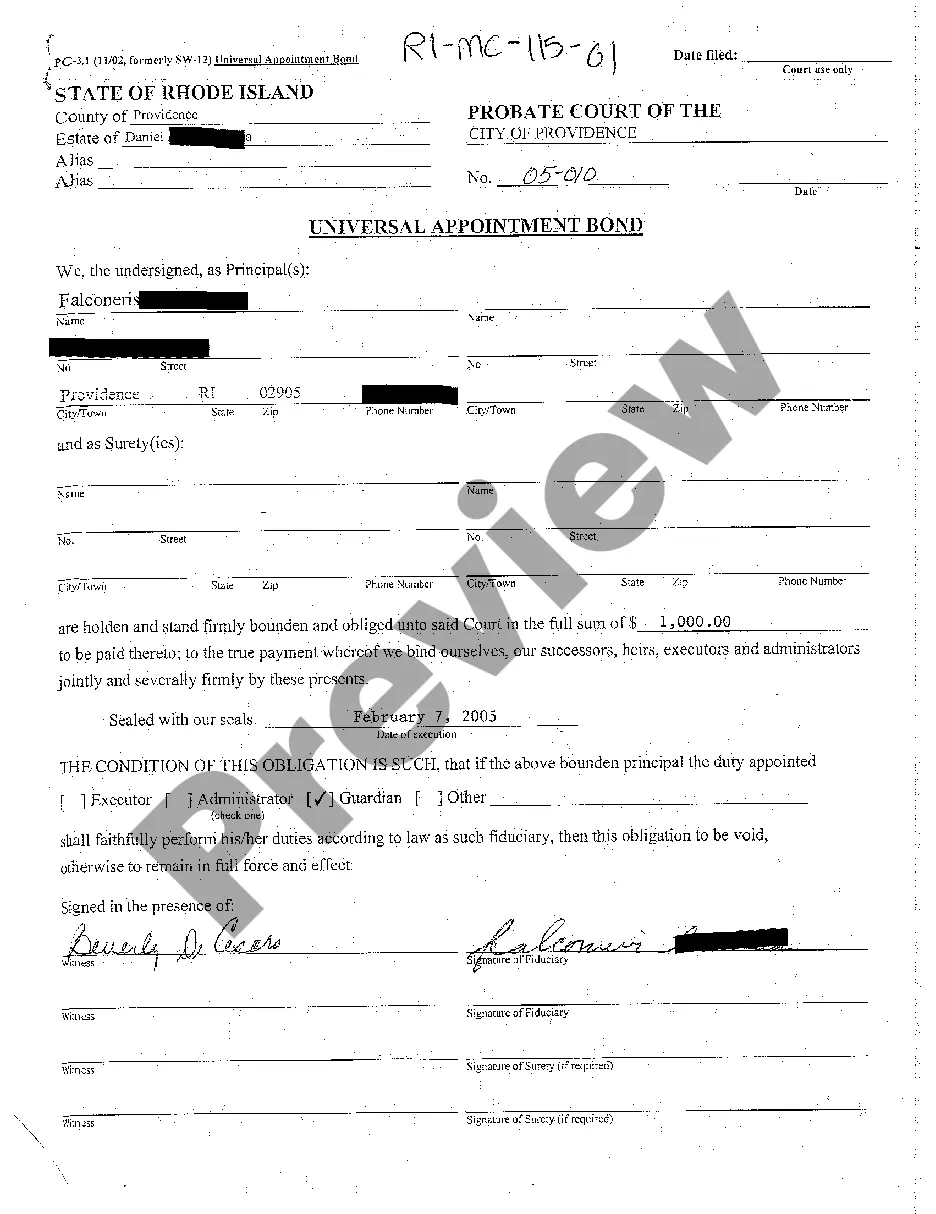

The fees to file a New York quitclaim deed vary from county to county, but some of the fees are similar. As of 2018, the basic fee for filing a quitclaim deed of residential or farm property is $125, while the fee for all other property is $250. These fees are for the RP-5217 form.

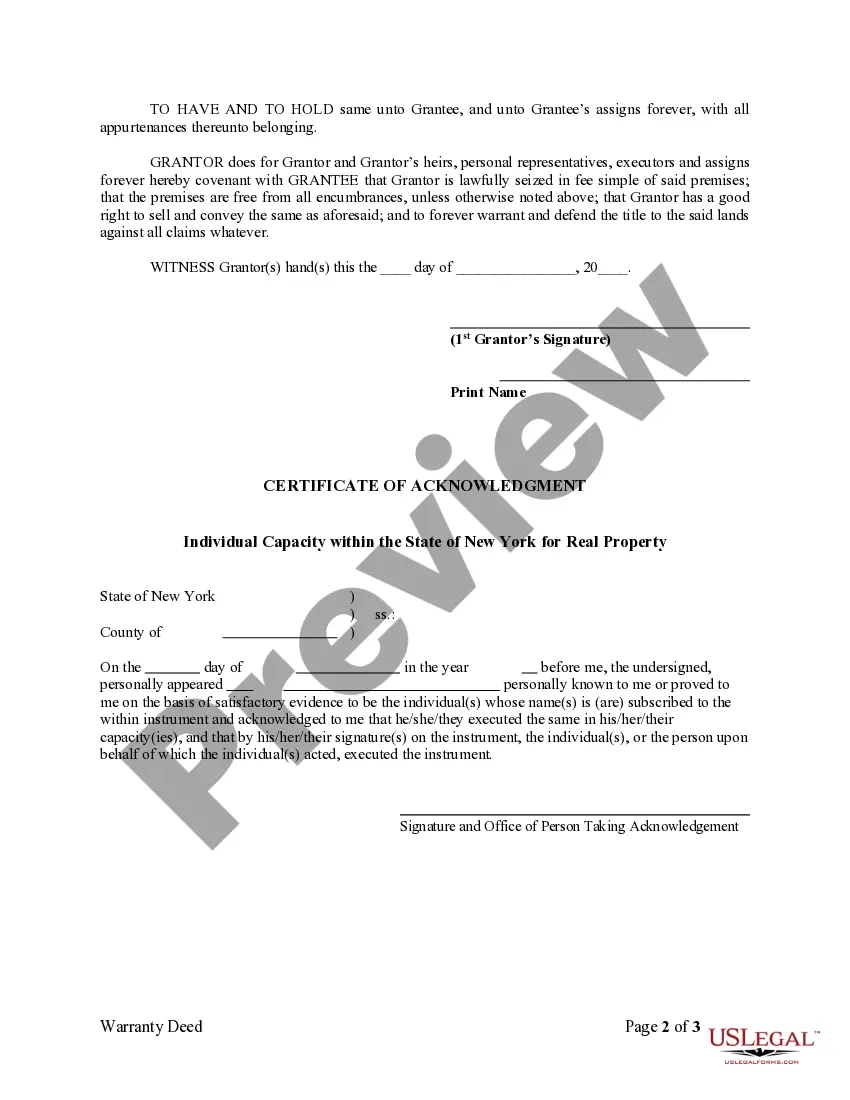

Retrieve your original deed. Get the appropriate deed form. Draft the deed. Sign the deed before a notary. Record the deed with the county recorder. Obtain the new original deed.

However, there are substantial downsides associated with transferring your primary home into an LLC.If you are using your personal residence for estate planning purposes, a qualified personal residence trust (QPRT) may be more effective than transferring your property to a limited liability company.

Does LLC ownership count as time used as a primary residence? For a single-member LLC, the answer is typically yes. For example, if the house is owned by an LLC. The Treasury Regulations allow for the capital gains exclusion when title is held by a single-member disregarded entity.

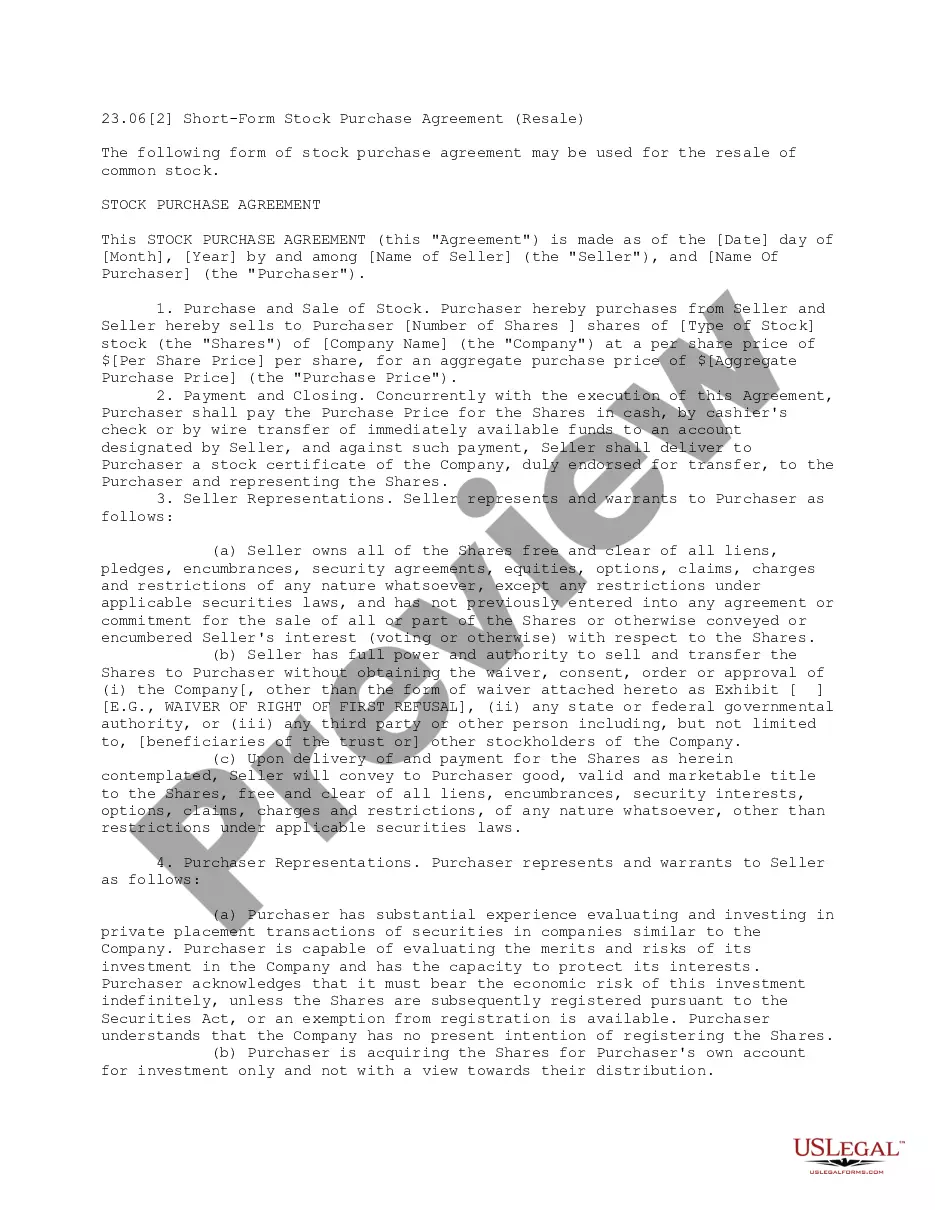

A warranty deed guarantees that: The grantor is the rightful owner of the property and has the legal right to transfer the title.The title would withstand third-party claims to ownership of the property. The grantor will do anything to ensure the grantee's title to the property.

The only way to forcibly change the ownership status is through a legal action and the resultant court order. However, if an owner chooses to be removed from the deed, it is simply a matter of preparing a new deed transferring that owner's interest in the property.

To change the deed in New York City, as we discussed, we will need a deed signed and notorized by the grantor. Additionally, the deed must also be filed and recorded with the Office of the City Register along with transfer documents which identify if any taxes are due.

To change the deed in New York City, as we discussed, we will need a deed signed and notorized by the grantor. Additionally, the deed must also be filed and recorded with the Office of the City Register along with transfer documents which identify if any taxes are due.