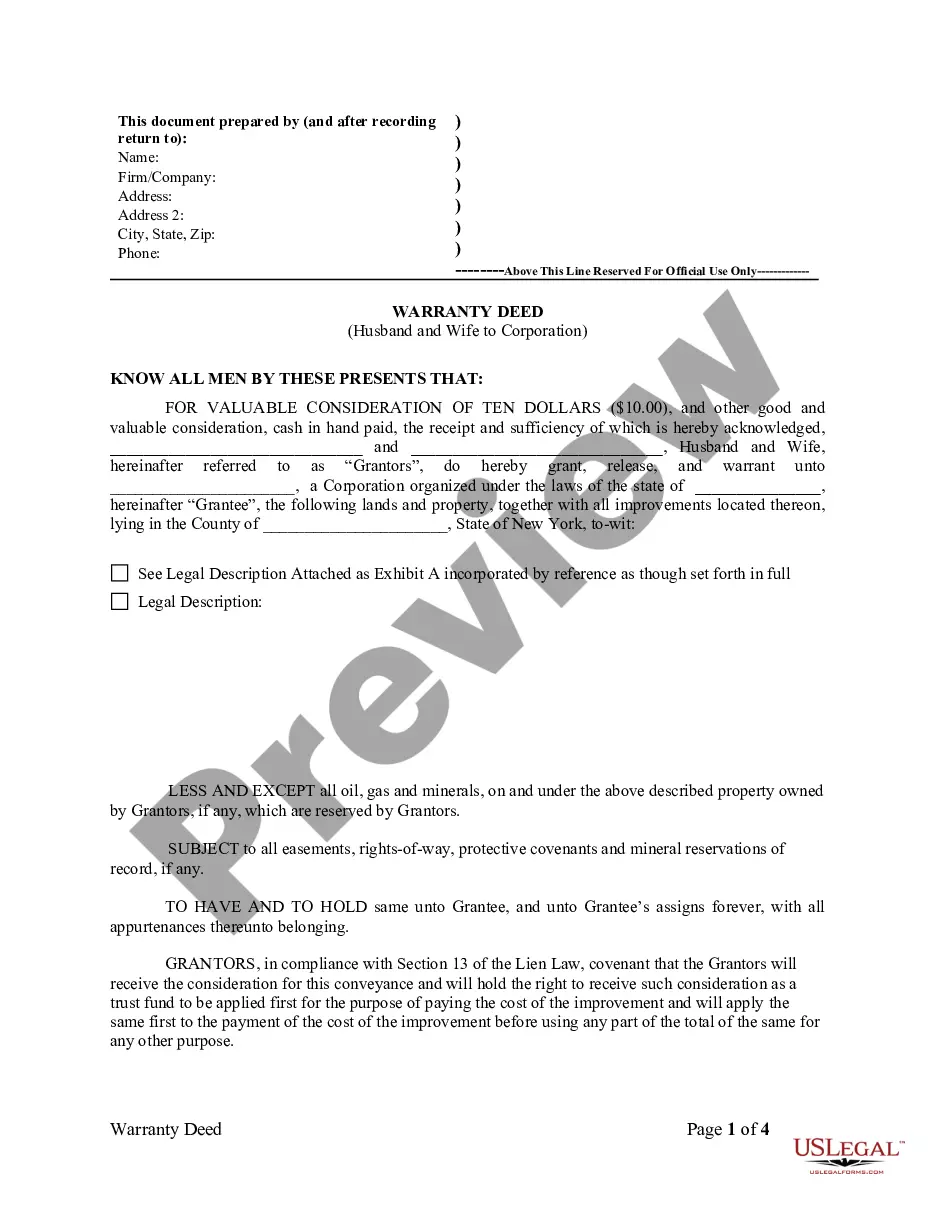

New York Warranty Deed from Husband and Wife to Corporation

Description

How to fill out New York Warranty Deed From Husband And Wife To Corporation?

US Legal Forms is actually a unique system where you can find any legal or tax template for submitting, such as New York Warranty Deed from Husband and Wife to Corporation. If you’re sick and tired of wasting time seeking ideal samples and spending money on file preparation/legal professional charges, then US Legal Forms is precisely what you’re searching for.

To enjoy all the service’s advantages, you don't have to install any software but simply select a subscription plan and register an account. If you already have one, just log in and look for the right sample, save it, and fill it out. Downloaded documents are saved in the My Forms folder.

If you don't have a subscription but need New York Warranty Deed from Husband and Wife to Corporation, take a look at the recommendations listed below:

- check out the form you’re looking at applies in the state you want it in.

- Preview the sample its description.

- Click on Buy Now button to access the register webpage.

- Select a pricing plan and continue signing up by providing some info.

- Decide on a payment method to complete the registration.

- Save the file by choosing your preferred format (.docx or .pdf)

Now, submit the file online or print it. If you feel unsure concerning your New York Warranty Deed from Husband and Wife to Corporation form, speak to a attorney to analyze it before you send out or file it. Begin hassle-free!

Form popularity

FAQ

What Is the Difference Between a Warranty Deed & a Survivorship Deed?A warranty deed is the most comprehensive and provides the most guarantees. Survivorship isn't so much a deed as a title. It's a way to co-own property where, upon the death of one owner, ownership automatically passes to the survivor.

To change the deed in New York City, as we discussed, we will need a deed signed and notorized by the grantor. Additionally, the deed must also be filed and recorded with the Office of the City Register along with transfer documents which identify if any taxes are due.

A warranty deed, also known as a general warranty deed, is a legal real estate document between the seller (grantor) and the buyer (grantee). The deed protects the buyer by pledging that the seller holds clear title to the property and there are no encumbrances, outstanding liens, or mortgages against it.

A special warranty deed is a deed to real estate where the seller of the propertyknown as the grantorwarrants only against anything that occurred during their physical ownership. In other words, the grantor doesn't guarantee against any defects in clear title that existed before they took possession of the property.

A warranty deed is a higher level of protection produced by the seller upon the real estate closing. It includes a full legal description of the property, and confirms the title is clear and free from all liens, encumbrances, or title defects. Most property sales make use of a warranty deed.

Corporate warranty deeds offer the seller's guarantee to the buyer in regards to the validity of the chain of title. Generally, special warranty deeds only protect against problems occurring since the seller purchased the property.

The fees to file a New York quitclaim deed vary from county to county, but some of the fees are similar. As of 2018, the basic fee for filing a quitclaim deed of residential or farm property is $125, while the fee for all other property is $250. These fees are for the RP-5217 form.

It's important to note that a warranty deed does not actually prove the grantor has ownership (a title search is the best way to prove that), but it is a promise by the grantor that they are transferring ownership and if it turns out they don't actually own the property, the grantor will be responsible for compensating