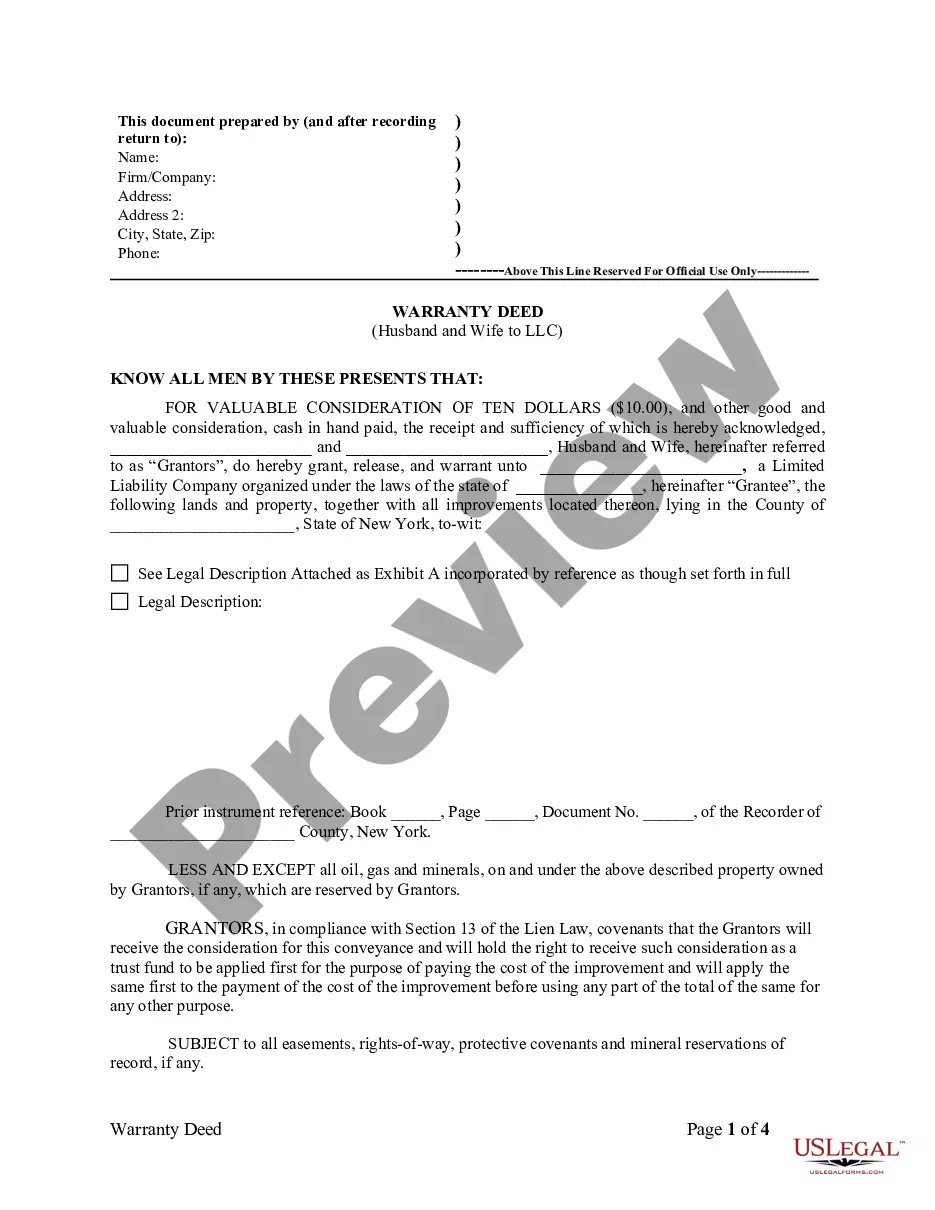

New York Warranty Deed from Husband and Wife to LLC

Description New York Llc Application

How to fill out New York Warranty Deed From Husband And Wife To LLC?

US Legal Forms is actually a special system to find any legal or tax document for submitting, including New York Warranty Deed from Husband and Wife to LLC. If you’re fed up with wasting time looking for perfect samples and paying money on file preparation/attorney charges, then US Legal Forms is precisely what you’re seeking.

To experience all the service’s benefits, you don't need to download any application but simply choose a subscription plan and create your account. If you have one, just log in and look for an appropriate sample, download it, and fill it out. Saved documents are saved in the My Forms folder.

If you don't have a subscription but need New York Warranty Deed from Husband and Wife to LLC, take a look at the guidelines below:

- Double-check that the form you’re considering is valid in the state you want it in.

- Preview the example and look at its description.

- Simply click Buy Now to reach the register webpage.

- Select a pricing plan and carry on signing up by entering some info.

- Decide on a payment method to complete the sign up.

- Save the document by selecting your preferred format (.docx or .pdf)

Now, submit the file online or print it. If you are unsure regarding your New York Warranty Deed from Husband and Wife to LLC template, contact a legal professional to examine it before you send out or file it. Start without hassles!

Deed Husband Wife Form popularity

Official Husband Application Other Form Names

New York Llc New York FAQ

No you can't. A single member LLC is just you as far as the IRS is concerned. You're just living in your own property. You can't rent your own house to yourself.

Creating an LLC for your rental property is a smart choice as a property owner. It reduces your liability risk, effectively separates your assets, and has the tax benefit of pass-through taxation.You can add unique bank accounts for each rental property.

Creating an LLC for your rental property is a smart choice as a property owner. It reduces your liability risk, effectively separates your assets, and has the tax benefit of pass-through taxation.

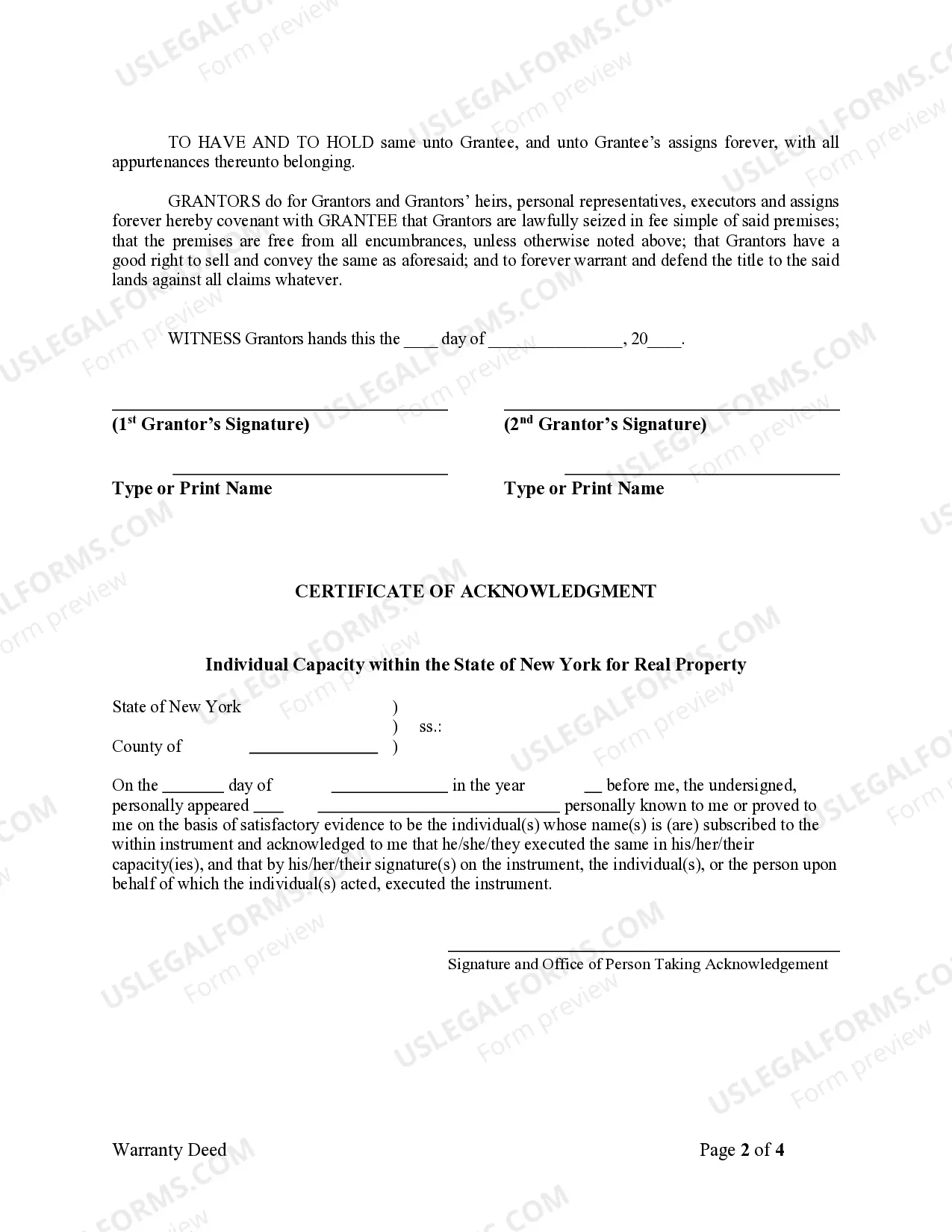

To change the deed in New York City, as we discussed, we will need a deed signed and notorized by the grantor. Additionally, the deed must also be filed and recorded with the Office of the City Register along with transfer documents which identify if any taxes are due.

Transferring property to an LLC is a simple way to reduce your personal liability for claims relating to the property. But a property title transfer should be only part of your strategy. It's also important to contact an insurance agent and obtain adequate liability insurance to cover any claims that might arise.

Does LLC ownership count as time used as a primary residence? For a single-member LLC, the answer is typically yes. For example, if the house is owned by an LLC. The Treasury Regulations allow for the capital gains exclusion when title is held by a single-member disregarded entity.

However, there are substantial downsides associated with transferring your primary home into an LLC.If you are using your personal residence for estate planning purposes, a qualified personal residence trust (QPRT) may be more effective than transferring your property to a limited liability company.

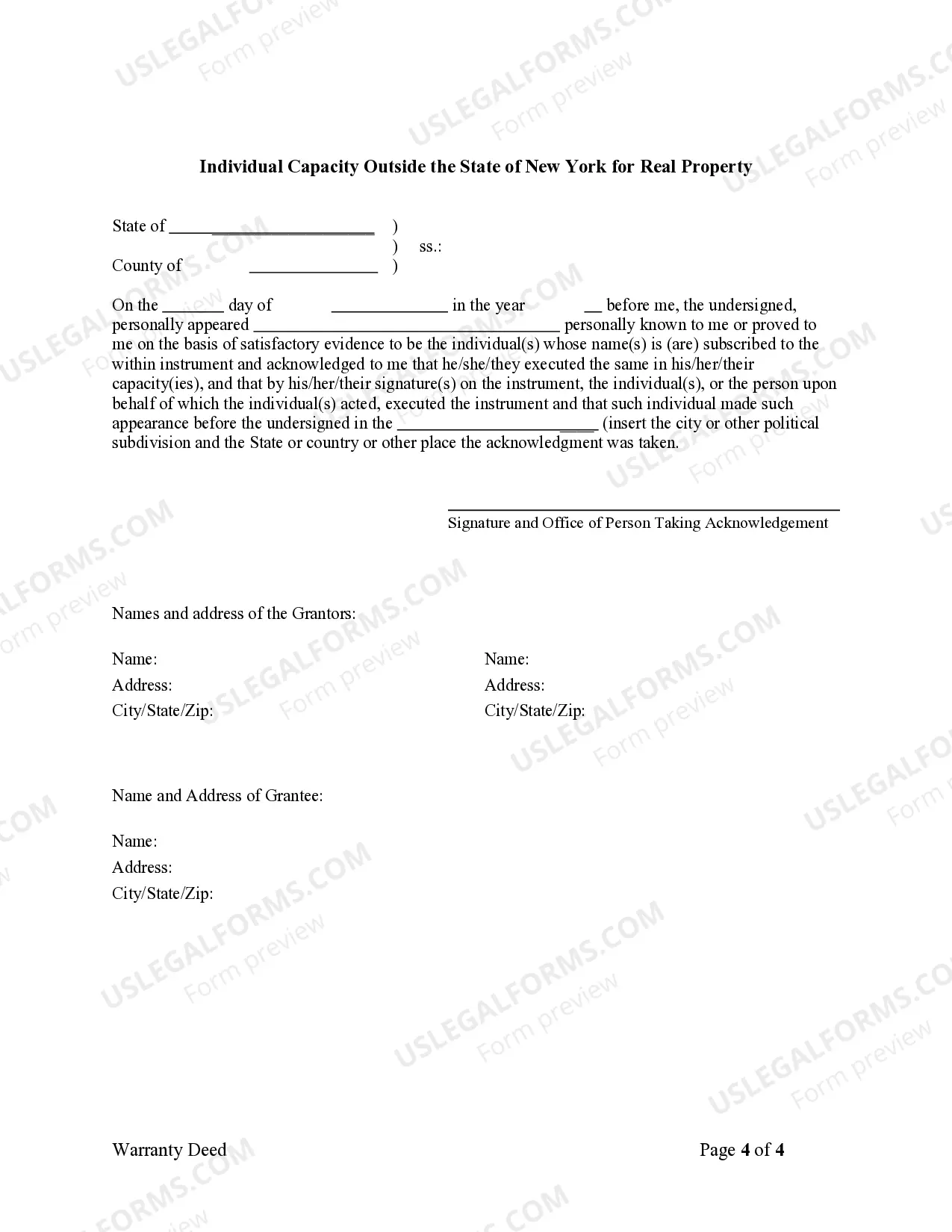

The fees to file a New York quitclaim deed vary from county to county, but some of the fees are similar. As of 2018, the basic fee for filing a quitclaim deed of residential or farm property is $125, while the fee for all other property is $250. These fees are for the RP-5217 form.