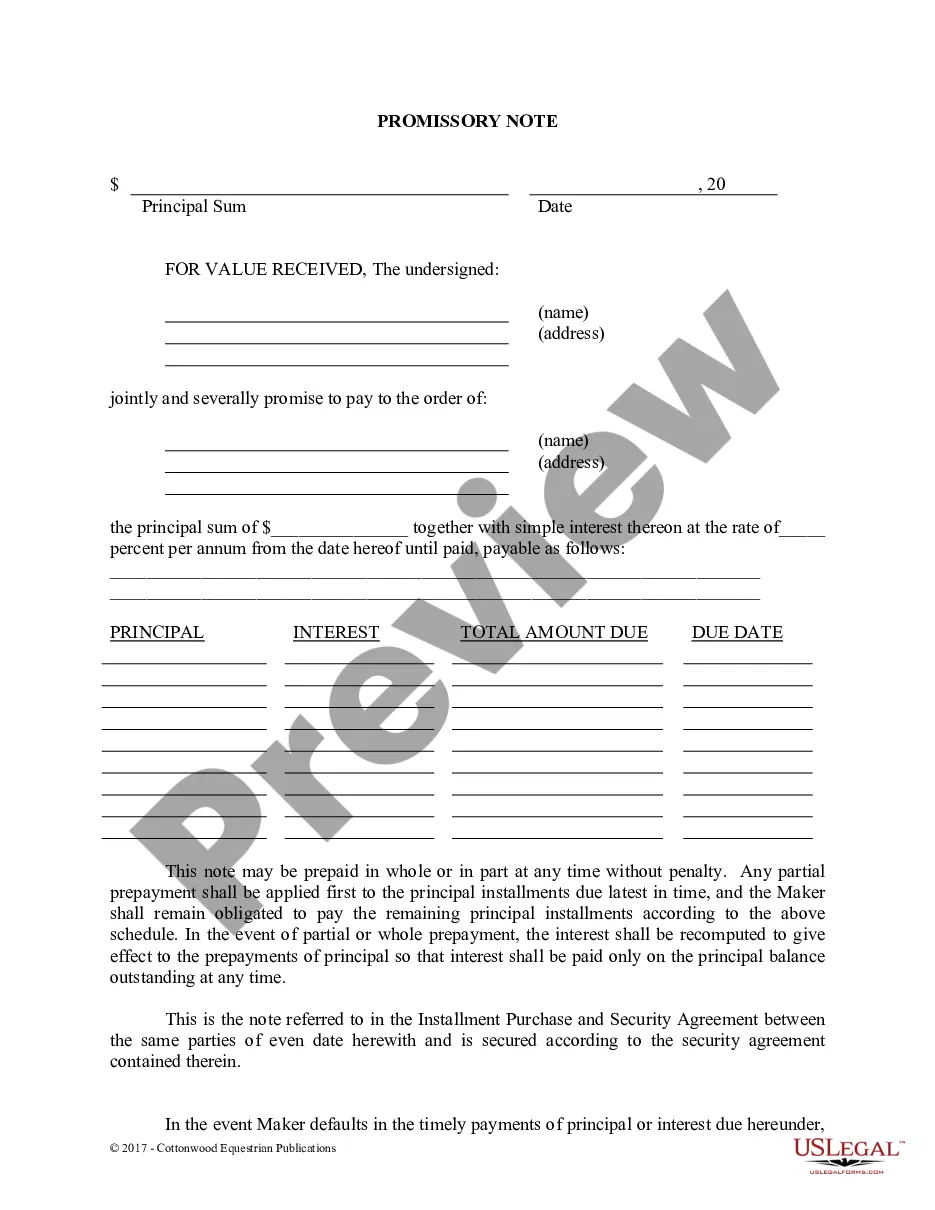

New York Promissory Note - Horse Equine Forms

Description

How to fill out New York Promissory Note - Horse Equine Forms?

US Legal Forms is actually a unique platform where you can find any legal or tax template for filling out, including New York Promissory Note - Horse Equine Forms. If you’re sick and tired of wasting time looking for ideal samples and paying money on document preparation/attorney fees, then US Legal Forms is precisely what you’re trying to find.

To enjoy all the service’s benefits, you don't have to download any software but simply choose a subscription plan and create your account. If you already have one, just log in and find an appropriate template, download it, and fill it out. Saved files are kept in the My Forms folder.

If you don't have a subscription but need New York Promissory Note - Horse Equine Forms, check out the guidelines below:

- check out the form you’re checking out applies in the state you want it in.

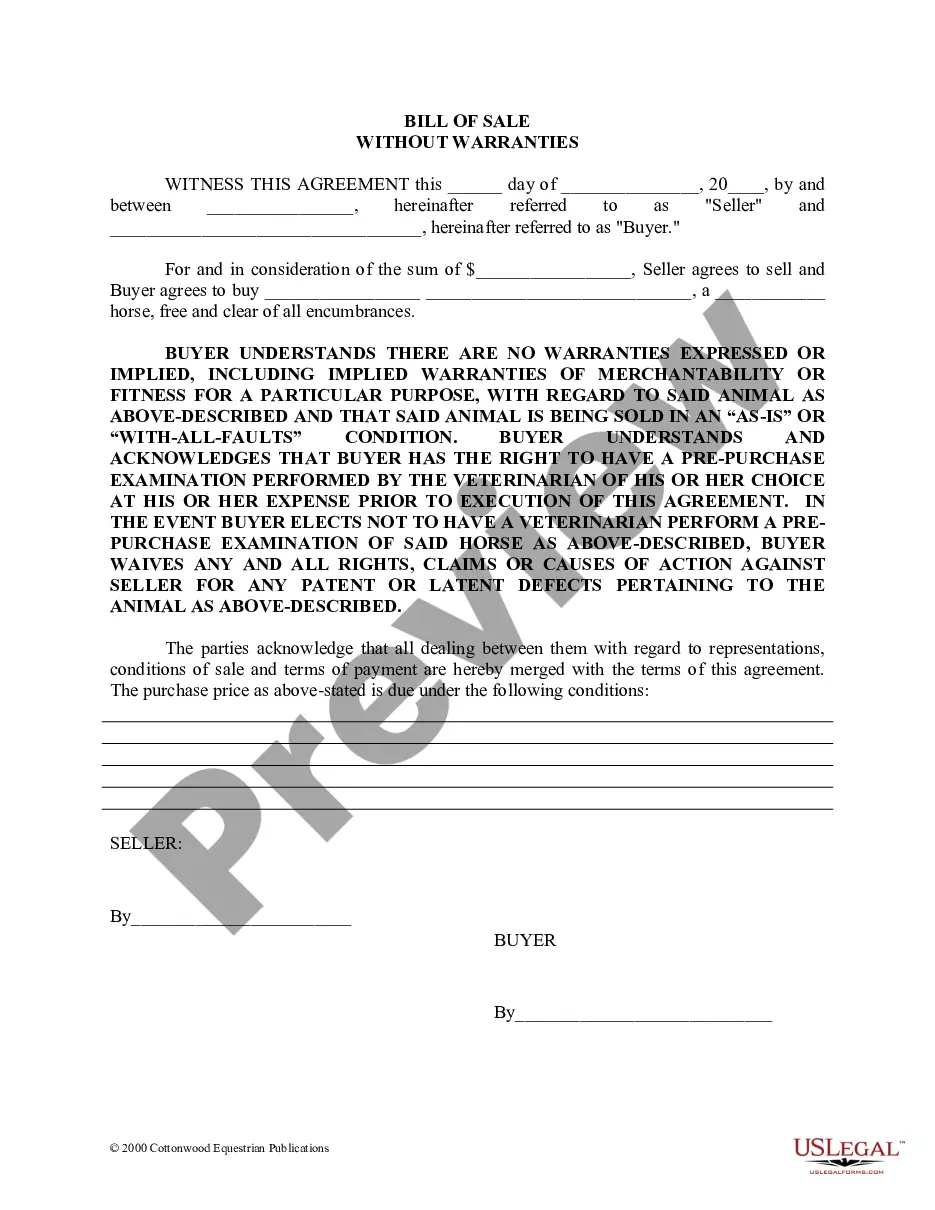

- Preview the example and read its description.

- Click on Buy Now button to access the sign up webpage.

- Select a pricing plan and carry on registering by providing some information.

- Pick a payment method to finish the registration.

- Download the document by selecting your preferred format (.docx or .pdf)

Now, complete the document online or print it. If you feel unsure concerning your New York Promissory Note - Horse Equine Forms sample, contact a legal professional to analyze it before you decide to send or file it. Begin without hassles!

Form popularity

FAQ

Form 1040. The U.S. Individual Income Tax Return is the bread and butter of tax forms -- the starting point for most taxpayers. Form 1040EZ. As the name suggests, the 1040EZ is a pretty basic individual filing tax form. Form 1040A. Form W-2. Form W-4. Form W-4P. Form 1099-MISC. Form 1098.

For both the 1040 and California, either is acceptable. Do not staple a payment to the return, however. Do not staple or paperclip your return. The only thing that should be stapled is/are your W2 form(s) or income documents that have tax withholding.

You must file Form IT-201, Resident Income Tax Return, if you were a New York State resident for the entire year.

You may file a NY state tax return by mail. The New York Department of Taxation and Finance removed the penalty so you may file a NY state tax return by mail (see page 35: https://www.tax.ny.gov/pdf/current_forms/it/it201i.pdf).

Download them from IRS.gov. Order by phone at 1-800-TAX-FORM (1-800-829-3676)

You may file a NY state tax return by mail. The New York Department of Taxation and Finance removed the penalty so you may file a NY state tax return by mail (see page 35: https://www.tax.ny.gov/pdf/current_forms/it/it201i.pdf).

Used by nonresident taxpayers filing jointly on Form IT-203 when only one spouse had New York source income.If filed before the due date, will allow a taxpayer an automatic extension of six months to file Form IT-201, Resident Income Tax Return, or Form IT-203, Nonresident and Part-Year Resident Income Tax Return.

The IT-201 is a New York State income tax return form. If you are filing state taxes for New York this year, then yes you will need this form and you want to make sure that you fill it out entirely. Turbo Tax would have a copy of your 2015 IT-201 only if you filed state taxes for the state of New York last year.

The IT-201 is a New York State income tax return form. If you are filing state taxes for New York this year, then yes you will need this form and you want to make sure that you fill it out entirely. Turbo Tax would have a copy of your 2015 IT-201 only if you filed state taxes for the state of New York last year.