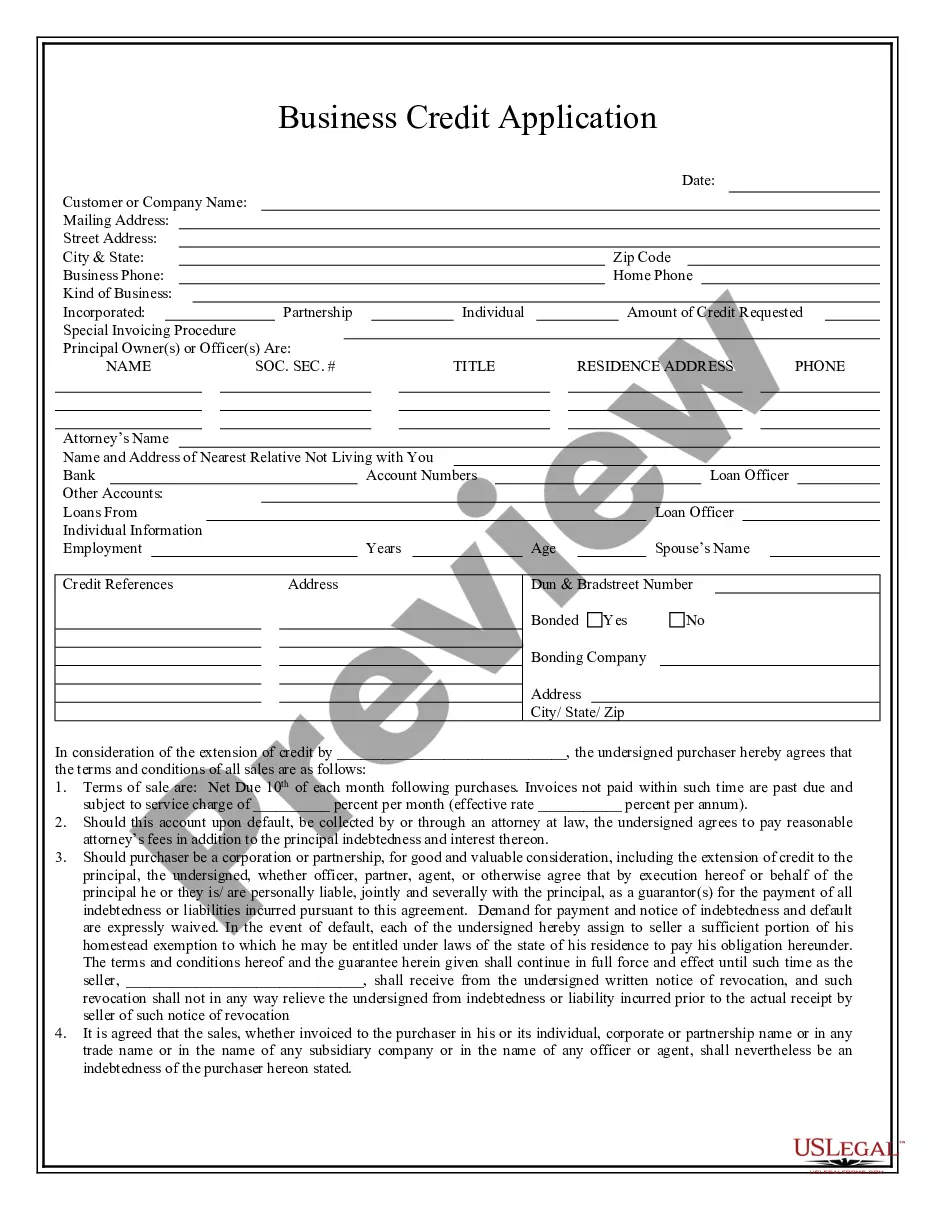

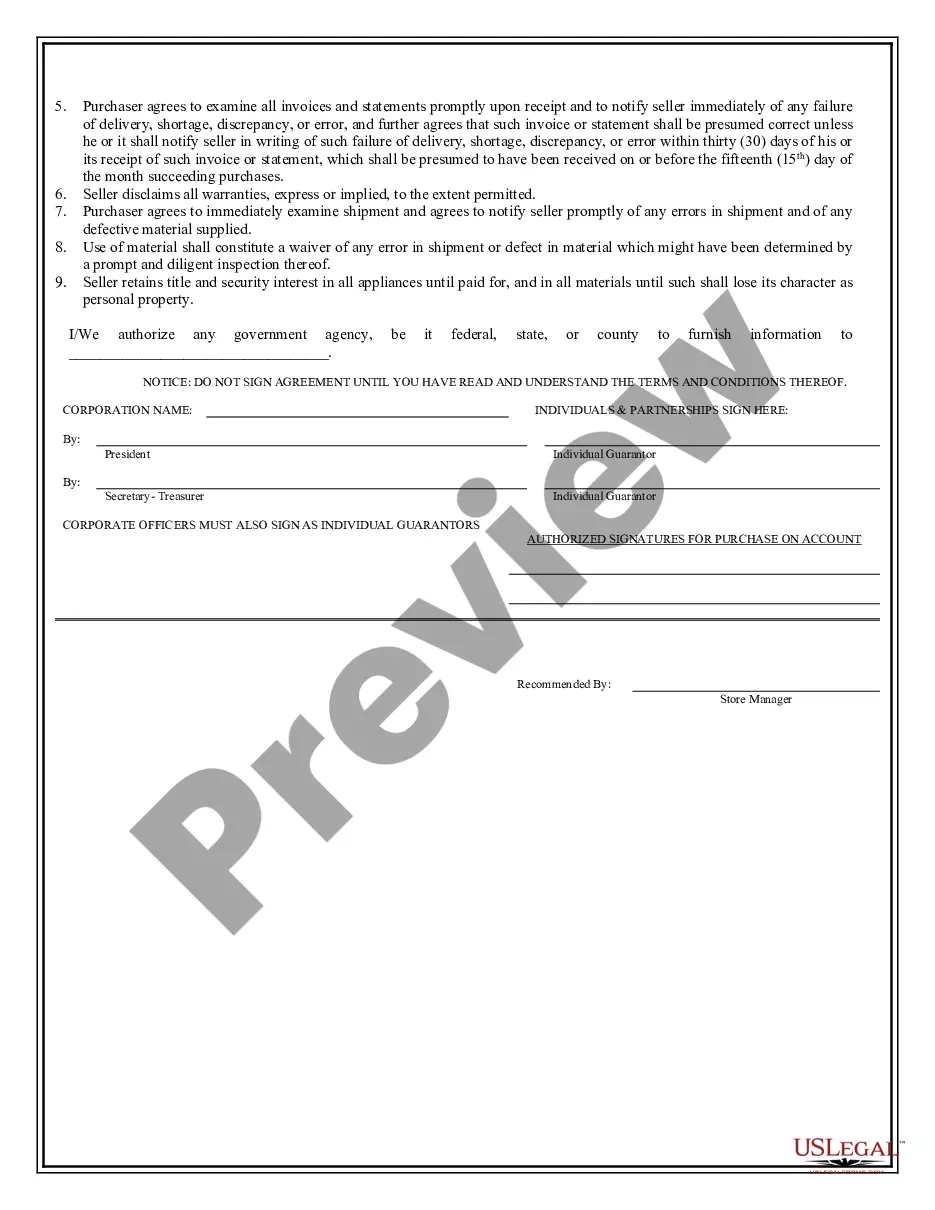

New York Business Credit Application

Description

How to fill out New York Business Credit Application?

US Legal Forms is really a special platform where you can find any legal or tax template for completing, including New York Business Credit Application. If you’re sick and tired of wasting time searching for appropriate samples and spending money on file preparation/legal professional charges, then US Legal Forms is precisely what you’re trying to find.

To reap all the service’s advantages, you don't need to download any application but simply choose a subscription plan and sign up an account. If you have one, just log in and look for a suitable sample, save it, and fill it out. Saved documents are saved in the My Forms folder.

If you don't have a subscription but need to have New York Business Credit Application, take a look at the instructions below:

- Double-check that the form you’re looking at applies in the state you need it in.

- Preview the sample its description.

- Click on Buy Now button to access the sign up page.

- Pick a pricing plan and continue signing up by entering some information.

- Pick a payment method to finish the sign up.

- Download the document by choosing your preferred file format (.docx or .pdf)

Now, complete the file online or print out it. If you feel unsure regarding your New York Business Credit Application template, contact a attorney to review it before you send or file it. Begin without hassles!

Form popularity

FAQ

New York & Company Comenity Bank Approval. Congrats!

Yes, you can continue to use your RUNWAYREWARDS Credit Card for all purchases at nyandcompany.com and fashiontofigure.com.

Write a business plan. Choose a business name. Choose a business entity and register your business. Obtain your EIN and register for taxes. Obtain permits, licenses, employer information, and insurance. Secure startup funding. Get a business bank account and credit card. Kick off your marketing plan.

New York & Company Card Overall Rating: 3.5/5.0 Sporting a hefty 27.24% APR, the RUNWAYREWARDS Credit Card is not a product for people who carry a balance. Instead, the card's purchase rewards are the real draw for most shoppers, offering a $10 Reward for every $200 spent on the RUNWAYREWARDS Credit Card.

You can contact New York & Company customer service for the RunwayRewards credit card at 800-889-0494, Monday through Saturday from 8 a.m. to 9 p.m. ET. To pay your bill, follow the automated prompts by entering your credit card number or your Social Security number.

Generally, the best small-business credit cards require a score of 670 or higher. While you might be able to qualify for a card with a lower score, you'll likely pay a higher interest rate or earn fewer rewards. When it comes to getting a small-business loan, banks have higher approval requirements.

Q: What credit score do you need to get approved for a New York and Company credit card? Actually, it is believed that you must have a credit score starting with 650 (or fair) in order to get this credit card.