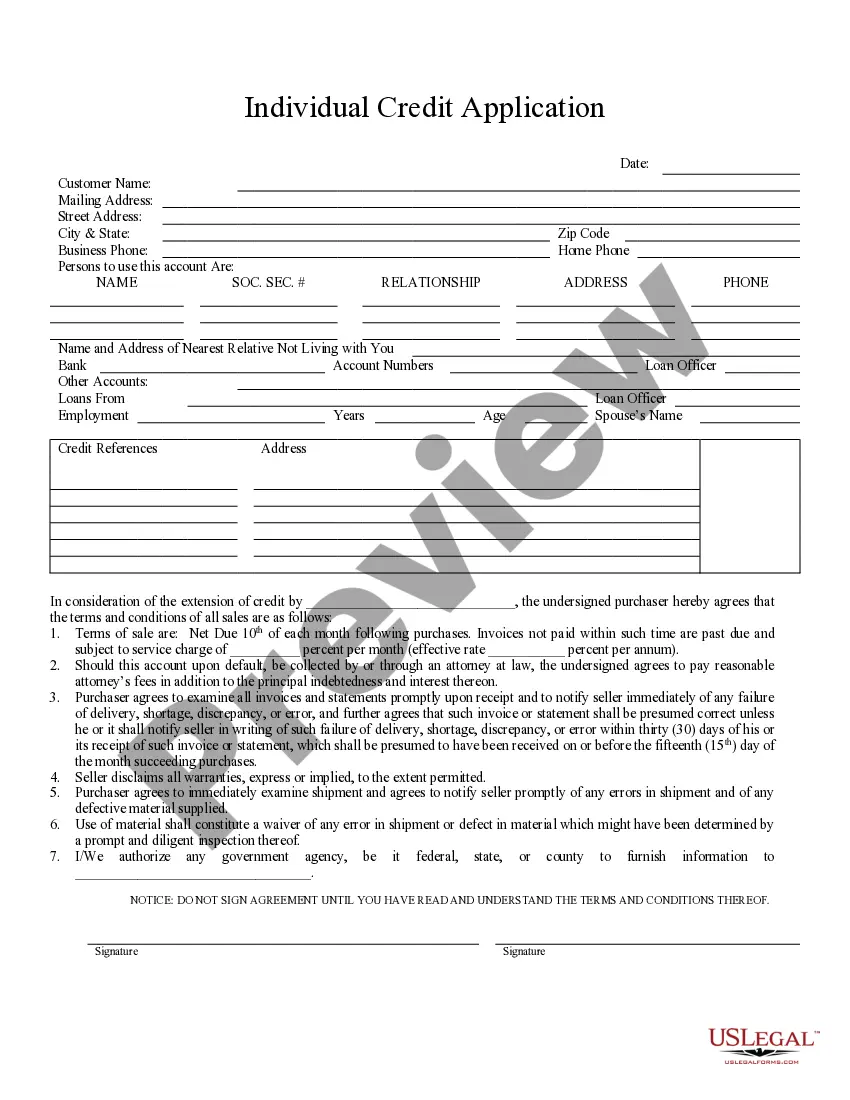

New York Individual Credit Application

Description

How to fill out New York Individual Credit Application?

US Legal Forms is really a unique system to find any legal or tax template for filling out, including New York Individual Credit Application. If you’re fed up with wasting time seeking perfect examples and spending money on document preparation/legal professional fees, then US Legal Forms is precisely what you’re trying to find.

To enjoy all of the service’s benefits, you don't need to download any software but just pick a subscription plan and register an account. If you have one, just log in and get a suitable template, download it, and fill it out. Saved documents are kept in the My Forms folder.

If you don't have a subscription but need New York Individual Credit Application, check out the instructions below:

- check out the form you’re considering is valid in the state you want it in.

- Preview the form its description.

- Simply click Buy Now to get to the register page.

- Pick a pricing plan and carry on registering by providing some info.

- Pick a payment method to complete the sign up.

- Save the document by choosing the preferred file format (.docx or .pdf)

Now, fill out the file online or print it. If you feel unsure concerning your New York Individual Credit Application sample, contact a legal professional to check it before you decide to send or file it. Start without hassles!

Form popularity

FAQ

You must claim this credit directly on Form IT-201, Resident Income Tax Return, or Form IT-203, Nonresident and Part-Year Resident Income Tax Return.

The Child Tax Credit is a refundable tax credit of up to $3,600 per qualifying child under 18. The credit begins to phase out when adjusted gross income reaches $75,000 for single filers, $150,000 for joint filers and $112,500 for head of household filers.

A To be eligible for Accredited Provider status, an organization must be a "legal organization," and must have organized, sponsored and administered, during the preceding three years, at least eight separate and distinct CLE courses, in New York (or outside of New York but not accredited by a New York Approved

These include dependent children who are age 17 or older at the end of 2019 or parents or other qualifying individuals supported by the taxpayer. Publication 972, Child Tax Credit, available now on IRS.gov, has further details and will soon be updated for tax year 2019.

New York City school tax credit (fixed amount) You are entitled to this refundable credit if you: were a full-year or part-year New York City resident, cannot be claimed as a dependent on another taxpayer's federal income tax return, and. had income of $250,000 or less.

Form NYC-210, Claim for New York City School Tax Credit.

New York State household credit full- or part-year resident. married or head of household with a federal adjusted gross income (FAGI) of $32,000 or less (allowed for married filing separate) single with an FAGI of $28,000 or less.

To be eligible to claim this credit, you must meet all of the following conditions for the 2020 tax year: Your household gross income was $18,000 or less. You occupied the same New York residence for six months or more. You were a New York State resident for all of 2020.

You can receive the STAR credit if you own your home and it's your primary residence and the combined income of the owners and the owners' spouses is $500,000 or less. STAR exemption: a reduction on your school tax bill.