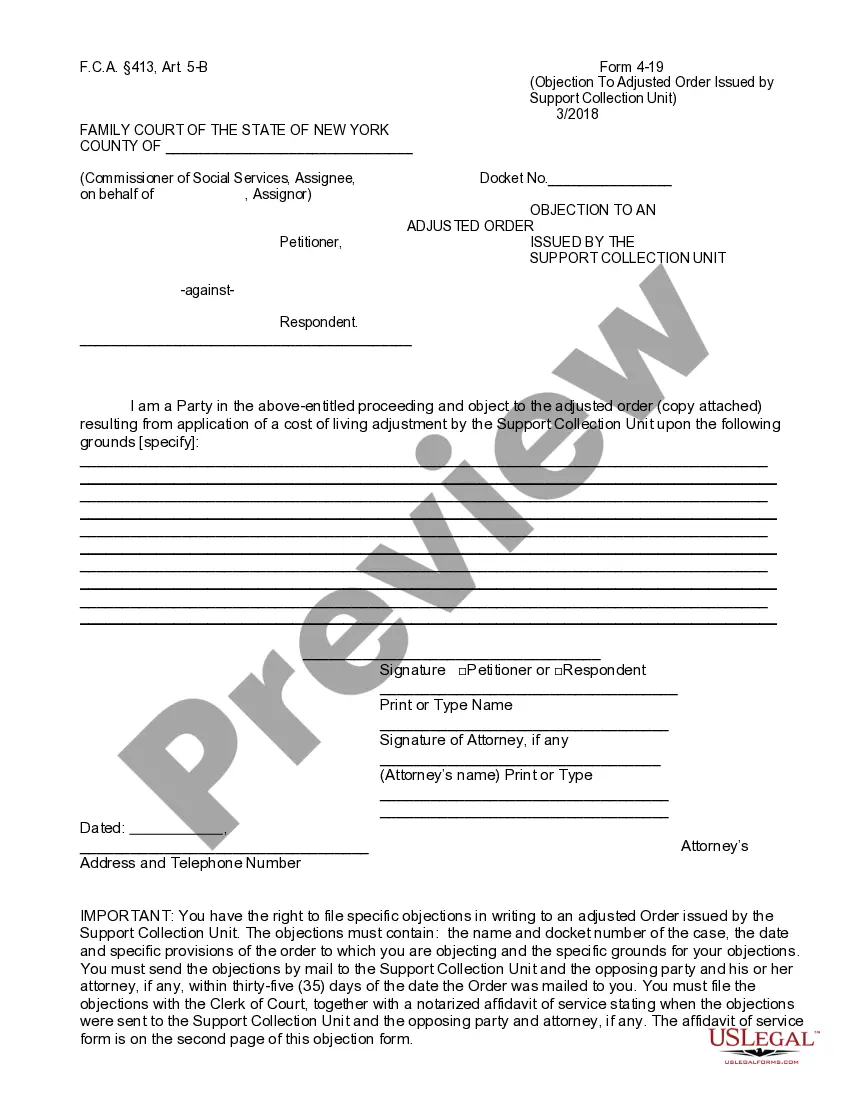

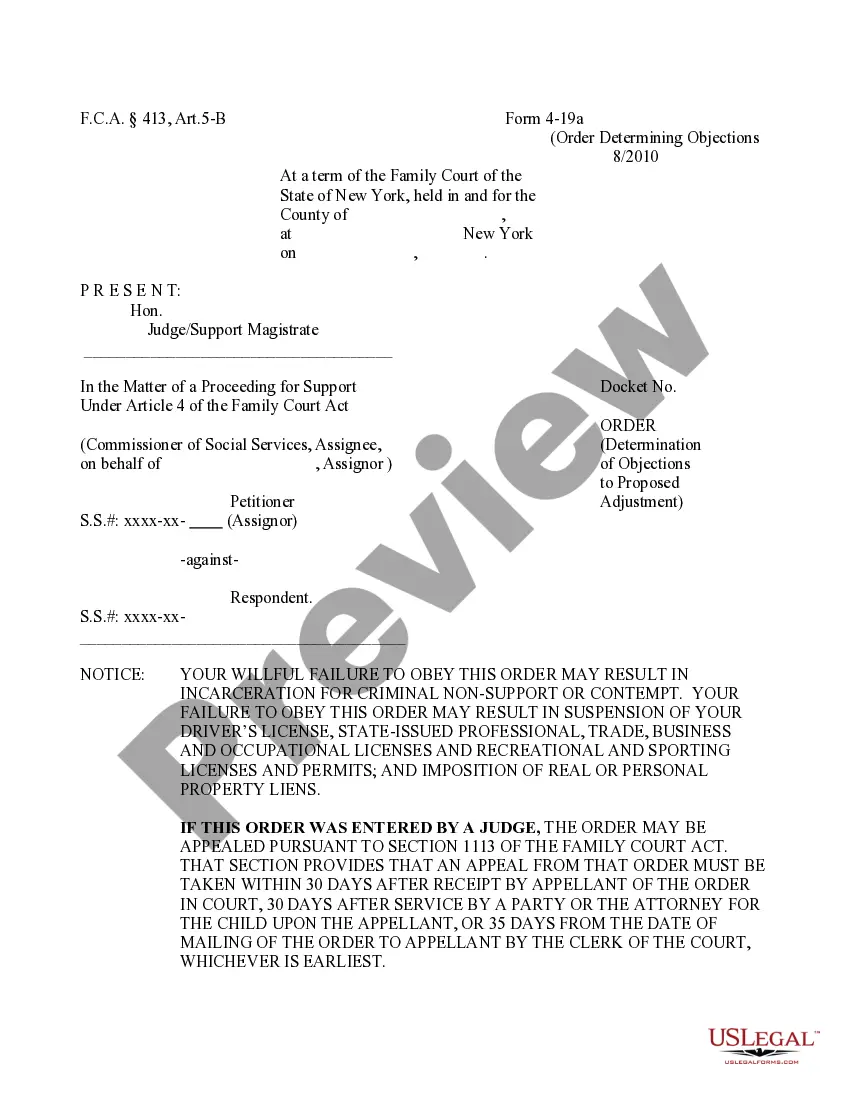

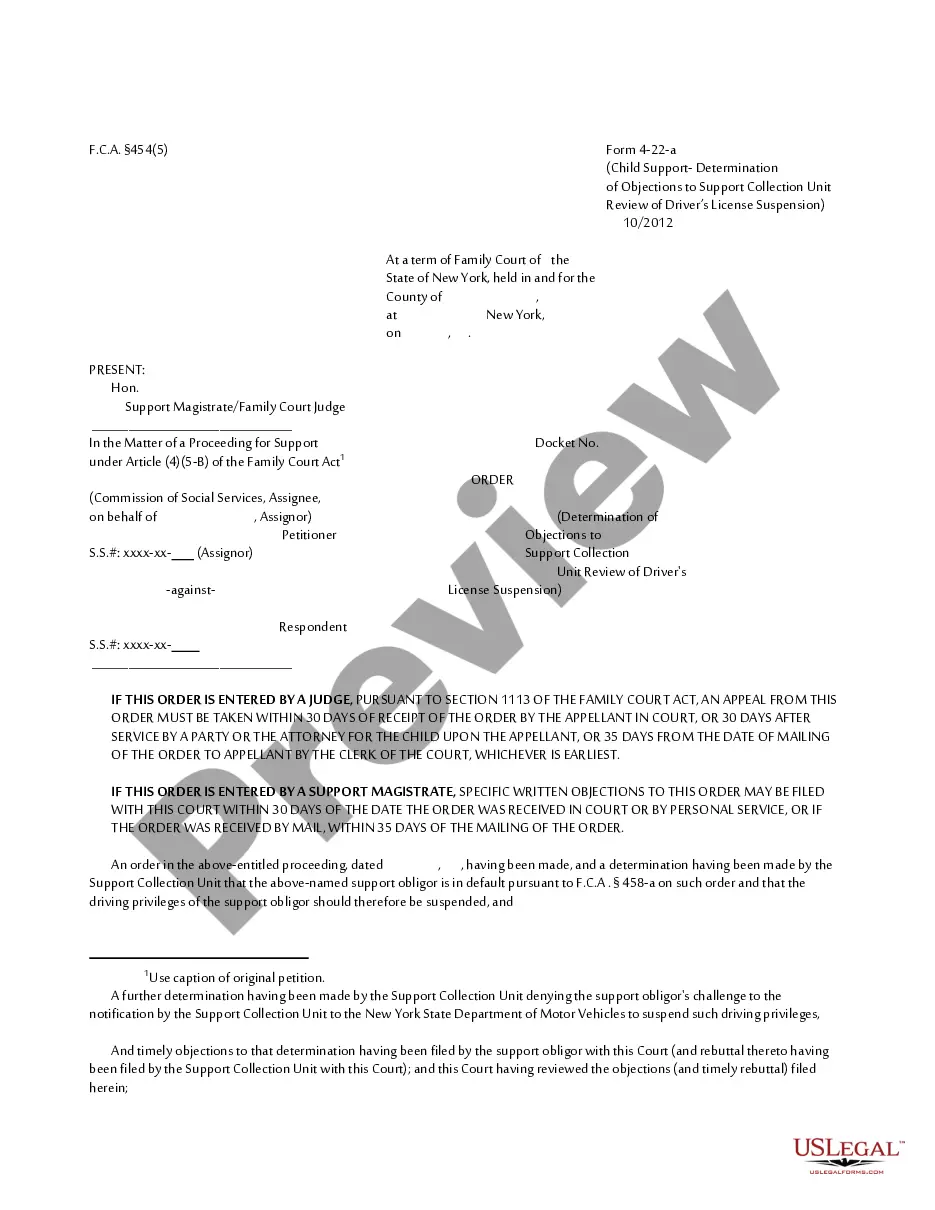

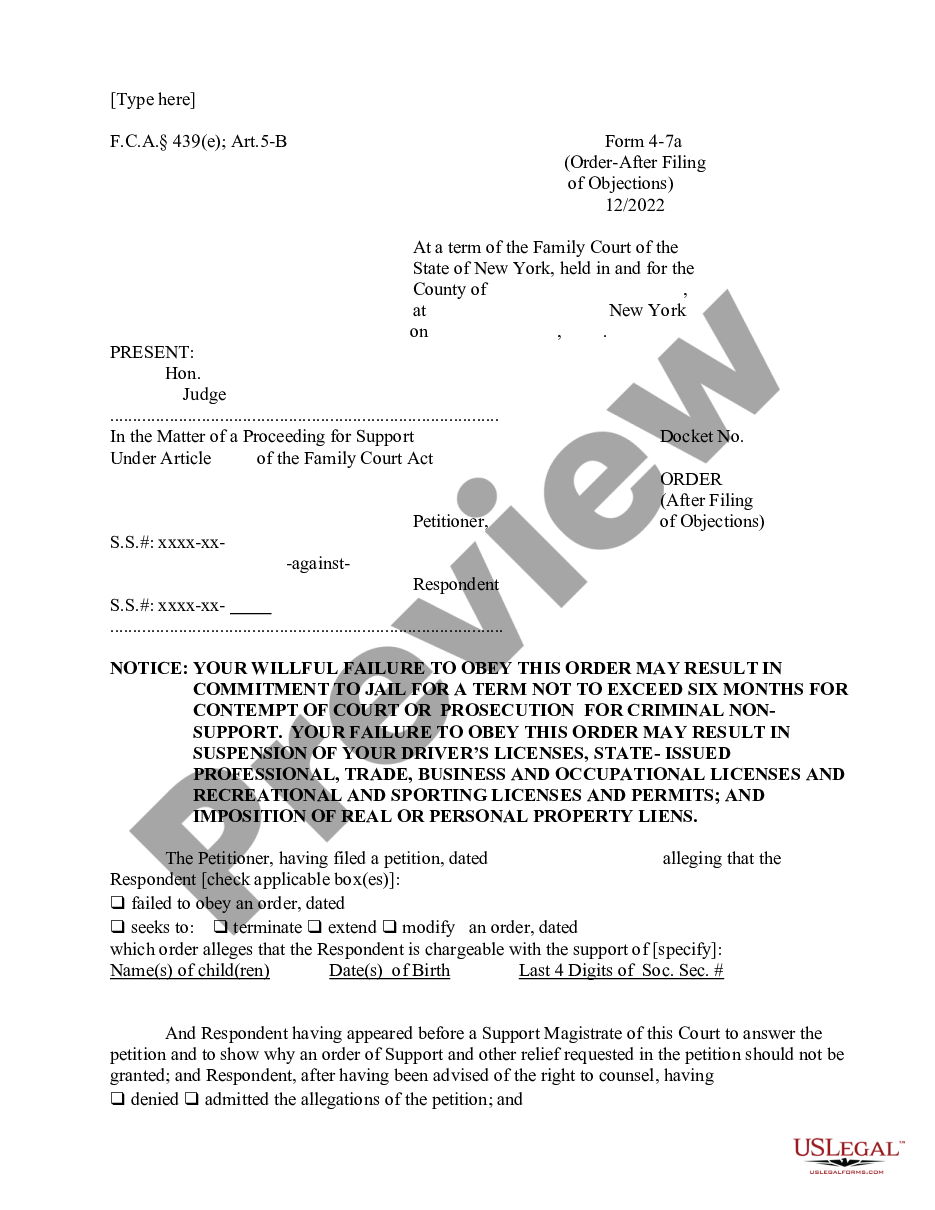

This form is an official State of New York Family Court sample form, a detailed Order Determining Objection to Adjusted Order - Cost of Living Adjustment (COLA).

New York Order Determination of Objections To Adjusted Order COLA

Description

How to fill out New York Order Determination Of Objections To Adjusted Order COLA?

US Legal Forms is actually a special platform to find any legal or tax form for filling out, including New York Order Determining Objection to Adjusted Order - Cost of Living Adjustment - COLA. If you’re sick and tired of wasting time searching for suitable examples and paying money on papers preparation/legal professional fees, then US Legal Forms is exactly what you’re seeking.

To experience all of the service’s benefits, you don't need to download any software but simply select a subscription plan and create an account. If you already have one, just log in and get an appropriate sample, save it, and fill it out. Downloaded documents are all stored in the My Forms folder.

If you don't have a subscription but need to have New York Order Determining Objection to Adjusted Order - Cost of Living Adjustment - COLA, check out the guidelines below:

- make sure that the form you’re taking a look at is valid in the state you want it in.

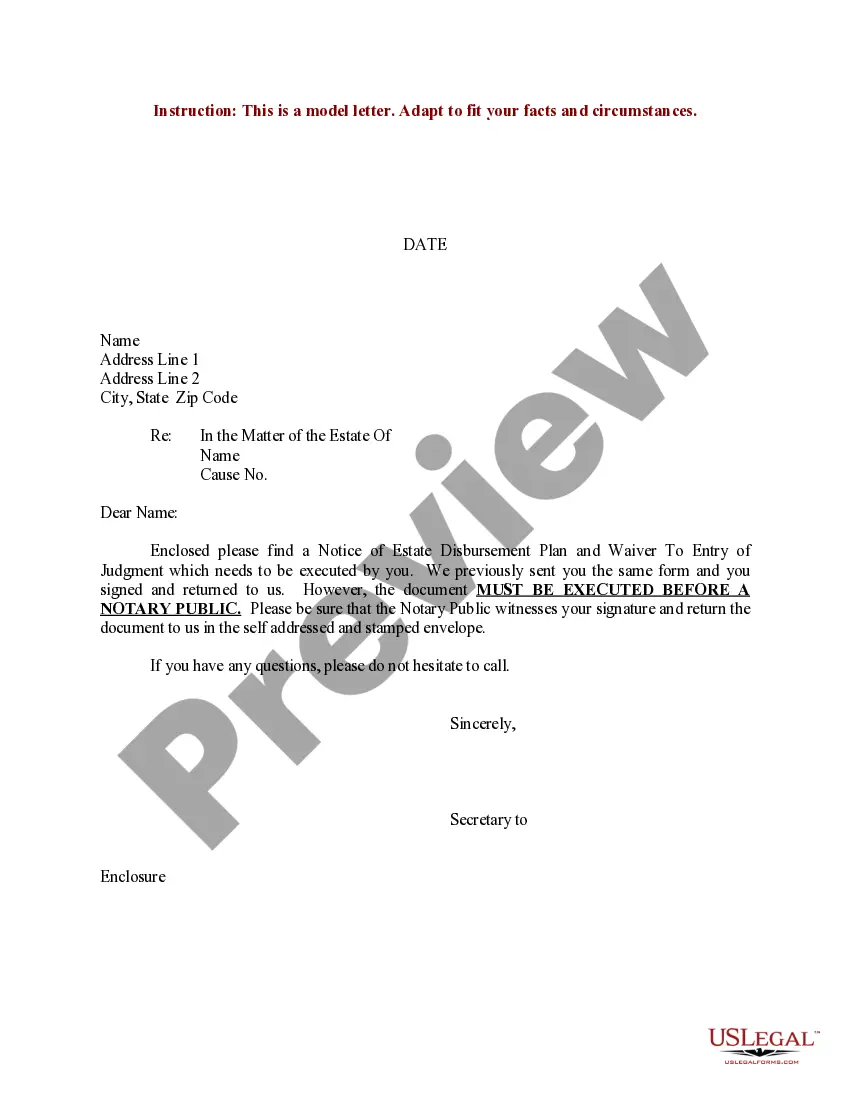

- Preview the sample and read its description.

- Click on Buy Now button to access the sign up page.

- Pick a pricing plan and continue signing up by entering some information.

- Decide on a payment method to complete the sign up.

- Save the document by choosing your preferred file format (.docx or .pdf)

Now, complete the file online or print out it. If you feel uncertain regarding your New York Order Determining Objection to Adjusted Order - Cost of Living Adjustment - COLA sample, speak to a lawyer to check it before you send or file it. Start without hassles!

Form popularity

FAQ

Overview. The IRS will change your routinely refund for many reasons, for example to correct a math error, to pay an existing tax debt or to pay a non-tax debt.You also hear from the IRS when they deduct a certain amount from your refund to cover a debt.

If your state refund was less than what you expected, it may have been offset to pay an outstanding debt in the state of NY or the state made adjustments while processing your return. The state should send you a notice explaining what happened.

The New York adjusted gross income of a resident individual means his federal adjusted gross income as defined in the laws of the United States for the taxable year, with the modifications specified in this section. (b) Modifications increasing federal adjusted gross income.(3) Income taxes.

Adjusted gross income (AGI) is your gross income which includes wages, dividends, alimony, capital gains, business income, retirement distributions and other income minus certain payments you've made during the year, such as student loan interest or contributions to a traditional individual retirement account or a

Adjusted refund amount means the IRS either owes you more money on your return, or you owe more money in taxes. For example, the IRS may use your refund to pay an existing tax debt and issue you a CP 49 notice.