New York Procedures are the rules and regulations that must be followed when conducting business in the state of New York. These procedures include a variety of topics, such as taxation, labor laws, real estate transactions, banking regulations, and liability insurance. There are several types of New York Procedures, including: 1. Taxation Procedures: This includes filing taxes with the state, as well as understanding the rates for both state and local taxes. 2. Labor Laws: These outline the rights of employees, such as minimum wage rates, overtime pay, and paid leave regulations. 3. Real Estate Transactions: This covers the process for buying or selling real estate in New York, including the necessary paperwork and fees. 4. Banking Regulations: This refers to the rules and regulations regarding banking transactions, such as account opening, transfers, and more. 5. Liability Insurance: This covers the requirements for businesses to have liability insurance, as well as understanding the different types of coverage available.

New York Procedures

Description

Get your form ready online

Our built-in tools help you complete, sign, share, and store your documents in one place.

Make edits, fill in missing information, and update formatting in US Legal Forms—just like you would in MS Word.

Download a copy, print it, send it by email, or mail it via USPS—whatever works best for your next step.

Sign and collect signatures with our SignNow integration. Send to multiple recipients, set reminders, and more. Go Premium to unlock E-Sign.

If this form requires notarization, complete it online through a secure video call—no need to meet a notary in person or wait for an appointment.

We protect your documents and personal data by following strict security and privacy standards.

Make edits, fill in missing information, and update formatting in US Legal Forms—just like you would in MS Word.

Download a copy, print it, send it by email, or mail it via USPS—whatever works best for your next step.

Sign and collect signatures with our SignNow integration. Send to multiple recipients, set reminders, and more. Go Premium to unlock E-Sign.

If this form requires notarization, complete it online through a secure video call—no need to meet a notary in person or wait for an appointment.

We protect your documents and personal data by following strict security and privacy standards.

Looking for another form?

How to fill out New York Procedures?

US Legal Forms is the most straightforward and profitable way to find appropriate formal templates. It’s the most extensive online library of business and personal legal documentation drafted and checked by attorneys. Here, you can find printable and fillable blanks that comply with national and local laws - just like your New York Procedures.

Obtaining your template takes just a few simple steps. Users that already have an account with a valid subscription only need to log in to the website and download the document on their device. Later, they can find it in their profile in the My Forms tab.

And here’s how you can obtain a properly drafted New York Procedures if you are using US Legal Forms for the first time:

- Read the form description or preview the document to guarantee you’ve found the one meeting your needs, or locate another one utilizing the search tab above.

- Click Buy now when you’re certain about its compatibility with all the requirements, and judge the subscription plan you prefer most.

- Create an account with our service, log in, and purchase your subscription using PayPal or you credit card.

- Choose the preferred file format for your New York Procedures and download it on your device with the appropriate button.

Once you save a template, you can reaccess it at any time - just find it in your profile, re-download it for printing and manual completion or upload it to an online editor to fill it out and sign more effectively.

Take advantage of US Legal Forms, your trustworthy assistant in obtaining the required formal documentation. Give it a try!

Form popularity

FAQ

Rule 14. Disclosure Disputes. If the court's Part Rules address discovery disputes, those Part Rules will govern discovery disputes in a pending case. If the court's Part Rules are silent with respect to discovery disputes, the following Rule will apply.

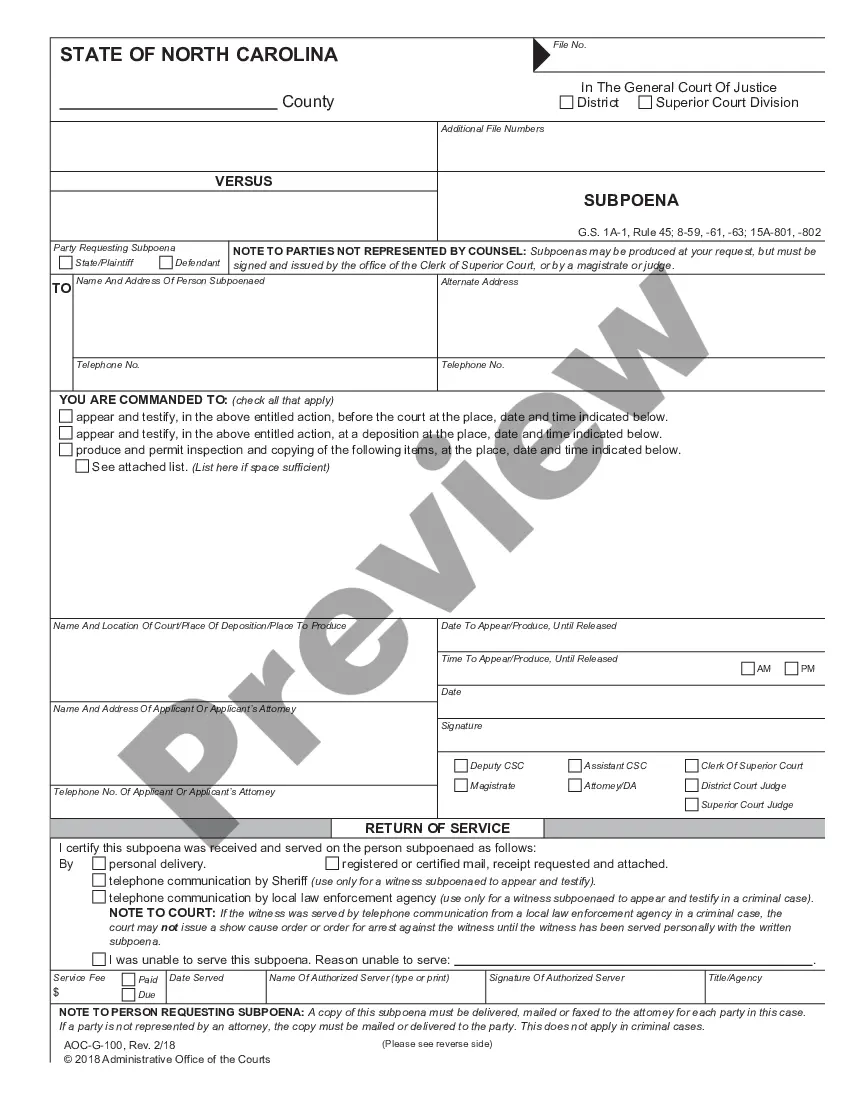

11-f - Depositions of Entities; Identification of Matters (a) A notice or subpoena may name as a deponent a corporation, business trust, estate, trust, partnership, limited liability company, association, joint venture, public corporation, government, or govern- mental subdivision, agency or instrumentality, or any

Within 20 days after service of a note of issue and certificate of readiness, any party to the action or special proceeding may move to vacate the note of issue, upon affidavit showing in what respects the case is not ready for trial, and the court may vacate the note of issue if it appears that a material fact in the

The New York Administrative Procedure Act is the law governing procedures for state administrative agencies to propose and issue regulations and provides for judicial review of agency adjudications and other final decisions in New York. It can be found in the Consolidated Laws of New York.

Unless a rule or statute specifically states otherwise, a pleading need not be verified or accompanied by an affidavit. The court must strike an unsigned paper unless the omission is promptly corrected after being called to the attorney's or party's attention.

22 CRR-NY 202.8-CRR (1) affidavits, affirmations, briefs and memoranda of law in chief shall be limited to 7,000 words each; (2) reply affidavits, affirmations, and memoranda shall be no more than 4,200 words and shall not contain any arguments that do not respond or relate to those made in the memoranda in chief.

Rule 11-c. Discovery of Electronically Stored Information from Nonparties. Parties and nonparties should adhere to the Commercial Division's Guidelines for Discovezy of Electronically Stored Information ("ESI") from nonparties. which can be found in Appendix A to these Rules of the Commercial Division.

11-a - Interrogatories. (a) Interrogatories are limited to 25 in number, including subparts, unless another limit is specified in the preliminary conference order. This limit applies to consolidated actions as well.