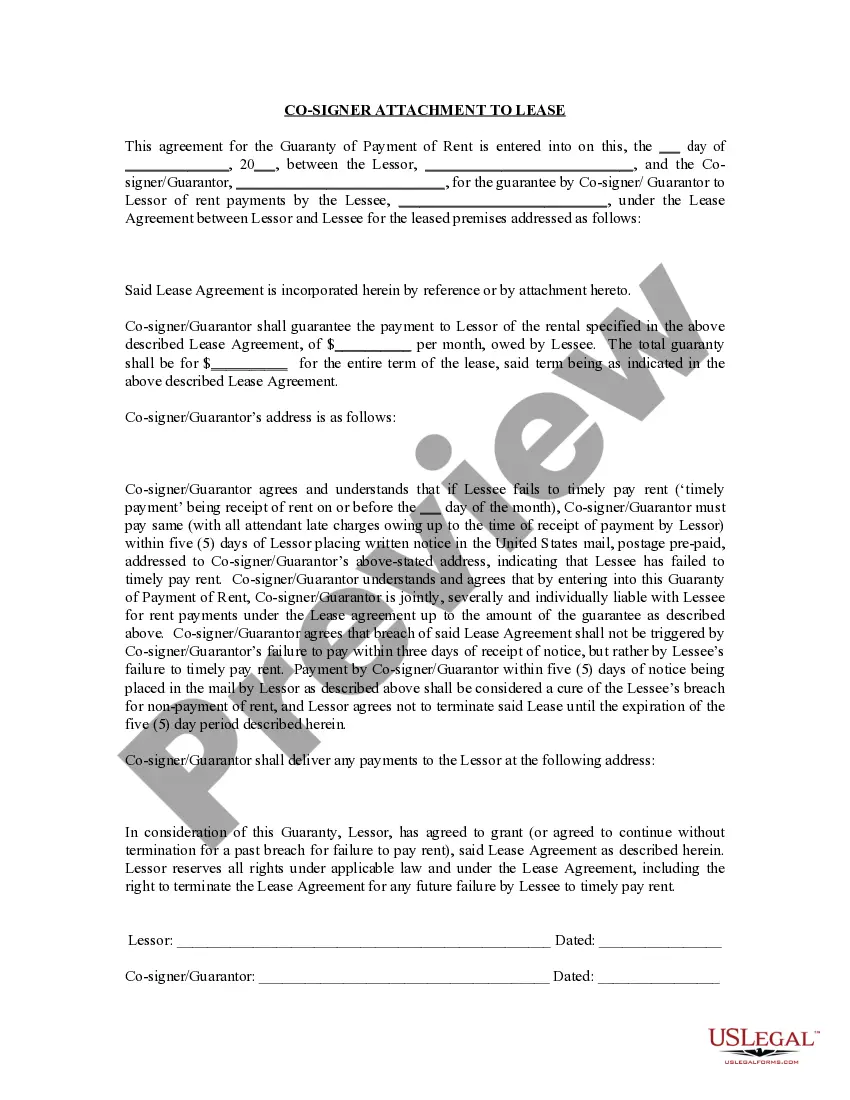

A guaranty is a contract under which one person agrees to pay a debt or perform a duty if the other person who is bound to pay the debt or perform the duty fails to do so. Usually, the party receiving the guaranty will first try to collect or obtain performance from the debtor before trying to collect from the one making the guaranty (guarantor).

New York Guaranty Attachment to Lease for Guarantor or Cosigner

Description

How to fill out New York Guaranty Attachment To Lease For Guarantor Or Cosigner?

In terms of filling out New York Guaranty Attachment to Lease for Guarantor or Cosigner, you most likely visualize a long process that involves choosing a perfect sample among numerous similar ones after which having to pay out legal counsel to fill it out to suit your needs. On the whole, that’s a sluggish and expensive choice. Use US Legal Forms and select the state-specific document within clicks.

If you have a subscription, just log in and click on Download button to get the New York Guaranty Attachment to Lease for Guarantor or Cosigner form.

In the event you don’t have an account yet but want one, follow the step-by-step manual listed below:

- Make sure the file you’re downloading is valid in your state (or the state it’s needed in).

- Do so by reading through the form’s description and also by clicking on the Preview function (if accessible) to see the form’s information.

- Simply click Buy Now.

- Select the suitable plan for your budget.

- Sign up to an account and choose how you would like to pay: by PayPal or by card.

- Download the document in .pdf or .docx file format.

- Find the record on the device or in your My Forms folder.

Skilled lawyers draw up our templates to ensure that after downloading, you don't need to bother about enhancing content material outside of your individual details or your business’s information. Join US Legal Forms and get your New York Guaranty Attachment to Lease for Guarantor or Cosigner example now.

Form popularity

FAQ

Write out your qualifications as a guarantor -- your income, assets and other personal details supporting why you would be able to take responsibility should the tenant or borrower fail to do so. You can also list your accountant to testify to your financial state, as well as other character references.

To write a guarantor letter, start by writing the date at the top of the signNow, followed by your full name and address. Below your information, address the letter to the company you're dealing with and begin the letter by identifying yourself and the person you're guaranteeing.

HOW TO FILL OUT THE GUARANTORS FORM. ADDRESS AND UNIT APPLYING FOR: Put the full address and unit of the apartment to be rented. FIRST NAME AND LAST NAME: The guarantors full name. GUARANTOR FOR: Name of the person who will be renting the apartment.

Be over 21 years old. have a good credit history. have a separate bank account to the borrower you may be able to guarantee a loan for a spouse or partner, but only if you have separate bank accounts.

Ask the owner whether he allows for co-signers. Schedule a meeting with the owner and your co-signer. Sign the lease or rental agreement once the co-signer passes the property owner's requirements. Ask the landlord whether he objects to another tenant moving into the home.

Leasing companies typically have higher credit score requirements, so borrowers with poor credit generally have better chances of working with a bad credit lender for a car loan. Leasing is usually reserved for borrowers with good credit, but a cosigner could give you the boost you need to get into a lease.

Co-signers have equal responsibility for payment of monthly rental costs, while a guarantor is generally sought for payment only when the primary signer is unable to make the rental payment.

To co-sign for you, he will have to complete the application process and demonstrate that he is creditworthy. If he passes the rental application and credit check, he will need to sign the lease agreement as your co-signer.

Date the date at which the Guarantor form was signed. Guarantor the name of the Guarantor. Landlord the name of the landlord. Tenant the name of the tenant that is being Guaranteed. Property the address of the property that is being rented.