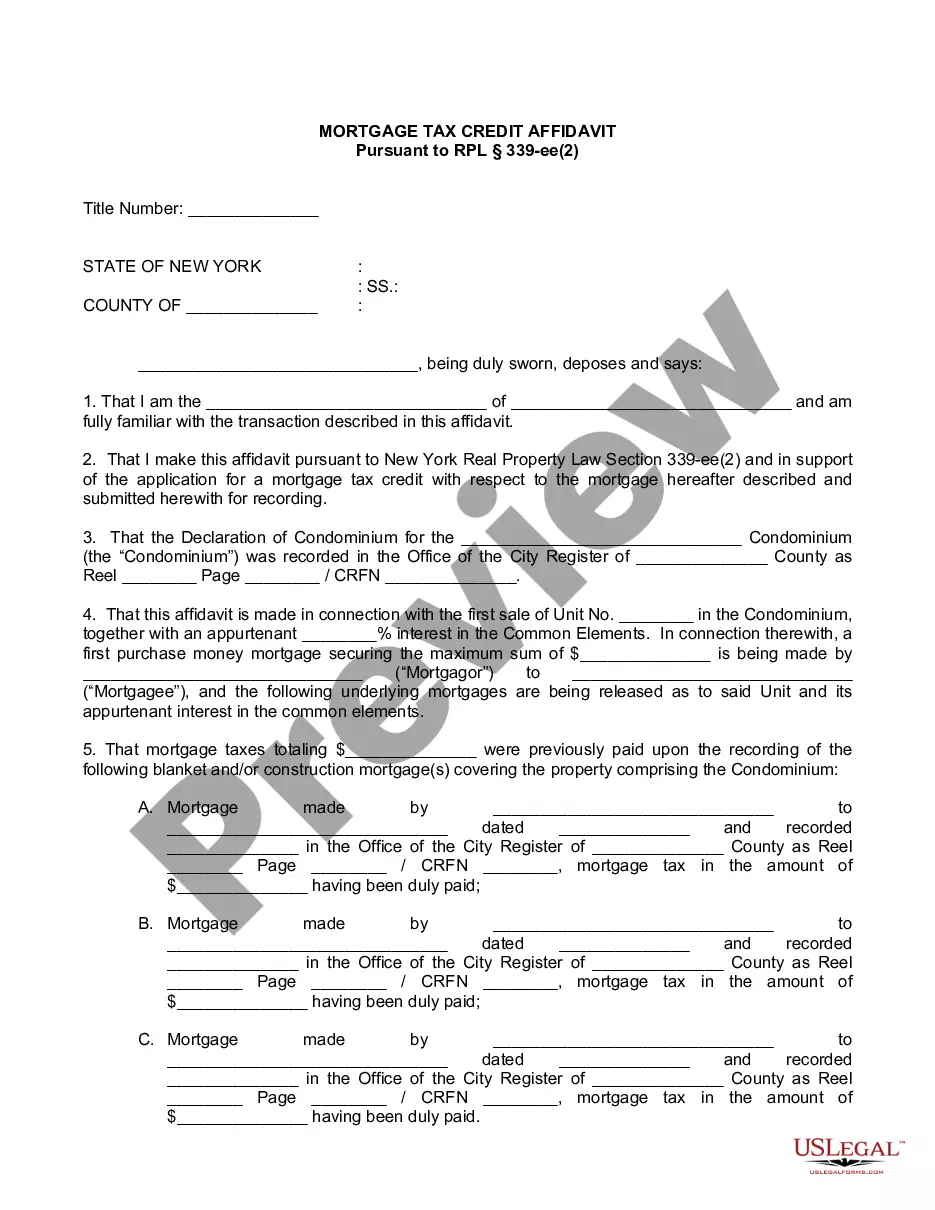

A New York Mortgage Tax Credit Affidavit is a legal document that consists of two parts — a Certificate of Eligibility and a Disclosure Statement. The Certificate of Eligibility is signed by a borrower and lender, and states that the borrower is eligible for a mortgage tax credit in the state of New York. The Disclosure Statement is then signed by the borrower and lender, and sets out the details of the mortgage tax credit, including the amount of the credit, the rate of interest, the term of the loan, and any other pertinent information. There are two types of New York Mortgage Tax Credit Affidavits. The first is the Standard New York Mortgage Tax Credit Affidavit, which is used for all home purchases and refinances. The second is the Enhanced New York Mortgage Tax Credit Affidavit, which is used for purchases of homes in certain designated areas.

New York Mortgage Tax Credit Affidavit

Description

Key Concepts & Definitions

A mortgage tax credit affidavit is a legal document used in the United States to claim tax credits related to mortgage interest payments. This affidavit helps homeowners reduce their taxable income by certifying their eligibility for the Mortgage Credit Certificate (MCC) program. The MCC program is designed to make homeownership more affordable by allowing qualifying taxpayers to convert a portion of their mortgage interest into a direct federal tax credit.

Step-by-Step Guide

- Verify Eligibility: Ensure you meet the income and purchase price requirements specific to your state and county.

- Attend a Homebuyer Education Course: This is usually required to participate in the MCC program.

- Apply for an MCC: Submit an application through your local or state housing finance agency before closing on your home loan.

- Sign the Mortgage Tax Credit Affidavit: This will likely occur during the mortgage closing process, where you affirm under penalty of perjury that you comply with the programs requirements.

- File your Taxes: Use IRS Form 8396 to claim the credit when filing your federal income tax return.

Risk Analysis

The primary risks associated with a mortgage tax credit affidavit include:

- Documentation and Compliance: Failing to meet documentations and compliance can lead to disqualification from the MCC program and potential legal consequences.

- Misrepresentation: Any false statement on the affidavit can result in penalties, including fines or criminal charges.

- Loss of Benefits: Changes in income or property use that disqualify you from the program can lead to the loss of future tax credits.

Key Takeaways

- MCC benefits: Can significantly reduce the amount of income taxes you owe.

- Compliance: Ensure accurate and honest completion of all MCC related documents.

- Professional Advice: Consult with a tax professional or an advisor familiar with the MCC to maximize benefits and minimize risks.

Common Mistakes & How to Avoid Them

- Not researching eligibility requirements thoroughly, resulting in rejection.Prevention: Consult the appropriate housing finance agency's resources or a knowledgeable real estate agent.

- Filing incorrect forms or missing deadlines. Prevention: Use IRS Form 8396 and adhere to tax filing deadlines.

- Misunderstanding the affidavit's legal implications.Prevention: Seek legal advice before signing.

FAQ

- Who is eligible for a Mortgage Tax Credit? Eligibility varies by state and local program but generally targets first-time homebuyers, veterans, or lower-income families.

- How much can the MCC reduce my taxes? The MCC typically allows 20% to 50% of mortgage interest paid to be converted into a direct tax credit.

- Can I claim the mortgage tax credit every year? Yes, as long as you comply with the program's criteria and continue to use the home as your primary residence.

How to fill out New York Mortgage Tax Credit Affidavit?

Preparing legal paperwork can be a real stress unless you have ready-to-use fillable templates. With the US Legal Forms online library of formal documentation, you can be certain in the blanks you find, as all of them correspond with federal and state laws and are examined by our experts. So if you need to fill out New York Mortgage Tax Credit Affidavit, our service is the best place to download it.

Getting your New York Mortgage Tax Credit Affidavit from our library is as easy as ABC. Previously registered users with a valid subscription need only sign in and click the Download button once they find the correct template. Later, if they need to, users can pick the same document from the My Forms tab of their profile. However, even if you are new to our service, signing up with a valid subscription will take only a few minutes. Here’s a quick instruction for you:

- Document compliance verification. You should attentively examine the content of the form you want and ensure whether it satisfies your needs and complies with your state law requirements. Previewing your document and reviewing its general description will help you do just that.

- Alternative search (optional). If you find any inconsistencies, browse the library using the Search tab above until you find a suitable blank, and click Buy Now once you see the one you want.

- Account registration and form purchase. Create an account with US Legal Forms. After account verification, log in and choose your preferred subscription plan. Make a payment to continue (PayPal and credit card options are available).

- Template download and further usage. Choose the file format for your New York Mortgage Tax Credit Affidavit and click Download to save it on your device. Print it to complete your paperwork manually, or take advantage of a multi-featured online editor to prepare an electronic version faster and more effectively.

Haven’t you tried US Legal Forms yet? Sign up for our service now to get any formal document quickly and easily any time you need to, and keep your paperwork in order!

Form popularity

FAQ

To deduct mortgage interest, real estate taxes, and home office expenses, you must complete Form IT-196, New York Resident, Nonresident, and Part-Year Resident Itemized Deductions, to compute your New York State itemized deduction.

Do you have to pay NYS mortgage tax on a refinance? New York charges a NYS mortgage tax or specifically a recording tax on any new mortgage debt. This rate varies by county, with the minimum being 1.05 percent of the loan amount. But fortunately, homeowners aren't required to pay the tax again once they refinance.

This template is a Section 255 Affidavit, which is used in New York to confirm that the portion of debt secured by a consolidation, extension, and modification agreement (CEMA), for which mortgage recording tax has already been paid, is exempt from mortgage recording tax pursuant to NY CLS Tax § 255.

Borrower shall pay all taxes, charges, filing, registration and recording fees, excises and levies payable with respect to the Note or the Liens created or secured by the Loan Documents, other than income, franchise and doing business taxes imposed on Lender.

New York State imposes a tax on the privilege of recording a mortgage on real property located within the state. In addition, New York City, Yonkers, and various counties impose local taxes on mortgages that are recorded in those jurisdictions.

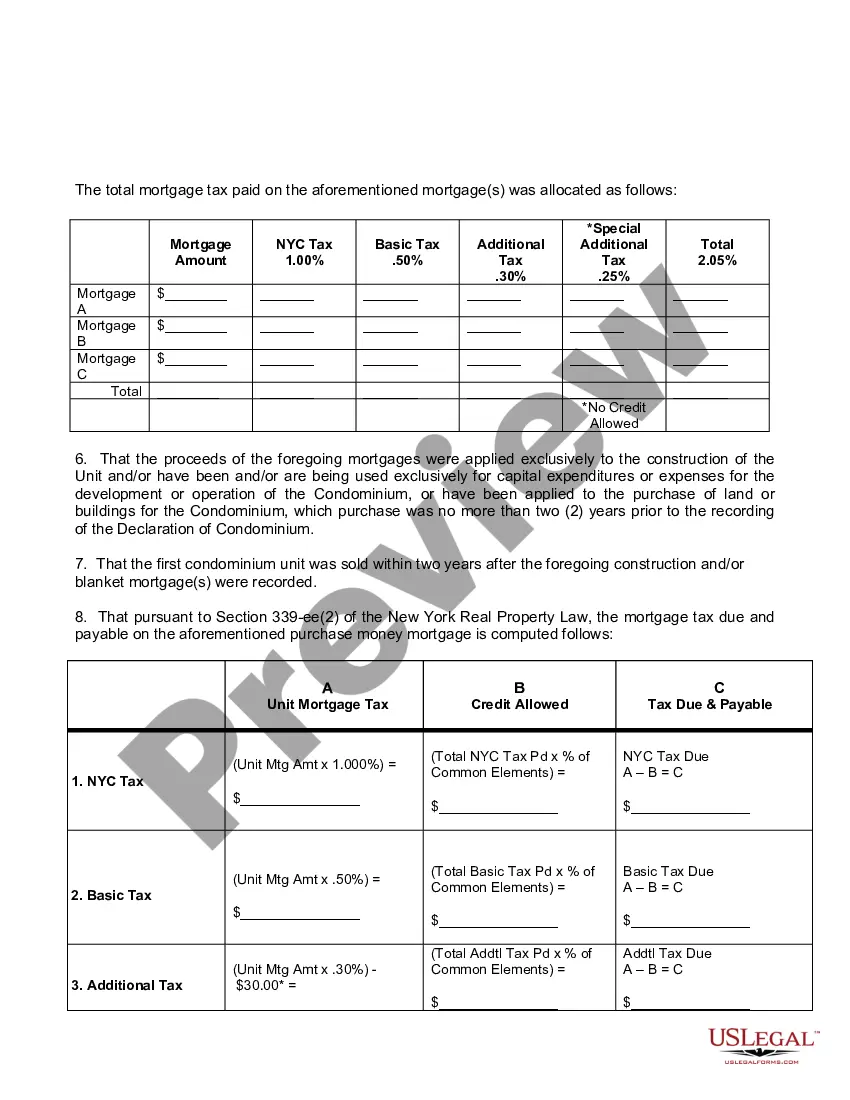

How much is the mortgage recording tax buyers pay in NYC? The mortgage recording tax requires purchasers to pay 1.8% on mortgage amounts under $500,000 and 1.925% on mortgage amounts above $500,000 in NYC (this includes the recording tax for both New York City and New York State).

Section 253 1-a. (b) of the New York State tax law provides that if the lender (1) operates on a nonprofit basis; and (2) is exempt from federal income taxation under Section 501(a) of the Internal Revenue Code, then the lender is exempt from paying the special additional tax.

Mortgage Tax is equal to 1.05% of the total mortgage amount (minus a $30.00 deduction if applicable) which consists of the following: Basic Mortgage Tax is . 50% of mortgage amount. SONYMA (State of New York Mortgage Authority) aka Additional Tax is .

The VA loan program, like FHA loans, views non-payment of property taxes to be a violation of the loan agreement. But VA loan rules do not require a lender to establish an escrow account for the taxes and insurance on properties bought with VA mortgage loans.

The Veterans' Exemption provides exemption of property not to exceed $4,000 for qualified veterans who own limited property (see Revenue and Taxation Code section 205).