The New York Additional Notice of Consumer Credit Action — all other courts is a type of legal document used in the state of New York. This document provides notice to the defendant of an action or suit being brought against them by a creditor in any other court than the Supreme Court of New York. It must be properly served on the defendant in order for the action or suit to proceed. The New York Additional Notice of Consumer Credit Action — all other courts includes information such as the name and address of the plaintiff and defendant, the court where the action or suit is pending, and the amount of the claim or demand. It also includes the time, date, and place of the hearing, as well as a statement of the relief sought by the plaintiff. There are two types of New York Additional Notice of Consumer Credit Action — all other courts. The first is an Original Notice, which is served on the defendant when the action or suit is first filed. The second type is a Renewal Notice, which is served on the defendant when the action or suit is renewed.

New York Additional Notice of Consumer Credit Action - all other courts

Description

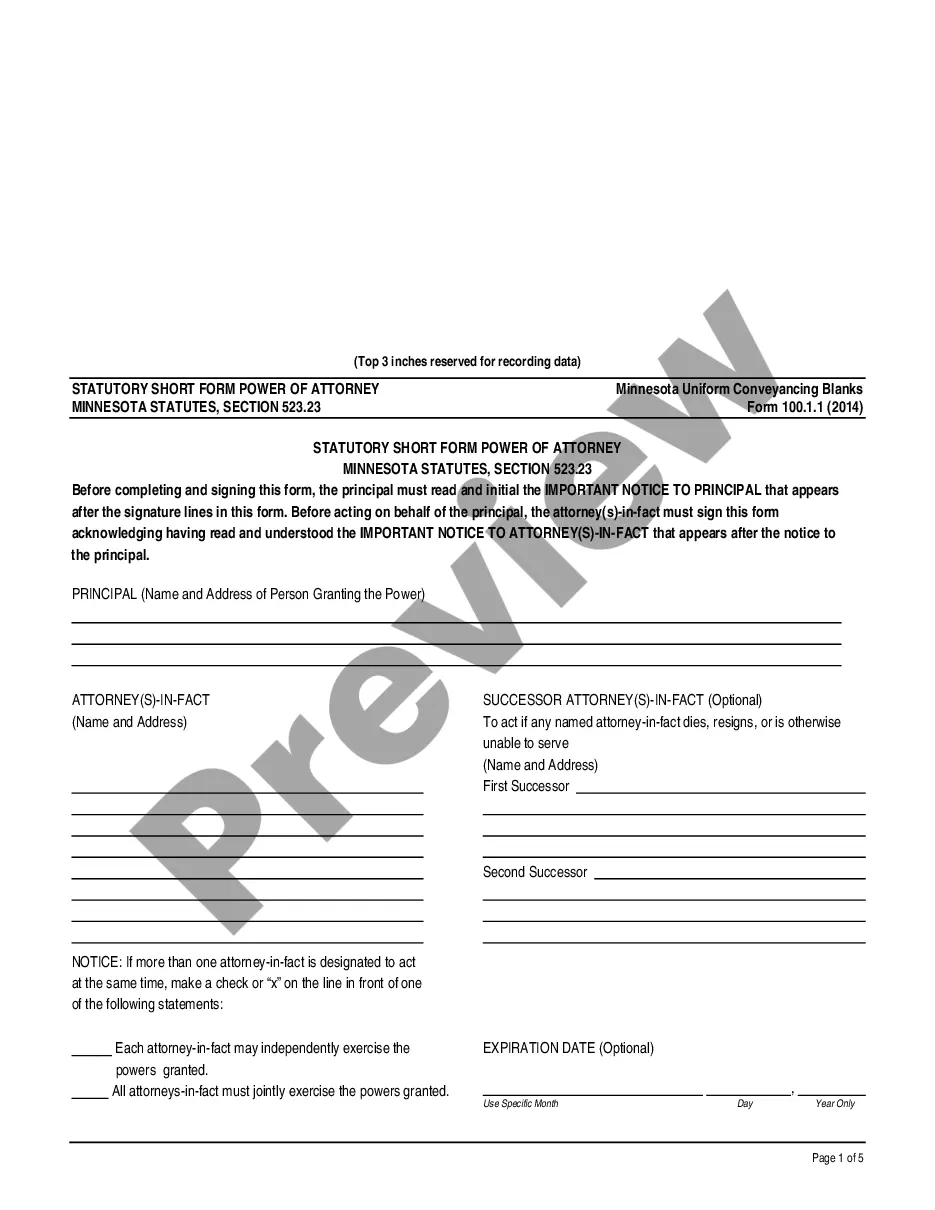

How to fill out New York Additional Notice Of Consumer Credit Action - All Other Courts?

How much time and resources do you usually spend on composing formal paperwork? There’s a better opportunity to get such forms than hiring legal specialists or wasting hours browsing the web for a suitable blank. US Legal Forms is the premier online library that provides professionally drafted and verified state-specific legal documents for any purpose, including the New York Additional Notice of Consumer Credit Action - all other courts.

To get and complete an appropriate New York Additional Notice of Consumer Credit Action - all other courts blank, follow these simple instructions:

- Look through the form content to ensure it complies with your state regulations. To do so, check the form description or use the Preview option.

- If your legal template doesn’t meet your requirements, find a different one using the search bar at the top of the page.

- If you already have an account with us, log in and download the New York Additional Notice of Consumer Credit Action - all other courts. If not, proceed to the next steps.

- Click Buy now once you find the correct document. Choose the subscription plan that suits you best to access our library’s full opportunities.

- Create an account and pay for your subscription. You can make a transaction with your credit card or through PayPal - our service is absolutely safe for that.

- Download your New York Additional Notice of Consumer Credit Action - all other courts on your device and complete it on a printed-out hard copy or electronically.

Another advantage of our library is that you can access previously purchased documents that you safely keep in your profile in the My Forms tab. Get them at any moment and re-complete your paperwork as often as you need.

Save time and effort completing formal paperwork with US Legal Forms, one of the most reliable web services. Sign up for us now!

Form popularity

FAQ

Until 2022, the statute of limitations for debt in New York was six years. However, in January 2021, the New York Senate passed a bill called the Consumer Credit Fairness Act of 2021 that reduced the statute of limitations on most types of debt to just three years. This bill was officially enacted on April 7, 2022.

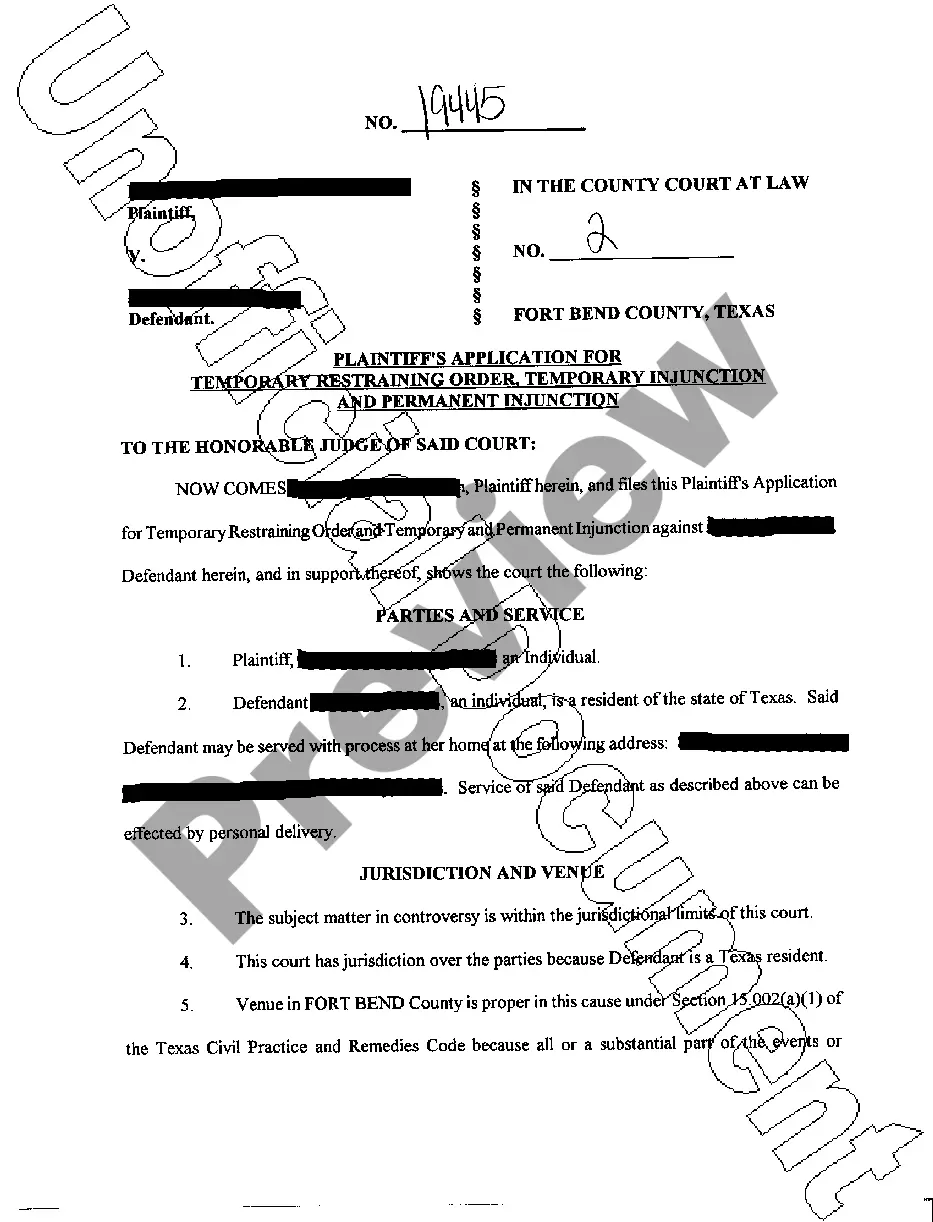

The Additional Notice of Lawsuit must be mailed promptly by the court clerk to the defendant, and no default judgment may be entered unless at least 20 days have elapsed from the date of mailing, or if returned to the court as undeliverable, unless the address matches the defendant's address on record with the New York

Summary: Yes, you can settle after service. The best way to settle a debt lawsuit is first to file a response, then contact the otherside and make an offer???.

What benefits does the Consumer Credit Fairness Act give to debtors? By reducing the statute of limitations for debt collection lawsuits from six years to three years, the Consumer Credit Fairness Act will significantly reduce the amount of debt involved in a lawsuit.

If you received a Summons and Complaint, you only have a short time to deliver a written Answer to the plaintiff and the Court. The Answer is your chance to tell the court your defenses or reasons why the plaintiff must not win the case. Some courts let you give your Answer to the Clerk at the courthouse in person.

You can either answer the summons in writing or in person. If you answer in person, you must go to the courthouse clerk's office and tell the clerk about your defenses to the plaintiff's claims. The clerk will check off the boxes in a Consumer Credit Transaction Answer In Person form.

The written response must be made within 20 days of personal service, or within 30 days of the time when service by any other means is complete. If the defendant fails to respond he or she is in default and plaintiff may be able to obtain a default judgment against the defendant.

Summary: The statute of limitations on most debt in New York is just three years. This means that creditors and debt collectors only have three years from the date of the last activity on an account to sue someone for a debt.