New York Holding Corporation Stipulation-For Publicly Traded Corporations Only — rev102611 is a document that outlines the requirements that publicly traded companies must meet in order to be eligible for holding corporation status in the state of New York. This stipulation outlines the requirements for eligibility, including the number of shareholders, types of assets held, and reporting requirements. It also outlines the process for obtaining holding corporation status, including filing an application with the New York State Department of Taxation and Finance. This stipulation also outlines the benefits of holding corporation status, including tax reductions and exemptions. There are two types of New York Holding Corporation Stipulation-For Publicly Traded Corporations Only — rev102611: one for domestic corporations and one for foreign corporations.

New York Holding Corporation Stipulation-For Publicly Traded Corporations Only - rev102611

Description

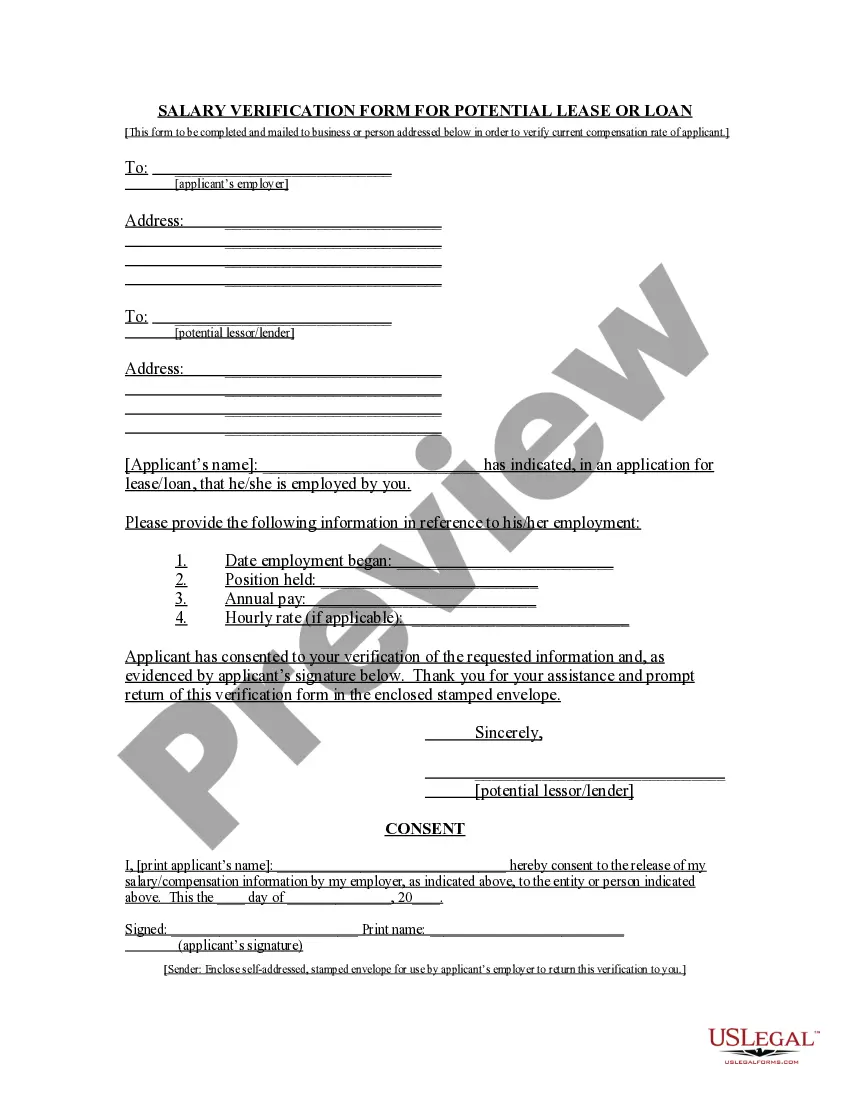

How to fill out New York Holding Corporation Stipulation-For Publicly Traded Corporations Only - Rev102611?

US Legal Forms is the most straightforward and profitable way to find appropriate legal templates. It’s the most extensive web-based library of business and individual legal paperwork drafted and checked by attorneys. Here, you can find printable and fillable blanks that comply with national and local laws - just like your New York Holding Corporation Stipulation-For Publicly Traded Corporations Only - rev102611.

Obtaining your template requires just a couple of simple steps. Users that already have an account with a valid subscription only need to log in to the website and download the form on their device. Afterwards, they can find it in their profile in the My Forms tab.

And here’s how you can get a professionally drafted New York Holding Corporation Stipulation-For Publicly Traded Corporations Only - rev102611 if you are using US Legal Forms for the first time:

- Read the form description or preview the document to make certain you’ve found the one meeting your requirements, or locate another one utilizing the search tab above.

- Click Buy now when you’re certain about its compatibility with all the requirements, and select the subscription plan you prefer most.

- Register for an account with our service, sign in, and pay for your subscription using PayPal or you credit card.

- Choose the preferred file format for your New York Holding Corporation Stipulation-For Publicly Traded Corporations Only - rev102611 and save it on your device with the appropriate button.

Once you save a template, you can reaccess it whenever you want - simply find it in your profile, re-download it for printing and manual fill-out or import it to an online editor to fill it out and sign more proficiently.

Take advantage of US Legal Forms, your reputable assistant in obtaining the corresponding official paperwork. Try it out!

Form popularity

FAQ

Most people think of a liquor license transfer as the process of transferring a liquor license from one person to the next. This most commonly occurs when a business with a liquor license is sold to another person. However, by law there is no such thing as a liquor license transfer in NY state.

Contact the Licensing Bureau Press "1", then "2" for refund or surrender of a license518-474-3114. - Press "1", then "3" for licensing assistance 518-474-3114.

Mail application to: If no payment is required with this application, send to the Albany Office located at 80 South Swan Street, Suite 900, Albany, NY 12210. If payment is required, mail to: New York State Liquor Authority, PO Box 782772, Philadelphia, PA 19178-2772.

Mail application to: If no payment is required with this application, send to the Albany Office located at 80 South Swan Street, Suite 900, Albany, NY 12210. If payment is required, mail to: New York State Liquor Authority, PO Box 782772, Philadelphia, PA 19178-2772.

The review process currently takes approximately 22-26 weeks for most types of applications; however, most retail businesses and all manufacturing businesses are eligible to apply for a temporary retail operating permit or to apply for a temporary manufacturing permit that allows many applicants to be open and

If you have any other urgent matter, please contact us at (518) 474-3114. We thank you for your understanding and cooperation.