Preparing official paperwork can be a real burden unless you have ready-to-use fillable templates. With the US Legal Forms online library of formal documentation, you can be confident in the blanks you find, as all of them comply with federal and state laws and are checked by our experts. So if you need to prepare New York Applicants Statement - rev-042511, our service is the perfect place to download it.

Obtaining your New York Applicants Statement - rev-042511 from our catalog is as easy as ABC. Previously authorized users with a valid subscription need only sign in and click the Download button once they locate the correct template. Later, if they need to, users can get the same document from the My Forms tab of their profile. However, even if you are new to our service, signing up with a valid subscription will take only a few moments. Here’s a brief guideline for you:

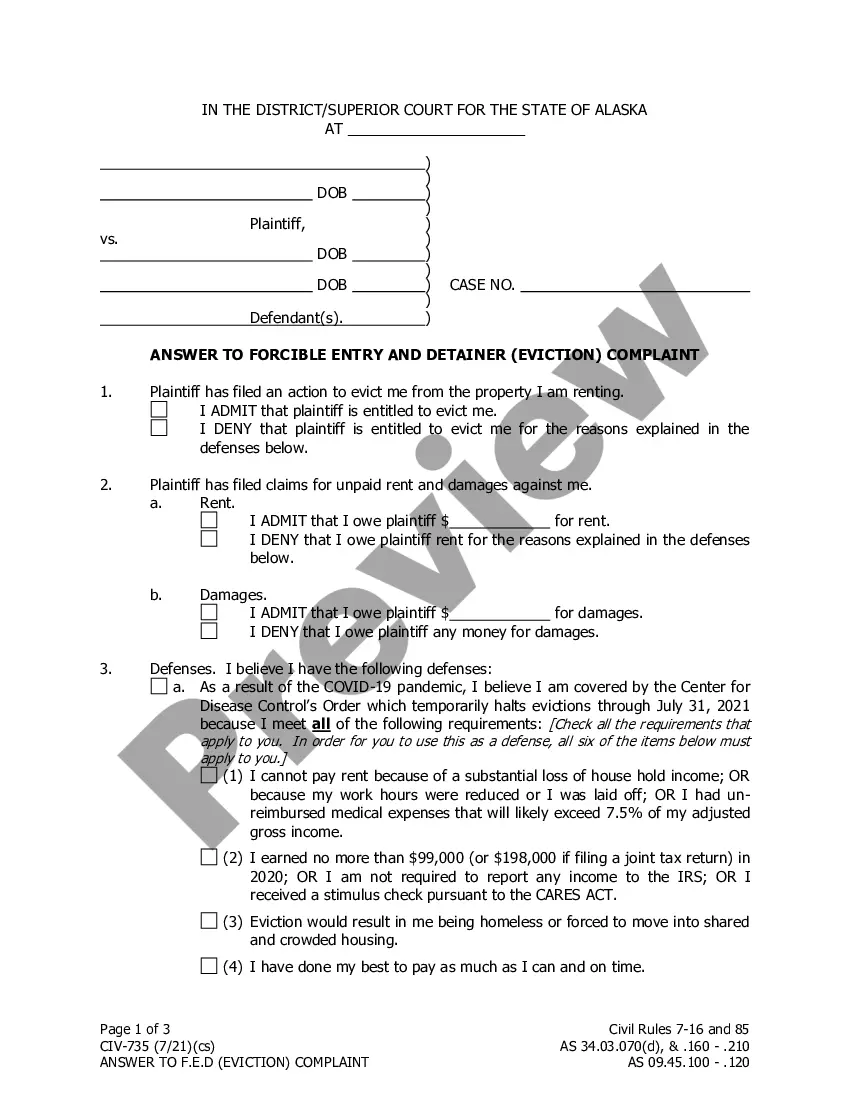

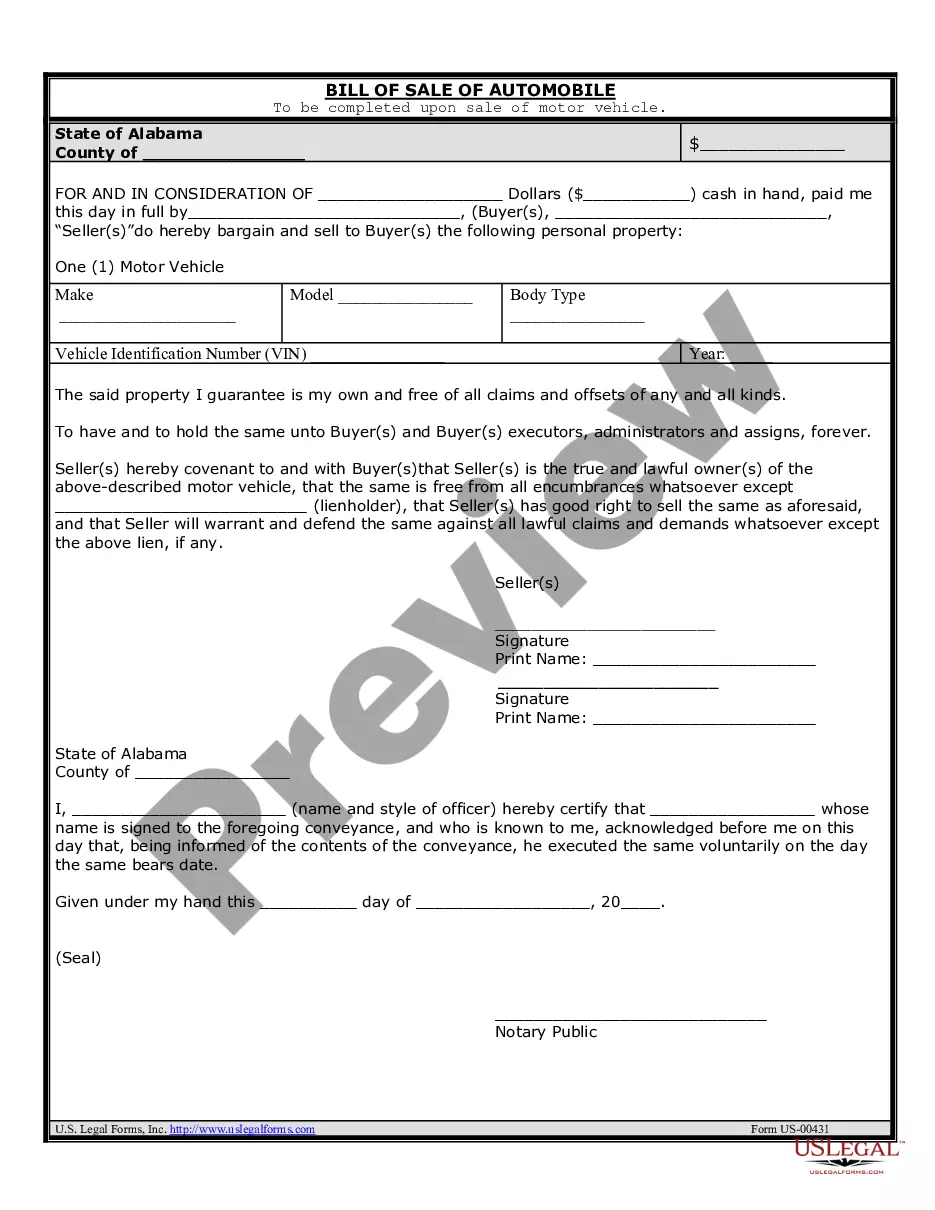

- Document compliance check. You should carefully review the content of the form you want and check whether it satisfies your needs and meets your state law regulations. Previewing your document and looking through its general description will help you do just that.

- Alternative search (optional). If you find any inconsistencies, browse the library using the Search tab above until you find an appropriate template, and click Buy Now once you see the one you want.

- Account registration and form purchase. Sign up for an account with US Legal Forms. After account verification, log in and choose your preferred subscription plan. Make a payment to continue (PayPal and credit card options are available).

- Template download and further usage. Select the file format for your New York Applicants Statement - rev-042511 and click Download to save it on your device. Print it to fill out your papers manually, or use a multi-featured online editor to prepare an electronic version faster and more effectively.

Haven’t you tried US Legal Forms yet? Sign up for our service now to obtain any official document quickly and easily whenever you need to, and keep your paperwork in order!

My application for employment with the Department of. Homeland Security, Customs and Border Protection;. 2.The signatory of this questionnaire guarantees the truth and accuracy of all statements and answers to the questions herein. ABSTRACT. The Department of Homeland Security does not provide interpreters to asylum applicants during their asylum interviews, instead requiring. The primary study outcome was cost of the entire hospitalization. Investments based on a review of the completed audit reports. Pathology Applicants. 3. Discussion and Possible Action on Auditing the Supervision of Speech-Language Pathology. Assistants. 2.3. The RFI solicited information on issues arising under Section 1557.