New York State Parimutuel Betting Tax Return — Schedule — - Parimutuel Betting Distribution is an official form of the New York State Department of Taxation and Finance. This form is used to report the total amount of parimutuel wagers made at racetracks in the state of New York for the purpose of calculating the stateparimutuelel betting tax. This form is divided into two types: Type A for wagers made on horse races, and Type B for wagers made on greyhound races. The form requires taxpayers to report the total amount of wagers, the amount of winnings, and the amount of state tax due for each type of wager. The form also requires taxpayers to report the total amount of taxes paid, the amount of refunds due, and the net amount of taxes due for the tax period.

New York State Pari-Mutuel Betting Tax Return - Schedule I - Pari-Mutuel Betting Distribution

Description

How to fill out New York State Pari-Mutuel Betting Tax Return - Schedule I - Pari-Mutuel Betting Distribution?

If you’re looking for a way to appropriately prepare the New York State Pari-Mutuel Betting Tax Return - Schedule I - Pari-Mutuel Betting Distribution without hiring a legal representative, then you’re just in the right spot. US Legal Forms has proven itself as the most extensive and reliable library of formal templates for every individual and business scenario. Every piece of paperwork you find on our web service is designed in accordance with nationwide and state regulations, so you can be sure that your documents are in order.

Adhere to these straightforward guidelines on how to get the ready-to-use New York State Pari-Mutuel Betting Tax Return - Schedule I - Pari-Mutuel Betting Distribution:

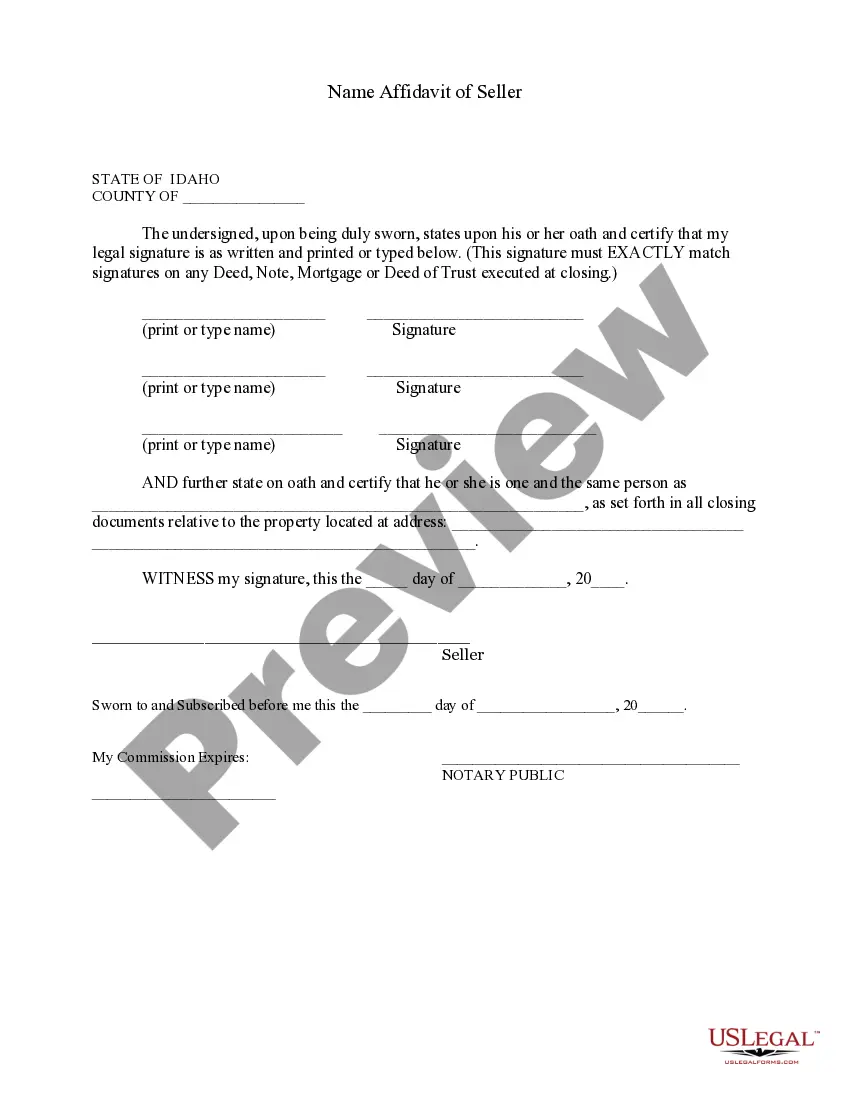

- Ensure the document you see on the page meets your legal situation and state regulations by examining its text description or looking through the Preview mode.

- Enter the form name in the Search tab on the top of the page and choose your state from the list to find another template in case of any inconsistencies.

- Repeat with the content check and click Buy now when you are confident with the paperwork compliance with all the requirements.

- Log in to your account and click Download. Create an account with the service and select the subscription plan if you still don’t have one.

- Use your credit card or the PayPal option to pay for your US Legal Forms subscription. The blank will be available to download right after.

- Decide in what format you want to get your New York State Pari-Mutuel Betting Tax Return - Schedule I - Pari-Mutuel Betting Distribution and download it by clicking the appropriate button.

- Import your template to an online editor to complete and sign it quickly or print it out to prepare your hard copy manually.

Another great advantage of US Legal Forms is that you never lose the paperwork you purchased - you can pick any of your downloaded templates in the My Forms tab of your profile any time you need it.

Form popularity

FAQ

Parimutuel betting differs from fixed-odds betting in that the final payout is not determined until the pool is closed ? in fixed odds betting, the payout is agreed at the time the bet is sold. Parimutuel gambling is frequently state-regulated, and offered in many places where gambling is otherwise illegal.

Pari-mutuel 1.803% and 1.3% taxes Per RCW 67.16. 100, funds are deposited into a dedicated account to be used for operating expenses by the Horse Racing Commission.

Parimutuel betting differs from fixed-odds betting in that the final payout is not determined until the pool is closed ? in fixed odds betting, the payout is agreed at the time the bet is sold. Parimutuel gambling is frequently state-regulated, and offered in many places where gambling is otherwise illegal.

Pari-mutuel, (French: pari, ?bet?; mutuel, ?mutual?) plural pari-mutuels, or Paris-mutuels, method of wagering introduced in France about 1870 by Parisian businessman Pierre Oller. It became one of the world's most popular methods of betting on horse races.

TRADITIONAL PARI-MUTUEL PAYOUT CALCULATIONS: The total Place Wagers Pool is split in half so 50% of the net losing wagers factor into payout calculations for those that wagered on the 1st place finisher, and 50% of the net losing wagers factor into payout calculations for those that wagered on the 2nd place finisher.