New York Employee Claim for Compensation

Description

How to fill out New York Employee Claim For Compensation?

In terms of submitting New York Employee's Claim For Compensation for Workers' Compensation, you probably think about an extensive process that involves finding a ideal sample among a huge selection of similar ones and then being forced to pay out an attorney to fill it out to suit your needs. Generally speaking, that’s a slow and expensive option. Use US Legal Forms and pick out the state-specific document within clicks.

If you have a subscription, just log in and then click Download to have the New York Employee's Claim For Compensation for Workers' Compensation sample.

If you don’t have an account yet but want one, stick to the step-by-step guide listed below:

- Make sure the document you’re getting applies in your state (or the state it’s needed in).

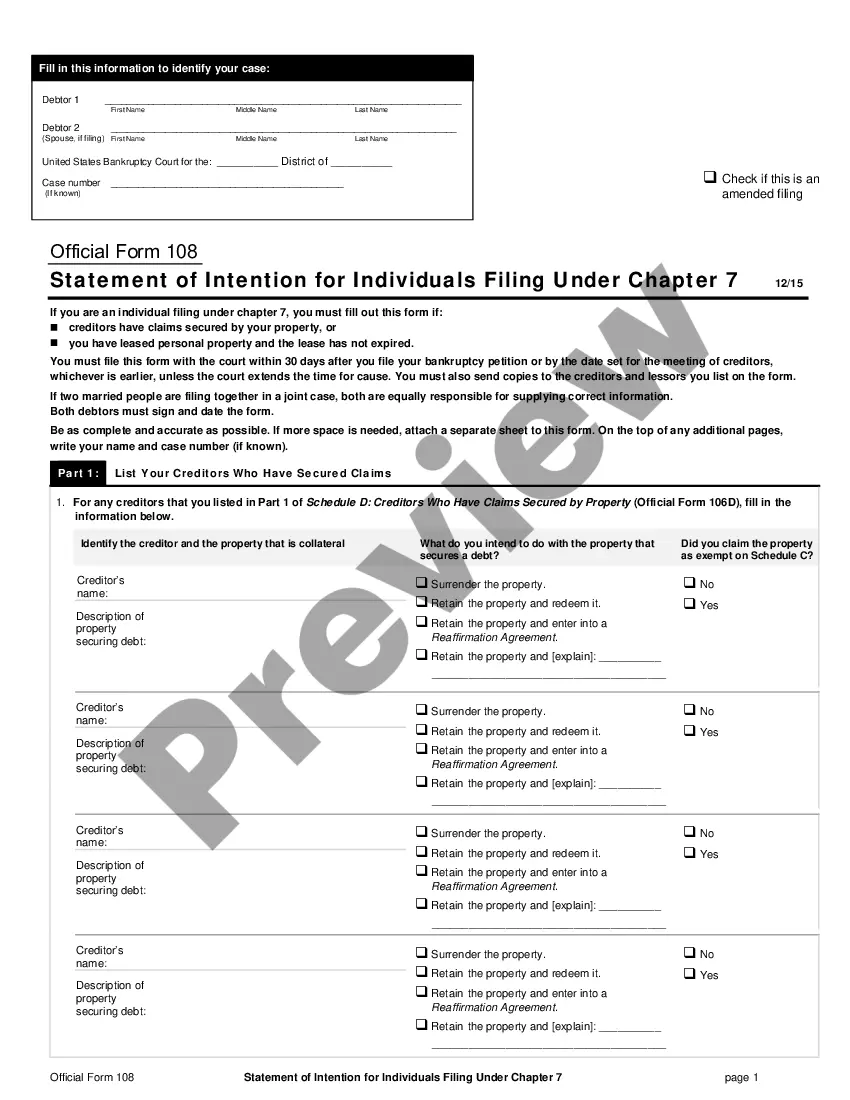

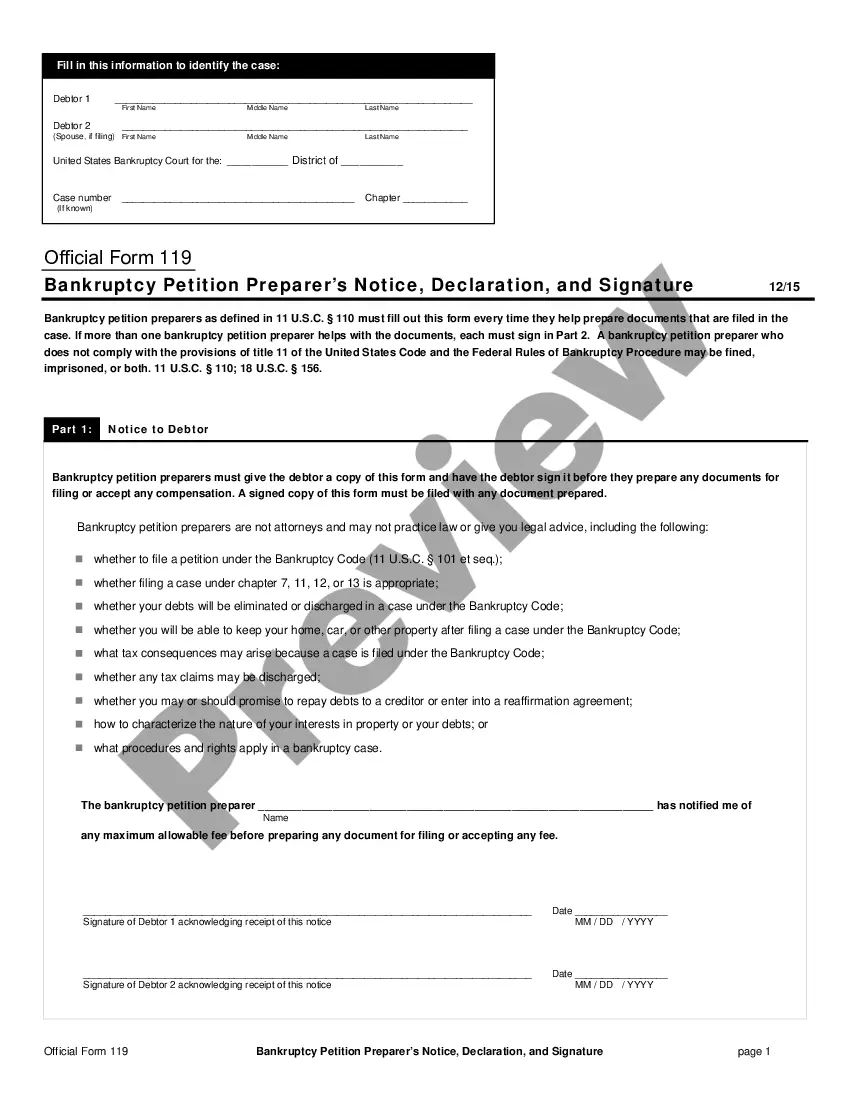

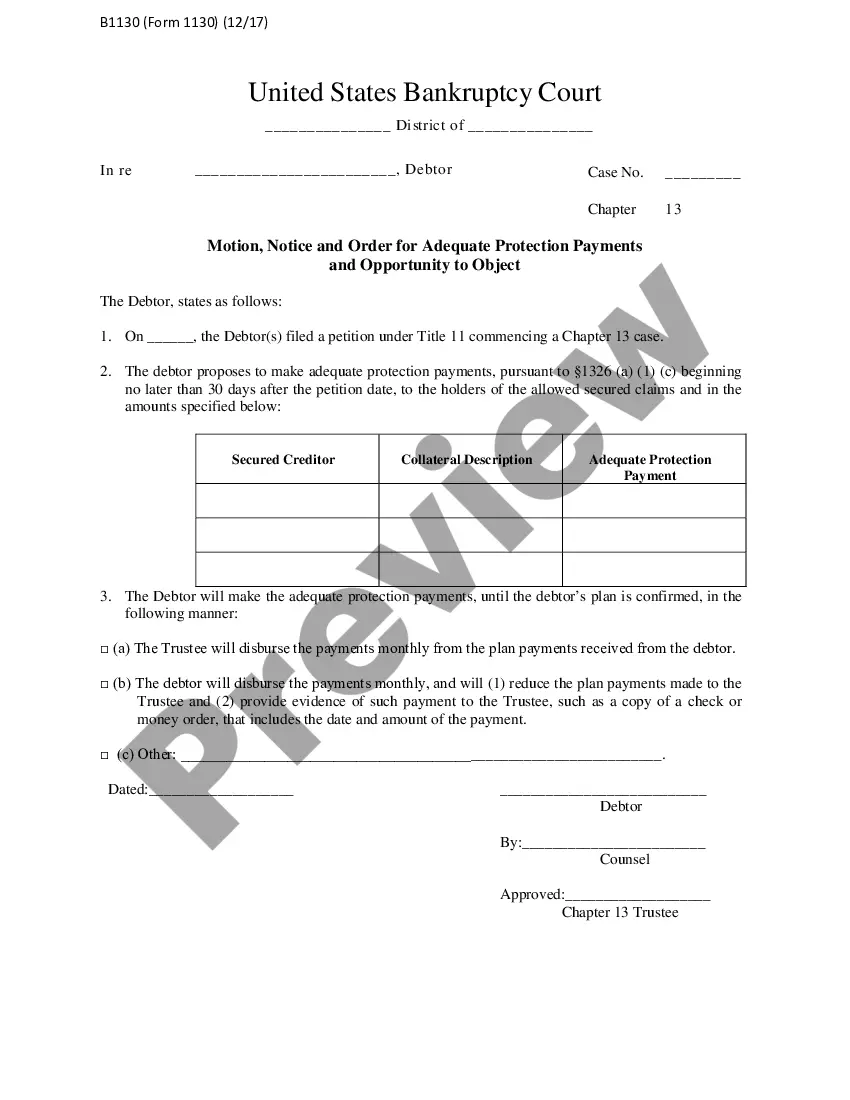

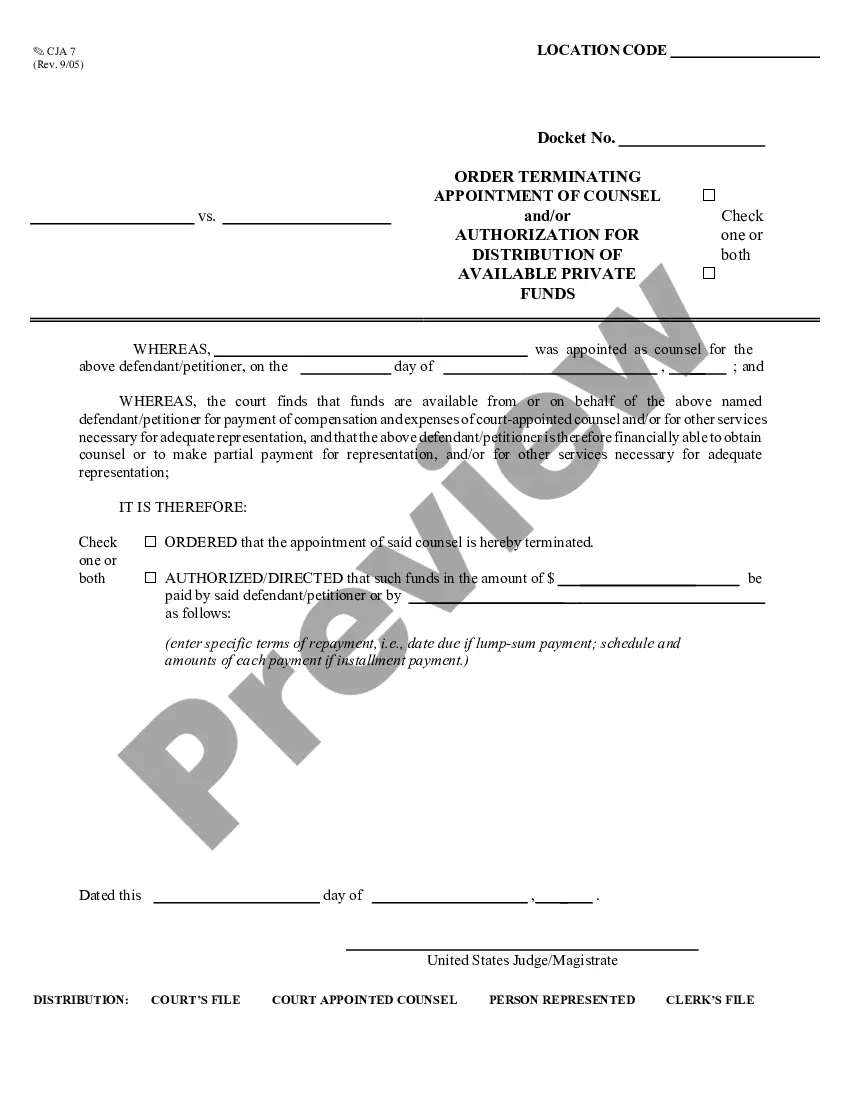

- Do so by looking at the form’s description and by clicking on the Preview option (if accessible) to see the form’s information.

- Click on Buy Now button.

- Choose the appropriate plan for your financial budget.

- Join an account and select how you would like to pay: by PayPal or by card.

- Download the document in .pdf or .docx file format.

- Get the document on your device or in your My Forms folder.

Skilled lawyers work on drawing up our templates to ensure that after saving, you don't have to worry about modifying content material outside of your personal information or your business’s details. Be a part of US Legal Forms and receive your New York Employee's Claim For Compensation for Workers' Compensation document now.

Form popularity

FAQ

In NSW, a worker for workers compensation purposes is 'a person who has entered into or works under a contract of service or a training contract with an employer2026'.If you are a small employer, your premium will not be impacted by the costs of your workers compensation claims.

New York Workers' Compensation Benefits These temporary disability benefits equal two-thirds of your average weekly wage, multiplied by the percentage of your disability. Cash benefits are subject to a weekly maximum established by the state each year. As of July 1, 2017, the maximum benefit is $870.61 per week.

A workers' compensation insurance policy is based on payroll, regardless of whether the employee is full-time, part-time, temporary or seasonal. Begin with the gross payroll for each employee. Tips for Calculating Payroll: Gross payroll for each employee can be rounded to the nearest $1,000.

An employee should file a workers' compensation claim if injuries were sustained on the job or within the scope of employment. This includes occupational accidents, diseases, trauma injuries, or illness caused by exposure to work activities or chemicals.

Businesses in New York State must have workers' compensation coverage for all employees. The rule includes part-time employees and family members employed by the company. Employers must have a workers' compensation insurance policy.Businesses must show proof of the policy when getting business permits.

Workers' Comp Payroll DefinitionWages or salaries including retroactive wages or salaries.Payment by an employer of amounts otherwise required by law to be paid by employees to statutory insurance or pension plans, such as the Federal Social Security Act.

For the most part, the answer is no. Worker's compensation benefits in California are considered non-taxable income. Workers' compensation is a public, federally funded benefit designed to help employees settle their bills as they recover from a work-related illness or injury.

Is workers' compensation insurance tax deductible? Generally, workers' compensation insurance premiums are tax deductible for businesses. The IRS, however, does not allow employees to deduct any workers' compensation benefits they receive from their taxes.

In general, every employer in New York is required to purchase Workers Compensation Insurance. This insurance protects you if you are injured while working. It pays for medical care for the injury and lost time benefits. This insurance is mandatory and your employer cannot charge you for the insurance coverage.