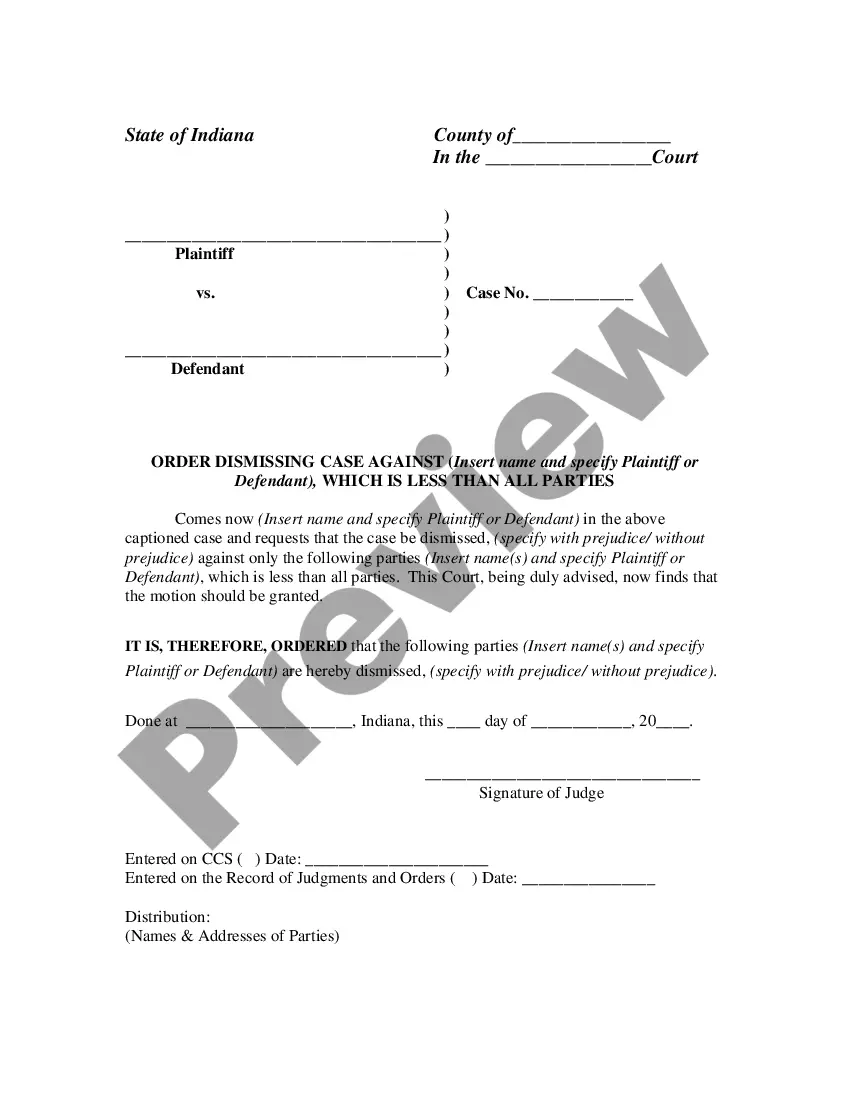

New York Schedule A (Description)

Description

How to fill out New York Schedule A (Description)?

Among lots of paid and free samples which you get on the internet, you can't be sure about their accuracy. For example, who created them or if they’re competent enough to deal with what you require these people to. Keep relaxed and utilize US Legal Forms! Discover New York Schedule A (Description) templates developed by professional legal representatives and avoid the expensive and time-consuming procedure of looking for an attorney and then paying them to write a papers for you that you can easily find yourself.

If you have a subscription, log in to your account and find the Download button near the form you are seeking. You'll also be able to access all your earlier saved documents in the My Forms menu.

If you are using our platform the first time, follow the guidelines listed below to get your New York Schedule A (Description) with ease:

- Make sure that the file you find applies in the state where you live.

- Look at the file by reading the information for using the Preview function.

- Click Buy Now to begin the ordering process or find another sample using the Search field found in the header.

- Choose a pricing plan and create an account.

- Pay for the subscription with your credit/debit/debit/credit card or Paypal.

- Download the form in the required file format.

When you’ve signed up and bought your subscription, you may use your New York Schedule A (Description) as often as you need or for as long as it remains active in your state. Change it with your preferred editor, fill it out, sign it, and create a hard copy of it. Do much more for less with US Legal Forms!

Form popularity

FAQ

The IRS Form 1040 is one of the official documents that U.S. taxpayers can use to file their annual income tax return.The 1040 form is divided into sections where you report your income and deductions to determine the amount of tax you owe or the refund you can expect to receive.

As a nonresident, you only pay tax on New York source income, which includes earnings from work performed in New York State, and income from real property located in the state.

Complete Form IT-225 and submit it with your return to report any New York additions and subtractions that do not have their own line on your return. Refer to the charts found on pages 17-19 for a listing of addition and subtraction modification(s) for your specific filing that may be entered on this form.

NEW YORK RESIDENCY TEST The test is as follows: If you maintain a permanent place of abode in New York for more than 11 months of the year and spend 184 days or more in New York during the taxable year you will be considered New York resident.

Complete Form IT-225 and submit it with your return to report any New York additions and subtractions that do not have their own line on your return. Refer to the charts found on pages 17-19 for a listing of addition and subtraction modification(s) for your specific filing that may be entered on this form.

If your state refund was less than what you expected, it may have been offset to pay an outstanding debt in the state of NY or the state made adjustments while processing your return. The state should send you a notice explaining what happened.

Income tax forms are the official government documents you're required to fill out when you pay your taxes. Generally, the more complex your finances are the more tax forms you may need to fill out.

The IT-201 is the main income tax form for New York State residents. It is analogous to the US Form 1040, but it is four pages long, instead of two pages. The first page of IT-201 is mostly a recap of information that flows directly from the federal tax forms.

You must file Form IT-201, Resident Income Tax Return, if you were a New York State resident for the entire year.